Vermont Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

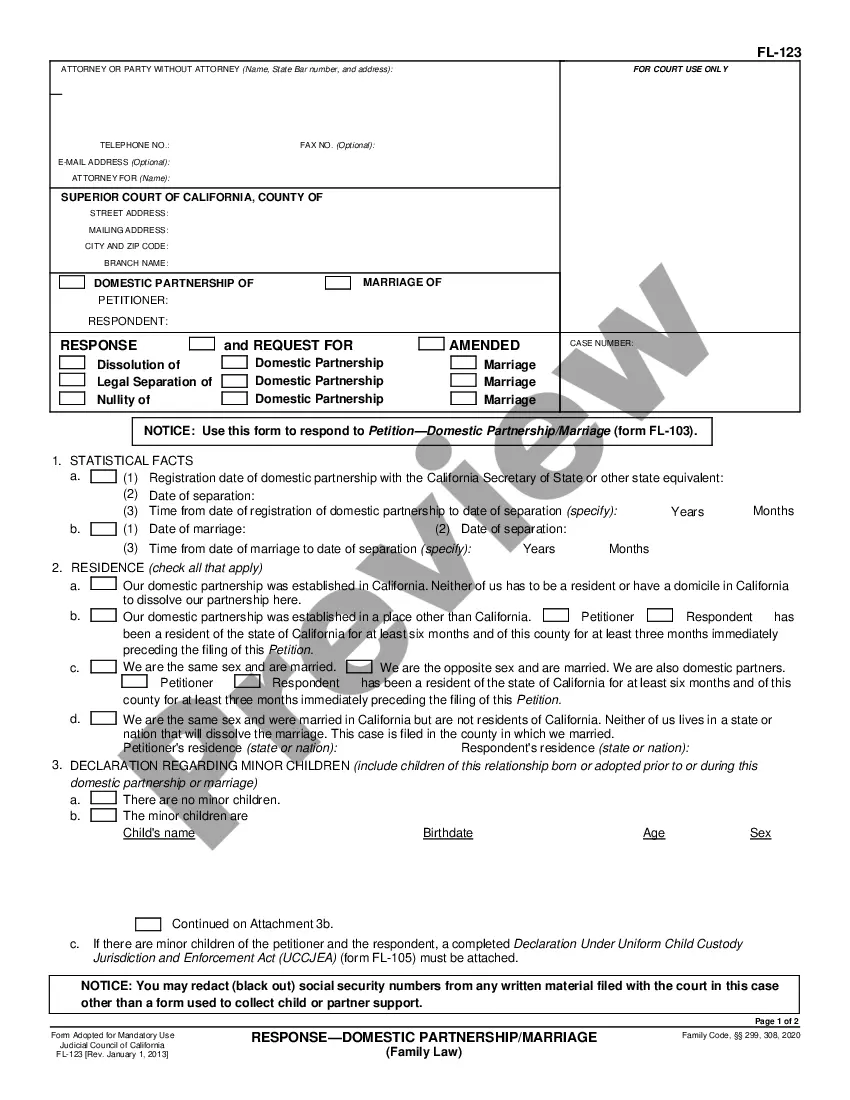

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

If you wish to comprehensive, acquire, or printing legal file web templates, use US Legal Forms, the most important selection of legal types, which can be found on the Internet. Take advantage of the site`s simple and hassle-free look for to discover the paperwork you want. Numerous web templates for organization and personal functions are categorized by categories and states, or key phrases. Use US Legal Forms to discover the Vermont Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust in a handful of mouse clicks.

If you are previously a US Legal Forms customer, log in in your account and click on the Down load option to have the Vermont Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust. You can also entry types you previously downloaded from the My Forms tab of your account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right city/region.

- Step 2. Make use of the Review option to examine the form`s content. Never forget about to see the description.

- Step 3. If you are unhappy with all the type, use the Research discipline on top of the display screen to get other variations in the legal type design.

- Step 4. Once you have found the form you want, click the Buy now option. Opt for the rates prepare you choose and add your credentials to sign up to have an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to complete the financial transaction.

- Step 6. Find the format in the legal type and acquire it on the product.

- Step 7. Full, modify and printing or indication the Vermont Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

Each legal file design you buy is the one you have permanently. You might have acces to every single type you downloaded within your acccount. Select the My Forms portion and decide on a type to printing or acquire once again.

Remain competitive and acquire, and printing the Vermont Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust with US Legal Forms. There are millions of skilled and status-specific types you may use for your personal organization or personal requires.

Form popularity

FAQ

Vermont domestication is a procedure authorized by Vermont law that lets an LLC change the state that primarily governs the company. Vermont's domestication process allows an LLC formed in another state?called a foreign LLC or out-of-state LLC?to transfer to Vermont.

The nonstatutory conversion starts with forming an entirely new business entity, followed by a vote to approve a merger between your existing entity and the new one. Then, your business owners will need to voluntarily and formally trade in their ownership in your previous entity for ownership shares in the new entity.

Note that while the conversion is technically tax free, you'll have to report gains made through the process, such as reduced liability. Beyond legal liability and taxes, changing your business entity may have additional consequences.

Statutory conversion ? In a conversion, a document is filed with the state filing office to change from one entity form to another. There is no need to form a new entity.

Conversion is an intentional tort which occurs when a party takes the chattel property of another with the intent to deprive them of it. Conversion is not applicable to real property. For the purposes of conversion, ?intent? merely means the objective to possess the property or exert property rights over it.

Unlike a statutory merger, where the surviving entity already exists, the converted entity does not legally come into existence until the conversion. The converting entity ?becomes? the converted entity.