Vermont Proposed amendment to articles eliminating certain preemptive rights

Description

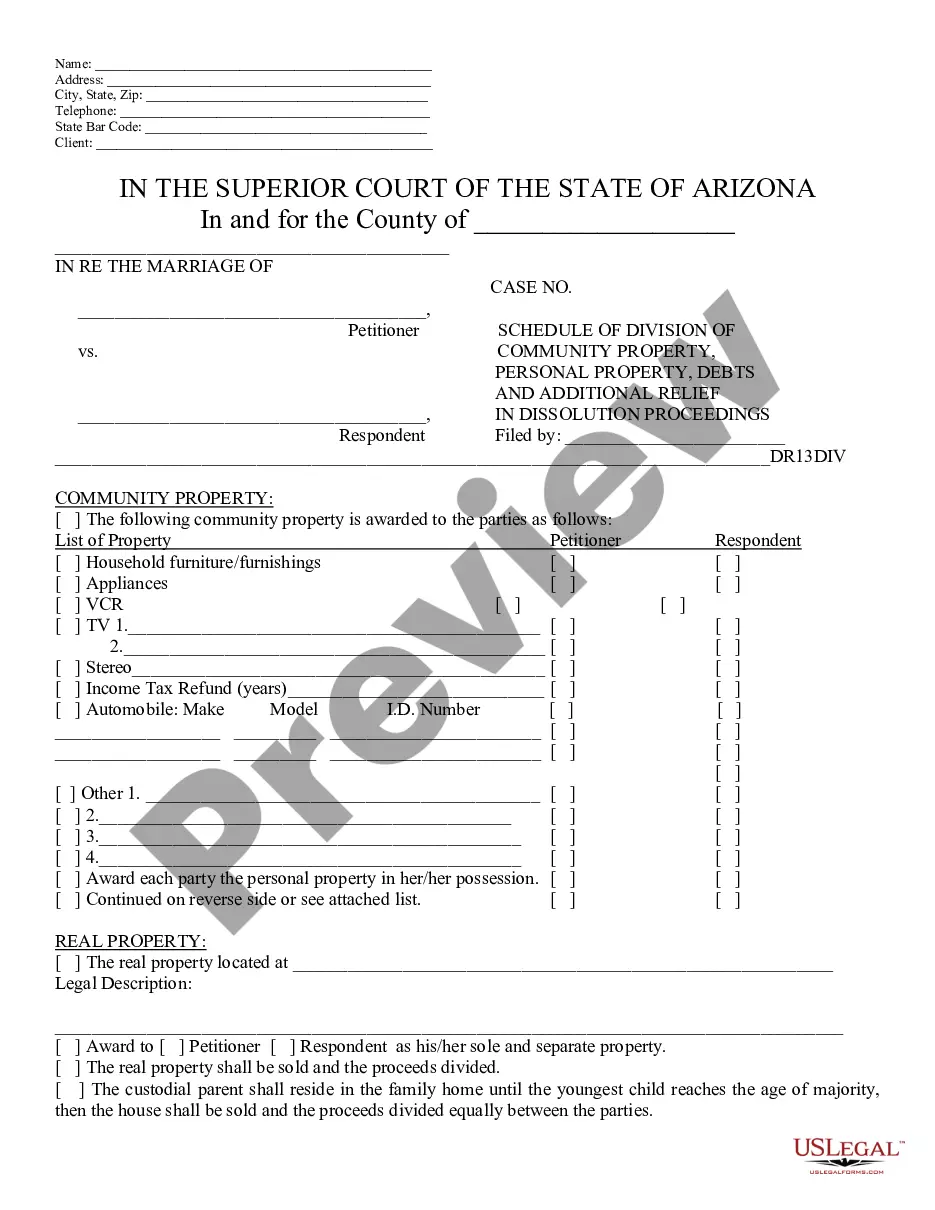

How to fill out Proposed Amendment To Articles Eliminating Certain Preemptive Rights?

US Legal Forms - one of many largest libraries of legal kinds in America - offers a variety of legal papers web templates you are able to obtain or print out. Making use of the site, you can get a huge number of kinds for organization and individual purposes, categorized by types, states, or key phrases.You can find the most up-to-date models of kinds just like the Vermont Proposed amendment to articles eliminating certain preemptive rights in seconds.

If you currently have a monthly subscription, log in and obtain Vermont Proposed amendment to articles eliminating certain preemptive rights in the US Legal Forms collection. The Download button can look on each and every type you see. You have access to all previously downloaded kinds from the My Forms tab of your respective account.

If you want to use US Legal Forms initially, listed here are straightforward instructions to get you started:

- Ensure you have selected the best type for your personal town/region. Select the Review button to review the form`s content material. Look at the type outline to actually have selected the proper type.

- In case the type doesn`t satisfy your needs, utilize the Lookup industry on top of the screen to discover the one which does.

- In case you are pleased with the shape, validate your option by simply clicking the Buy now button. Then, opt for the rates program you like and give your credentials to sign up for the account.

- Method the financial transaction. Use your bank card or PayPal account to finish the financial transaction.

- Pick the format and obtain the shape on the gadget.

- Make alterations. Load, modify and print out and indicator the downloaded Vermont Proposed amendment to articles eliminating certain preemptive rights.

Each and every template you included with your money lacks an expiration day which is your own for a long time. So, if you want to obtain or print out yet another version, just visit the My Forms portion and click around the type you will need.

Obtain access to the Vermont Proposed amendment to articles eliminating certain preemptive rights with US Legal Forms, probably the most extensive collection of legal papers web templates. Use a huge number of professional and express-specific web templates that meet your business or individual requires and needs.

Form popularity

FAQ

Subchapter 001 : Freedom of Choice Act (b) The State of Vermont recognizes the fundamental right of every individual who becomes pregnant to choose to carry a pregnancy to term, to give birth to a child, or to have an abortion.

37, ABORTION AND GENDER-AFFIRMING CARE 'SHIELD BILL' MONTPELIER, VT ? Today the Vermont Senate gave final approval to S. 37, known as the ?shield bill,? which would provide protections to patients and providers who administer or receive reproductive and gender-affirming care in Vermont.

4. This proposal would amend the Constitution of the State of Vermont to ensure that every Vermonter enjoys equal treatment and respect under the law. The Constitution is our founding legal document stating the overarching values of our society.

That the people are guaranteed the liberty and dignity to determine their own life's course. The right to personal reproductive autonomy is central to the liberty protected by this Constitution and shall not be denied or infringed unless justified by a compelling State interest achieved by the least restrictive means.

Article 22: The Reproductive Liberty Amendment On Election Day in 2022, Vermont voters made history by PASSING Article 22, the Reproductive Liberty Amendment!

Personal reproductive liberty] That an individual's right to personal reproductive autonomy is central to. the liberty and dignity to determine one's own life course and shall not be. denied or infringed unless justified by a compelling State interest achieved by. the least restrictive means.

Article 22. [ Personal reproductive liberty] That an individual's right to personal reproductive autonomy is central to. the liberty and dignity to determine one's own life course and shall not be. denied or infringed unless justified by a compelling State interest achieved by.