Vermont Stock Option and Stock Award Plan of American Stores Company

Description

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

If you need to full, obtain, or produce legal file templates, use US Legal Forms, the most important collection of legal types, which can be found on the web. Make use of the site`s easy and hassle-free look for to get the files you want. Numerous templates for company and specific purposes are categorized by groups and claims, or key phrases. Use US Legal Forms to get the Vermont Stock Option and Stock Award Plan of American Stores Company within a few clicks.

Should you be presently a US Legal Forms client, log in to your accounts and click on the Down load option to get the Vermont Stock Option and Stock Award Plan of American Stores Company. You may also gain access to types you previously downloaded inside the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that correct metropolis/nation.

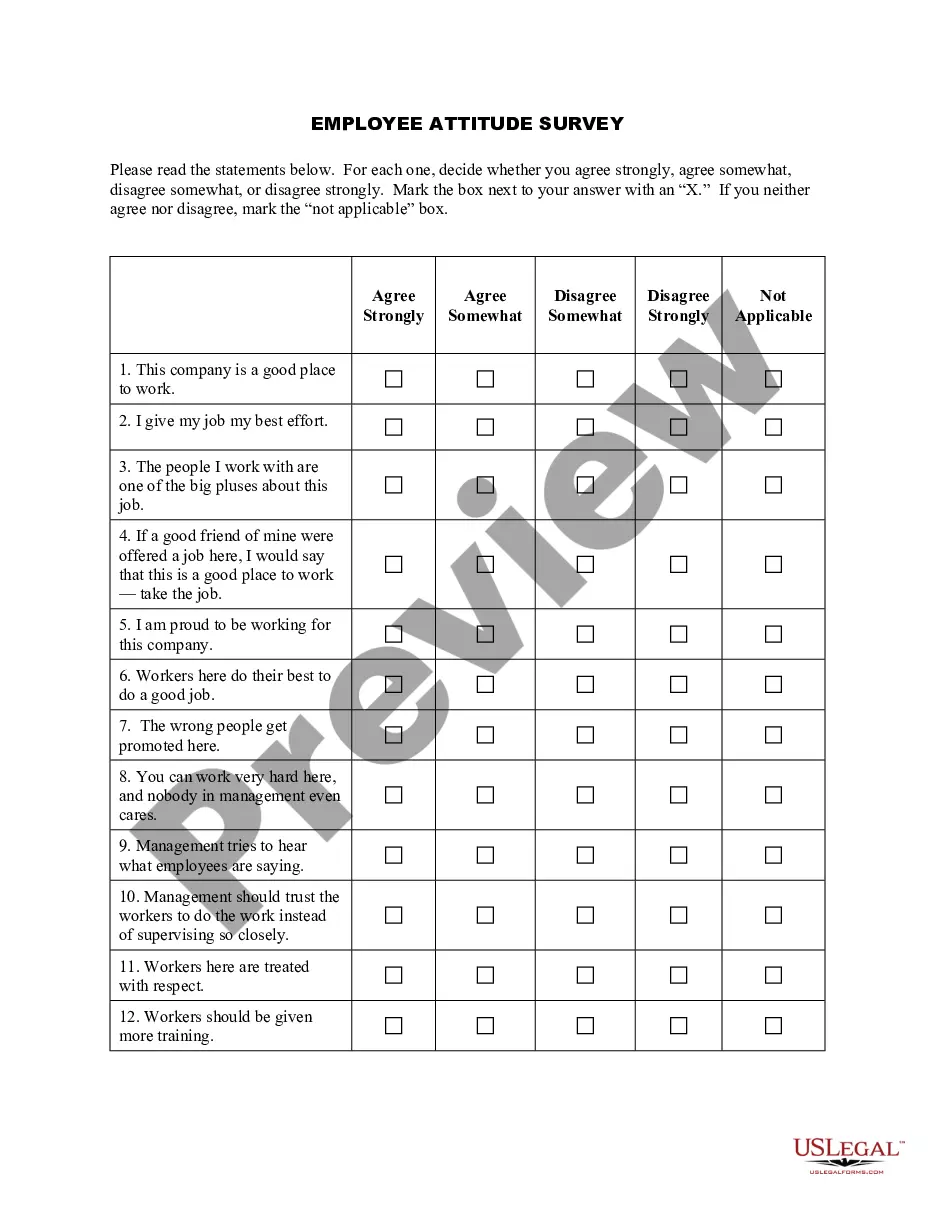

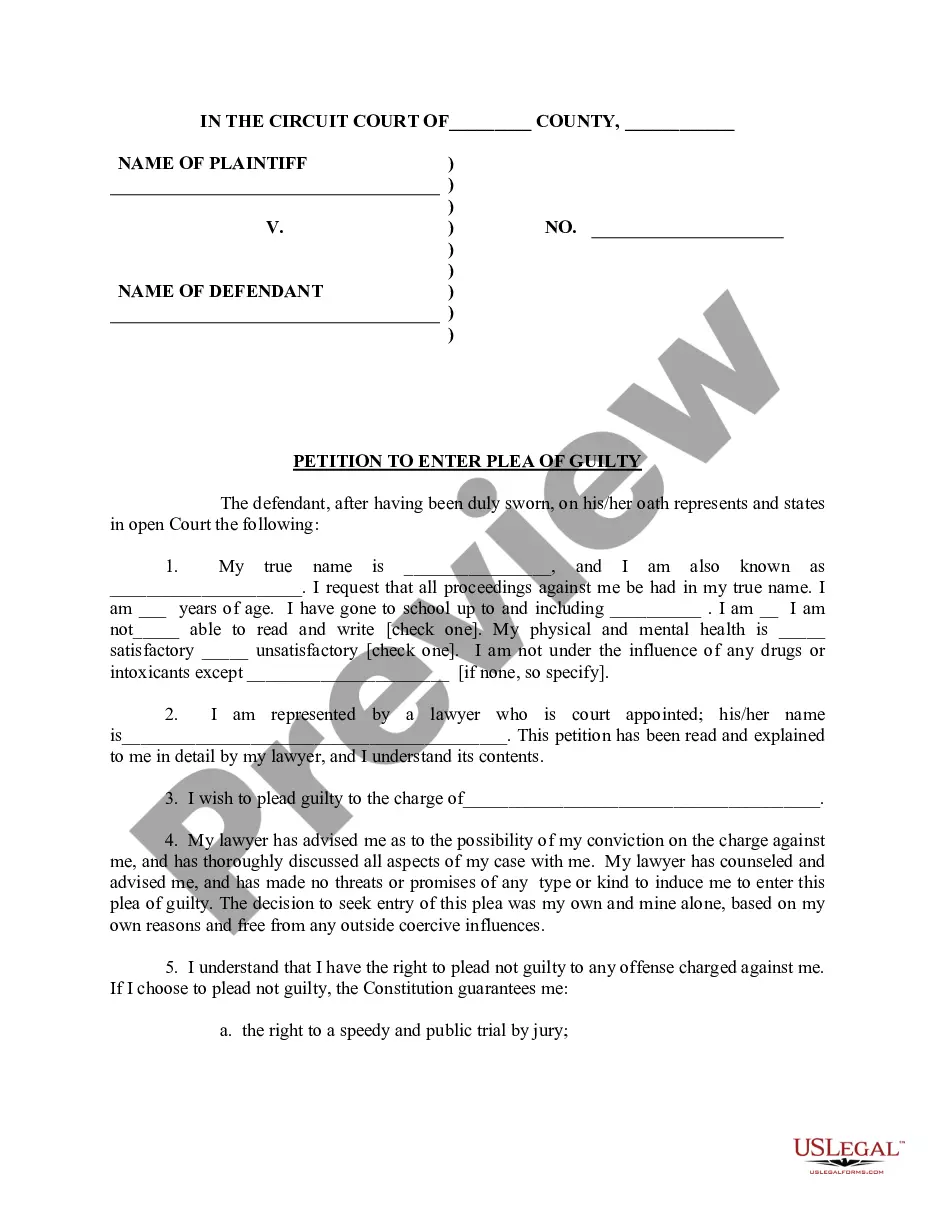

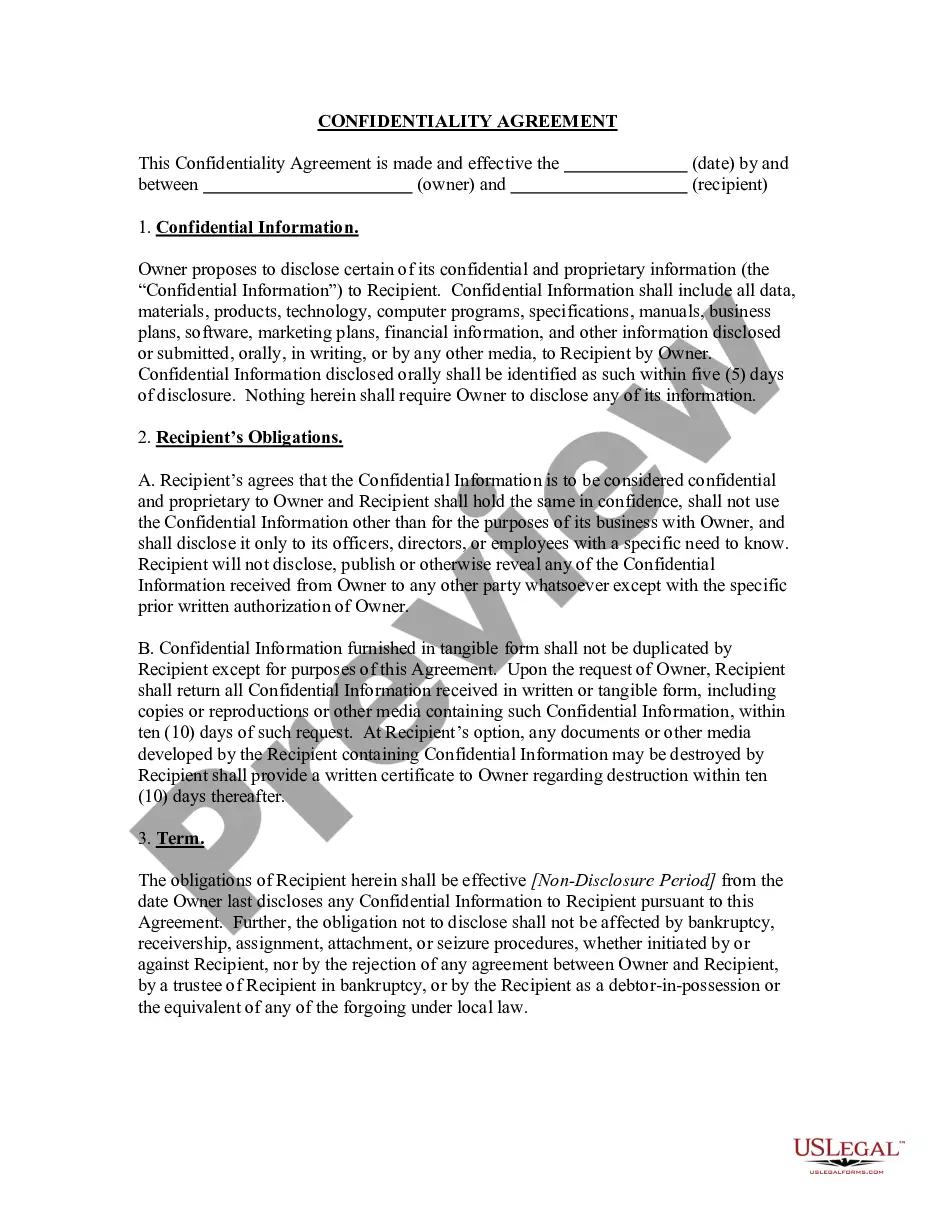

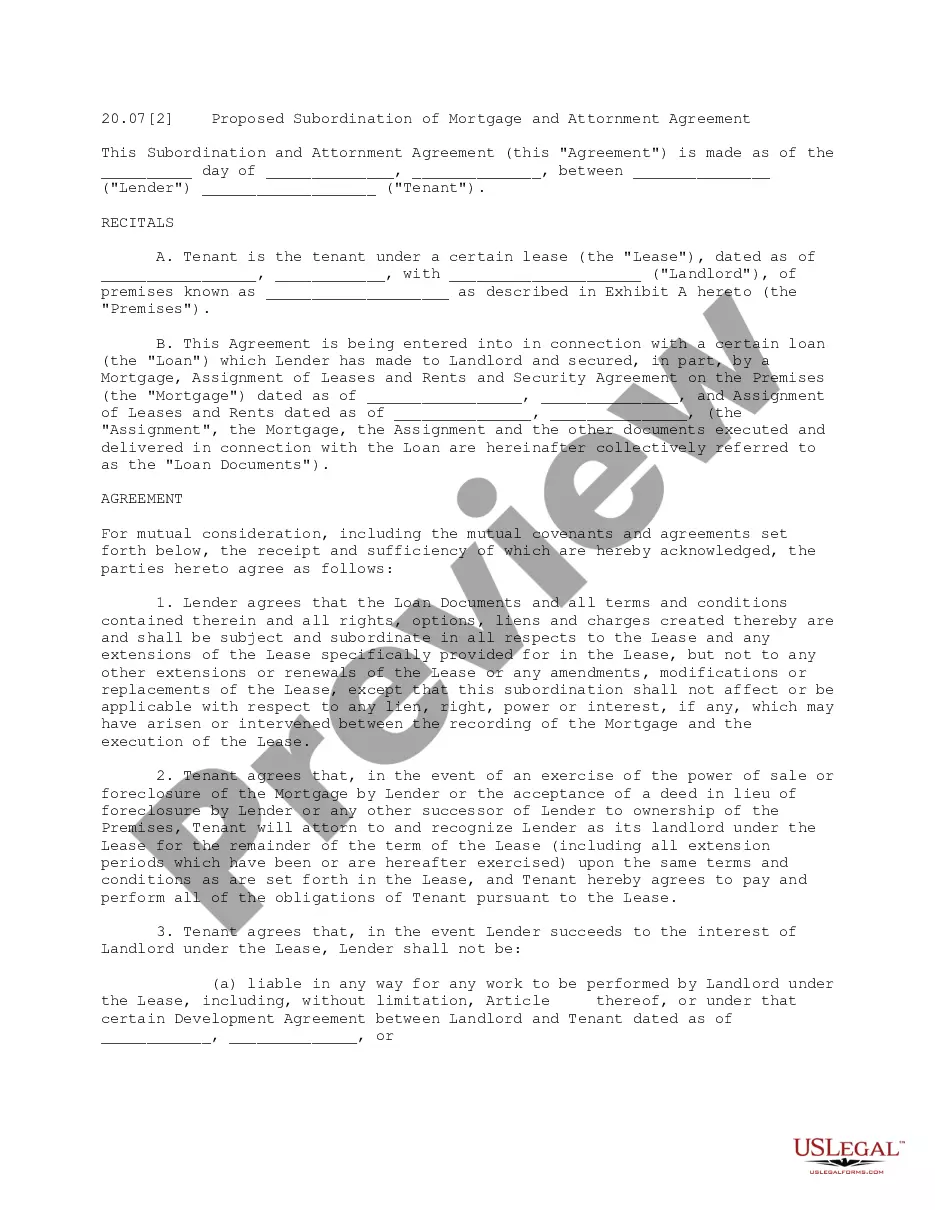

- Step 2. Make use of the Review option to examine the form`s articles. Don`t overlook to learn the explanation.

- Step 3. Should you be not satisfied with all the type, take advantage of the Search field at the top of the screen to find other variations in the legal type design.

- Step 4. When you have found the form you want, select the Get now option. Choose the rates program you prefer and include your references to register for the accounts.

- Step 5. Process the transaction. You can utilize your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure in the legal type and obtain it in your system.

- Step 7. Complete, modify and produce or indicator the Vermont Stock Option and Stock Award Plan of American Stores Company.

Every legal file design you purchase is your own property forever. You might have acces to each and every type you downloaded within your acccount. Click the My Forms section and select a type to produce or obtain again.

Compete and obtain, and produce the Vermont Stock Option and Stock Award Plan of American Stores Company with US Legal Forms. There are many expert and express-particular types you can use to your company or specific needs.

Form popularity

FAQ

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

RSAs vs. RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock.

A restricted stock award is when a company grants someone stock as a form of compensation. The stock awarded has additional conditions on it, including a vesting schedule, so is called restricted stock. Restricted stock awards may also be called simply stock awards or stock grants.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.