Vermont Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes

Description

How to fill out Stock Option Plan - Permits Optionees To Transfer Stock Options To Family Members Or Other Persons For Estate Planning Purposes?

US Legal Forms - among the largest libraries of lawful forms in the USA - offers a wide range of lawful record web templates it is possible to acquire or print. Utilizing the website, you can find a large number of forms for organization and personal purposes, sorted by types, states, or keywords and phrases.You will discover the newest variations of forms just like the Vermont Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes in seconds.

If you have a monthly subscription, log in and acquire Vermont Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes through the US Legal Forms library. The Acquire option can look on every single kind you look at. You have accessibility to all earlier saved forms from the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed below are simple recommendations to help you get started out:

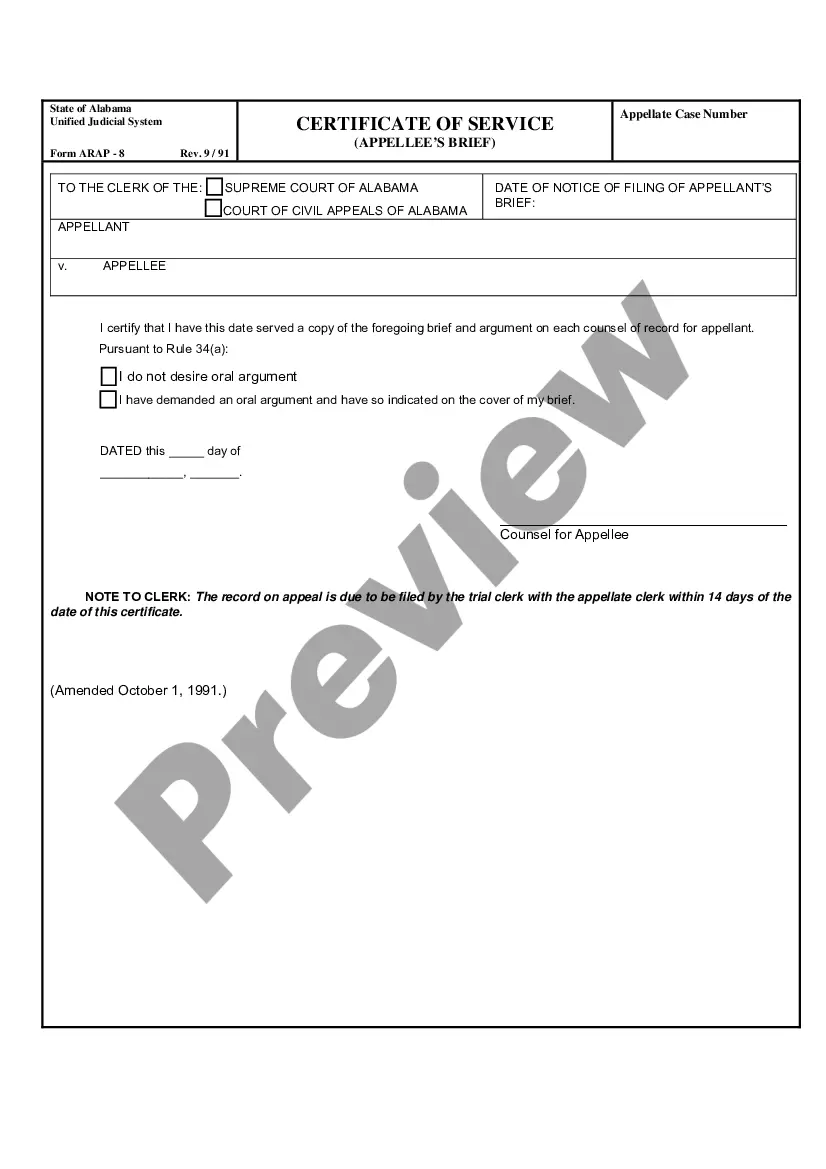

- Ensure you have selected the best kind for your personal city/state. Click the Preview option to check the form`s content. See the kind description to ensure that you have selected the proper kind.

- When the kind doesn`t suit your demands, make use of the Lookup field on top of the monitor to find the one who does.

- If you are happy with the form, confirm your option by clicking on the Buy now option. Then, opt for the costs program you want and supply your qualifications to register to have an accounts.

- Process the transaction. Make use of bank card or PayPal accounts to finish the transaction.

- Find the file format and acquire the form on the device.

- Make adjustments. Complete, change and print and indicator the saved Vermont Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes.

Each template you put into your bank account does not have an expiration particular date and is your own permanently. So, in order to acquire or print yet another copy, just go to the My Forms section and click on around the kind you need.

Obtain access to the Vermont Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes with US Legal Forms, probably the most comprehensive library of lawful record web templates. Use a large number of skilled and express-particular web templates that meet up with your business or personal needs and demands.

Form popularity

FAQ

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

Understanding Inherited Stock Options If you inherit stock upon the original owner's death, your first task will be to check the paperwork that comes with the options to determine whether they expired upon the original holder's death. Some options expire on the death of the holder, and others do not.

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

Stocks can be a great gift, and if you're wondering how to transfer stock to a family member, you can simply contact your broker. You could also fill out a stock transfer form and endorse the stock certificate. Learning how to gift stocks is the easy part ? you also have to consider the tax implications.

Permitted transferees usually include family members, trusts for family members or limited partnerships, or other entities owned by family members. In a simple option transfer to a family member, you transfer a vested option to a child, grandchild, or other heir.

In most cases, the options do not lapse. After your death, your estate or beneficiary may exercise any vested options, ing to the option grant's terms and deadlines, along with any estate-planning documents (e.g. a will).

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

The stock option deduction loophole is one of the most unfair and regressive tax loopholes of all. Stock options get treated like capital gains. That means it allows those with stock options to pay tax at half the rate everyone else pays on their employment income.