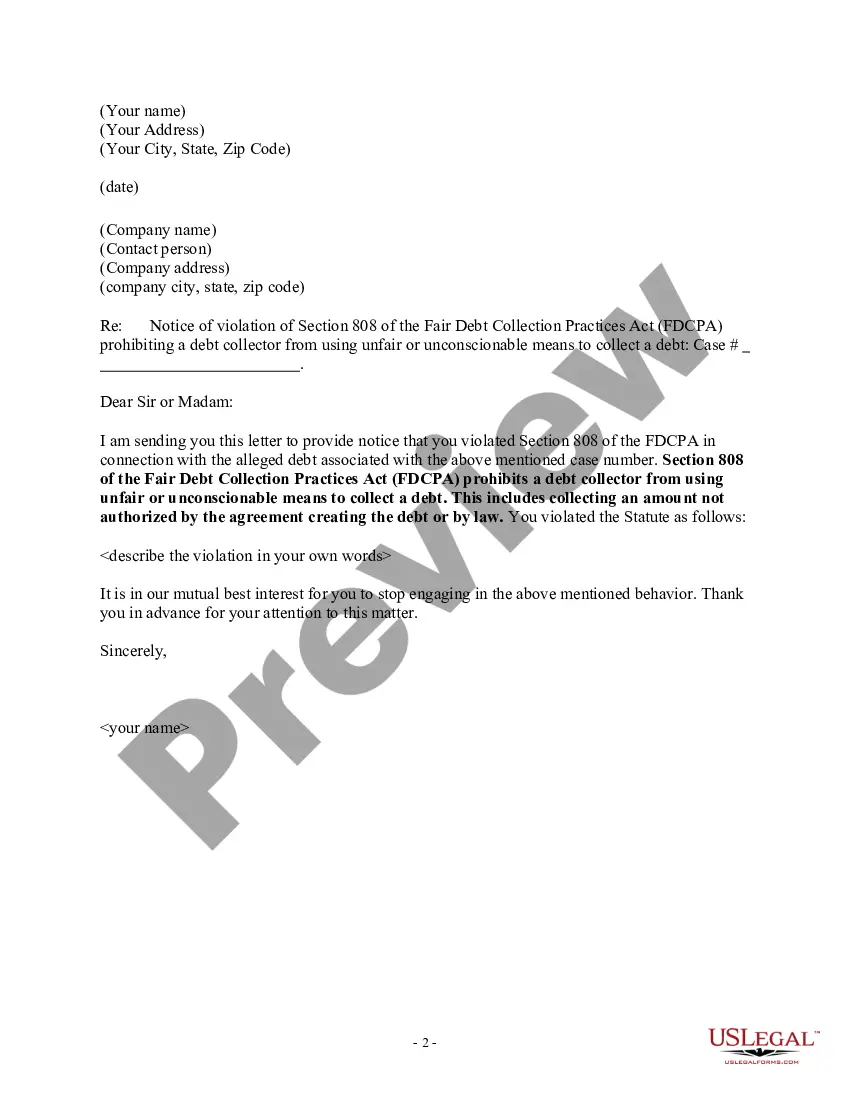

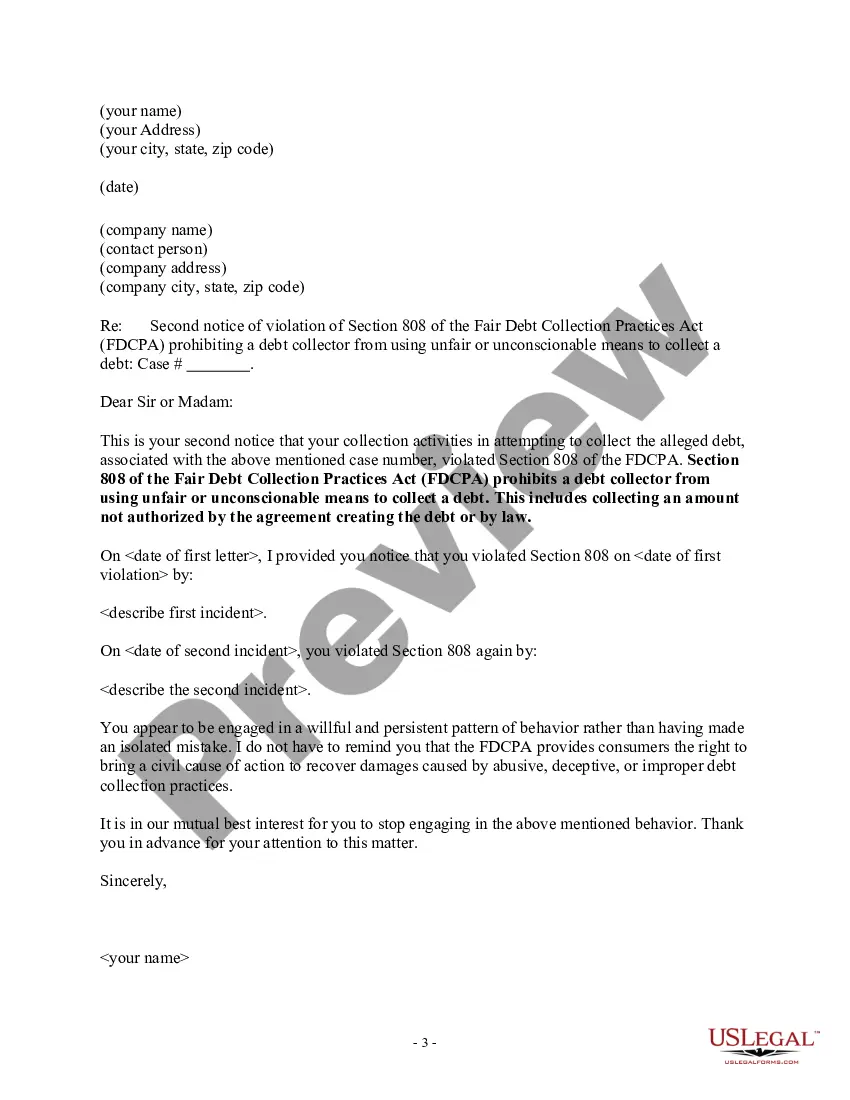

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Vermont Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

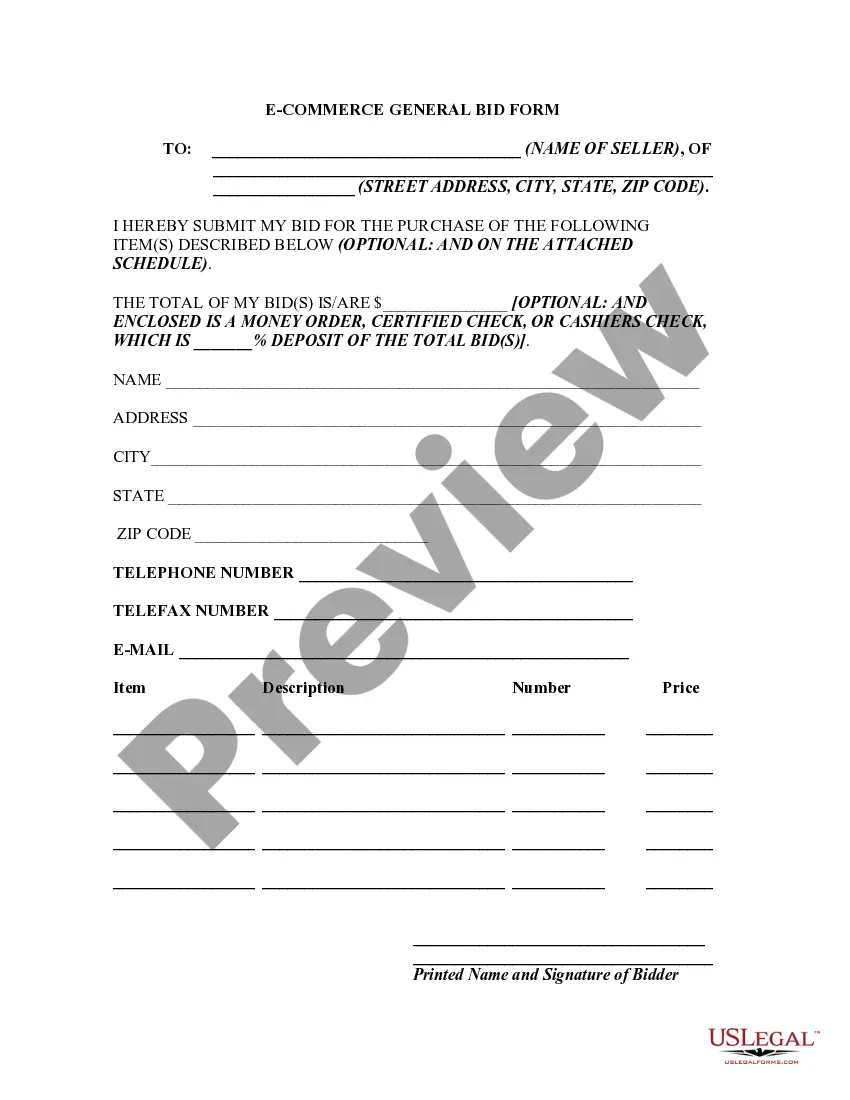

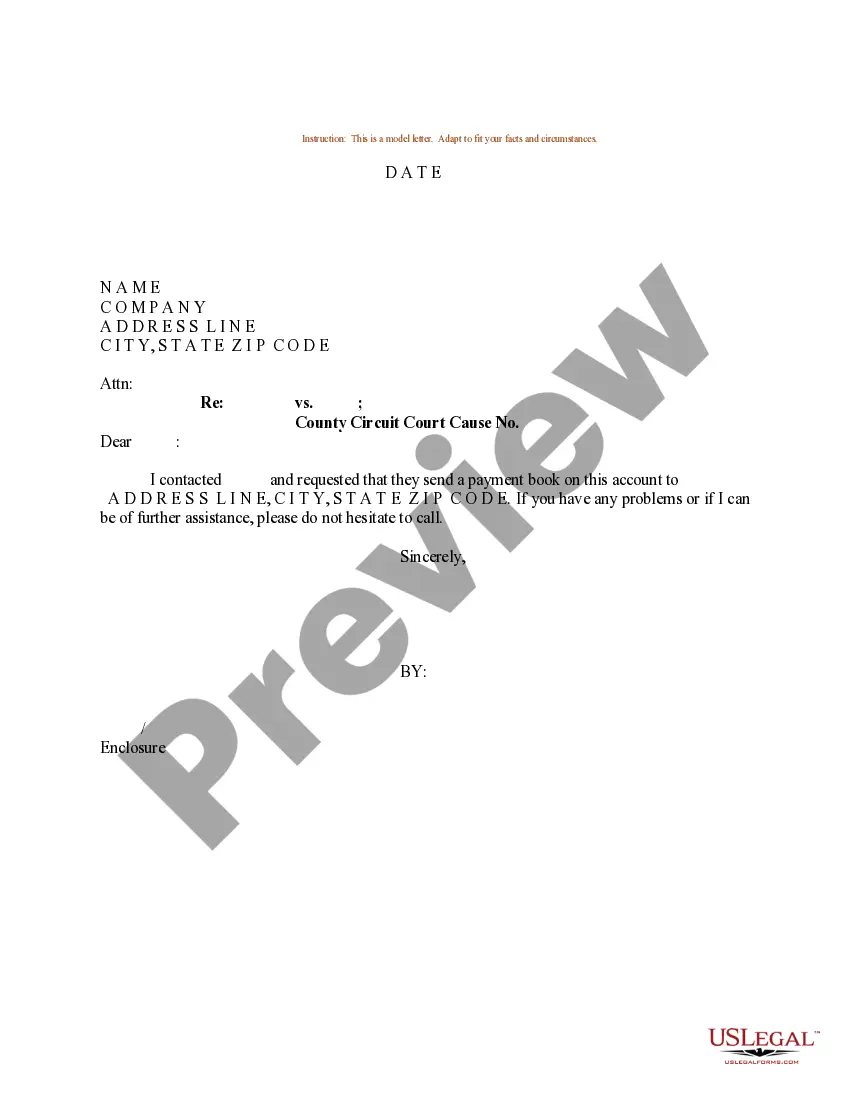

How to fill out Vermont Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

You may spend time online attempting to find the legal papers template that suits the state and federal specifications you require. US Legal Forms provides 1000s of legal kinds which can be analyzed by specialists. You can actually down load or print out the Vermont Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law from my service.

If you have a US Legal Forms profile, you may log in and click the Download switch. Next, you may total, modify, print out, or sign the Vermont Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Each legal papers template you acquire is your own property permanently. To acquire another copy of any bought form, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site the very first time, stick to the simple guidelines below:

- First, make sure that you have chosen the proper papers template for the region/city of your choosing. Look at the form outline to ensure you have chosen the proper form. If readily available, take advantage of the Preview switch to search from the papers template too.

- In order to find another version of your form, take advantage of the Research discipline to obtain the template that meets your needs and specifications.

- Once you have located the template you desire, click Get now to continue.

- Choose the costs plan you desire, type in your references, and register for a merchant account on US Legal Forms.

- Full the purchase. You can utilize your charge card or PayPal profile to fund the legal form.

- Choose the file format of your papers and down load it to your gadget.

- Make alterations to your papers if needed. You may total, modify and sign and print out Vermont Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Download and print out 1000s of papers layouts making use of the US Legal Forms web site, which provides the greatest assortment of legal kinds. Use skilled and condition-particular layouts to handle your business or person demands.

Form popularity

FAQ

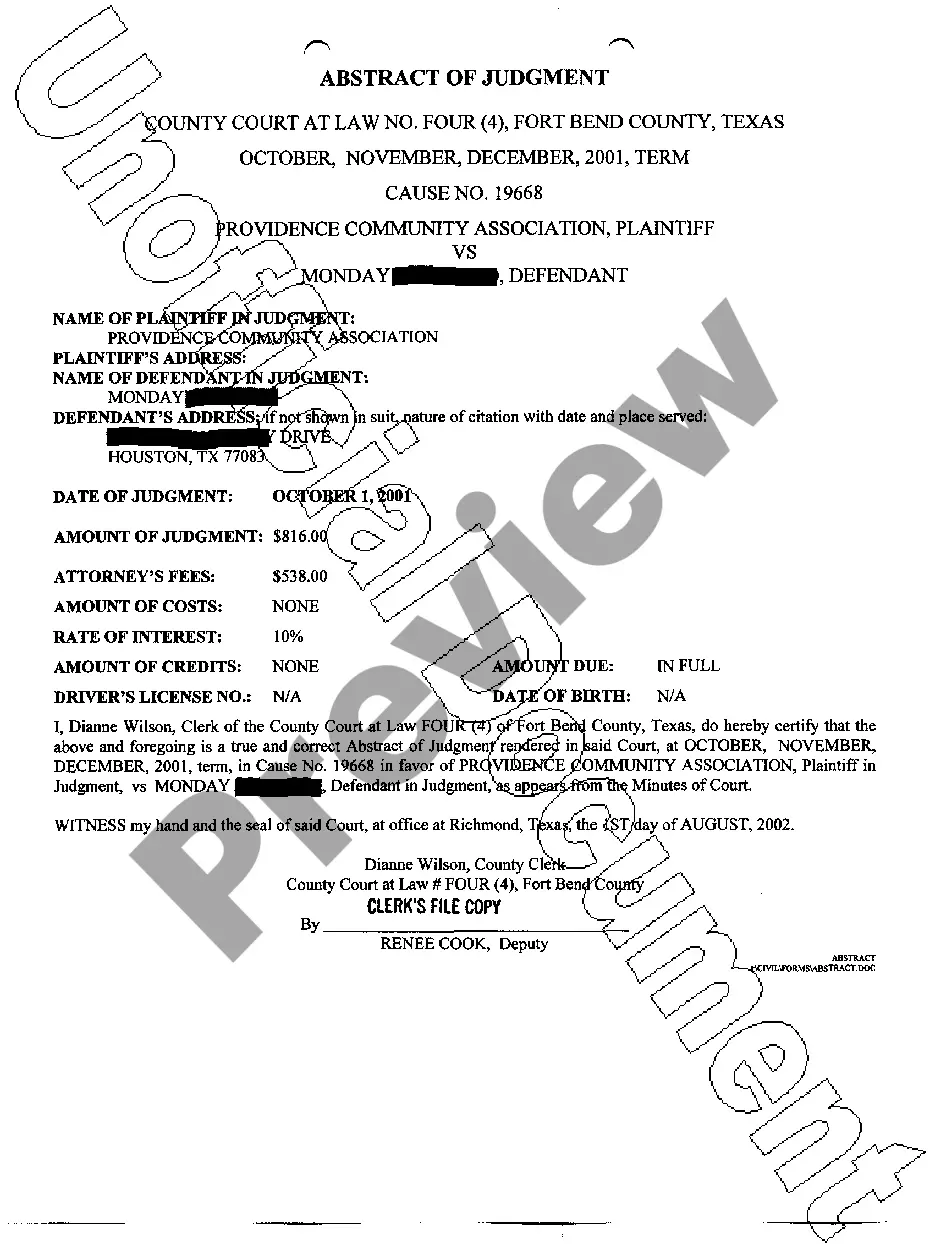

The document must include the credit limit, the interest rate and details of how and when a debtor is to discharge his payment obligations. A failure to produce such a document is still capable of rendering the agreement irredeemably unenforceable.

Does debt go away after 7 years? In the UK, for most people, unsecured debts go away after a period of 6 years from the point when they started or 6 years from the point when they last made a payment to, or had contact with, their creditor. This period can be 12 years for some mortgage debts.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

If a creditor waits too long to take court action, the debt will become 'unenforceable' or statute barred. This means the debt still exists but the law (statute) can be used to prevent (bar) the creditor from getting a court judgment or order to recover it.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan. Credits agreements are created for both retail and institutional loans.