Vermont Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

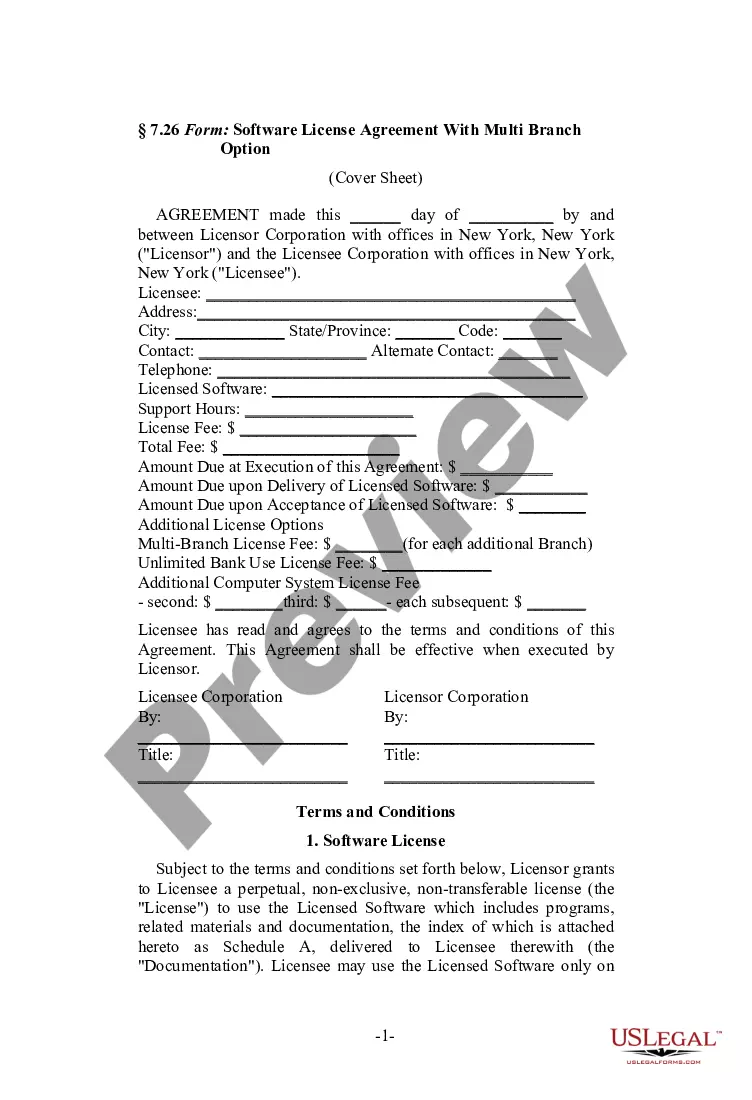

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

Are you currently inside a position that you need files for sometimes organization or specific functions virtually every time? There are a variety of legitimate file layouts available online, but discovering versions you can depend on isn`t easy. US Legal Forms provides 1000s of form layouts, just like the Vermont Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, that happen to be published to fulfill state and federal demands.

When you are already familiar with US Legal Forms internet site and possess an account, merely log in. After that, you may obtain the Vermont Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation template.

If you do not have an profile and wish to start using US Legal Forms, follow these steps:

- Get the form you need and make sure it is for that proper city/state.

- Take advantage of the Review key to examine the form.

- Look at the outline to actually have chosen the correct form.

- In the event the form isn`t what you are seeking, utilize the Look for discipline to discover the form that fits your needs and demands.

- When you obtain the proper form, click Buy now.

- Opt for the rates plan you want, submit the necessary information and facts to generate your bank account, and purchase the order utilizing your PayPal or credit card.

- Decide on a convenient paper file format and obtain your backup.

Discover every one of the file layouts you have bought in the My Forms menu. You can obtain a additional backup of Vermont Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation whenever, if necessary. Just click the necessary form to obtain or produce the file template.

Use US Legal Forms, probably the most considerable variety of legitimate types, in order to save time as well as stay away from mistakes. The support provides appropriately produced legitimate file layouts that you can use for a range of functions. Produce an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

If a startup never goes public, the stock options that employees have may become worthless or may have limited value. Stock options give employees the right to purchase a certain number of shares in the company at a predetermined price (also known as the exercise price or strike price).

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Unvested Options ? Depending on the structure of the deal, there are three possibilities for unvested options. The holdings could be canceled, they might be converted to cash and paid out over time, or they could be converted to the acquiring company stock and subject to a new vesting schedule.

The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income. Non-qualified stock options (NSOs) are taxed as ordinary income. Generally, ISO stock is awarded only to top management and highly-valued employees.

A stock option may be worth exercising if the current stock price (also known as the fair market value or FMV*) is more than the exercise price.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.