The Vermont Equity Incentive Plan is a comprehensive program designed to incentivize and retain top talent within organizations operating in the state of Vermont. This plan allows companies to offer various forms of equity-based compensation to their employees, aligning their interests with the company's long-term growth and success. The Vermont Equity Incentive Plan aims to enhance employee engagement, attract skilled professionals, and foster a culture of ownership and commitment. Keywords: Vermont Equity Incentive Plan, incentivize, retain top talent, organizations, equity-based compensation, employee engagement, long-term growth, employee ownership, commitment. There are different types of equity incentive plans available under the Vermont Equity Incentive Plan. These include: 1. Stock Option Plans: Stock options grant employees the right to purchase company stock at a predetermined price (known as the exercise price) within a specified timeframe. This type of plan allows employees to benefit from the company's share price appreciation over time. 2. Restricted Stock Unit (RSU) Plans: RSU plans offer employees the right to receive shares of company stock once specific vesting conditions are met. Unlike stock options, RSS do not require employees to purchase the stock; instead, they receive it as a form of compensation. 3. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company stock at a discounted price, usually through regular payroll deductions. This type of plan enables employees to acquire company stock at a lower cost, encouraging their participation in the company's long-term success. 4. Performance Share Plans: Performance share plans grant employees shares of company stock based on predetermined performance goals and targets. These plans incentivize employees to achieve specific objectives, and the quantity of shares received depends on the level of goal attainment. 5. Phantom Stock Plans: Phantom stock plans provide employees with virtual shares that mimic the value and performance of actual company stock. Although employees do not own real shares, they are entitled to receive cash or stock equivalent to the increase in value of these virtual shares over time. Keywords: Stock Option Plans, Restricted Stock Unit (RSU) Plans, Employee Stock Purchase Plans (ESPN), Performance Share Plans, Phantom Stock Plans, equity-based compensation, vesting conditions, stock purchase, performance goals, virtual shares. The Vermont Equity Incentive Plan offers businesses in Vermont a flexible framework to design equity compensation programs that suit their specific needs. It encourages employee participation, aligns employee interests with company goals, and helps attract and retain top talent. With a range of equity-based options available, companies can tailor their plans to reward and motivate their workforce effectively. Keywords: Vermont Equity Incentive Plan, flexibility, employee participation, aligning interests, company goals, attract and retain top talent, equity-based options, reward, motivate, workforce.

Vermont Equity Incentive Plan

Description

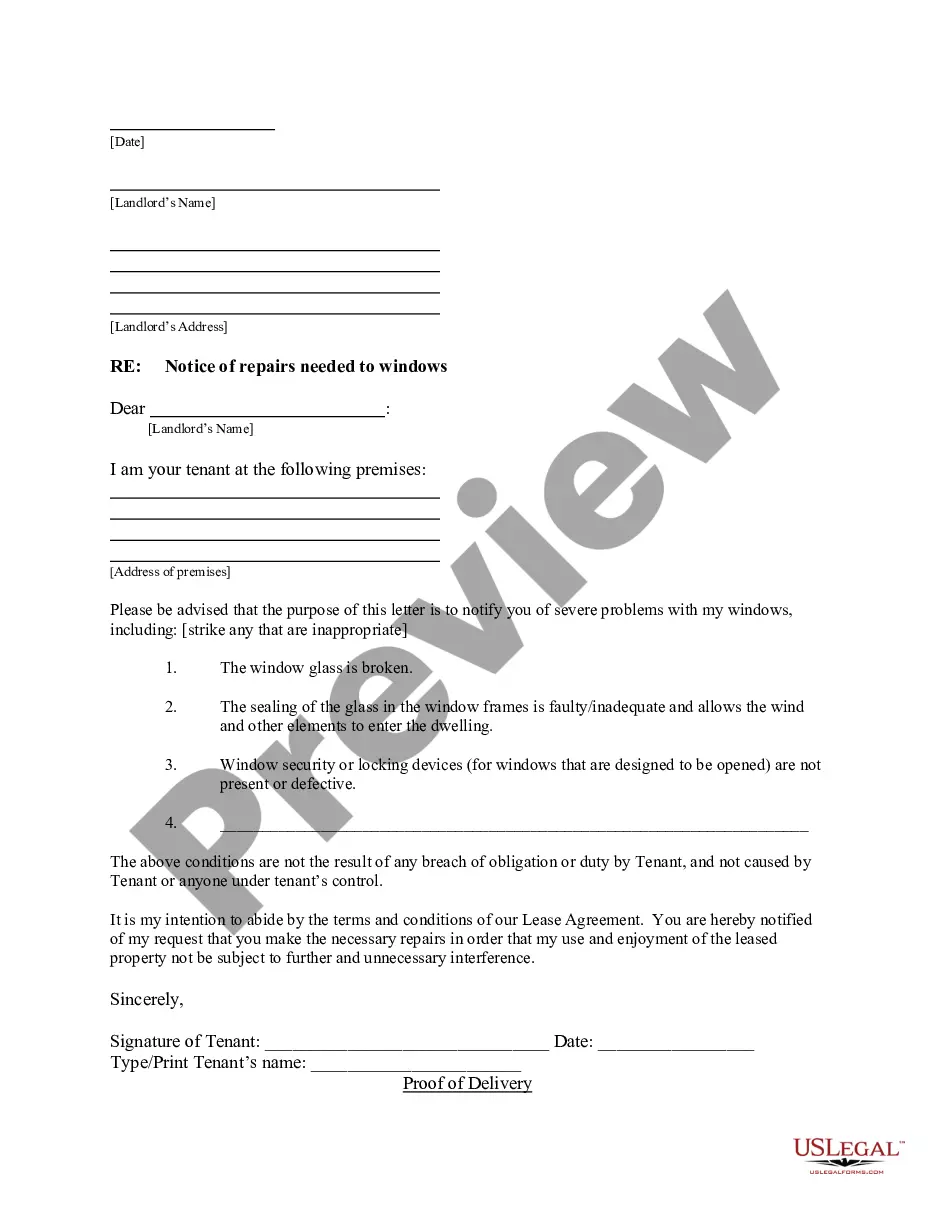

How to fill out Vermont Equity Incentive Plan?

Choosing the right legitimate document web template can be a battle. Naturally, there are a lot of templates available on the net, but how do you find the legitimate kind you require? Make use of the US Legal Forms internet site. The service offers a large number of templates, such as the Vermont Equity Incentive Plan, which you can use for enterprise and private needs. All the kinds are checked by experts and meet state and federal needs.

If you are currently registered, log in to your accounts and then click the Acquire switch to have the Vermont Equity Incentive Plan. Utilize your accounts to search through the legitimate kinds you may have bought earlier. Go to the My Forms tab of your own accounts and acquire an additional copy of the document you require.

If you are a whole new end user of US Legal Forms, listed below are straightforward instructions that you can stick to:

- Initially, be sure you have selected the correct kind for your personal town/area. It is possible to examine the shape making use of the Review switch and look at the shape description to make sure this is the best for you.

- In the event the kind will not meet your preferences, take advantage of the Seach discipline to find the appropriate kind.

- When you are certain the shape is acceptable, select the Buy now switch to have the kind.

- Opt for the pricing prepare you desire and enter the necessary information and facts. Create your accounts and purchase an order using your PayPal accounts or Visa or Mastercard.

- Select the submit format and obtain the legitimate document web template to your gadget.

- Complete, revise and print out and signal the obtained Vermont Equity Incentive Plan.

US Legal Forms will be the biggest library of legitimate kinds where you can discover numerous document templates. Make use of the company to obtain expertly-produced documents that stick to state needs.

Form popularity

FAQ

This grant offers up to $7,500 in reimbursements for eligible expenses to remote workers who become full-time residents on or after February 1, 2022 and continue to work for an out-of-state employer. The application portal is now live and accepting applications.

Vermont continues to accept relocation grant applications for employees moving to the state. Employees who have recently moved, or plan to move to Vermont, may still be eligible for a relocation expense reimbursement grant of up to $7,500 through the state's "ThinkVermont" Worker Relocation Incentive program.

Loan Repayment Program Qualifying students who graduated in the Spring of 2023 can receive up to $5,000 in student loan forgiveness when they choose to reside in Vermont post-graduation and seek employment with a Vermont-based organization.

What are ?qualified relocation expenses?? Qualified relocation expenses are: Closing costs for a primary residence or lease deposit and one month rent, hiring a moving company, renting moving equipment, shipping, and the cost of moving supplies.

Vermont is looking for more workers, and it's willing to pay. New residents of the Green Mountain State can get up to $7,500 if they're up for working in short-staffed industries like childcare, construction or restaurants.

The Worker Relocation Incentive Program is now live and accepting applications from those looking to move to the state, whether to work remotely or take a job with a Vermont company. These grants are awarded on a first come, first served basis, and completing a valid application does not guarantee a grant.

Based on previous worker incentive programs' success, ThinkVT launched a new relocation incentive program in November 2022. The new program will pay approved applicants up to $7,500 for moving expenses if they move to Vermont.

Based on previous worker incentive programs' success, ThinkVT launched a new relocation incentive program in November 2022. The new program will pay approved applicants up to $7,500 for moving expenses if they move to Vermont.