Vermont Information Sheet — When are Entertainment Expenses Deductible and Reimbursable If you're a Vermont taxpayer wondering about the reducibility and reimbursability of entertainment expenses, this information sheet aims to provide you with all the necessary details. Understanding the rules and limitations surrounding these expenses can help you maximize your deductions and ensure compliance with the state's tax laws. Types of Vermont Information Sheets — When are Entertainment Expenses Deductible and Reimbursable: 1. Personal Entertainment Expenses: Personal entertainment expenses are typically not deductible or reimbursable. It's important to differentiate between personal and business-related entertainment expenses to ensure proper tax treatment. 2. Business Entertainment Expenses: Business entertainment expenses may be deductible and reimbursable under certain circumstances. Taxpayers should carefully review the eligibility criteria and documentation requirements to claim these deductions. Key considerations for reducibility and reimbursement of entertainment expenses in Vermont: 1. Ordinary and Necessary Test: To be considered deductible or reimbursable, entertainment expenses should meet the ordinary and necessary test. This means that the expenses are directly related to, or associated with, the conduct of your trade or business and are considered customary in your industry. 2. Substantiation Requirements: Vermont taxpayers must maintain detailed records and receipts that substantiate both the amount and business purpose of each entertainment expense. This documentation is crucial in case of an audit, ensuring appropriate compliance with the state's requirements. 3. Direct Business Discussion: For entertainment expenses to be deductible, they should involve a direct business discussion or activity, directly preceding or following the entertainment. The primary purpose of the entertainment should be conducting business, rather than personal enjoyment. 4. Reasonableness: The expenses claimed for reducibility or reimbursement must be reasonable. Vermont's taxpayers should ensure that the costs are neither excessive nor lavish in relation to the business purpose served. 5. Non-Entertainment Component: If an entertainment event involves both entertainment elements and a substantial non-entertainment component, such as a business presentation, deduction for the non-entertainment portion may be allowed. Proper allocation of expenses is crucial in such cases. 6. Employee Reimbursement: In cases where an employee incurs entertainment expenses on behalf of their employer, the reimbursement may be tax-free if it meets the necessary criteria. Employees should adhere to Vermont's requirements for documentation and business purpose substantiation. Stay Informed and Compliant: As tax laws and regulations may change over time, it is important to consult the latest Vermont tax guidance and rules pertaining to the reducibility and reimbursement of entertainment expenses. Staying informed ensures that you are aware of any updated requirements and can make accurate deductions while remaining compliant with the state's tax laws. Remember to consult with a qualified tax professional or refer to official Vermont tax resources for precise information and guidance tailored to your specific situation.

Vermont Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

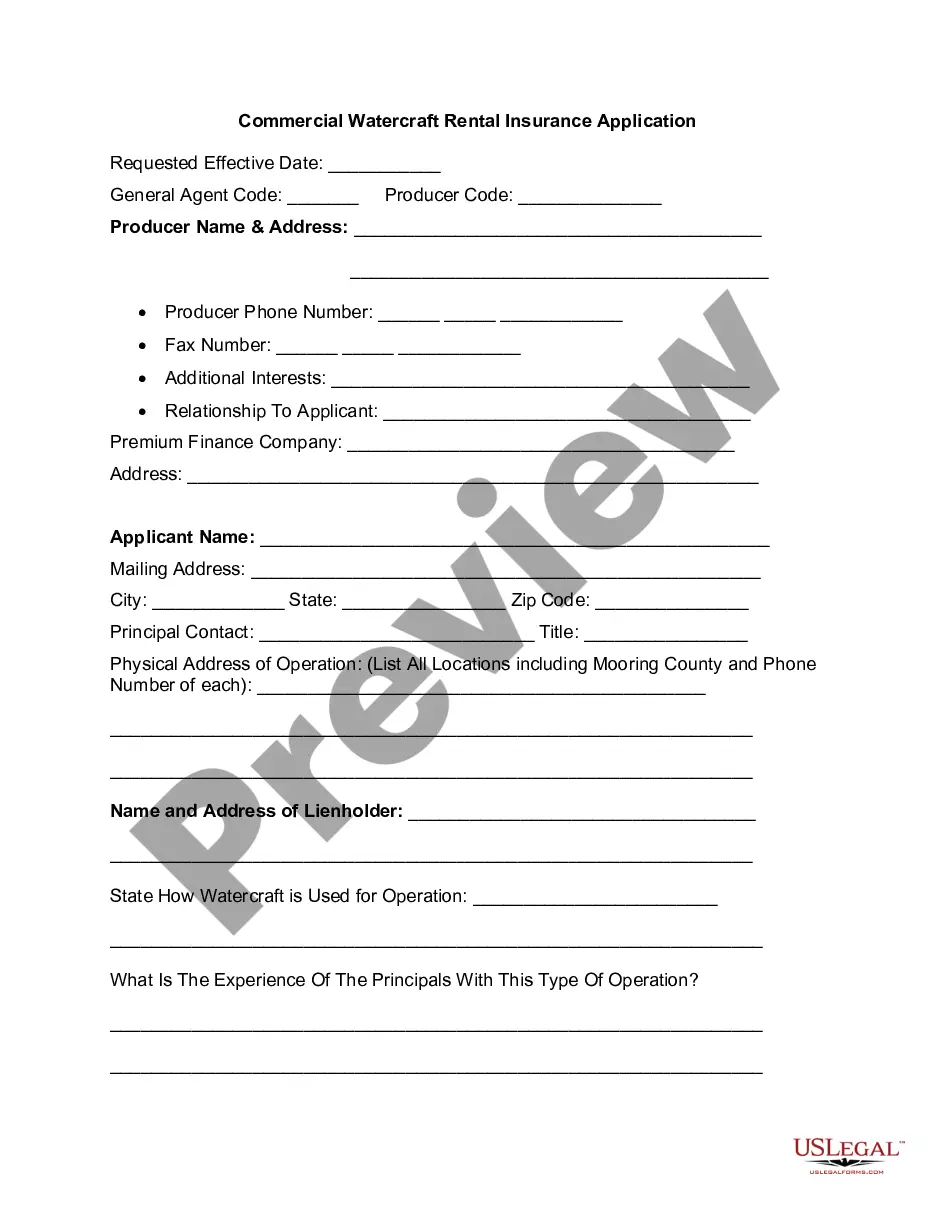

How to fill out Vermont Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

Are you in a position the place you require files for both business or specific purposes nearly every time? There are a lot of legal papers themes available on the Internet, but locating types you can rely is not easy. US Legal Forms provides 1000s of kind themes, such as the Vermont Information Sheet - When are Entertainment Expenses Deductible and Reimbursable, that are composed to meet federal and state specifications.

If you are currently knowledgeable about US Legal Forms site and possess a free account, simply log in. After that, you are able to obtain the Vermont Information Sheet - When are Entertainment Expenses Deductible and Reimbursable web template.

If you do not have an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is for your correct metropolis/county.

- Utilize the Preview option to review the form.

- See the description to ensure that you have selected the proper kind.

- When the kind is not what you`re seeking, use the Research area to find the kind that meets your needs and specifications.

- If you get the correct kind, click on Acquire now.

- Opt for the prices plan you want, submit the required details to make your bank account, and buy your order with your PayPal or Visa or Mastercard.

- Pick a handy file format and obtain your duplicate.

Get all of the papers themes you may have purchased in the My Forms menu. You may get a more duplicate of Vermont Information Sheet - When are Entertainment Expenses Deductible and Reimbursable anytime, if needed. Just select the essential kind to obtain or print the papers web template.

Use US Legal Forms, the most considerable variety of legal kinds, to conserve time and stay away from faults. The service provides expertly manufactured legal papers themes that can be used for a range of purposes. Create a free account on US Legal Forms and begin producing your lifestyle easier.