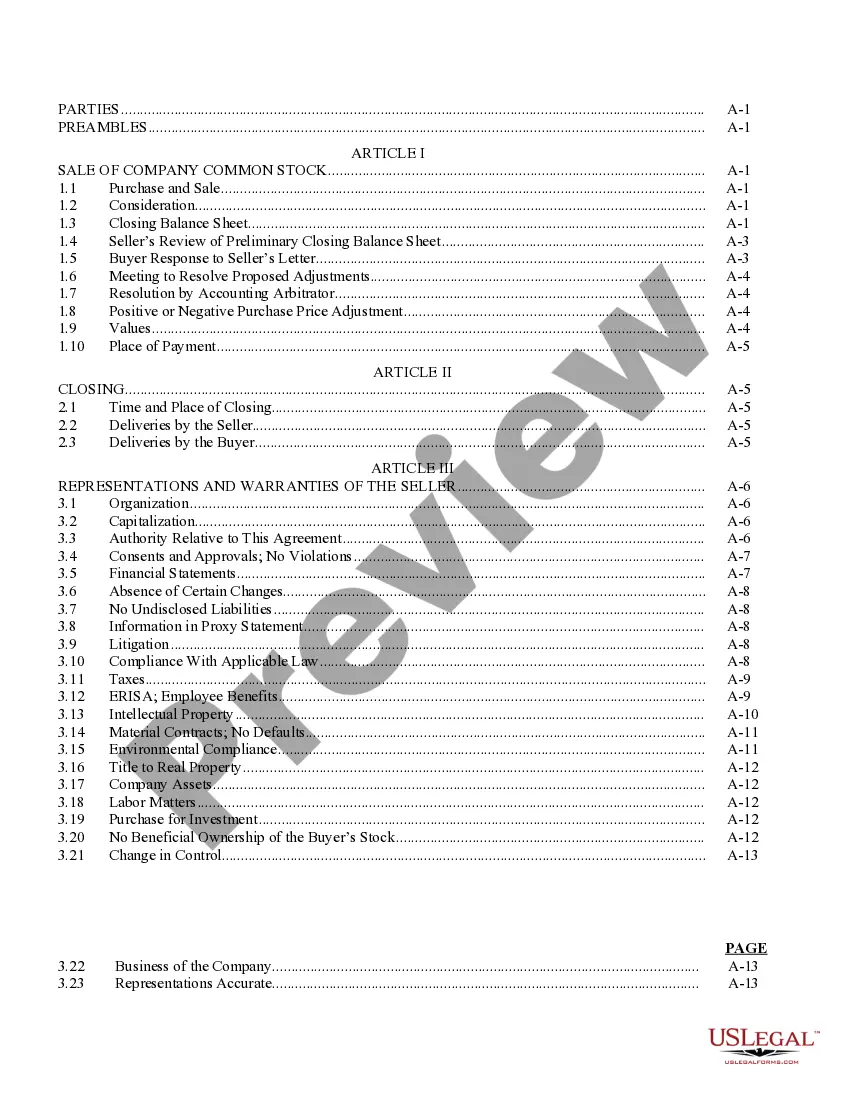

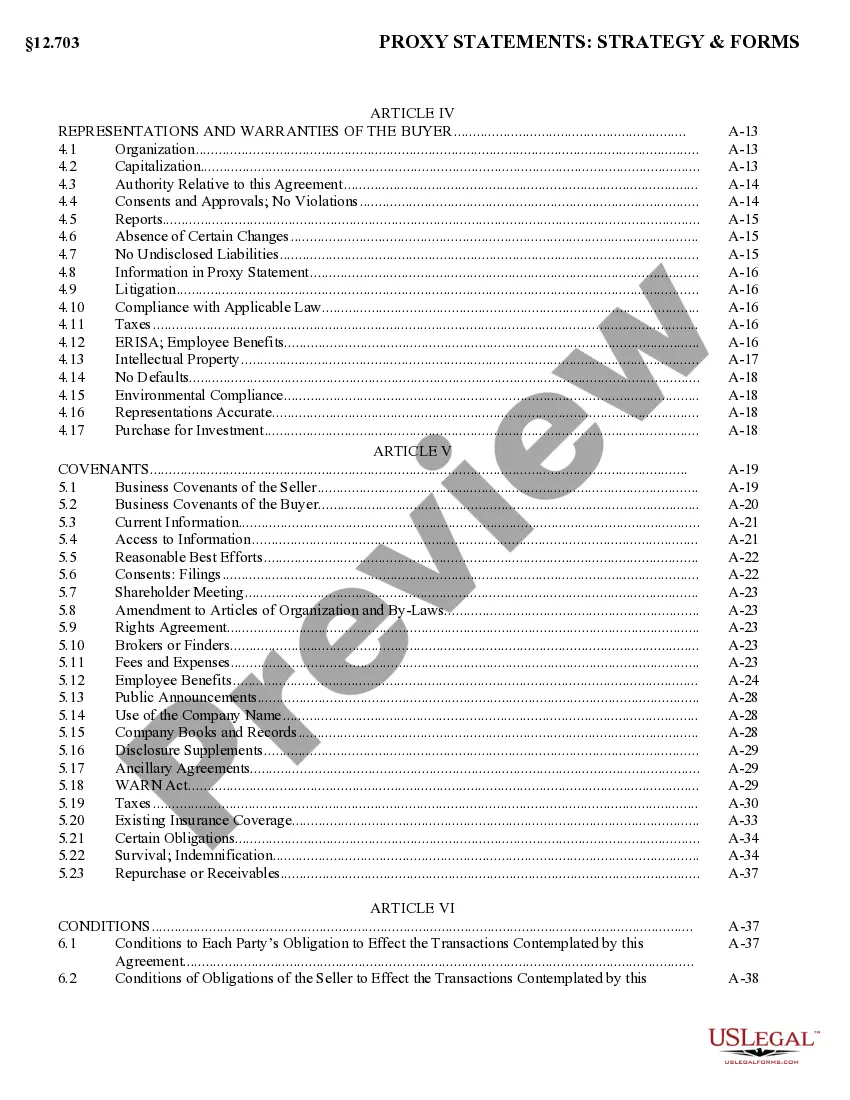

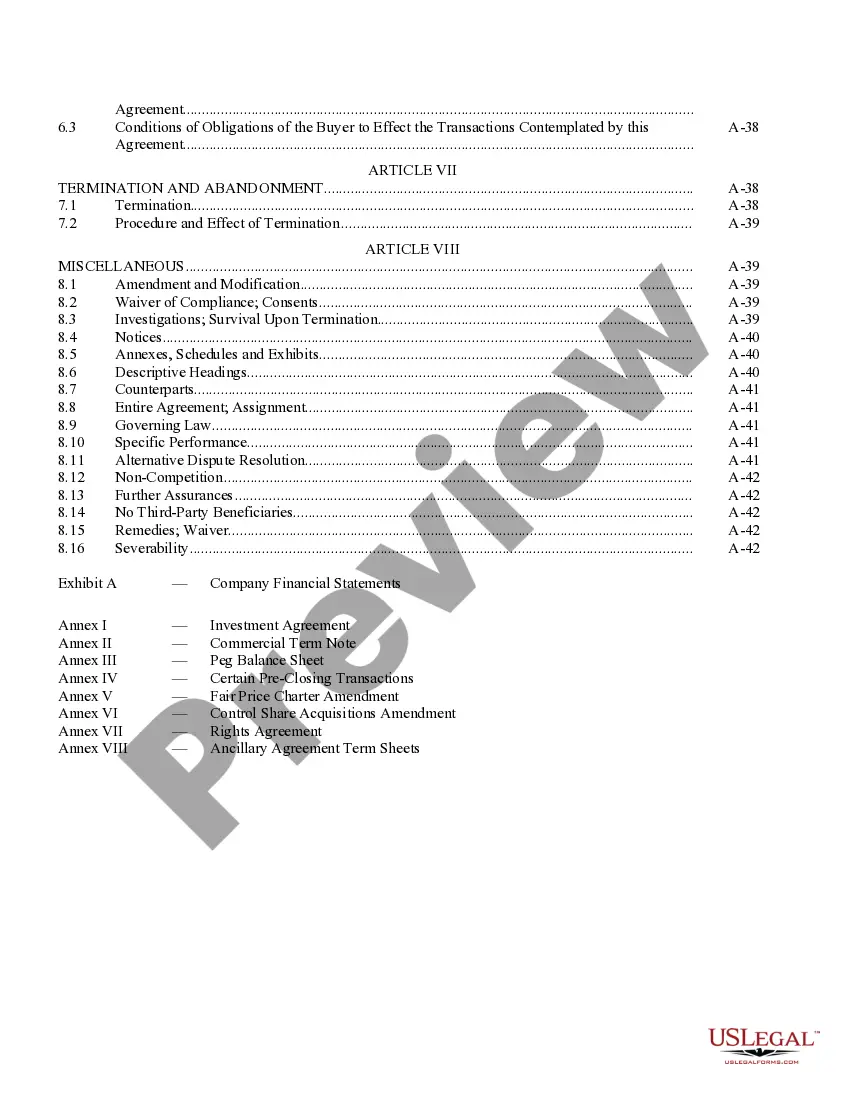

Vermont Sample Stock Purchase Agreement general form to be used across the United States

Description

How to fill out Sample Stock Purchase Agreement General Form To Be Used Across The United States?

If you want to total, acquire, or printing authorized record layouts, use US Legal Forms, the largest variety of authorized kinds, which can be found online. Take advantage of the site`s easy and practical research to get the papers you need. Different layouts for business and specific functions are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the Vermont Sample Stock Purchase Agreement general form to be used across the United States in a couple of click throughs.

When you are currently a US Legal Forms customer, log in to the accounts and click the Download button to get the Vermont Sample Stock Purchase Agreement general form to be used across the United States. You can even access kinds you previously saved from the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for your proper metropolis/region.

- Step 2. Utilize the Review option to examine the form`s information. Never neglect to read through the outline.

- Step 3. When you are unhappy with all the develop, make use of the Search field on top of the screen to get other models in the authorized develop format.

- Step 4. After you have identified the shape you need, go through the Acquire now button. Pick the costs program you prefer and add your qualifications to sign up for the accounts.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the purchase.

- Step 6. Find the structure in the authorized develop and acquire it on your own product.

- Step 7. Total, revise and printing or indication the Vermont Sample Stock Purchase Agreement general form to be used across the United States.

Each authorized record format you buy is the one you have permanently. You possess acces to every single develop you saved inside your acccount. Click the My Forms segment and decide on a develop to printing or acquire once more.

Contend and acquire, and printing the Vermont Sample Stock Purchase Agreement general form to be used across the United States with US Legal Forms. There are millions of professional and express-certain kinds you can utilize for the business or specific requirements.

Form popularity

FAQ

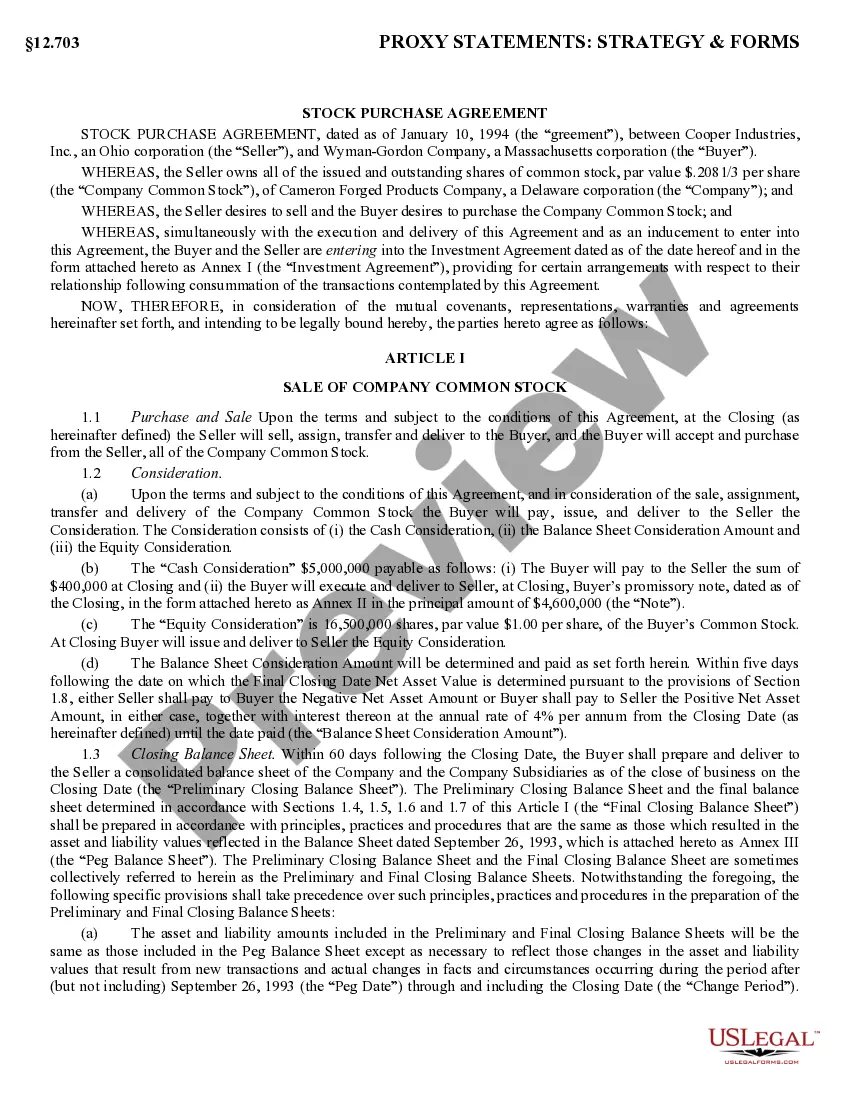

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A purchase agreement is the final document used to transfer a property from the seller to the buyer, while a purchase and sale agreement specifies the terms of the transaction. Parties will sign a purchase agreement after both parties have complied with the terms of the purchase and sale agreement.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

It details specific information about the stock transfer, including warranties, dispute resolution measures, allocation of costs, etc. It is a binding agreement that ensures the stock transfer will proceed. The buyer and seller can review the agreement and get a clear understanding of the transaction in advance.

A stock purchase agreement (also referred to as a stock transfer agreement or share transfer agreement) that can be used with a sale of stock between two stockholders of a target company or an intercompany transfer between two affiliates.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Understanding Stock Purchase Agreements The basic terms of the deal are the seller's and buyer's legal names, the number of stocks being purchased and at what price, and the closing date.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.