Vermont Purchase Invoice

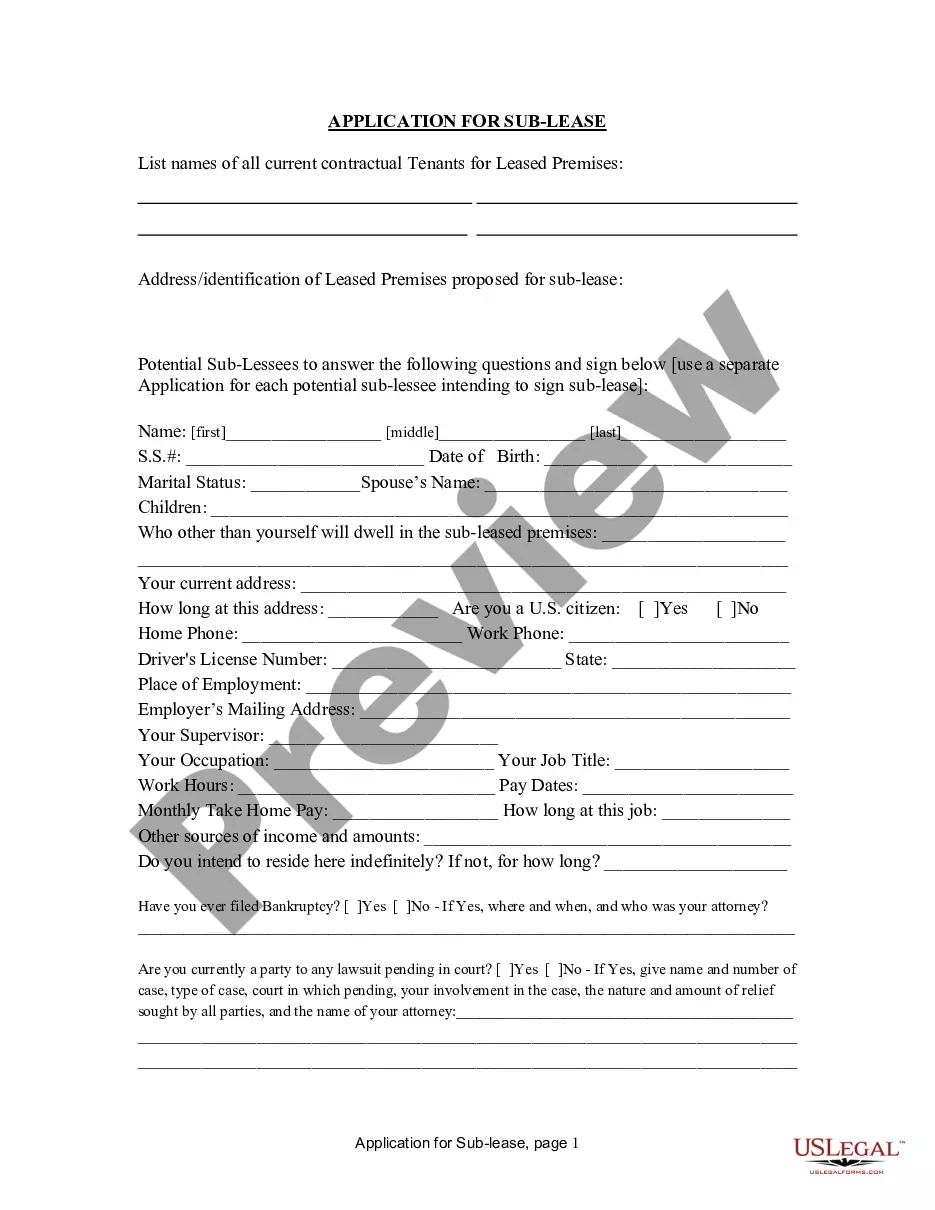

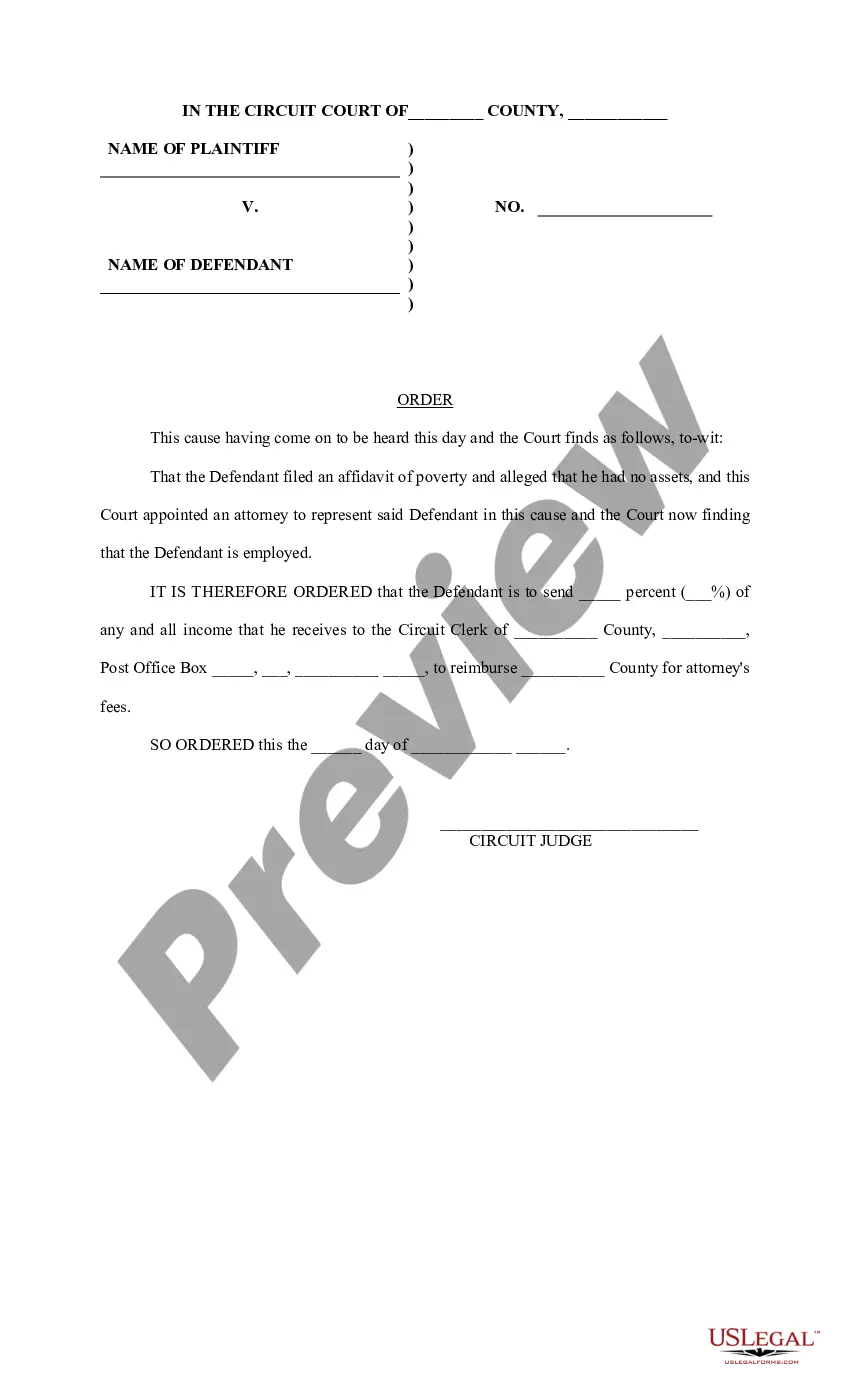

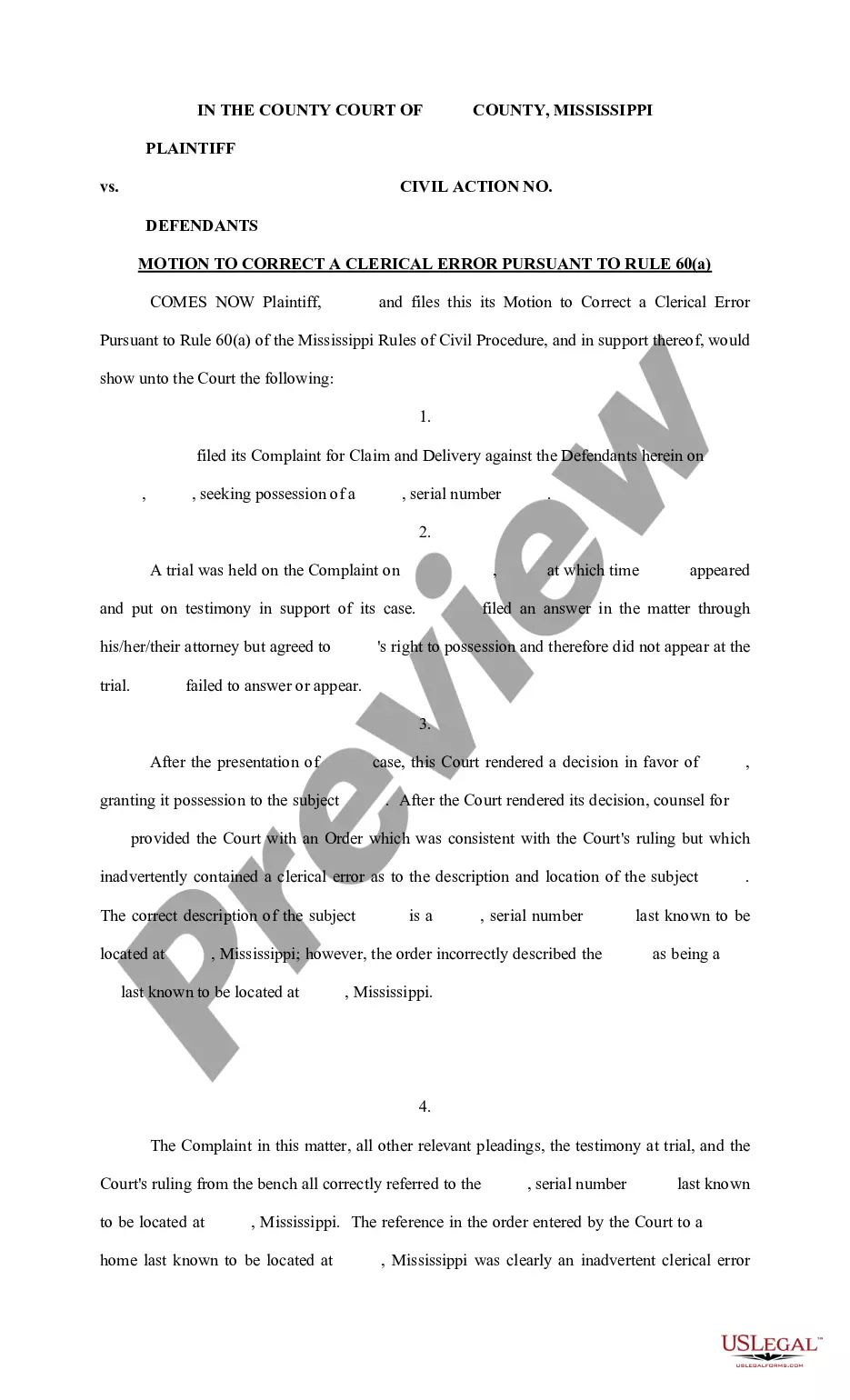

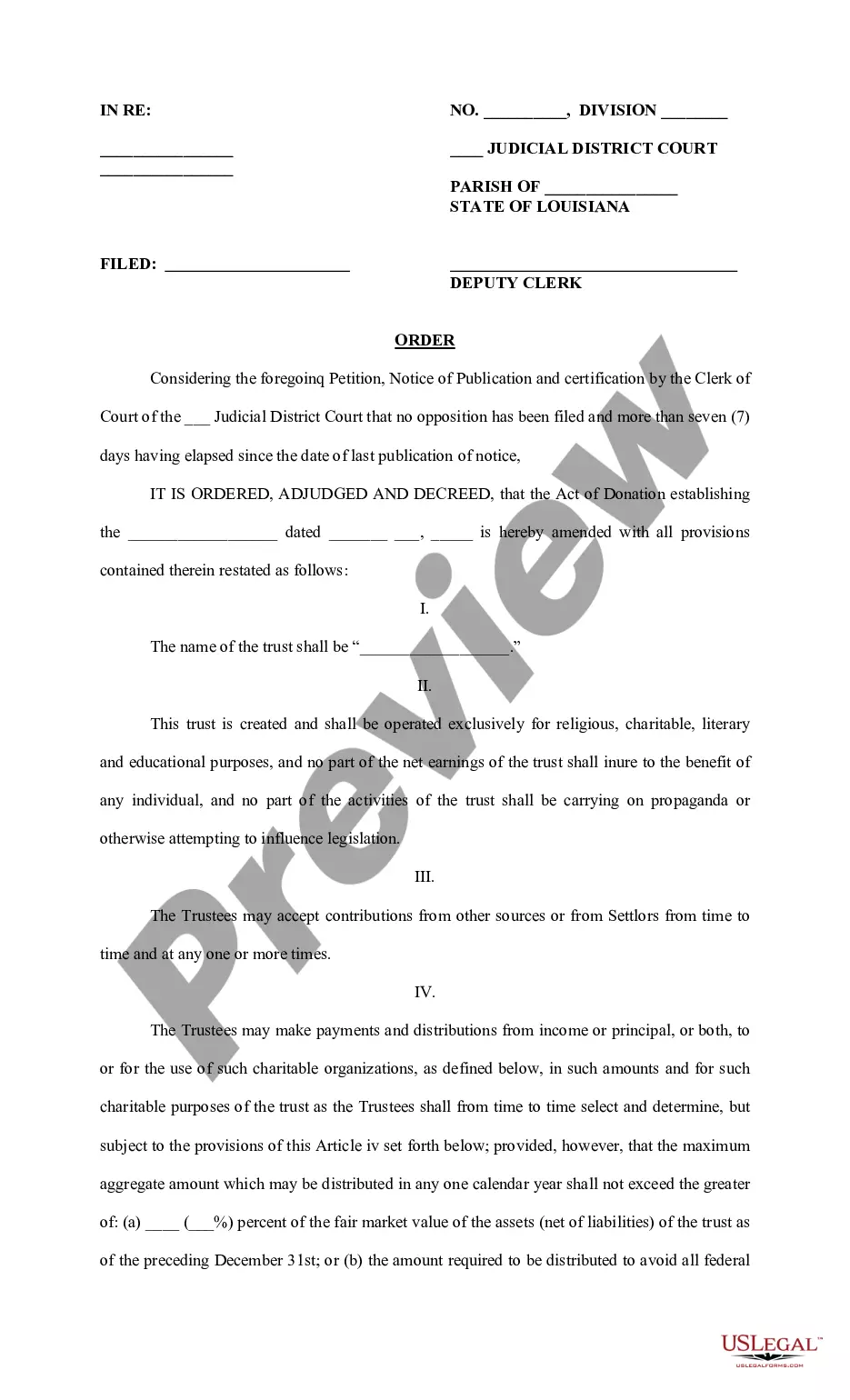

Description

How to fill out Purchase Invoice?

Have you found yourself in a situation where you require documentation for either organization or particular needs almost daily.

There is a range of legitimate document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers a vast collection of template forms, like the Vermont Purchase Invoice, that are designed to meet state and federal requirements.

Once you have the right form, click on Acquire now.

Select a suitable pricing plan, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Vermont Purchase Invoice template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

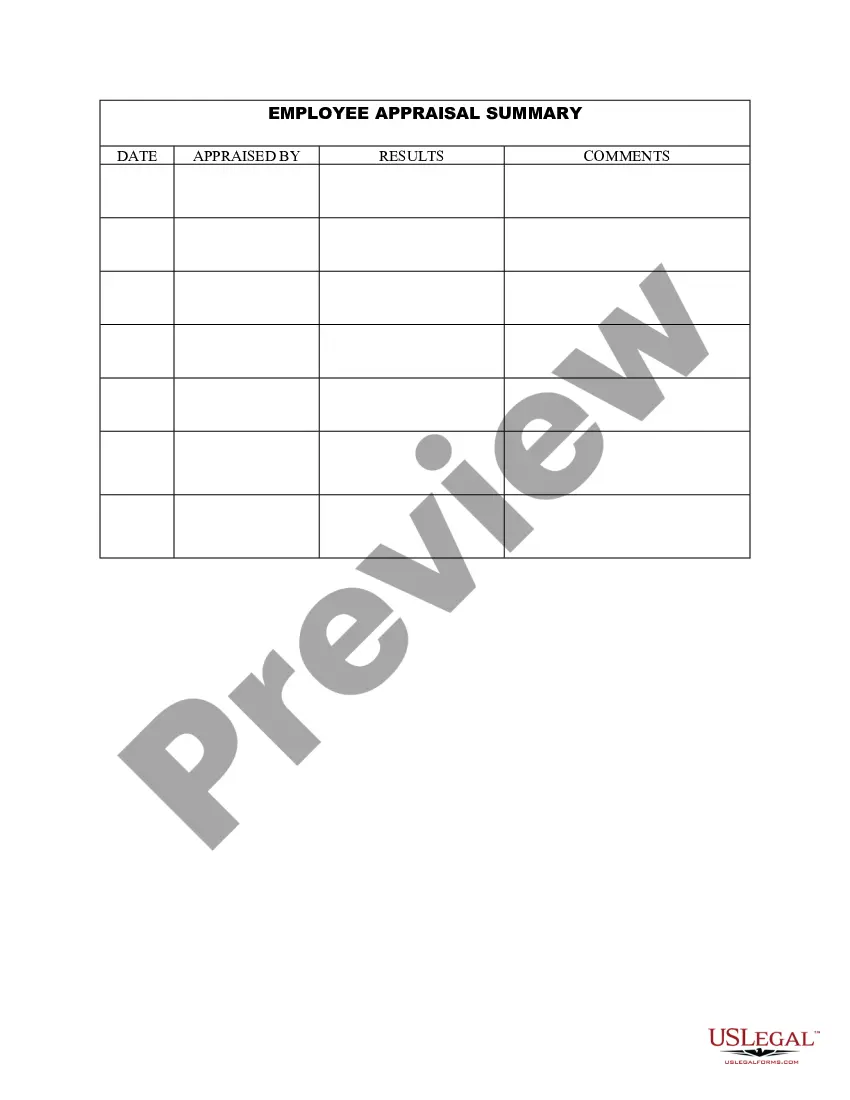

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Research field to find the form that meets your requirements.

Form popularity

FAQ

No, Vermont is not a no tax state. While some states may have no sales tax, Vermont imposes a sales tax on most goods and services, which impacts the Vermont Purchase Invoice you may need to issue. It's crucial for businesses to understand Vermont's tax structure to remain compliant and avoid unexpected costs. Always stay informed about changes in tax laws to ensure accuracy.

In Vermont, the sales tax for online purchases is currently set at 6%. This tax applies to most tangible goods, making it essential to consider when creating your Vermont Purchase Invoice. Additionally, certain municipalities may impose an extra local option tax, which varies by location. To ensure you apply the correct rate, consult your local tax authority or use trusted resources.

You can contact the Vermont Department of Taxes directly through their official website for inquiries or assistance. They provide various contact methods, including phone and email options. Remember, if you have questions related to your Vermont Purchase Invoice or tax responsibilities, reaching out to them can provide clarity.

Yes, Vermont has implemented an online sales tax for e-commerce businesses. If you sell products online and create Vermont Purchase Invoices, make sure to apply the appropriate sales tax to transactions. Being aware of this requirement can ensure compliance and help avoid potential fines.

Vermont offers various tax incentives that can benefit individuals and businesses. While it may not be regarded as the most tax-friendly state, it provides opportunities to offset expenses through deductions and credits. Consider how the Vermont Purchase Invoice reflects these incentives, as they can help manage your overall tax liability.

Yes, if you earn income in Vermont, you typically need to file a state tax return. This requirement also applies to businesses that issue Vermont Purchase Invoices. Make sure to review the specific guidelines based on your situation, and consult a tax professional if needed.

Finding your Vermont tax ID number is essential for your business. You can locate it on your Vermont Purchase Invoice or by accessing your account on the Vermont Department of Taxes website. If you have trouble, consider contacting the department directly for assistance in retrieving your number.

To mail your Vermont state tax return, direct it to the address specified on the tax form or the Vermont Department of Taxes website. For personal filings, the address often relates to your residence location. Always ensure your Vermont Purchase Invoice is included to streamline your submission process. Timely mailing of your return can help you avoid penalties and ensure your records are accurate.

You can reach the Vermont Department of Taxes by visiting their official website, where you will find contact numbers and email options. For specific questions regarding your Vermont Purchase Invoice, consider calling their customer service line for direct assistance. Additionally, you can visit local tax offices in Vermont for face-to-face consultations. Keeping open lines of communication ensures you get the help you need promptly.

The Vermont tax deadline usually falls on April 15 each year, aligning with federal tax deadlines. If this date is on a weekend or holiday, the deadline may shift, so always check for updates. Filing your taxes on time is crucial, as late submissions can incur penalties. Using a Vermont Purchase Invoice can help you organize your expenses, making the filing process easier.