Vermont Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

How to fill out Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

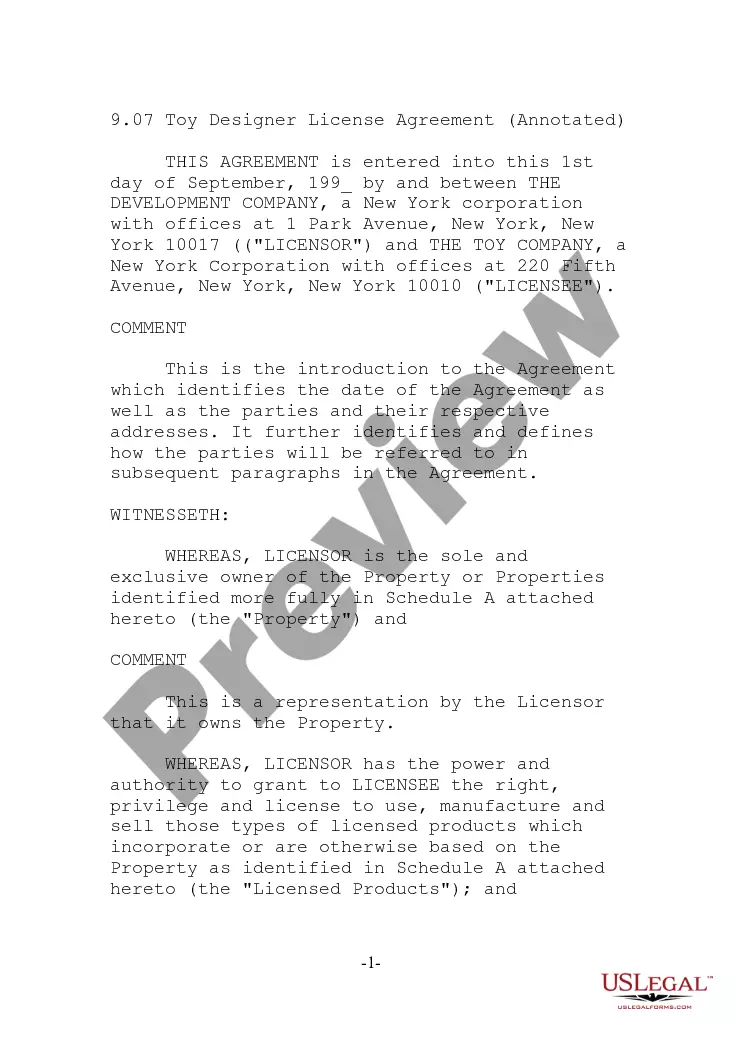

Choosing the right lawful file template can be quite a have a problem. Naturally, there are a variety of layouts available on the net, but how do you find the lawful form you require? Utilize the US Legal Forms site. The services gives 1000s of layouts, including the Vermont Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, which you can use for enterprise and private demands. All of the varieties are examined by specialists and satisfy state and federal needs.

Should you be previously signed up, log in for your accounts and click the Acquire switch to obtain the Vermont Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits. Make use of your accounts to appear from the lawful varieties you may have bought in the past. Proceed to the My Forms tab of your accounts and obtain one more backup from the file you require.

Should you be a whole new end user of US Legal Forms, here are simple directions for you to follow:

- Very first, be sure you have selected the right form to your town/region. You may look through the shape making use of the Preview switch and browse the shape information to guarantee it will be the right one for you.

- When the form will not satisfy your needs, take advantage of the Seach discipline to get the right form.

- When you are certain the shape is suitable, select the Purchase now switch to obtain the form.

- Choose the rates plan you desire and enter in the necessary information and facts. Build your accounts and buy the order making use of your PayPal accounts or Visa or Mastercard.

- Select the data file formatting and obtain the lawful file template for your device.

- Total, revise and print out and indicator the attained Vermont Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits.

US Legal Forms is definitely the most significant catalogue of lawful varieties in which you can discover various file layouts. Utilize the service to obtain professionally-made paperwork that follow status needs.

Form popularity

FAQ

How to gift company shares. Usually there will be no restrictions on the transfer of shares to a family member. However you do need to check your company's articles of association and any shareholder agreements, to ensure such a share transfer is permitted and that you follow any provisions of transfer.

Shares or debentures are movable property. They are transferable in the manner provided by the articles of the company, especially, the shares of any member of a public company. The transfer of securities is possible through any contract or arrangement between two or more persons.

Stocks can be a great gift, and if you're wondering how to transfer stock to a family member, you can simply contact your broker. You could also fill out a stock transfer form and endorse the stock certificate. Learning how to gift stocks is the easy part ? you also have to consider the tax implications.

Consideration refers to the value of what is paid for the stocks and shares. You need to state the amount if the person buying the shares pays cash. If there is zero consideration, this must be recorded. Consideration can also include other stocks or satisfaction of a debt.

Stocks can be given to a recipient, who then benefits from any gains in the stock's price. Giving stocks and other securities can also have benefits for donors as well, particularly if the stock has previously appreciated in value. If you're the donor, you can potentially avoid taxes on the earnings or gains.

How To Transfer S Corp Stock To Someone Else Talk to the other person to see if they have a brokerage account. ... You need to get the Account Details from the recipient. ... You must authorize the transfer. ... Finally, you will need to wait for the transfer to be completed.