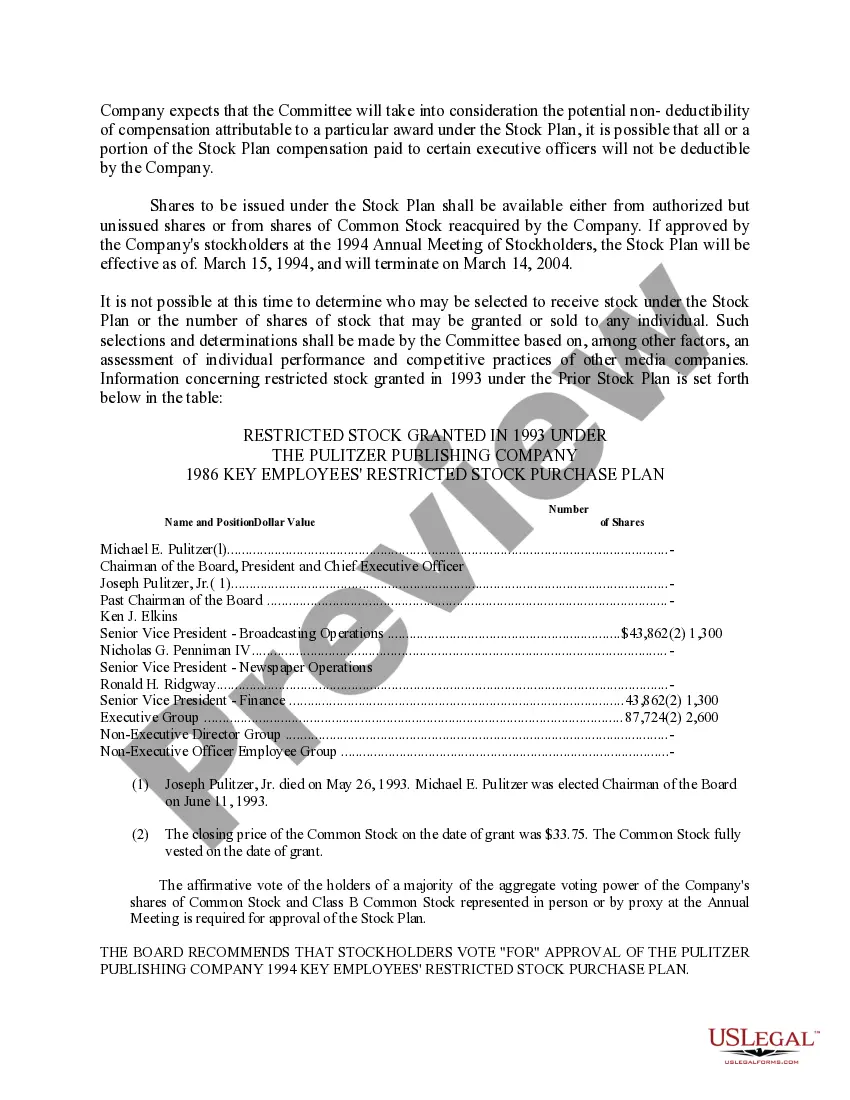

Title: Vermont Approval of The Pulitzer Publishing Co.'s Key Employees' Restricted Stock Purchase Plan Introduction: The Pulitzer Publishing Co., a renowned media conglomerate, has obtained Vermont's approval for its Key Employees' Restricted Stock Purchase Plan. This comprehensive plan aims to incentivize and reward key employees by offering them the opportunity to purchase restricted company stock under certain conditions. By outlining the plan's features and benefits, eligible employees can make informed decisions to participate in this program. Keywords: The Pulitzer Publishing Co., Vermont, approval, Key Employees' Restricted Stock Purchase Plan I. Overview of The Pulitzer Publishing Co.'s Key Employees' Restricted Stock Purchase Plan The Pulitzer Publishing Co. has established a comprehensive Key Employees' Restricted Stock Purchase Plan that has been approved by the state of Vermont. This plan allows eligible key employees to purchase a specific number of company stocks at predetermined prices. II. Eligibility and Participation a. Criteria: The plan identifies key employees based on certain pre-defined criteria such as seniority, performance, and contributions to the company. b. Restricted Stock Units (RSS): Eligible employees will be granted a specific number of RSS, representing the right to purchase a corresponding number of company shares at a later date. III. Vesting and Restricted Period a. Vesting Schedule: The plan includes a vesting period during which the RSS gradually convert into full ownership of company shares. The vesting schedule may vary based on individual employee agreements. b. Restricted Period: During the vesting period, employees cannot sell, transfer, or otherwise dispose of the purchased shares. IV. Purchase Options and Pricing a. Purchase Period: A designated purchase period is specified within the plan, allowing employees to acquire shares. b. Pricing: The plan sets a purchase price for the company shares, usually at a discounted rate compared to the market value at the time of purchase. c. Payment Options: Employees may have the flexibility to pay for the shares through payroll deductions, cash payments, or a combination of both. V. Tax Implications a. Income Tax: Employees should be aware of the tax consequences associated with participating in the plan, such as potential income tax obligations upon the purchase of company shares. b. Capital Gains Tax: Any gains realized upon the sale of the purchased shares may be subject to capital gains tax. VI. Advantages and Incentives a. Employee Retention: The Key Employees' Restricted Stock Purchase Plan is designed to motivate and retain key talent within The Pulitzer Publishing Co. b. Potential Gains: As the company grows, the increased value of the purchased shares may translate into significant financial gains for participating employees. c. Alignment of Interests: By becoming shareholders, employees have a vested interest in the company's success, fostering a stronger sense of ownership and dedication. Types of The Pulitzer Publishing Co.'s Key Employees' Restricted Stock Purchase Plan: 1. The Long-Term Incentive Plan: This plan focuses on rewarding key employees for their long-term commitment to the company by providing them with an opportunity to invest in restricted shares over an extended period. 2. The Performance-Based Stock Purchase Plan: Aimed at recognizing employees who meet specific performance metrics, this plan offers the chance to purchase restricted stock as a reward for exceptional results and contributions. Note: The types mentioned above are hypothetical, provided for illustrative purposes only, and might not reflect the actual plan(s) implemented by The Pulitzer Publishing Co.

Vermont Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.

Description

How to fill out Vermont Approval Of Key Employees' Restricted Stock Purchase Plan Of The Pulitzer Publishing Co.?

You may commit several hours on the Internet searching for the legal papers design which fits the federal and state demands you will need. US Legal Forms gives 1000s of legal forms that are evaluated by specialists. You can easily obtain or print out the Vermont Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. from our support.

If you already possess a US Legal Forms account, you are able to log in and then click the Acquire key. Following that, you are able to total, edit, print out, or signal the Vermont Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.. Each legal papers design you buy is your own property forever. To get one more version associated with a purchased form, proceed to the My Forms tab and then click the related key.

If you work with the US Legal Forms website for the first time, follow the easy recommendations under:

- Very first, be sure that you have chosen the correct papers design for your county/town of your choice. Read the form description to ensure you have selected the proper form. If readily available, use the Preview key to look from the papers design also.

- If you would like get one more variation of the form, use the Search field to find the design that suits you and demands.

- After you have identified the design you want, simply click Purchase now to proceed.

- Find the prices plan you want, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You should use your credit card or PayPal account to purchase the legal form.

- Find the structure of the papers and obtain it for your device.

- Make modifications for your papers if possible. You may total, edit and signal and print out Vermont Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co..

Acquire and print out 1000s of papers themes while using US Legal Forms web site, which offers the greatest collection of legal forms. Use expert and status-specific themes to take on your business or personal requires.