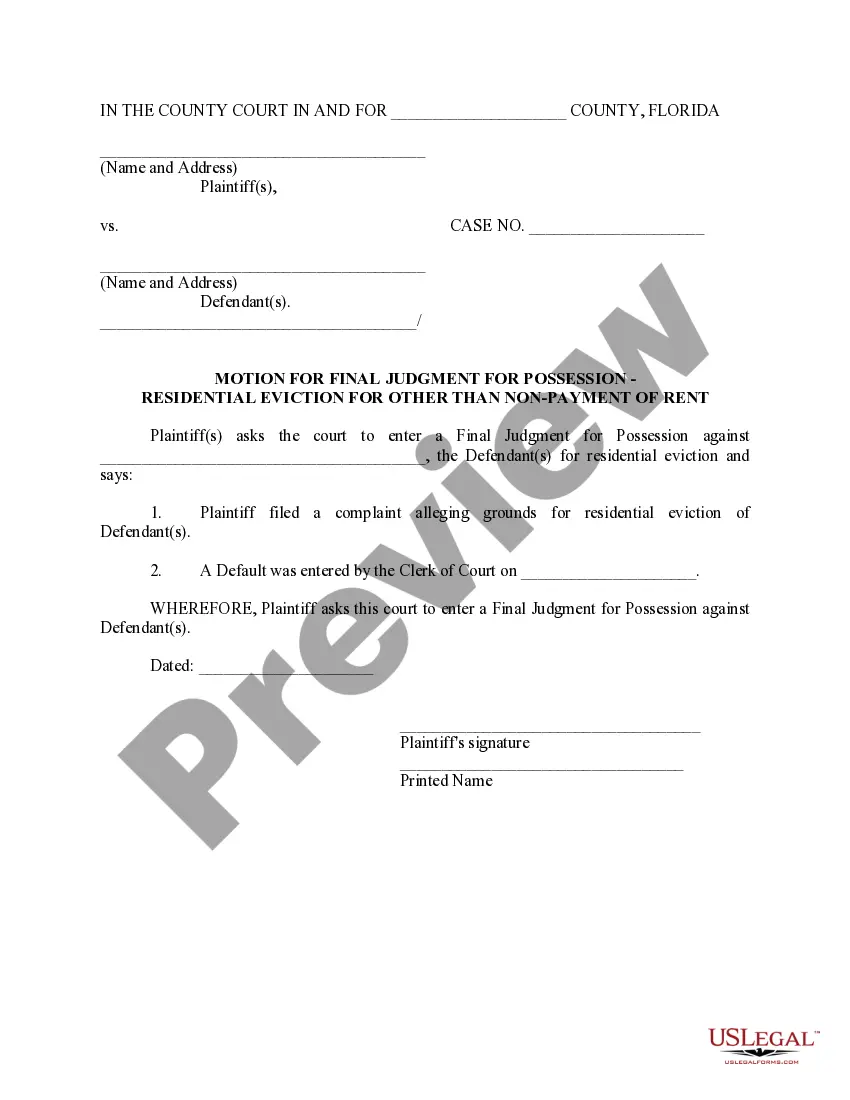

Vermont Form of Note

Description

How to fill out Form Of Note?

Discovering the right authorized papers design might be a have a problem. Needless to say, there are a lot of layouts available online, but how would you discover the authorized kind you require? Make use of the US Legal Forms web site. The service delivers a large number of layouts, for example the Vermont Form of Note, which you can use for company and personal demands. All of the varieties are examined by experts and meet state and federal demands.

In case you are currently authorized, log in to your account and click the Download button to obtain the Vermont Form of Note. Utilize your account to check through the authorized varieties you may have acquired earlier. Go to the My Forms tab of your own account and have an additional duplicate from the papers you require.

In case you are a brand new end user of US Legal Forms, listed here are basic recommendations for you to adhere to:

- First, ensure you have chosen the correct kind to your metropolis/region. You are able to check out the shape making use of the Preview button and read the shape outline to make sure this is basically the right one for you.

- In case the kind will not meet your requirements, take advantage of the Seach industry to get the proper kind.

- Once you are positive that the shape would work, click on the Acquire now button to obtain the kind.

- Opt for the prices plan you want and type in the needed details. Create your account and buy your order making use of your PayPal account or Visa or Mastercard.

- Choose the document file format and download the authorized papers design to your product.

- Total, change and print out and sign the obtained Vermont Form of Note.

US Legal Forms is the greatest library of authorized varieties where you can find a variety of papers layouts. Make use of the company to download professionally-made documents that adhere to condition demands.

Form popularity

FAQ

A homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile. All property is considered nonhomestead, unless it is declared as a homestead.

This form authorizes release of your tax information to an authorized recipient. This is NOT a Power of Attorney and does not authorize recipient to act on your behalf or make binding agreements for you.

Download fillable PDF forms from the web. Free, unlimited downloads! Order forms online. . Order forms by email. tax.formsrequest@vermont.gov.

Eligibility Your property qualifies as a homestead, and you have filed a Homestead Declaration for the current year's grand list. You were domiciled in Vermont for the full prior calendar year. You were not claimed as a dependent of another taxpayer. You have the property as your homestead as of April 1.

You may be eligible for a property tax credit based on your 2023/2024 property taxes if your property qualifies as a homestead and you meet the eligibility requirements described in this fact sheet. The maximum credit is $5,600 for the education property tax portion and $2,400 for the municipal property tax portion.

HOMEOWNERS Form HS-122, Homestead Declaration AND Property Tax Credit Claim, must be filed each year . Homeowners with Household Income up to $134,800 on Line z should complete Form HS-122, Section B . You may be eligible for a property tax credit . This schedule must be filed with Form HS-122 .

A resident of Vermont is an individual who maintains a permanent place of abode within the state, or the individual is domiciled in the state for 183 days or more. If the filer earns more than $100, then they must file a Vermont income tax return and will need to file Form IN-111 on or before April 15.

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.