Vermont Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

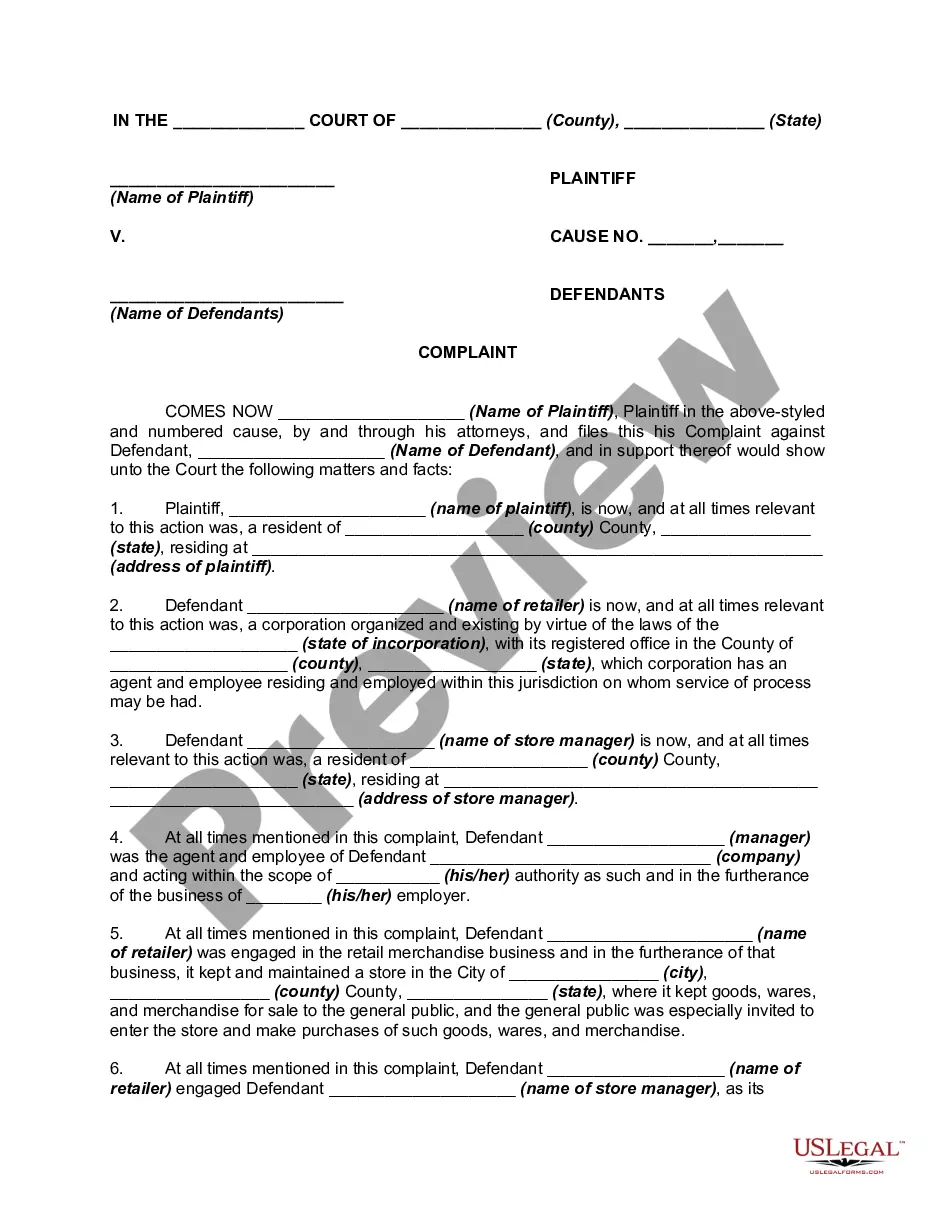

Finding the right authorized document web template can be quite a battle. Naturally, there are a variety of themes available on the net, but how can you obtain the authorized type you want? Make use of the US Legal Forms website. The services offers a large number of themes, such as the Vermont Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., that you can use for organization and private demands. Every one of the forms are examined by specialists and fulfill state and federal demands.

If you are currently registered, log in to the account and click on the Down load option to find the Vermont Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.. Make use of account to look through the authorized forms you have acquired formerly. Visit the My Forms tab of your respective account and get an additional version from the document you want.

If you are a new consumer of US Legal Forms, listed here are easy recommendations so that you can comply with:

- Initial, make certain you have selected the right type to your metropolis/state. You are able to check out the form utilizing the Review option and study the form information to make certain it will be the best for you.

- When the type fails to fulfill your needs, use the Seach field to find the proper type.

- When you are sure that the form is proper, select the Buy now option to find the type.

- Opt for the costs program you need and type in the needed details. Make your account and pay for the transaction with your PayPal account or Visa or Mastercard.

- Pick the submit format and down load the authorized document web template to the product.

- Full, change and printing and sign the received Vermont Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

US Legal Forms is definitely the most significant collection of authorized forms where you can discover different document themes. Make use of the service to down load professionally-manufactured documents that comply with status demands.

Form popularity

FAQ

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Non-statutory stock options are also known as a non-qualified stock options. These are a stock option for employees, but also for vendors, the board of directors, contractors, and anyone else the company issues them to. They are named as such because the will not qualify within the strict guidelines of ISOs.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.