Title: Vermont Utilization by a REIT: Financing Five Development Projects through Partnership Structures Introduction: In the world of real estate investment, Rests (Real Estate Investment Trusts) play a vital role in financing and managing various development projects. In the case of Vermont, Rests have utilized partnership structures as a means of financing five distinct development projects. This comprehensive article aims to delve into the details of the different types of Vermont Utilization by Rests in financing these projects, highlighting relevant keywords and their significance. 1. Vermont Partnership Financing: Vermont, renowned for its scenic beauty and vibrant communities, presents an attractive landscape for real estate development. Rests have capitalized on this opportunity by leveraging partnership structures to fund and successfully execute multiple projects. The utilization of partnership structures offers numerous advantages, including risk-sharing, tax benefits, and increased liquidity. 2. Joint Ventures: One prevalent form of partnership utilized by Rests for Vermont development projects is joint ventures. These collaborative ventures involve the pooling of financial resources and expertise between the REIT and a partner, typically another real estate firm or developer. Joint ventures allow the sharing of risk and reward, pooling of capital, and access to local knowledge, which proves beneficial in navigating Vermont's unique real estate market. 3. Limited Partnerships: Rests have also adopted limited partnerships in financing Vermont development projects. Limited partnerships involve the REIT assuming the role of a general partner, responsible for managing the project, while limited partners contribute capital and have a more passive role. This structure enables Rests to attract investors seeking limited liability while allowing them to participate in the project's financial performance. 4. Public-Private Partnerships (PPP): In some instances, Rests in Vermont have pursued Public-Private Partnerships with government entities to fund development projects. These strategic collaborations aim to leverage the expertise and resources of both parties, delivering desired results while meeting public objectives. Public-Private Partnerships have been instrumental in financing large-scale developments, such as infrastructure projects, mixed-use developments, and affordable housing initiatives. 5. Tax Increment Financing (TIF): A noteworthy financing tool utilized by Rests in Vermont is Tax Increment Financing. TIF allows Rests to capture a portion of the increased property tax revenue generated from development projects to finance infrastructure improvements and other eligible costs. By effectively utilizing TIF, Rests can optimize project financing and contribute to the economic growth of targeted areas in Vermont. Conclusion: The utilization of partnership structures by Rests in financing Vermont development projects showcases their adaptability and strategic approach in maximizing opportunities. Through joint ventures, limited partnerships, public-private partnerships, and the implementation of tax increment financing, Rests effectively navigate the real estate market, mitigate risks, create value, and contribute to the growth and vibrancy of Vermont's communities.

Vermont Utilization by a REIT of partnership structures in financing five development projects

Description

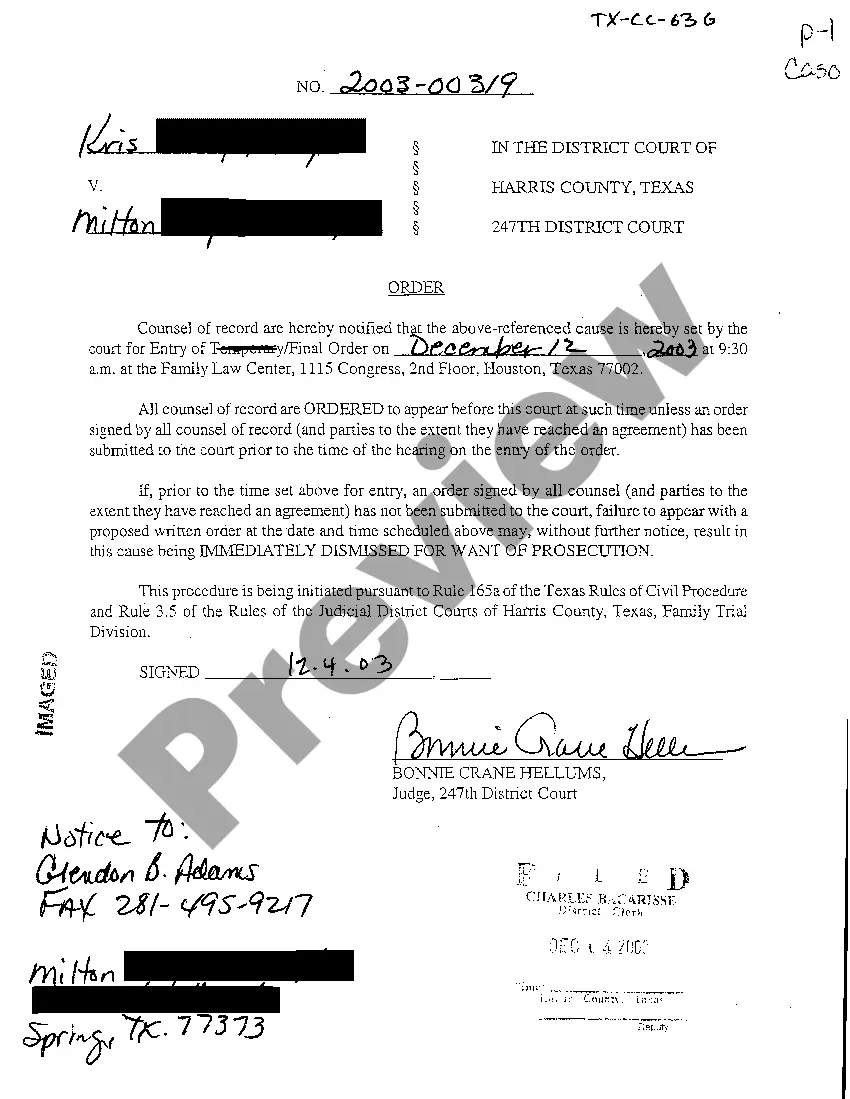

How to fill out Vermont Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

If you wish to total, acquire, or produce authorized document layouts, use US Legal Forms, the most important variety of authorized varieties, that can be found online. Use the site`s simple and convenient look for to get the documents you require. Numerous layouts for company and specific uses are sorted by groups and states, or search phrases. Use US Legal Forms to get the Vermont Utilization by a REIT of partnership structures in financing five development projects within a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in to the account and click on the Obtain switch to find the Vermont Utilization by a REIT of partnership structures in financing five development projects. You may also gain access to varieties you in the past delivered electronically from the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the proper city/country.

- Step 2. Make use of the Review method to check out the form`s articles. Never overlook to see the outline.

- Step 3. In case you are unsatisfied using the develop, make use of the Research field near the top of the display screen to find other variations of the authorized develop template.

- Step 4. Once you have discovered the shape you require, click on the Acquire now switch. Pick the pricing plan you favor and put your qualifications to register to have an account.

- Step 5. Method the transaction. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the file format of the authorized develop and acquire it on your own device.

- Step 7. Full, change and produce or signal the Vermont Utilization by a REIT of partnership structures in financing five development projects.

Each and every authorized document template you acquire is yours for a long time. You may have acces to every single develop you delivered electronically with your acccount. Click the My Forms area and decide on a develop to produce or acquire once again.

Remain competitive and acquire, and produce the Vermont Utilization by a REIT of partnership structures in financing five development projects with US Legal Forms. There are many professional and status-particular varieties you can use for the company or specific demands.

Form popularity

FAQ

Though they're different groupings, all REITs are structured as C-corporations for tax purposes that are allowed a special tax deduction for dividends paid from taxable income. For a REIT to receive a dividend paid deduction (DPD), they are required to make an election and adhere to certain rules and compliance.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

The two main types of REITs are equity REITs and mortgage REITs, commonly known as mREITs. Equity REITs generate income through the collection of rent on, and from sales of, the properties they own for the long-term. mREITs invest in mortgages or mortgage securities tied to commercial and/or residential properties.

General requirements A REIT cannot be closely held. A REIT will be closely held if more than 50 percent of the value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals at any point during the last half of the taxable year, (this is commonly referred to as the 5/50 test).

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

There are two main types of real estate investment trusts (REITs) that investors can buy: equity REITs and mortgage REITs. Equity REITs own and operate properties, while mortgage REITs invest in mortgages and related assets.

In a side-by-side structure, a REIT operates alongside other investment vehicles, such as private equity funds or other non-REIT structures. This arrangement allows investors to choose between traditional REIT investments and alternative investment strategies offered by the other vehicles.

Real estate fund strategies are often categorized into one or a combination of the following types. Real Estate Development Funds. Joint Venture Real Estate Funds. Structured Finance Real Estate Funds. Opportunistic/ Special Opportunity Funds. Distressed Asset Funds. Multi-Strategy Funds. Closed-End Structure.