Title: Understanding the Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets Introduction: The Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legally binding document that facilitates the transfer of ownership of all assets from a corporation to a buyer. This agreement includes a detailed allocation of the purchase price between tangible and intangible business assets. In Vermont, there are various types of agreements available to suit different business needs. This article aims to provide a comprehensive overview of the Vermont Agreement, its purpose, and different types. Key Terms and Structures: 1. Corporation: A legal entity that is separate from its owners and shareholders. 2. Assets: Valuable resources owned by the corporation, including tangible assets (physical property) and intangible assets (intellectual property, goodwill, trademarks, patents). 3. Purchase Price: The agreed-upon amount that the buyer pays to acquire the assets. 4. Allocation: The process of dividing the purchase price between tangible and intangible assets based on their respective values. Components of the Vermont Agreement for Sale of all Assets: 1. Parties Involved: Identify and provide detailed information about the buyer and the corporation selling the assets, including their legal names, addresses, and contact information. 2. Asset Description: Present a comprehensive list of the assets being sold, categorizing them as tangible (e.g., land, buildings, machinery, inventory) or intangible (e.g., patents, trademarks, customer databases). 3. Purchase Price and Allocation: Specify the total purchase price and allocate it among different asset categories based on their fair market values. 4. Representations and Warranties: Outline the seller's assurances regarding the assets, their condition, ownership, and any liabilities associated with them. 5. Closing and Transfer: Specify the closing date and the responsibilities of each party for transferring the assets, including any necessary filings or registrations. 6. Indemnification: Establish the framework for compensating the buyer in case of any undisclosed liabilities or breaches of the agreement by the seller. 7. Governing Law: Identify Vermont as the jurisdiction under which the agreement will be interpreted and enforced. Types of Vermont Agreement for Sale of all Assets: 1. Simplified Agreement: This streamlined agreement is suitable for the sale of small businesses with a limited number of assets and straightforward purchase price allocation. 2. Comprehensive Agreement: Designed for larger corporations or complex transactions, this agreement includes more extensive provisions, due diligence requirements, and thorough documentation for both tangible and intangible assets. Conclusion: The Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a crucial legal document that facilitates the smooth transfer of ownership. This agreement ensures the buyer acquires all desired assets and establishes a fair allocation of the purchase price. It is essential to consult legal professionals experienced in Vermont corporate law to draft and review such agreements.

Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Vermont Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

If you need to full, acquire, or produce lawful document web templates, use US Legal Forms, the most important selection of lawful kinds, that can be found online. Take advantage of the site`s basic and convenient lookup to find the documents you require. Various web templates for business and person functions are categorized by groups and claims, or key phrases. Use US Legal Forms to find the Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets within a number of clicks.

Should you be already a US Legal Forms client, log in to the accounts and then click the Down load switch to have the Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. You may also gain access to kinds you earlier saved within the My Forms tab of your accounts.

If you use US Legal Forms for the first time, refer to the instructions beneath:

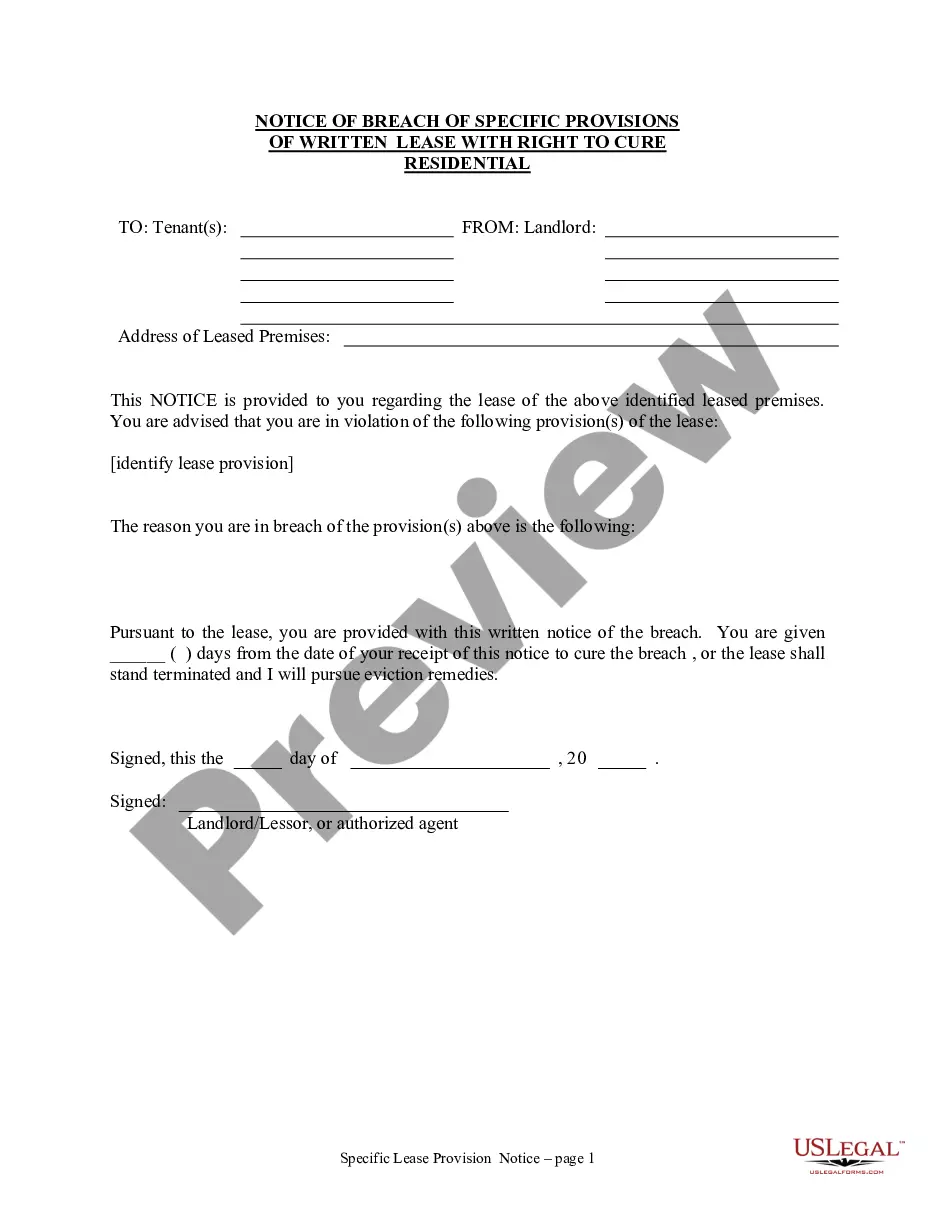

- Step 1. Make sure you have chosen the shape to the correct area/land.

- Step 2. Take advantage of the Preview method to check out the form`s content material. Do not overlook to see the information.

- Step 3. Should you be unhappy with the type, utilize the Lookup area on top of the monitor to locate other variations of the lawful type format.

- Step 4. Upon having identified the shape you require, click on the Buy now switch. Select the pricing prepare you prefer and include your qualifications to sign up for an accounts.

- Step 5. Procedure the transaction. You should use your bank card or PayPal accounts to finish the transaction.

- Step 6. Find the format of the lawful type and acquire it in your device.

- Step 7. Total, edit and produce or signal the Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Every single lawful document format you purchase is the one you have permanently. You might have acces to every single type you saved with your acccount. Select the My Forms area and choose a type to produce or acquire once more.

Be competitive and acquire, and produce the Vermont Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets with US Legal Forms. There are thousands of expert and state-distinct kinds you may use to your business or person needs.