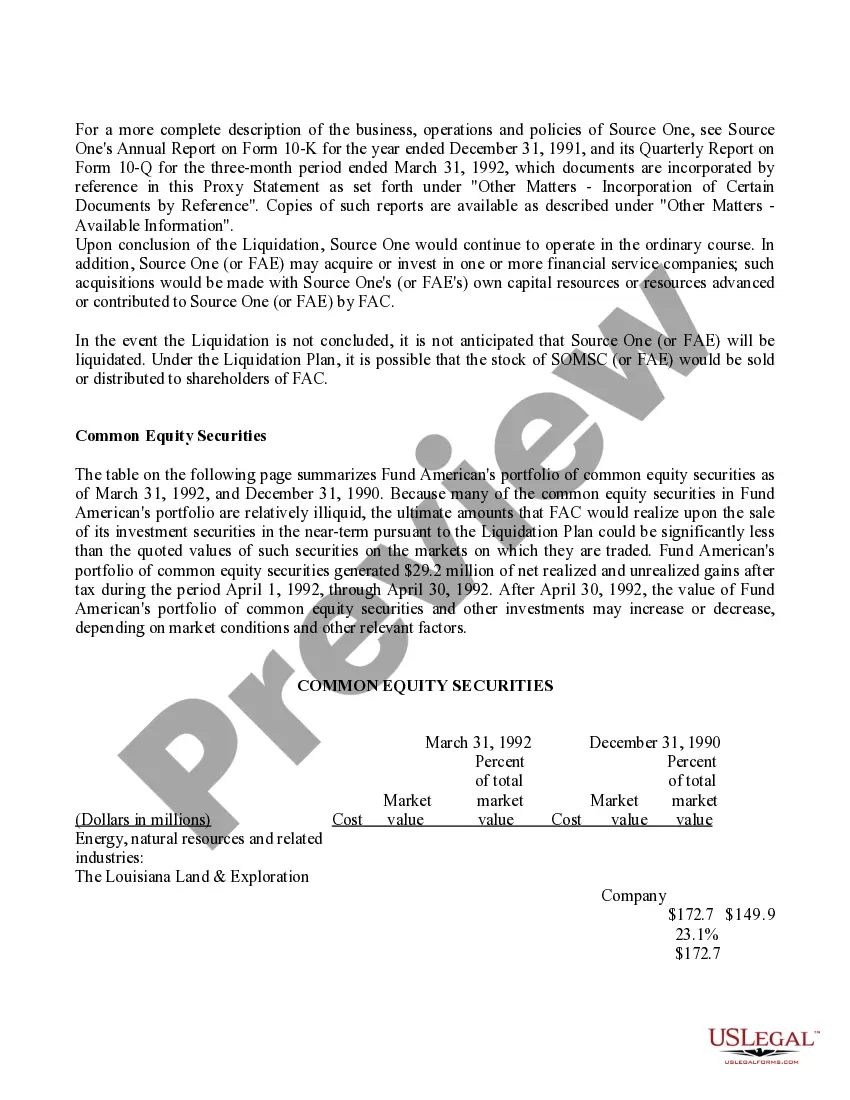

Vermont Proposal — Conclusion of the Liquidation is a legal document outlining the final steps and details of the liquidation process in Vermont. It aims to provide a comprehensive summary of the liquidation proceedings and ensure a smooth closure of the business or organization. The proposal typically includes multiple sections to cover various aspects of the liquidation, including the distribution of assets and liabilities, finalizing outstanding debts, and addressing any legal or financial obligations. These sections may be accompanied by relevant exhibits and supporting documentation. Key Elements of a Vermont Proposal — Conclusion of the Liquidation: 1. Introduction: — This section provides an overview of why the liquidation is taking place, the parties involved, and the timeline of the process. It sets the context for the document. 2. Distribution of Assets and Liabilities: — This section outlines how the liquidation proceeds will be distributed among different stakeholders, such as creditors, shareholders, and employees. It specifies the order of prioritization for debt repayment and the method of asset valuation. 3. Debt Settlement: — In this section, the proposal addresses any existing debts or obligations and provides a plan for settling them. It may include negotiations with creditors, repayment schedules, and a strategy for finalizing outstanding financial matters. 4. Employee Matters: — This portion focuses on how the interests and rights of employees will be protected during the liquidation process. It covers issues like severance packages, outstanding salaries, accrued benefits, and potential re-employment opportunities. 5. Legal and Regulatory Requirements: — This section ensures compliance with all relevant laws, regulations, and licensing authorities. It outlines the necessary filings, notifications, and certifications required to complete the liquidation process legally and smoothly. 6. Exhibits: — Exhibits attached to the proposal offer supporting evidence, financial statements, contracts, and any other relevant documentation required to validate the statements made in the proposal. These exhibits may vary based on the unique circumstances of each liquidation. Types of Vermont Proposals — Conclusion of the Liquidation: 1. Business Liquidation: — This type of proposal applies to the winding down and dissolution of a company or business entity, including corporations, partnerships, or sole proprietorship. 2. Non-profit Organization Liquidation: — Non-profit organizations seeking to conclude their activities can use a proposal tailored specifically for their needs. This includes addressing the distribution of assets remaining after fulfilling charitable missions and obligations. 3. Estate Liquidation: — If an individual passes away with outstanding debts and assets, the proposal for estate liquidation can be used to ensure proper estate administration and distribution. In conclusion, a Vermont Proposal — Conclusion of the Liquidation provides a comprehensive plan and framework for concluding the liquidation process in different contexts such as business, non-profit organizations, or estates. Through careful consideration of the relevant sections, this proposal aims to ensure all outstanding matters are addressed and the process is completed in accordance with legal requirements.

Vermont Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Vermont Proposal - Conclusion Of The Liquidation With Exhibit?

If you want to total, obtain, or print out lawful papers themes, use US Legal Forms, the biggest variety of lawful types, which can be found on-line. Make use of the site`s easy and convenient look for to get the documents you require. A variety of themes for organization and individual reasons are categorized by categories and states, or key phrases. Use US Legal Forms to get the Vermont Proposal - Conclusion of the Liquidation with exhibit in just a number of clicks.

If you are currently a US Legal Forms buyer, log in to your accounts and then click the Obtain option to get the Vermont Proposal - Conclusion of the Liquidation with exhibit. Also you can accessibility types you earlier saved in the My Forms tab of the accounts.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper area/country.

- Step 2. Utilize the Preview option to examine the form`s content material. Never forget about to see the explanation.

- Step 3. If you are unsatisfied with all the develop, use the Research field on top of the monitor to locate other versions in the lawful develop format.

- Step 4. After you have found the shape you require, click on the Acquire now option. Choose the pricing strategy you prefer and add your qualifications to register for the accounts.

- Step 5. Process the deal. You can utilize your bank card or PayPal accounts to complete the deal.

- Step 6. Find the format in the lawful develop and obtain it on the device.

- Step 7. Comprehensive, modify and print out or signal the Vermont Proposal - Conclusion of the Liquidation with exhibit.

Every single lawful papers format you purchase is the one you have permanently. You may have acces to each develop you saved inside your acccount. Click the My Forms portion and pick a develop to print out or obtain once again.

Remain competitive and obtain, and print out the Vermont Proposal - Conclusion of the Liquidation with exhibit with US Legal Forms. There are millions of expert and status-distinct types you can utilize for your organization or individual requires.

Form popularity

FAQ

The purpose of liquidation is to ensure that all the company's affairs have been dealt with and all its assets realised. When this has been done, the liquidator will apply to have the company removed from the register at the Companies House and dissolved, which means it ceases to exist.

The liquidation of a company is when the company's assets are sold and the company ceases operations and is deregistered. The assets are sold to pay back various claimants, such as creditors and shareholders.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

What happens to assets after liquidation? When a company is liquidated, the assets are sold and the profits are used to repay any creditors and shareholders. The reason why the assets are sold is because when a company enters liquidation, it typically does not have enough capital to pay off its debts.

Conclusion. In conclusion, liquidation is a legal process that is initiated when a company is unable to pay its debts. The assets of the company are sold off to pay off its creditors. The process of liquidation is usually carried out by a liquidator who is appointed by the court.