Vermont Directors and Officers Liability Insurance (D&O) is an essential form of coverage for businesses, organizations, and non-profits that aims to protect directors, officers, and key executives from potential lawsuits arising from their managerial decisions, actions, or omissions. This specialized insurance policy provides financial assistance by covering legal defense costs, settlements, and judgments associated with such claims, thereby safeguarding personal assets and minimizing the financial risks faced by these individuals. Directors and officers of companies in Vermont can be held personally liable for their actions, especially if they are found to have acted negligently, engaged in wrongful acts, or breached their fiduciary duties. Legal actions against these executives can come from various sources, including shareholders, employees, customers, competitors, regulatory bodies, and even investors. These claims can arise from allegations of mismanagement, conflicts of interest, fraud, financial misstatements, employment practices issues, and other similar concerns. Different types of Vermont D&O liability insurance policies are available to cater to the diverse needs of organizations. Some common coverage options are: 1. Side A Coverage: This policy insures individual directors and officers directly when indemnification is unavailable from their organization or if the company becomes financially insolvent and unable to honor its indemnification obligations. 2. Side B Coverage: This form of coverage reimburses the organization for the costs it incurs while indemnifying directors and officers. 3. Side C (Entity Coverage): Often referred to as "entity securities coverage," this policy protects the organization itself from securities claims made against it, typically resulting from alleged material misrepresentations or omissions in financial statements or prospectuses. 4. Non-Profit D&O Coverage: This specialized insurance policy caters specifically to non-profit organizations and covers the directors and officers for claims arising from their management decisions. The importance of Vermont D&O liability insurance cannot be overstated, as the potential financial liabilities faced by directors and officers can be substantial, leading to personal bankruptcy or severe financial repercussions. By securing this insurance, individuals can mitigate the risks associated with their managerial roles and focus on making informed decisions for the betterment of their organization, knowing they are protected from potential legal disputes and their impacts. In Vermont, businesses, organizations, and non-profits are encouraged to consult with reputable insurance providers to understand their specific needs and tailor their coverage accordingly. Understanding the nuances of directors and officers liability insurance and selecting appropriate coverage types can ensure comprehensive risk management and provide peace of mind for those serving in executive roles within Vermont-based companies and entities.

Vermont Directors and officers liability insurance

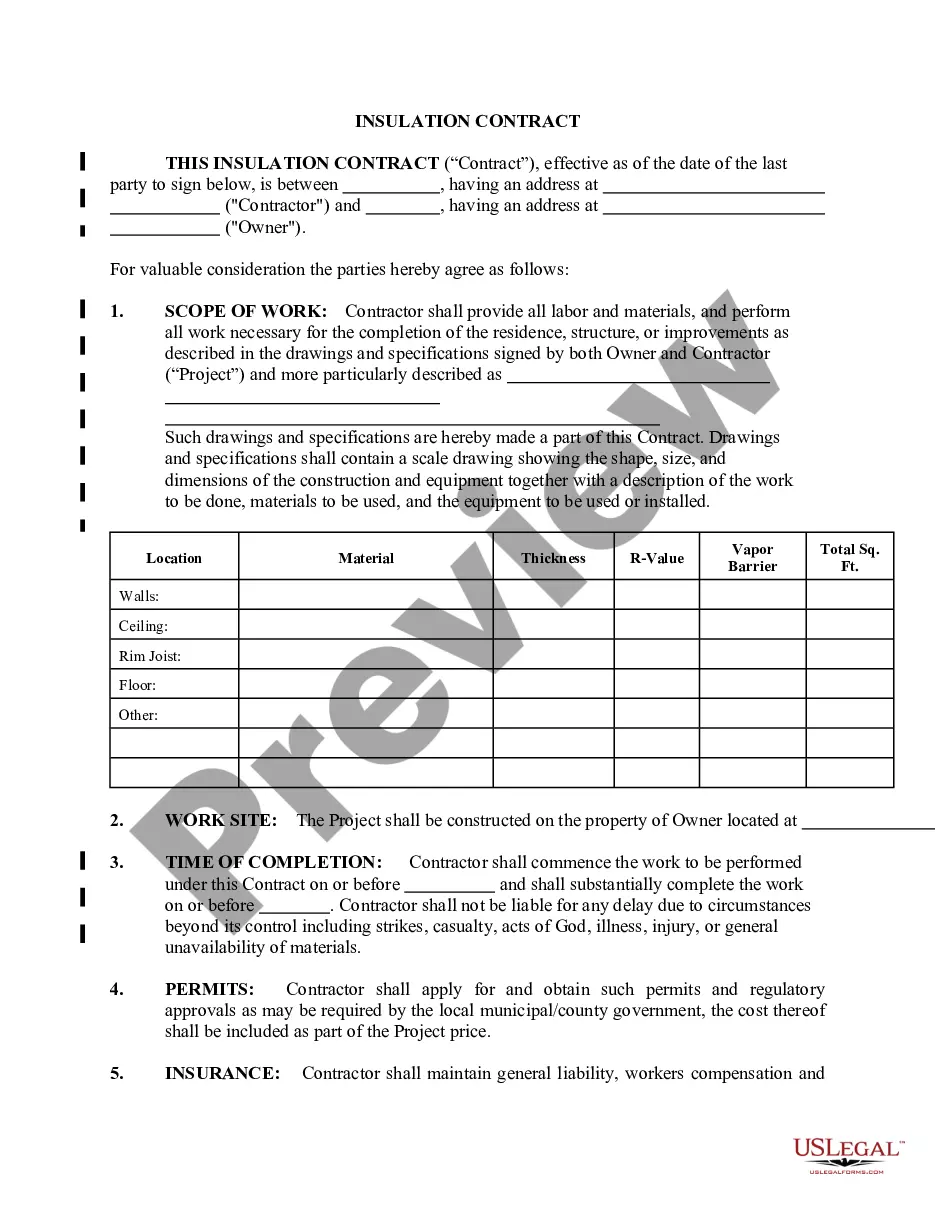

Description

How to fill out Vermont Directors And Officers Liability Insurance?

US Legal Forms - one of several most significant libraries of lawful types in America - offers an array of lawful record templates it is possible to acquire or print. While using web site, you can find a huge number of types for business and individual reasons, categorized by classes, suggests, or key phrases.You can get the most up-to-date types of types such as the Vermont Directors and officers liability insurance within minutes.

If you already possess a subscription, log in and acquire Vermont Directors and officers liability insurance from the US Legal Forms local library. The Down load switch can look on each develop you look at. You gain access to all previously saved types in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, here are straightforward guidelines to help you get started off:

- Be sure to have selected the best develop for your town/state. Click the Preview switch to analyze the form`s articles. Browse the develop outline to actually have chosen the proper develop.

- When the develop does not suit your needs, take advantage of the Lookup field at the top of the display screen to find the the one that does.

- In case you are happy with the shape, confirm your selection by clicking the Purchase now switch. Then, opt for the rates prepare you prefer and supply your qualifications to sign up to have an accounts.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal accounts to complete the deal.

- Pick the file format and acquire the shape on your product.

- Make changes. Load, modify and print and sign the saved Vermont Directors and officers liability insurance.

Every web template you included in your bank account does not have an expiry day and it is yours forever. So, if you wish to acquire or print another backup, just go to the My Forms segment and click on in the develop you want.

Gain access to the Vermont Directors and officers liability insurance with US Legal Forms, by far the most extensive local library of lawful record templates. Use a huge number of specialist and status-particular templates that meet your small business or individual requires and needs.