A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Vermont Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Vermont Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

Finding the right legitimate file design can be a have a problem. Naturally, there are tons of web templates available online, but how can you discover the legitimate form you will need? Use the US Legal Forms site. The support provides a large number of web templates, for example the Vermont Notice to Debt Collector - Falsely Representing a Document is Legal Process, that can be used for enterprise and private demands. Each of the varieties are examined by pros and meet state and federal requirements.

When you are presently signed up, log in for your bank account and click the Obtain switch to find the Vermont Notice to Debt Collector - Falsely Representing a Document is Legal Process. Make use of bank account to appear from the legitimate varieties you may have acquired previously. Check out the My Forms tab of your own bank account and obtain an additional backup of the file you will need.

When you are a whole new consumer of US Legal Forms, allow me to share simple guidelines so that you can adhere to:

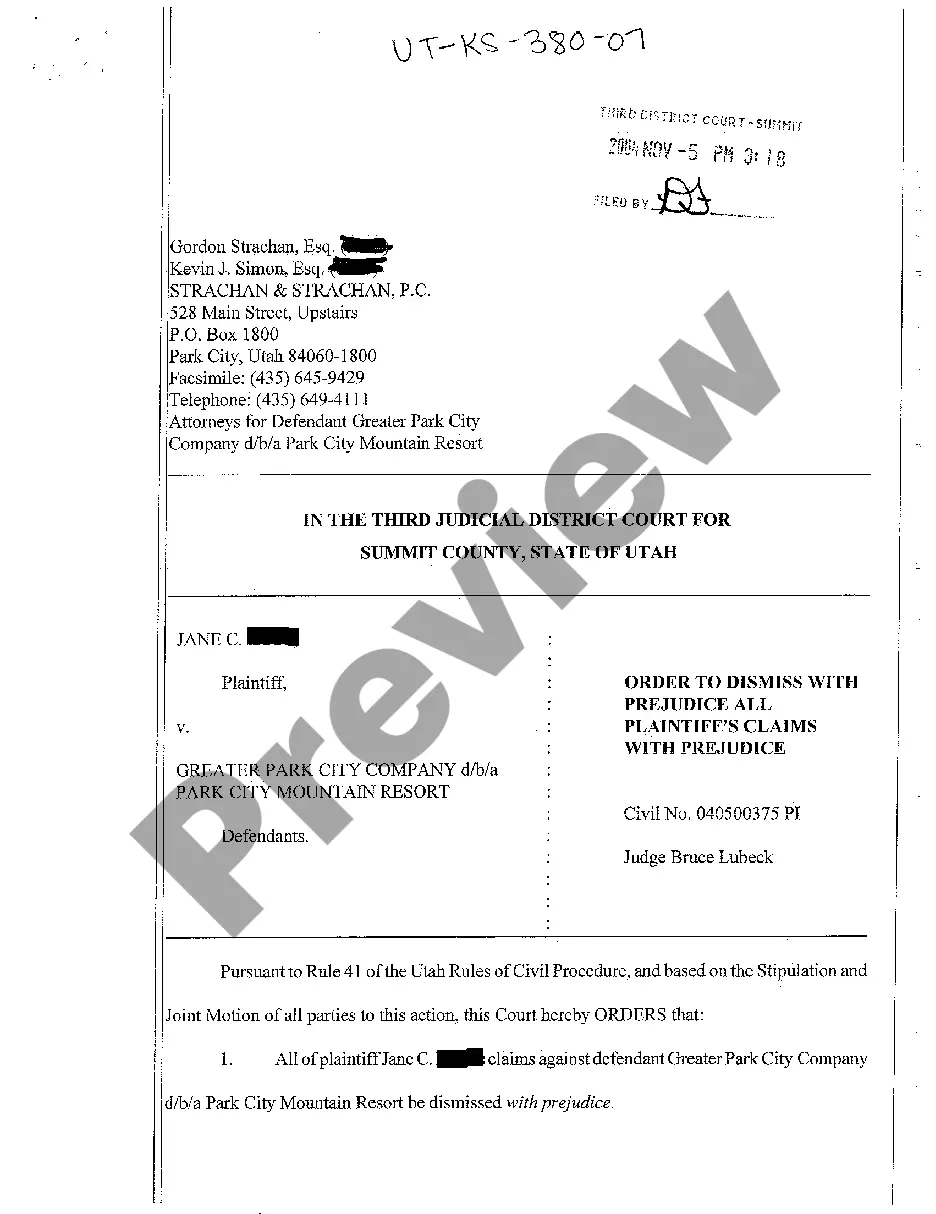

- First, ensure you have selected the correct form for your personal city/state. You may look over the form while using Preview switch and study the form description to make certain it is the right one for you.

- In the event the form is not going to meet your expectations, make use of the Seach area to get the correct form.

- When you are sure that the form is proper, select the Purchase now switch to find the form.

- Pick the rates program you desire and enter in the essential info. Create your bank account and buy your order with your PayPal bank account or Visa or Mastercard.

- Select the data file file format and down load the legitimate file design for your system.

- Full, modify and print out and indication the attained Vermont Notice to Debt Collector - Falsely Representing a Document is Legal Process.

US Legal Forms may be the biggest local library of legitimate varieties where you will find a variety of file web templates. Use the company to down load appropriately-produced paperwork that adhere to condition requirements.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Can You Sue a Company for Sending You to Collections? Yes, the FDCPA allows for legal action against certain collectors that don't comply with the rules in the law. If you're sent to collections for a debt you don't owe or a collector otherwise ignores the FDCPA, you might be able to sue that collector.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

You have three choices dispute the account (if it's inaccurate), contact the collection agency for a goodwill adjustment (if you've paid the account in full), or simply wait for the account to be removed from your reports in due time.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Normally, collections are disputed because the debtor believes they are incorrect for some reason. For example, if you review a copy of your credit report and you see a collection account that you believe belongs to another person, has an incorrect balance or is greater than seven years old, you can file a dispute.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.