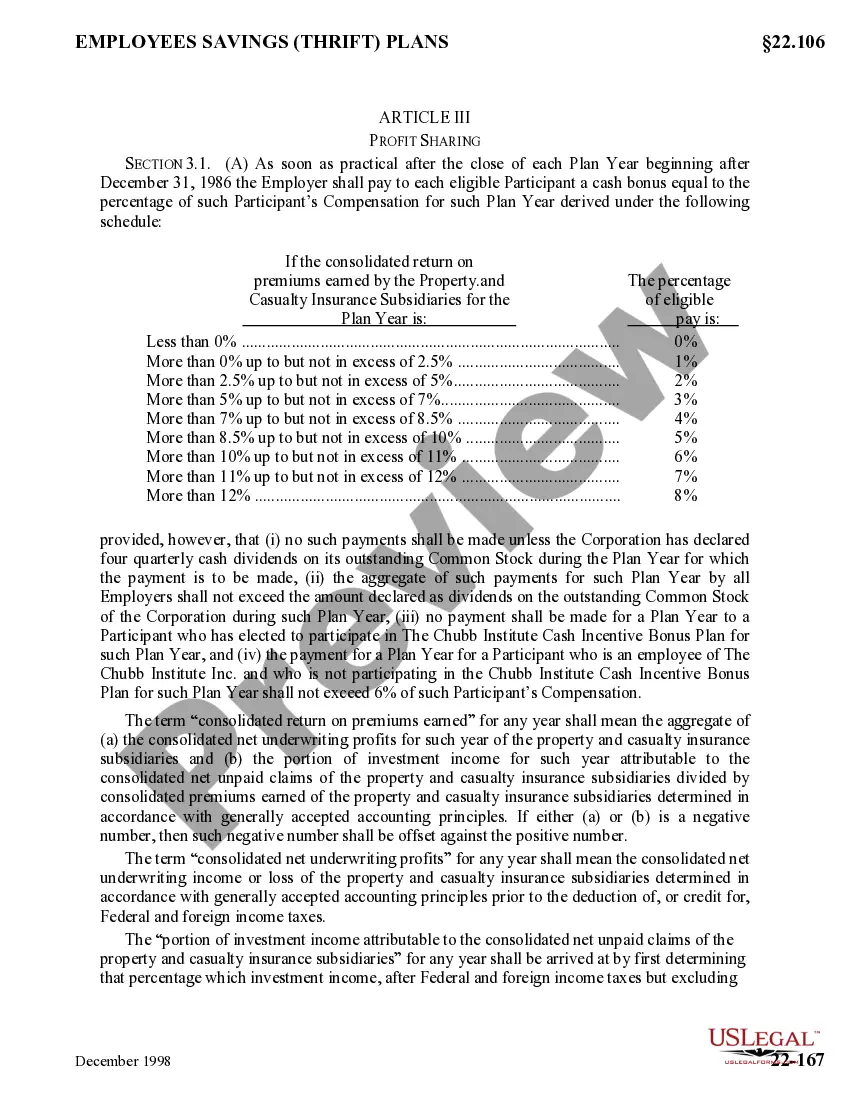

The Vermont Profit Sharing Plan is a retirement savings option available to employees working in the state of Vermont. It is designed to provide employees with an opportunity to share in the profits of a company and save for their future financial security. This plan allows employees to contribute a portion of their pre-tax income into their individual accounts, with the possibility of the employer making additional contributions. One type of Vermont Profit Sharing Plan is the traditional profit sharing plan. This plan allows employers to allocate a portion of their profits to be distributed among eligible employees. The shares are typically distributed based on an employee's salary or length of service, providing a financial incentive for employees to work efficiently and contribute to the company's success. Another type of Vermont Profit Sharing Plan is the employer-matching plan. In this plan, employers agree to match a certain percentage of the contributions made by employees. For example, if an employee contributes 5% of their salary to the plan, the employer may agree to match that with an additional 5%. This type of plan encourages employees to save for retirement by providing them with an extra financial incentive. The third type of Vermont Profit Sharing Plan is the employee stock ownership plan (ESOP). This plan allows employees to become partial owners of the company by allocating shares of stock to their individual accounts. The value of these shares may increase over time, providing employees with the opportunity to build wealth as the company grows. Sops also offer tax advantages to both the company and the employees. To participate in a Vermont Profit Sharing Plan, employees must meet certain eligibility requirements set by their employer. Typically, an employee must have worked for a minimum period, such as one year, and reach a specified age, such as 21 years old. Once eligible, employees can choose to contribute a portion of their income to the plan, up to the maximum contribution limit set by the Internal Revenue Service (IRS). It's important for employees to understand the investment options and rules associated with the Vermont Profit Sharing Plan. Typically, these plans offer a variety of investment options, such as mutual funds, stocks, and bonds, allowing employees to diversify their portfolios. Employees should also be aware of any vesting schedule, which determines when they gain ownership of the employer contributions. Vesting schedules vary by plan and can range from immediate vesting to a graded vesting schedule over a period of years. In conclusion, the Vermont Profit Sharing Plan is a retirement savings option that allows employees to share in a company's profits and save for their future financial security. With different types of plans, such as traditional profit sharing, employer-matching, and employee stock ownership plans, employees have the flexibility to choose the option that best suits their needs. By participating in the Vermont Profit Sharing Plan, employees can work towards building a comfortable retirement nest egg while enjoying potential tax benefits and the opportunity to accumulate wealth.

Vermont Profit Sharing Plan

Description

How to fill out Vermont Profit Sharing Plan?

Have you been in a placement in which you will need files for sometimes company or specific purposes virtually every day? There are plenty of legal document layouts accessible on the Internet, but locating ones you can depend on is not straightforward. US Legal Forms provides a huge number of develop layouts, just like the Vermont Profit Sharing Plan, which can be written to satisfy federal and state needs.

In case you are previously knowledgeable about US Legal Forms website and possess a merchant account, basically log in. Next, you can acquire the Vermont Profit Sharing Plan web template.

Should you not have an accounts and would like to start using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is to the correct town/region.

- Take advantage of the Preview button to check the form.

- Browse the explanation to actually have selected the correct develop.

- In case the develop is not what you are trying to find, use the Look for industry to get the develop that fits your needs and needs.

- When you find the correct develop, click on Acquire now.

- Select the costs plan you want, complete the desired information to produce your bank account, and purchase the order with your PayPal or credit card.

- Choose a handy paper format and acquire your backup.

Discover all of the document layouts you have bought in the My Forms menus. You may get a further backup of Vermont Profit Sharing Plan whenever, if necessary. Just click on the needed develop to acquire or produce the document web template.

Use US Legal Forms, one of the most substantial variety of legal forms, in order to save time and prevent errors. The assistance provides professionally made legal document layouts which can be used for a range of purposes. Produce a merchant account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

Your actual retirement benefit is determined by a formula which contains three aspects: your service credit, your age at retirement, and your average final compensation. You will be vested in the Vermont State Employees Retirement System when you have attained five years of creditable state service.

To figure out the best places to live in retirement, Bankrate examined each of those factors in a new study, ranking all 50 American states. In perhaps a surprising result, the top spot went to Iowa.

The state has a high retiree population and a low crime rate, making it a safe and welcoming place to live.

Vermont has a health retirement population, in fact, it's the fourth largest per 100K people, the 3rd lowest crime rate and the 13th lowest sales tax in the nation. There's a lot to like about Vermont if you can deal with the brutal winters and high cost of living.

A comfortable retirement costs an estimated $1,178,958 in Vermont, ing to 24/7 Wall St.

What is VT Saves? The VT Saves program establishes a retirement savings plan for Vermonters who are not currently offered a retirement plan through their employer. It's designed to make saving for retirement easy and automatic, at no cost to employers and no ongoing cost to taxpayers.

Maine received a score of 47.50 making it the 29th worse state to retire. Maine received a 43 for affordability, a 6 for quality of life, and a 23 for healthcare. Vermont got a 47.12 making it the 34th worse state to retire and right behind them is Connecticut with a 47.11.