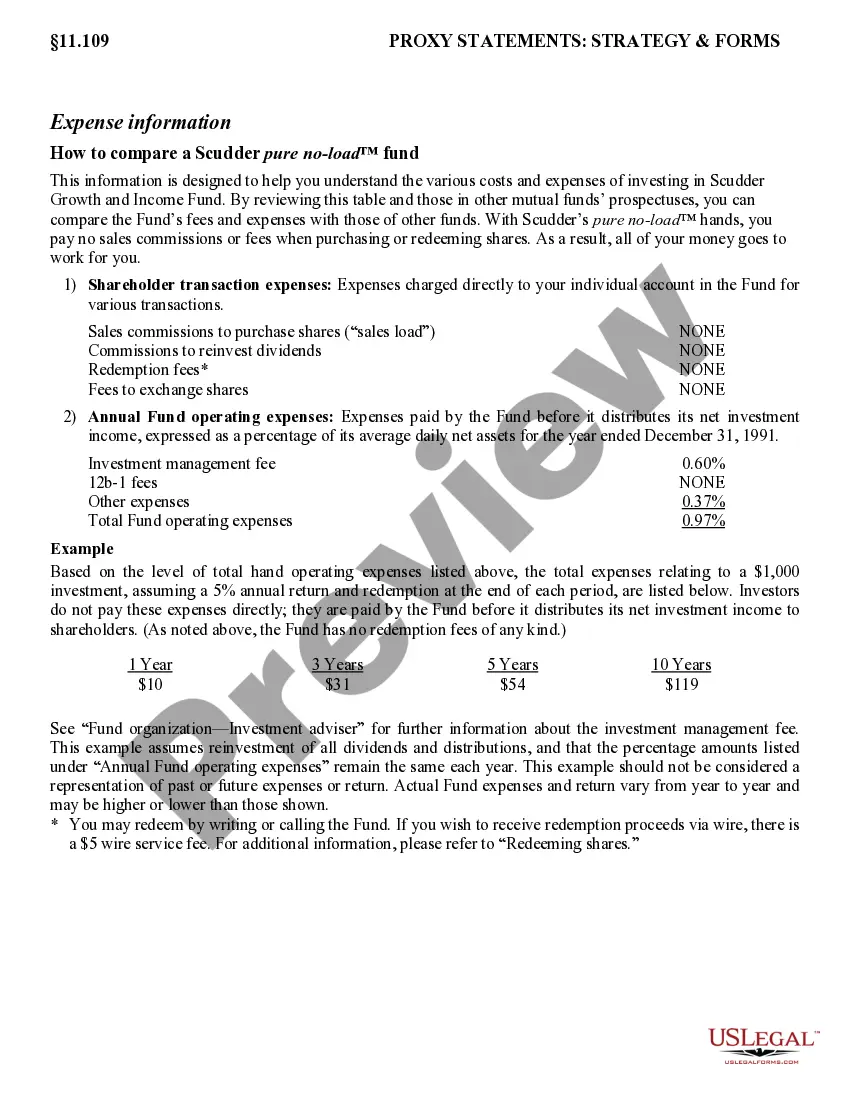

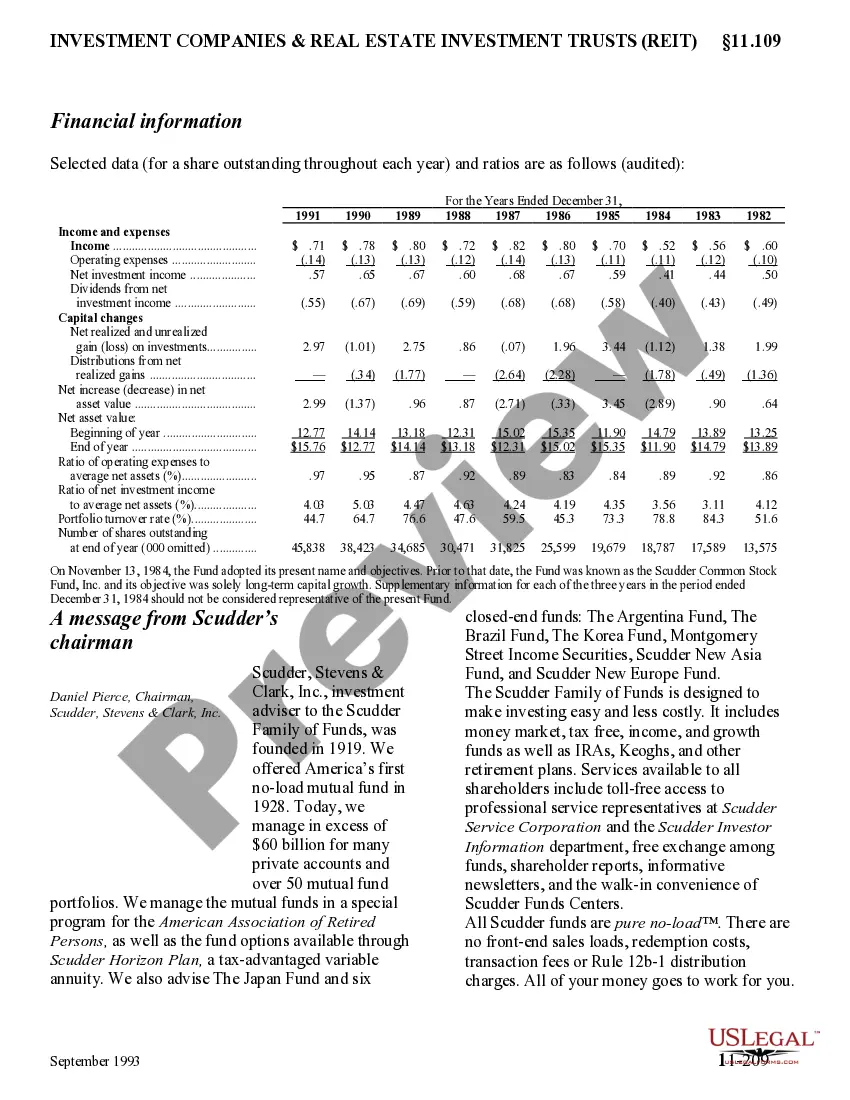

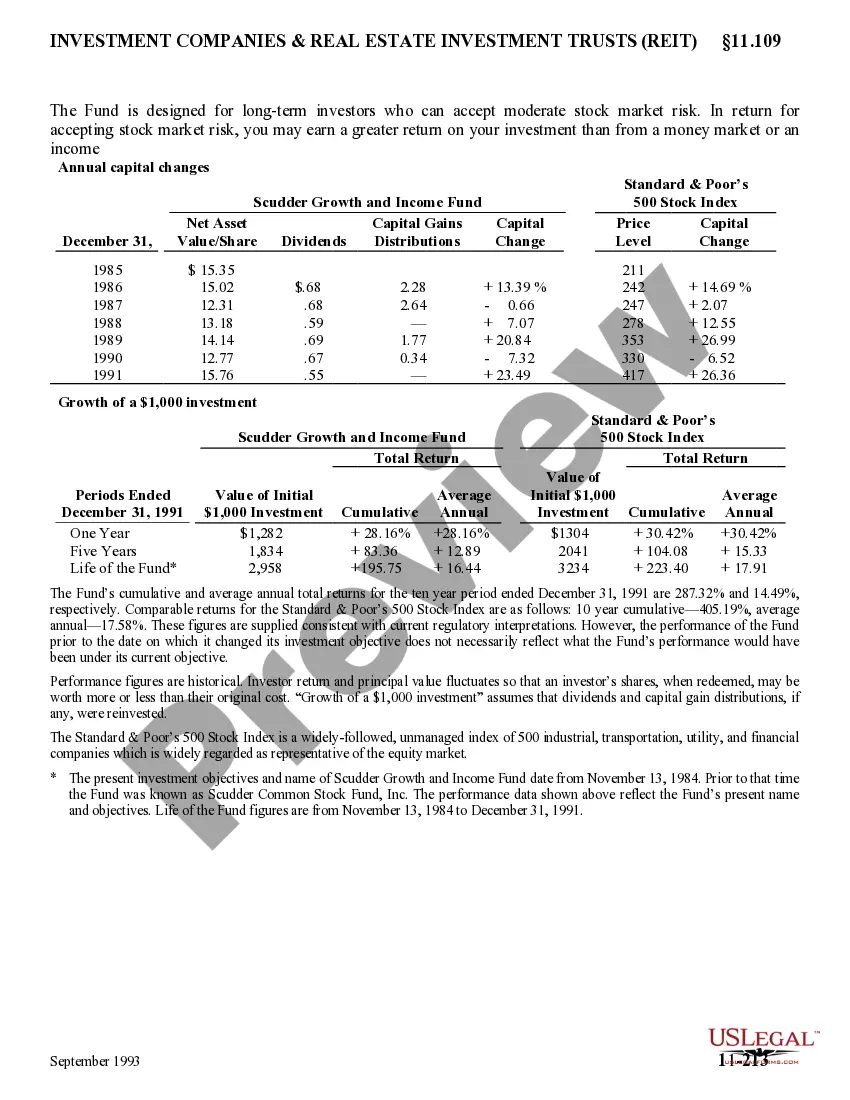

The Vermont Prospectus of Scudder Growth and Income Fund provides potential investors with a comprehensive understanding of this investment opportunity. The fund aims to achieve long-term capital growth and income by investing primarily in a diversified portfolio of equity and income securities. The Scudder Growth and Income Fund can be classified into two types: 1. Equity-focused: This type of fund primarily invests in stocks of companies across various sectors and market capitalization. It aims to generate capital appreciation by selecting growth-oriented stocks that have the potential for long-term value creation. The fund managers extensively research and assess these stocks to identify those with the highest growth potential. 2. Income-focused: This version of the Scudder Growth and Income Fund focuses on generating a regular income stream for investors. It invests in income-generating securities such as bonds, preferred stocks, and dividend-paying stocks. The fund managers carefully analyze the credit quality and sustainability of these income-generating assets to ensure a stable and consistent income flow. Key Features of the Vermont Prospectus of Scudder Growth and Income Fund: 1. Objectives: The fund aims to generate long-term capital growth and income while considering the potential risks associated with equity and income securities. 2. Investment Strategy: The fund employs a disciplined investment approach to construct a diversified portfolio consisting of carefully selected securities. The fund managers utilize fundamental analysis and research to identify investment opportunities with strong growth potential or attractive income characteristics. 3. Asset Allocation: The fund's portfolio typically includes a mix of equity securities, fixed-income securities, and other income-generating assets in varying proportions, depending on the fund type. The asset allocation is designed to balance the growth and income objectives of the fund. 4. Risk Management: The prospectus highlights the risks associated with investing in the Scudder Growth and Income Fund, such as market volatility, credit risk, interest rate risk, and stock-specific risks. It emphasizes the importance of diversification and the expertise of the fund managers in managing these risks. 5. Performance History: The Vermont Prospectus provides historical performance data, including returns, expense ratios, and benchmarks to assess the fund's performance over different time periods. This helps investors evaluate the fund's track record and compare it with other investment options. 6. Fees and Expenses: The prospectus outlines the fees and expenses associated with investing in the Scudder Growth and Income Fund, including management fees, distribution fees, and any other applicable charges. It gives a transparent overview of the costs involved in investing in the fund. 7. Prospectus Supplements: Depending on the specific type or series of the Scudder Growth and Income Fund, there may be supplemental prospectus documents providing additional information regarding investment options, redemption policies, shareholder services, and taxation details. These supplements further define the terms and conditions of each variant of the fund. Investors considering the Vermont Prospectus of Scudder Growth and Income Fund can refer to this detailed prospectus to make informed investment decisions. It serves as a comprehensive guide that includes all the necessary information required to understand the fund's objectives, strategies, risks, performance, and associated costs.

Vermont Prospectus of Scudder growth and income fund

Description

How to fill out Vermont Prospectus Of Scudder Growth And Income Fund?

Are you presently in a situation where you will need documents for sometimes enterprise or personal reasons just about every time? There are a variety of legal file templates available on the net, but finding types you can trust isn`t effortless. US Legal Forms delivers thousands of type templates, such as the Vermont Prospectus of Scudder growth and income fund, that are published to fulfill federal and state requirements.

If you are currently acquainted with US Legal Forms internet site and have your account, merely log in. Next, you can obtain the Vermont Prospectus of Scudder growth and income fund format.

If you do not have an account and would like to begin using US Legal Forms, abide by these steps:

- Find the type you need and ensure it is for the right city/area.

- Utilize the Preview button to check the shape.

- Read the outline to ensure that you have selected the appropriate type.

- When the type isn`t what you are searching for, make use of the Search field to find the type that meets your needs and requirements.

- If you find the right type, simply click Buy now.

- Opt for the pricing plan you would like, complete the specified info to generate your account, and pay money for the order with your PayPal or bank card.

- Choose a practical file structure and obtain your version.

Locate every one of the file templates you may have bought in the My Forms menus. You can aquire a further version of Vermont Prospectus of Scudder growth and income fund any time, if needed. Just click on the essential type to obtain or print the file format.

Use US Legal Forms, by far the most comprehensive selection of legal types, to save time and steer clear of errors. The support delivers professionally produced legal file templates which can be used for a variety of reasons. Make your account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

DWS Scudder changed its name to DWS Investments, completing a rebranding started two years ago to align with Deutsche Bank Asset Management (DeAM).

Effective February 6, 2006, Scudder Investments will change its name to DWS Scudder and the Scudder funds will be renamed DWS funds. The Trusts/Corporations that the funds are organized under will also be renamed DWS. Effective February 6, 2006, Scudder Investments will change ... - SEC.gov sec.gov ? edgar ? data ? ss012306allfunds sec.gov ? edgar ? data ? ss012306allfunds

Deutsche Bank buys Scudder Investments.

A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of capital and typically higher yields than some other cash products. Money Market Funds | Charles Schwab schwab.com ? money-market-funds schwab.com ? money-market-funds