Vermont Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

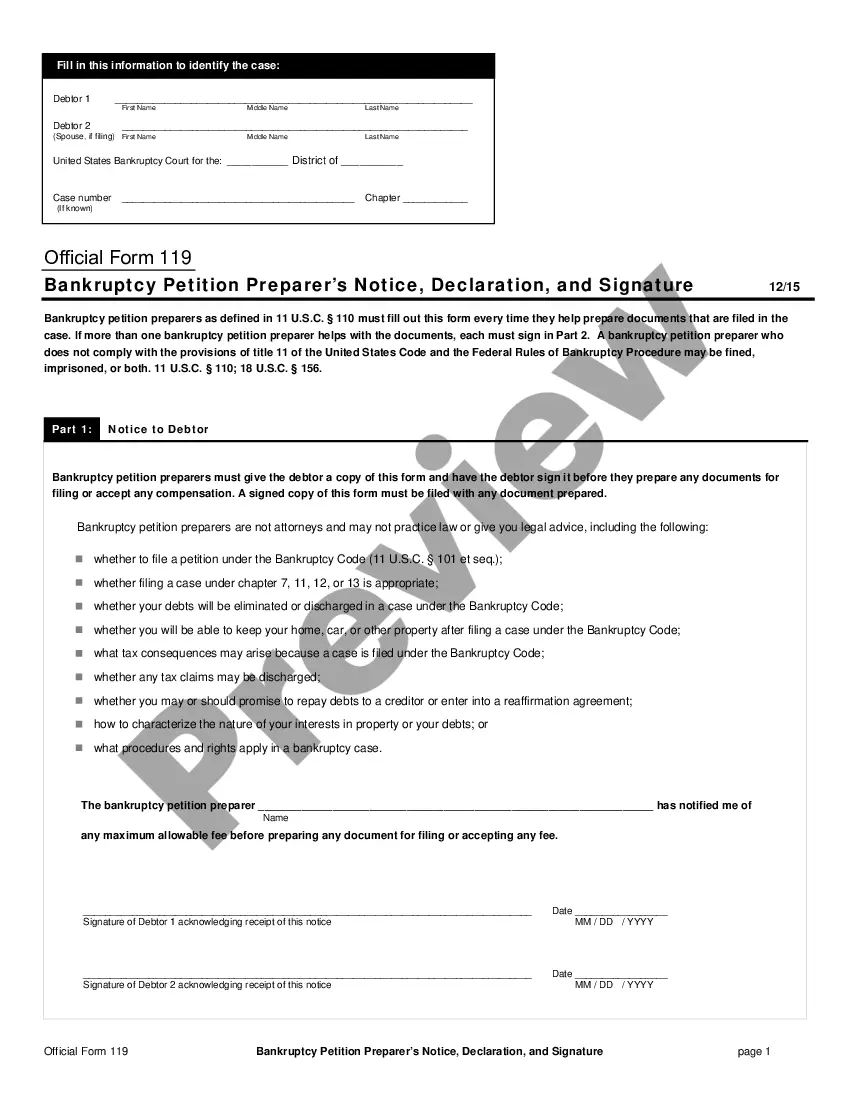

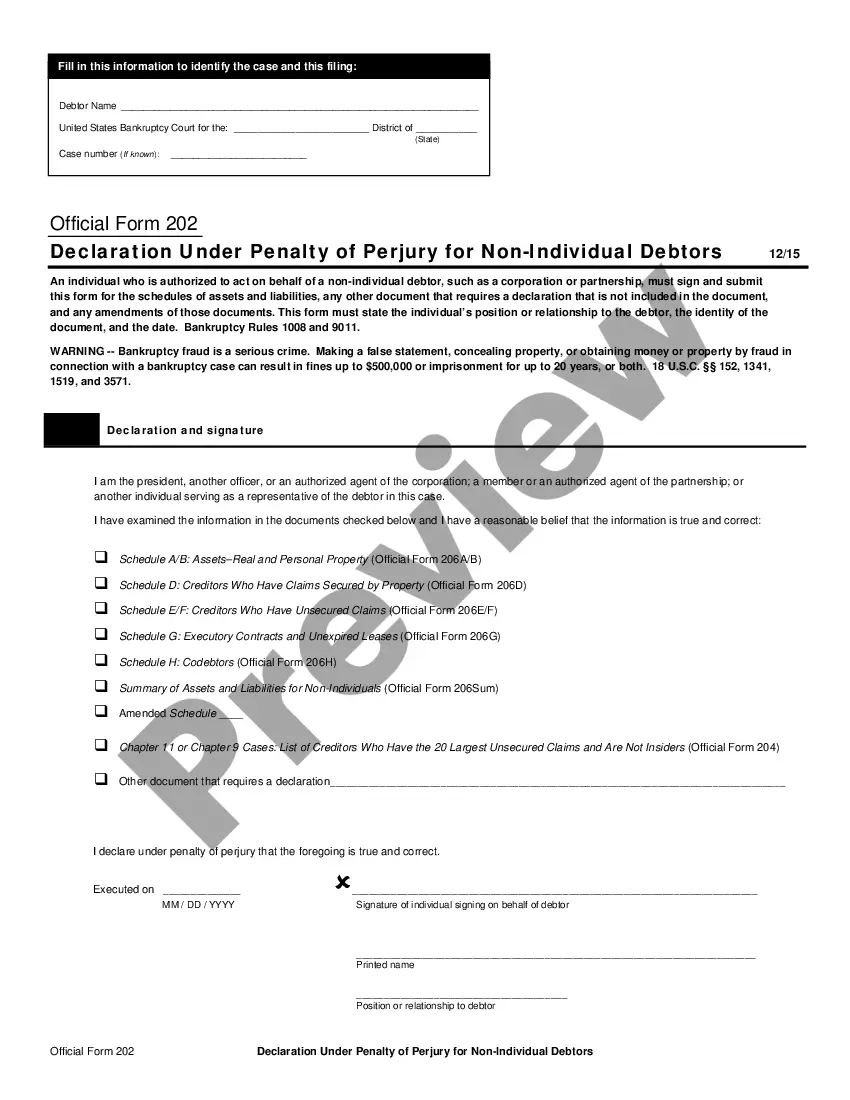

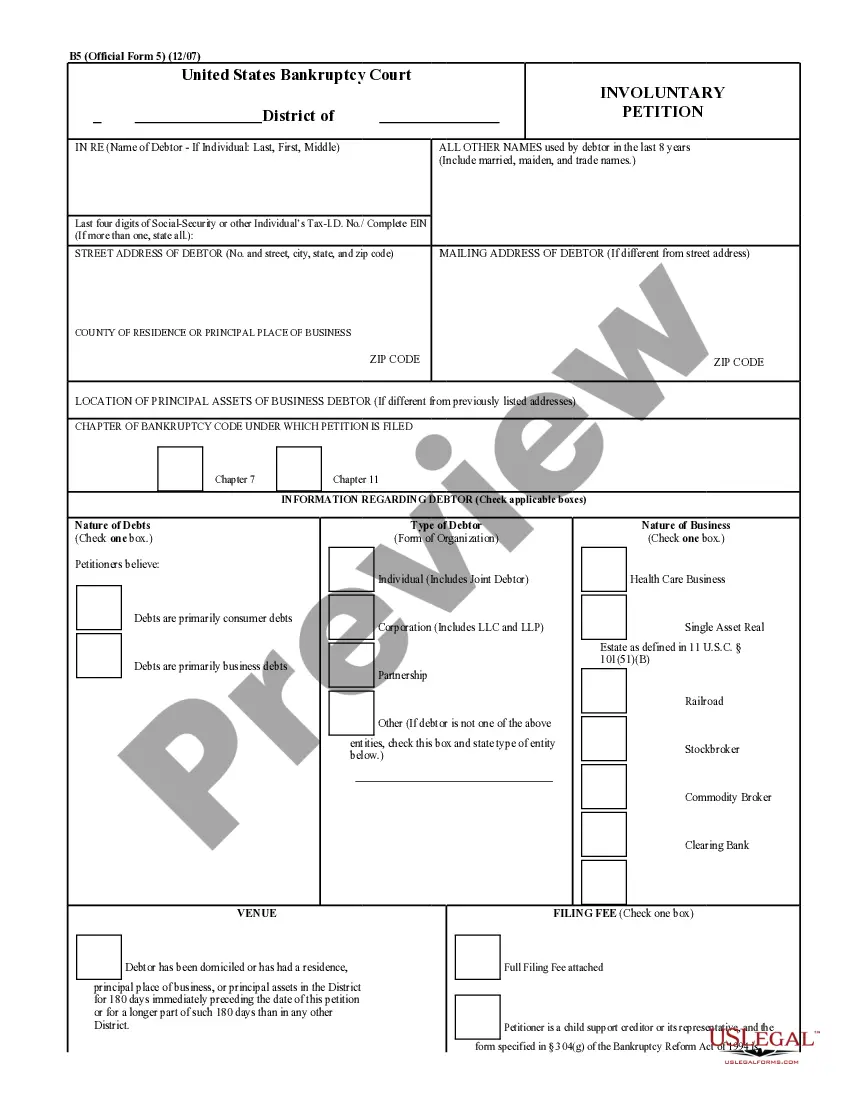

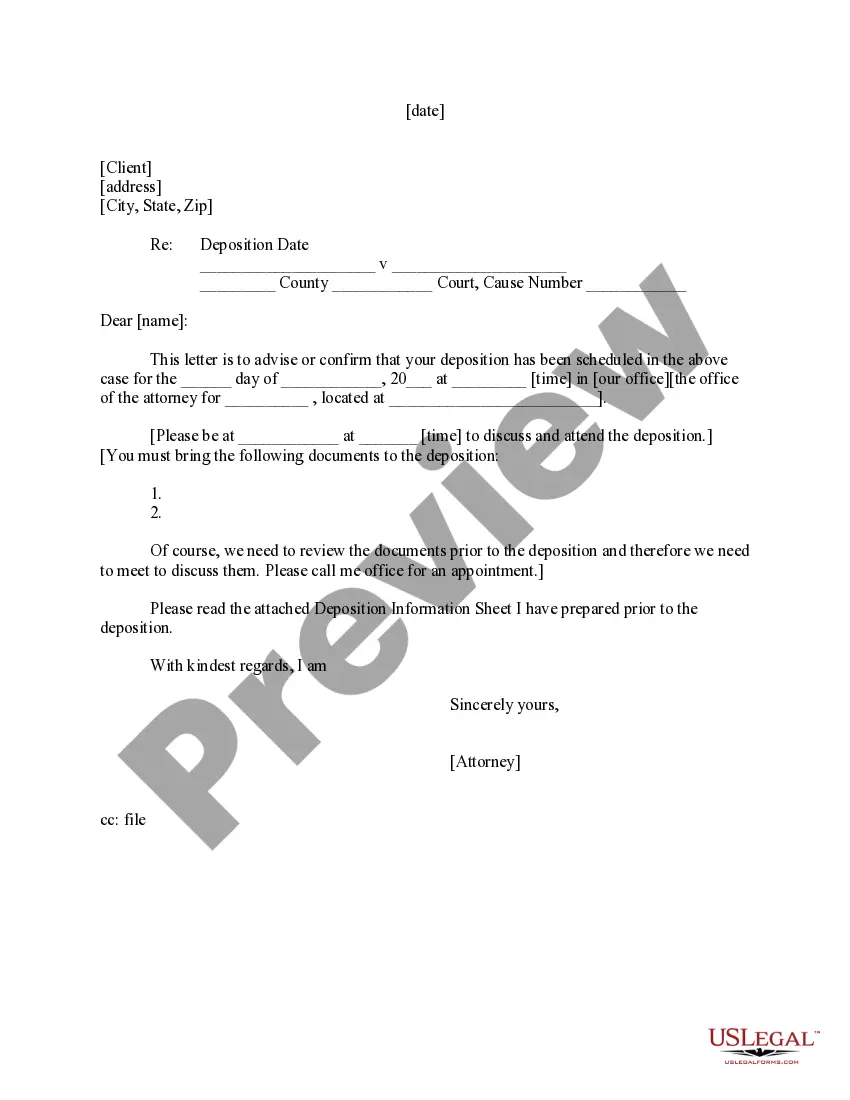

How to fill out Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

If you need to total, acquire, or produce legitimate file themes, use US Legal Forms, the greatest assortment of legitimate kinds, that can be found on the Internet. Take advantage of the site`s simple and handy look for to obtain the documents you will need. Numerous themes for organization and specific uses are categorized by groups and suggests, or search phrases. Use US Legal Forms to obtain the Vermont Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 in a couple of mouse clicks.

If you are currently a US Legal Forms customer, log in for your account and click on the Download switch to have the Vermont Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005. Also you can access kinds you formerly saved within the My Forms tab of your own account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape to the right city/region.

- Step 2. Take advantage of the Preview choice to check out the form`s content. Don`t overlook to see the outline.

- Step 3. If you are unhappy with all the kind, utilize the Search discipline at the top of the monitor to get other versions from the legitimate kind design.

- Step 4. Once you have identified the shape you will need, select the Buy now switch. Select the pricing program you choose and include your accreditations to register for an account.

- Step 5. Approach the transaction. You can use your charge card or PayPal account to complete the transaction.

- Step 6. Choose the structure from the legitimate kind and acquire it in your product.

- Step 7. Comprehensive, revise and produce or sign the Vermont Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005.

Each and every legitimate file design you buy is your own forever. You have acces to every single kind you saved inside your acccount. Go through the My Forms segment and choose a kind to produce or acquire once more.

Be competitive and acquire, and produce the Vermont Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 with US Legal Forms. There are millions of skilled and condition-distinct kinds you may use for your organization or specific demands.

Form popularity

FAQ

You are required to submit 1099 forms if: 1. The payment was subject to Vermont withholding or 2. The payment was made to a nonresident of Vermont for services performed in Vermont.

SR, line 2b should be the total of all taxable interest income. Line 2a, should be the total of all taxexempt interest income. These lines should equal the sum of all interest income, which is usually the sum of all your Forms 1099INT.

PTE taxes are designed to allow passthrough business owners and shareholders to pay state taxes on their net income at the entity level, like the corporate income tax, rather than paying taxes on their profits on the personal income tax.

You are domiciled in Vermont, or. You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.

Vermont State Income Tax You'll submit Form BI-471 to pay your LLC's taxes if it files with default, partnership, or S-corp status. LLCs with S-corp status or filing as partnerships pay Vermont's business entity income tax with a minimum fee of $250 every year on top of having to pay individual income taxes.

All domestic business partnerships headquartered in the United States must file Form 1065 each year, including general partnerships, limited partnerships, and limited liability companies (LLCs) classified as partnerships with at least two members.

Subchapter S Corporations, Partnerships and Limited Liability Companies engaged in activities in Vermont must file a Business Entity Income Tax return with the Commissioner of Taxes. This includes entities receiving income as a shareholder, partner, or member.

Schedule 3 (Form 1040) is an additional form that you may need to complete and attach to your Form 1040, depending on your individual tax situation. It is used to report various tax credits and payments that can potentially reduce your overall tax liability or increase the amount of your tax refund.