Vermont Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Discovering the right authorized record web template can be quite a have a problem. Of course, there are a lot of web templates available on the net, but how would you get the authorized kind you require? Utilize the US Legal Forms site. The services gives 1000s of web templates, for example the Vermont Approval of deferred compensation investment account plan, which you can use for organization and private needs. All of the varieties are inspected by experts and satisfy state and federal requirements.

When you are already signed up, log in to the account and click on the Acquire key to obtain the Vermont Approval of deferred compensation investment account plan. Make use of your account to search throughout the authorized varieties you might have ordered earlier. Check out the My Forms tab of your respective account and get another version of the record you require.

When you are a brand new customer of US Legal Forms, allow me to share simple recommendations for you to stick to:

- Very first, be sure you have chosen the right kind to your area/region. You may check out the form utilizing the Preview key and look at the form explanation to guarantee it is the best for you.

- If the kind will not satisfy your expectations, take advantage of the Seach field to obtain the correct kind.

- Once you are certain that the form is acceptable, select the Purchase now key to obtain the kind.

- Select the pricing program you would like and enter the essential information. Build your account and pay for an order using your PayPal account or credit card.

- Opt for the document file format and acquire the authorized record web template to the device.

- Complete, revise and print and sign the attained Vermont Approval of deferred compensation investment account plan.

US Legal Forms will be the greatest library of authorized varieties that you can discover numerous record web templates. Utilize the service to acquire professionally-made files that stick to condition requirements.

Form popularity

FAQ

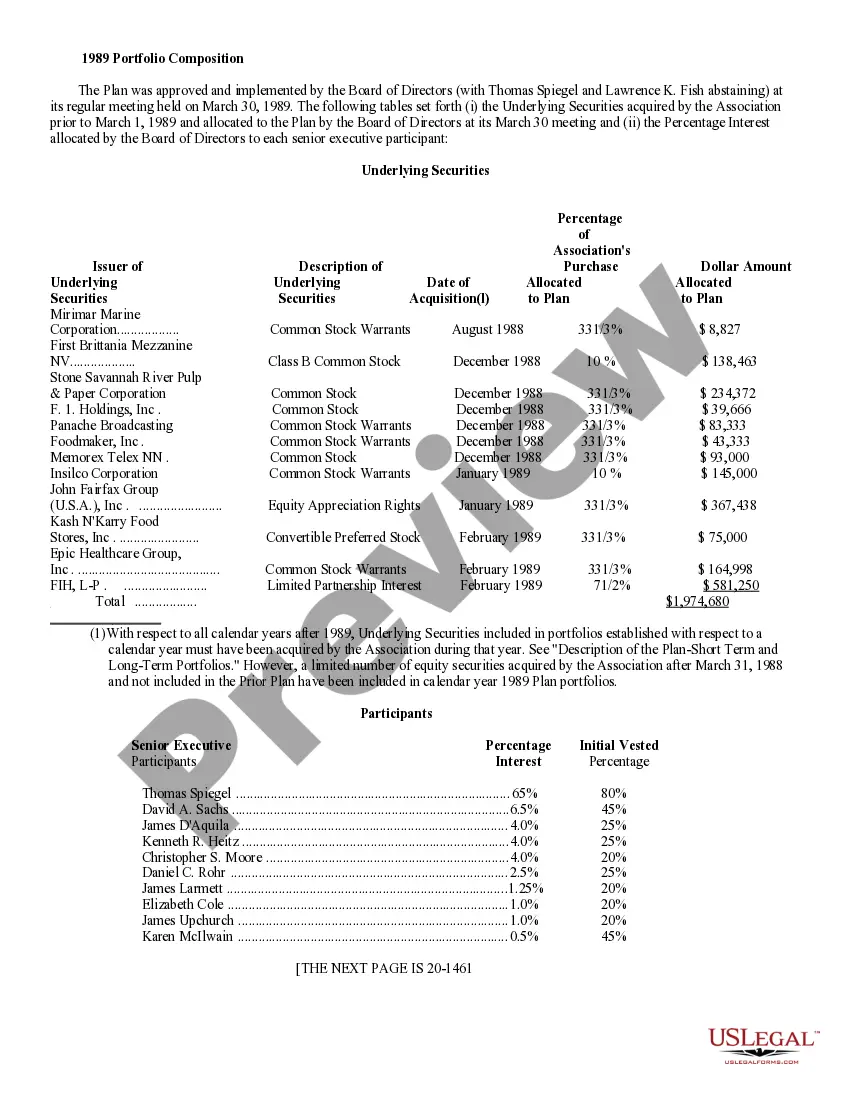

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

Usually, those payments will not affect your Social Security benefit if they are for work done before you retired.

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

You can process a distribution request by logging in to your account and navigating to Loans & Withdrawals > Taking a Withdrawal > Request a Withdrawal. If you have questions about distributions, call the Service Center at 844-523-2457.

If you take your deferred compensation payments over a period of 10 years or more, those payments will be taxed in the state where you reside, rather than in the state in which you earned the compensation, possibly reducing your state income taxes.

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

Depending on your plan provisions, the payment of the deferred compensation can also be structured to reduce your tax liability based on a series of installment payments or lump sum payments based on a specified time. By spreading out the payments, you potentially could reduce your income for each applicable year.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.