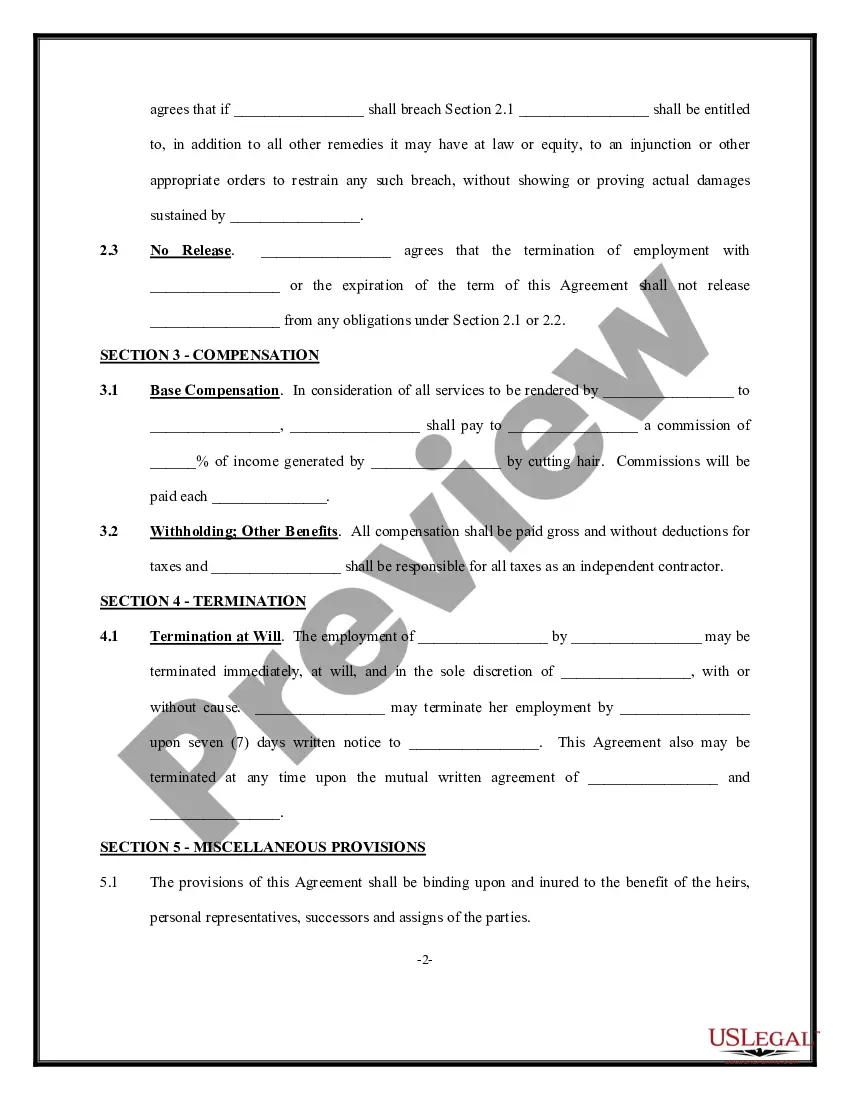

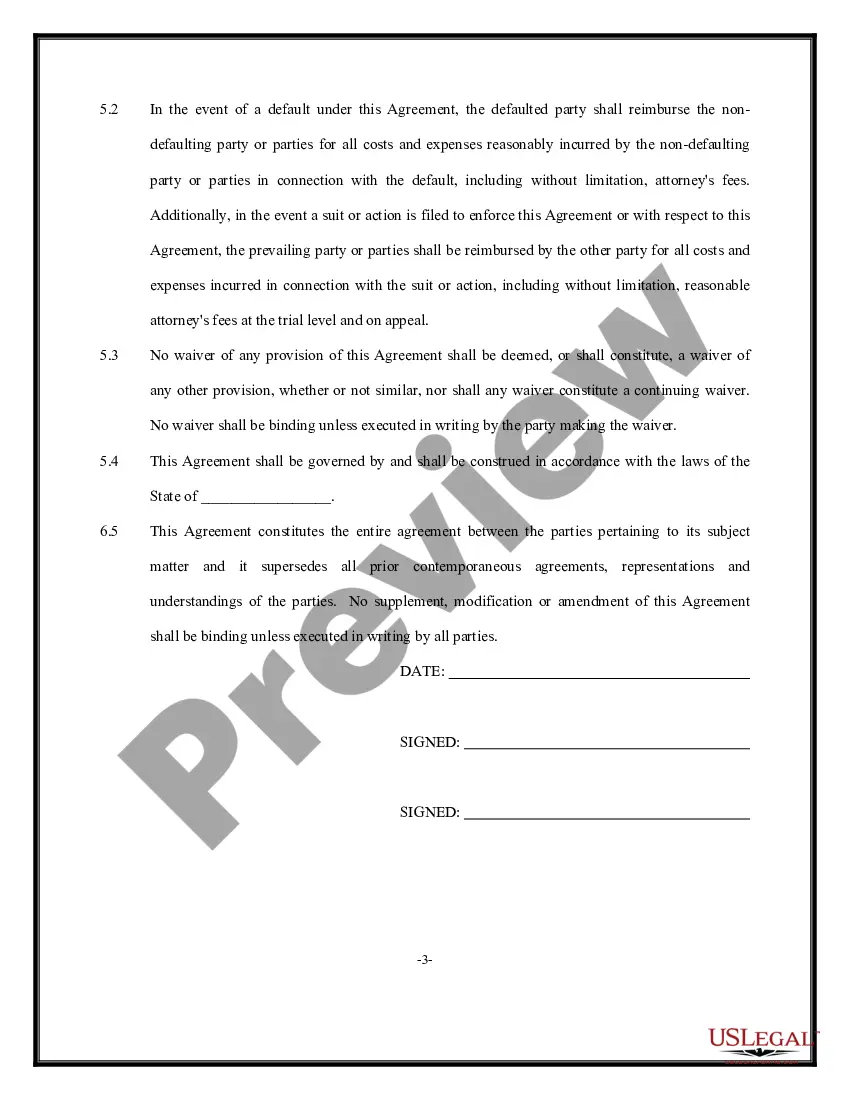

A Vermont Independent Contractor Agreement for Hair Stylist is a legally binding contract that clearly outlines the working relationship between a hair stylist and the salon or establishment they provide their services to. This agreement ensures that both parties understand their rights and responsibilities, and it protects their interests by specifying the terms and conditions of their working arrangement. Keywords: Vermont, Independent Contractor Agreement, Hair Stylist There are various types of Vermont Independent Contractor Agreements for Hair Stylists, including: 1. Booth Rental Agreement: This type of agreement is commonly used when a hair stylist rents a booth or station within a salon. It defines the rental terms, such as the duration of the agreement, rental fees, and any additional responsibilities, such as providing own supplies or sharing common resources. 2. Commission-based Agreement: In this type of agreement, the hair stylist receives a percentage of each service they perform or product they sell. The agreement outlines the commission structure, payment terms, and any other relevant conditions regarding the compensation. 3. Mobile Stylist Agreement: This agreement is specifically designed for hair stylists who provide their services on a mobile basis, traveling to clients' homes or specified locations. It addresses the terms related to travel expenses, appointment scheduling, and any additional requirements unique to this setup. 4. Partnership Agreement: A partnership agreement may be used when two or more hairstylists come together to operate a salon or establish a joint venture. It covers aspects such as profit sharing, decision-making procedures, responsibilities, and liabilities of each partner. Regardless of the type of agreement, important elements to include are: — Basic information: The names and addresses of the hair stylist and the salon/establishment they work with. — Scope of work: The specific hairstyling services the stylist will provide, including any restrictions or additional duties. — Term and termination: The duration of the agreement and conditions under which it can be terminated by either party. — Compensation: Clear explanation of how the hair stylist will be paid, including the rate, frequency, and method of payment. — Independent contractor status: The agreement should explicitly state that the hairstylist will work as an independent contractor and not as an employee of the salon. — Confidentiality and non-disclosure: Address any confidentiality obligations and restrictions regarding sharing trade secrets or client information. — Intellectual property rights: Determine who owns the rights to any original creations or techniques developed by the stylist during their engagement. — Indemnification: Specify who will be responsible for any claims or liabilities arising from the hair stylist's services. — Governing law: State that the agreement will be governed by the laws of Vermont and any disputes will be resolved in accordance with Vermont courts. In summary, a Vermont Independent Contractor Agreement for Hair Stylist is a crucial document that protects the rights and clarifies the working relationship between hair stylists and the establishments they work with. It is essential to have such an agreement in place to avoid any misunderstandings and ensure a mutually beneficial working arrangement.

Vermont Independent Contractor Agreement for Hair Stylist

Description

How to fill out Vermont Independent Contractor Agreement For Hair Stylist?

Are you in a place in which you need documents for sometimes organization or individual functions almost every working day? There are a lot of lawful papers layouts available on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms provides thousands of type layouts, just like the Vermont Independent Contractor Agreement for Hair Stylist, that happen to be written to satisfy state and federal needs.

If you are currently acquainted with US Legal Forms web site and possess your account, merely log in. Following that, it is possible to download the Vermont Independent Contractor Agreement for Hair Stylist template.

Unless you offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Get the type you will need and ensure it is to the proper city/state.

- Use the Review key to analyze the shape.

- Browse the outline to ensure that you have selected the right type.

- When the type isn`t what you are searching for, make use of the Search industry to discover the type that suits you and needs.

- Once you find the proper type, click on Get now.

- Select the rates plan you want, complete the required details to produce your account, and purchase an order making use of your PayPal or charge card.

- Select a hassle-free data file format and download your duplicate.

Find each of the papers layouts you may have bought in the My Forms menus. You can get a extra duplicate of Vermont Independent Contractor Agreement for Hair Stylist any time, if necessary. Just go through the essential type to download or print out the papers template.

Use US Legal Forms, one of the most extensive selection of lawful kinds, to save lots of efforts and steer clear of faults. The service provides skillfully made lawful papers layouts which can be used for a range of functions. Produce your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Reporting Income and EarningsIf you rent space in a salon, the owners may send you a 1099-MISC showing your earnings for the year. Not every salon does this, so it's important to keep records of your own. That's particularly true for cash payments, as you don't have checks or credit-card receipts to remind you.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

5 Things 1099 Employees Need to Know About TaxesYou're Responsible for Paying Quarterly Income Taxes.You're Responsible for Self-Employment Tax.Estimate How Much You'll Need to Pay.Develop a Bulletproof Savings Plan.Consider Software & Tax Pros.

Here are eight questions you should be ready to answer about contract work:How long is the contract?What are the company and position like?What are the typical hours?Is this a temp-to-hire position?How much is the contract pay rate?Are there benefits available?How will this position help me professionally?More items...?