Vermont Authorization to Purchase Corporation's Outstanding Common Stock: Explained The Vermont Authorization to purchase corporation's outstanding common stock refers to the legal process followed by a corporation in the state of Vermont to acquire its own common stock from existing shareholders. This authorization enables the corporation to repurchase its outstanding stock for various reasons, such as capital restructuring, improving financial ratios, rewarding investors, or preventing hostile takeovers. The purchase of common stock can also be beneficial to shareholders who wish to sell their shares and exit the company. Types of Vermont Authorization to Purchase Corporation's Outstanding Common Stock: 1. Open-Market Purchases: Corporations may utilize open-market purchases to acquire their own common stock from the public stock market. This method involves buying shares at prevailing market prices without negotiation directly with shareholders. 2. Negotiated Purchases: Some corporations may opt for negotiated purchases, wherein they approach specific shareholders and negotiate the terms of the stock repurchase. Negotiated purchases usually occur at a premium price or with additional benefits to encourage shareholders to sell their shares. 3. Tender Offers: A tender offer refers to a public invitation made by the corporation to its shareholders to tender (sell) a specific number or percentage of their shares at a predetermined price within a designated time frame. Shareholders have the choice of accepting or declining the offer. 4. Automatic Repurchase Plans: Under automatic repurchase plans, corporations set predetermined criteria such as price limits, timing, or other stipulations that trigger the repurchase of common stock automatically. This approach alleviates the need for constant board approval and allows the company to repurchase shares at various intervals. 5. Redemption: In some cases, corporations may use the redemption method to repurchase common stock. This method involves repurchasing shares directly from shareholders at a predetermined price and according to specific terms stated in the company's bylaws or articles of incorporation. It is important to note that the Vermont Authorization to purchase corporation's outstanding common stock must comply with legal requirements, including regulations set forth by the Vermont Secretary of State and the Securities and Exchange Commission (SEC). Corporations must also consider the financial implications, available funds, and potential effects on shareholder value before proceeding with any stock repurchase program. Overall, the Vermont Authorization to Purchase Corporation's Outstanding Common Stock provides corporations with a means to manage their capital structure and satisfy various strategic objectives. By repurchasing outstanding common stock, corporations can optimize their financial position and enhance the overall value proposition for existing shareholders.

Vermont Authorization to purchase corporation's outstanding common stock

Description

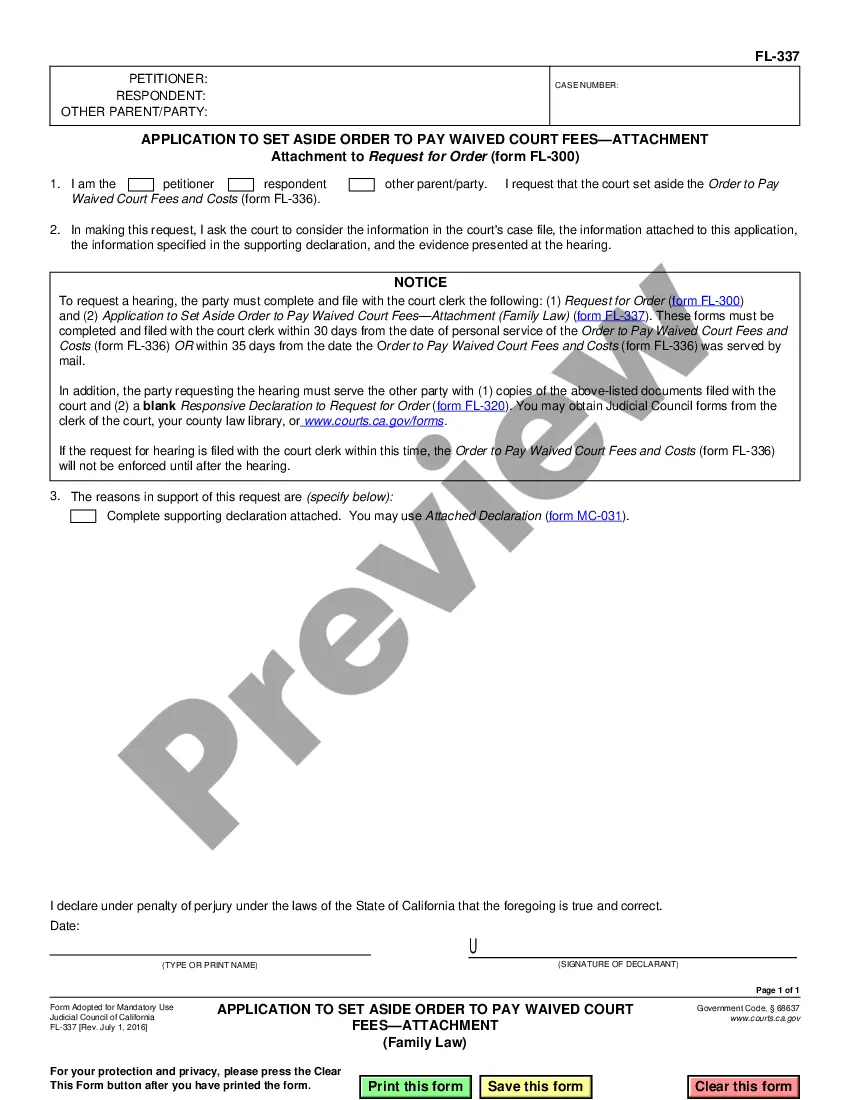

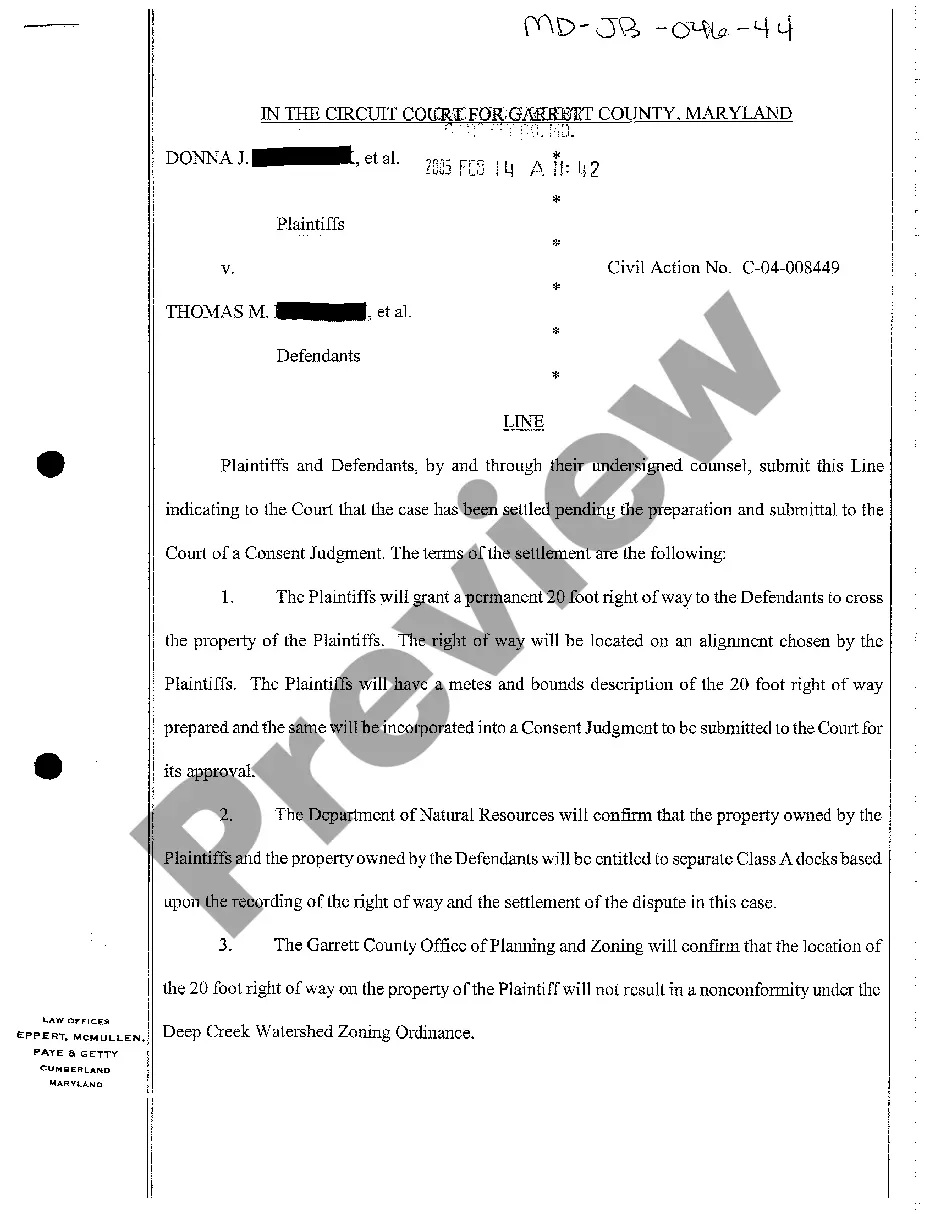

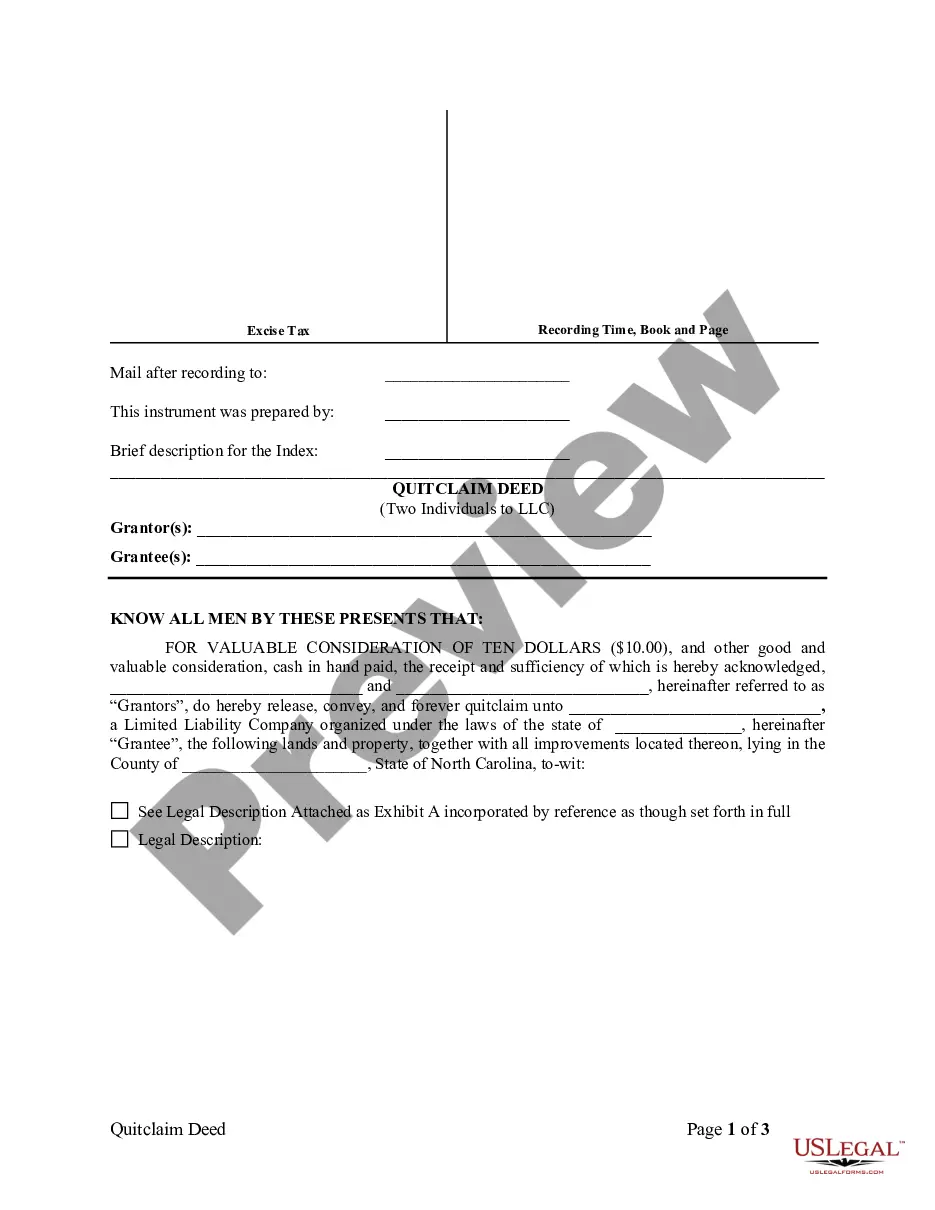

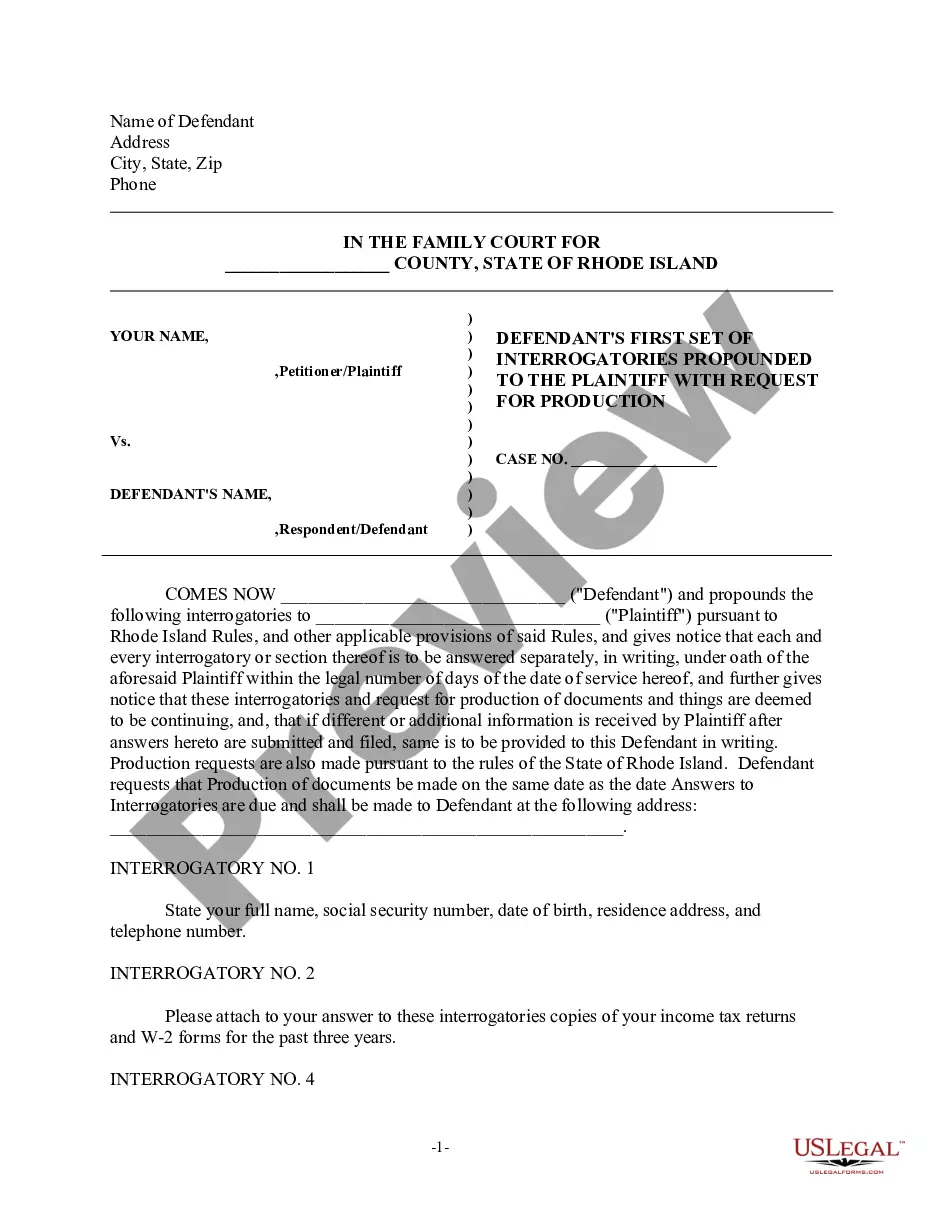

How to fill out Vermont Authorization To Purchase Corporation's Outstanding Common Stock?

US Legal Forms - among the largest libraries of legitimate types in the States - delivers a wide range of legitimate record layouts you are able to down load or produce. Using the site, you can get a huge number of types for business and person functions, sorted by categories, suggests, or key phrases.You will discover the most up-to-date variations of types like the Vermont Authorization to purchase corporation's outstanding common stock within minutes.

If you have a monthly subscription, log in and down load Vermont Authorization to purchase corporation's outstanding common stock from the US Legal Forms catalogue. The Down load switch will appear on each type you see. You have access to all earlier acquired types within the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, here are straightforward recommendations to get you started out:

- Be sure you have picked the correct type to your metropolis/area. Click the Review switch to analyze the form`s articles. Browse the type description to ensure that you have selected the appropriate type.

- In case the type doesn`t suit your demands, use the Search field towards the top of the monitor to discover the one that does.

- When you are satisfied with the shape, affirm your decision by clicking the Get now switch. Then, choose the prices strategy you prefer and provide your references to register for an bank account.

- Approach the purchase. Use your bank card or PayPal bank account to complete the purchase.

- Pick the structure and down load the shape on the gadget.

- Make alterations. Fill out, modify and produce and sign the acquired Vermont Authorization to purchase corporation's outstanding common stock.

Every template you included in your money does not have an expiry time and is also yours permanently. So, if you would like down load or produce another version, just visit the My Forms segment and click on on the type you want.

Gain access to the Vermont Authorization to purchase corporation's outstanding common stock with US Legal Forms, probably the most comprehensive catalogue of legitimate record layouts. Use a huge number of professional and condition-distinct layouts that satisfy your company or person requirements and demands.