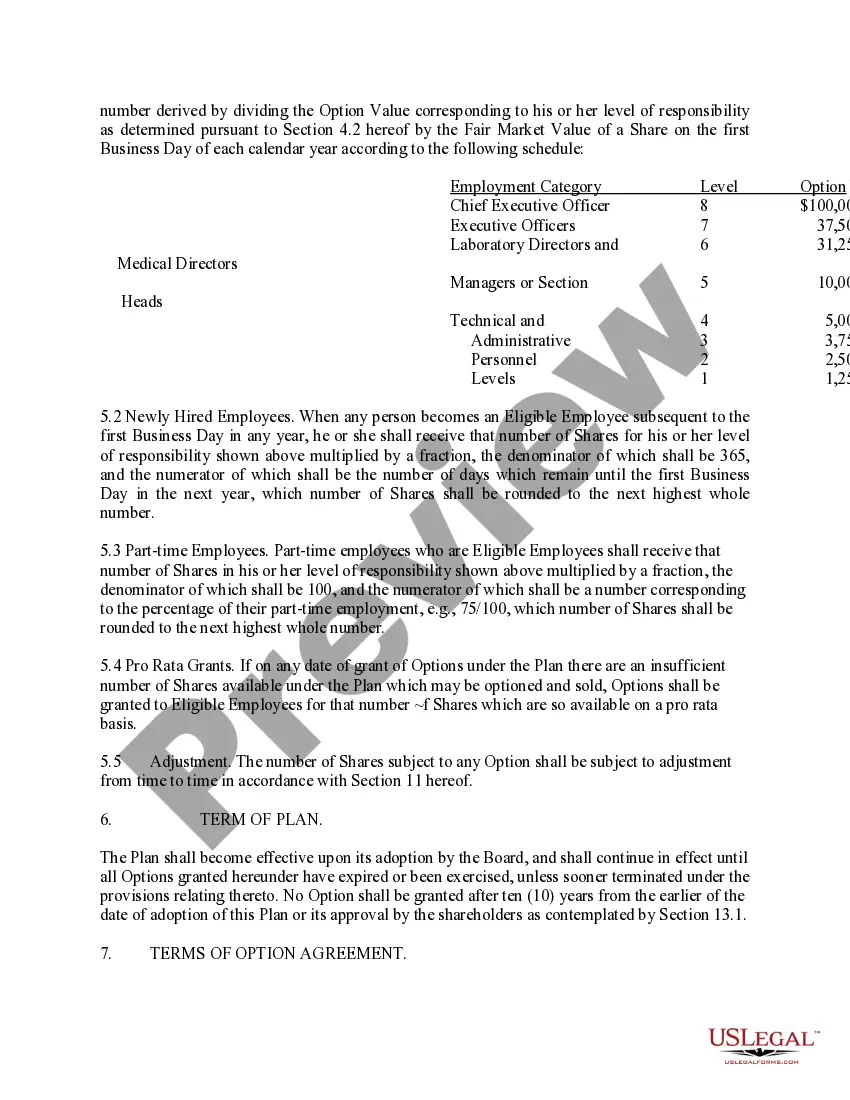

Vermont Employee Stock Option Plan of Vivien, Inc. (AESOP) — A Comprehensive Overview Introduction: The Vermont Employee Stock Option Plan (AESOP) is a unique employee benefit program offered by Vivien, Inc., a leading biotechnology company headquartered in Vermont. AESOP allows eligible employees of Vivien to have the opportunity to own a stake in the company through stock options. This detailed description will provide insights into the various components, benefits, and features of AESOP, highlighting its significance for employees and the organization as a whole. Key Features of AESOP: 1. Eligibility: AESOP is available to all permanent full-time employees of Vivien, Inc. who meet the predetermined eligibility criteria set by the company. 2. Stock Options: Under AESOP, eligible employees are granted stock options, which provide them the right to purchase a specified number of Vivien shares at a predetermined exercise price. 3. Vesting Schedule: To ensure employee retention and loyalty, AESOP utilizes a vesting schedule. This means that employees must work for a specific duration, typically referred to as a vesting period, before they can exercise their stock options entirely. Vesting periods are usually structured over multiple years to incentivize long-term commitment. 4. Stock Option Exercise Period: Upon completing the vesting period, employees are granted an exercise period during which they can purchase the company's shares using their stock options. This provides them the opportunity to benefit from the potential appreciation of Vivien's stock value over time. 5. Tax Benefits: AESOP may offer certain tax advantages to employees, as it allows them to defer taxation until they exercise their stock options or sell the acquired shares. Employees are encouraged to consult a professional tax advisor to understand the specific tax implications relevant to their individual situations. Types of AESOP: 1. Standard AESOP: The Standard AESOP is the primary stock option plan offered to eligible employees. It follows the establishment's general guidelines and features outlined in the AESOP program. 2. Executive AESOP: Vivien, Inc. may also offer an Executive AESOP tailored specifically for executives or senior management. This plan may include additional benefits, such as higher stock option grants, accelerated vesting schedules, or other customized features, designed to attract and retain top talent. Benefits of AESOP: 1. Employee Ownership: AESOP allows employees to become stakeholders in the company and align their financial interests with the success of Vivien. This fosters a sense of ownership, motivation, and pride among the workforce. 2. Long-Term Incentive: By rewarding employees with stock options, AESOP serves as a long-term incentive, encouraging them to contribute to the company's growth and profitability consistently. 3. Retention Tool: The vesting schedule of AESOP promotes employee retention by providing a strong incentive to remain with Vivien, Inc. for the duration of the vesting period. 4. Wealth Creation: As the stock value of Vivien increases over time, employees who exercise their stock options can potentially benefit from the appreciation of the company's shares, thus creating wealth alongside their regular compensation. Conclusion: The Vermont Employee Stock Option Plan (AESOP) is a valuable employee benefit program offered by Vivien, Inc., providing eligible employees with the opportunity to own a stake in the company. Through stock options, AESOP aligns the employees' financial interests with the company's growth and fosters a sense of ownership. With its various features, AESOP acts as a long-term incentive and retention tool while offering the potential for additional wealth creation. Vivien, Inc. may also customize AESOP to cater to the specific needs of its executive team through an Executive AESOP. Overall, AESOP symbolizes the commitment of Vivien towards its employees' financial success and corporate stewardship.

Vermont Employee Stock Option Plan of Vivigen, Inc.

Description

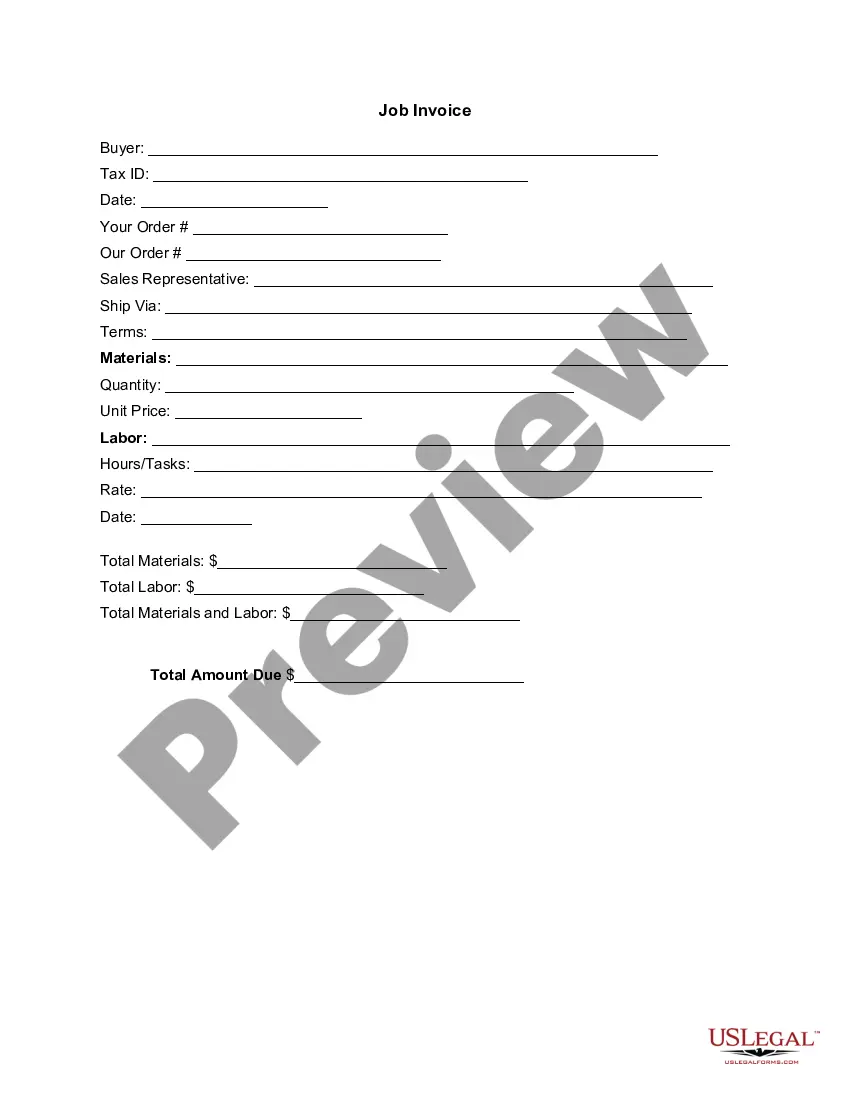

How to fill out Employee Stock Option Plan Of Vivigen, Inc.?

Choosing the right authorized papers template might be a battle. Naturally, there are a lot of layouts available on the Internet, but how will you discover the authorized form you need? Use the US Legal Forms internet site. The assistance provides a large number of layouts, such as the Vermont Employee Stock Option Plan of Vivigen, Inc., which can be used for organization and personal needs. All of the forms are examined by specialists and fulfill federal and state demands.

In case you are presently signed up, log in to your profile and click the Download option to have the Vermont Employee Stock Option Plan of Vivigen, Inc.. Use your profile to appear through the authorized forms you possess acquired formerly. Proceed to the My Forms tab of the profile and obtain yet another backup of your papers you need.

In case you are a new customer of US Legal Forms, listed below are simple instructions that you should adhere to:

- Very first, make sure you have selected the appropriate form to your metropolis/county. You are able to look over the form making use of the Review option and study the form outline to ensure this is the best for you.

- In case the form fails to fulfill your preferences, take advantage of the Seach area to get the proper form.

- Once you are certain that the form is proper, go through the Acquire now option to have the form.

- Pick the pricing strategy you would like and enter the necessary details. Build your profile and purchase the order making use of your PayPal profile or bank card.

- Pick the file formatting and obtain the authorized papers template to your device.

- Total, edit and print out and signal the attained Vermont Employee Stock Option Plan of Vivigen, Inc..

US Legal Forms is the most significant collection of authorized forms in which you will find numerous papers layouts. Use the service to obtain expertly-manufactured files that adhere to express demands.

Form popularity

FAQ

ESOPs are typically subject to vesting schedules, which determine when options become exercisable. For example, options may vest over a period of four years, with 25% vesting each year. In this case, if an employee quits after two years, they will only be able to exercise 50% of their options.

To convert ESOP to money, sell your ESOP shares on the stock market or through a broker.

Until you exercise, your options do not have any real value. The price that you will pay for those options is set in the contract that you signed when you started. You may hear people refer to this price as the grant price, strike price or exercise price.

If you are vested, you will need to request the distribution forms from the ESOP company. You may receive these forms as part of your retirement or exit paperwork. You may receive your distribution in installments or as a lump sum, depending on the plan's distribution policy.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An employer and employee agree on ESOP terms on the grant date. Once the employee has fulfilled the conditions or the relevant time period has elapsed, these employee stock options are vested. At this time the employee can exercise them or put simply ? buy them.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.