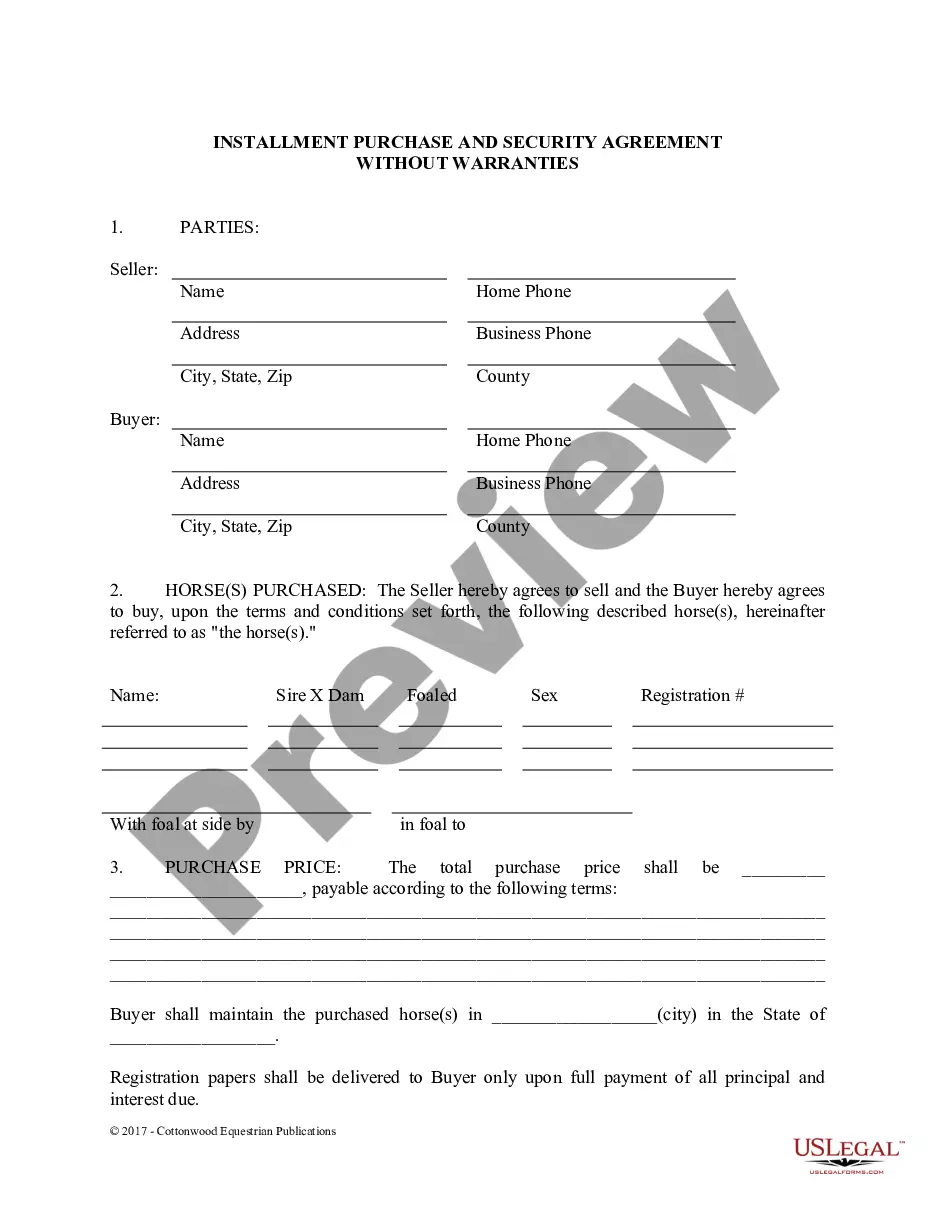

The Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas refers to a legally binding document that outlines the terms and conditions of a credit facility provided by the bank to the oil and gas company. This type of agreement is crucial for establishing the financial relationship between the two parties and ensuring smooth operations. The primary purpose of this credit agreement is to provide Southwest Royalties, Inc. with access to funds that can be used for various business purposes, such as exploration, drilling, and production activities in the oil and gas industry. Bank One Texas acts as the lender, offering the necessary credit to support the company's ongoing operations. The terms and conditions of the credit agreement may vary depending on the specific needs and requirements of Southwest Royalties, Inc. Some key components commonly found in such agreements include: 1. Loan Amount: The credit agreement will specify the maximum loan amount that Southwest Royalties, Inc. can borrow from Bank One Texas. This amount is determined based on the company's creditworthiness and financial standing. 2. Interest Rate: The agreement defines the applicable interest rate that Southwest Royalties, Inc. will pay on the borrowed funds. This rate can be fixed or variable and is determined by various factors including market conditions and the company's creditworthiness. 3. Repayment Terms: The credit agreement outlines the repayment terms, including the schedule and frequency of installments. It may also specify any required principal payments or balloon payments that need to be made. 4. Collateral: To secure the credit facility, Southwest Royalties, Inc. may be required to provide collateral. This can include assets such as oil and gas reserves, equipment, or other valuable properties, which can be seized by the bank in case of default. 5. Financial Covenants: The credit agreement may include certain financial covenants that Southwest Royalties, Inc. must meet during the term of the agreement. These covenants often include maintaining specific financial ratios or meeting specified performance metrics to ensure the company's financial stability. 6. Events of Default: The agreement will define certain events or conditions that would trigger a default, such as failure to make timely payments, breach of financial covenants, or the occurrence of an adverse legal or financial event. Though specific types of Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas were not explicitly mentioned, it is possible that there might be variations based on factors such as loan purpose or duration. Some potential variations could include a revolving credit agreement, equipment financing agreement, or project-specific credit agreement. These variations would have their unique terms and conditions tailored to the specific needs of Southwest Royalties, Inc. and Bank One Texas. In conclusion, the Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas serves as a crucial financial arrangement that allows the oil and gas company to access necessary funds for various business activities. It sets forth the terms and conditions that both parties must adhere to, ensuring a mutually beneficial relationship while mitigating financial risks.

Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

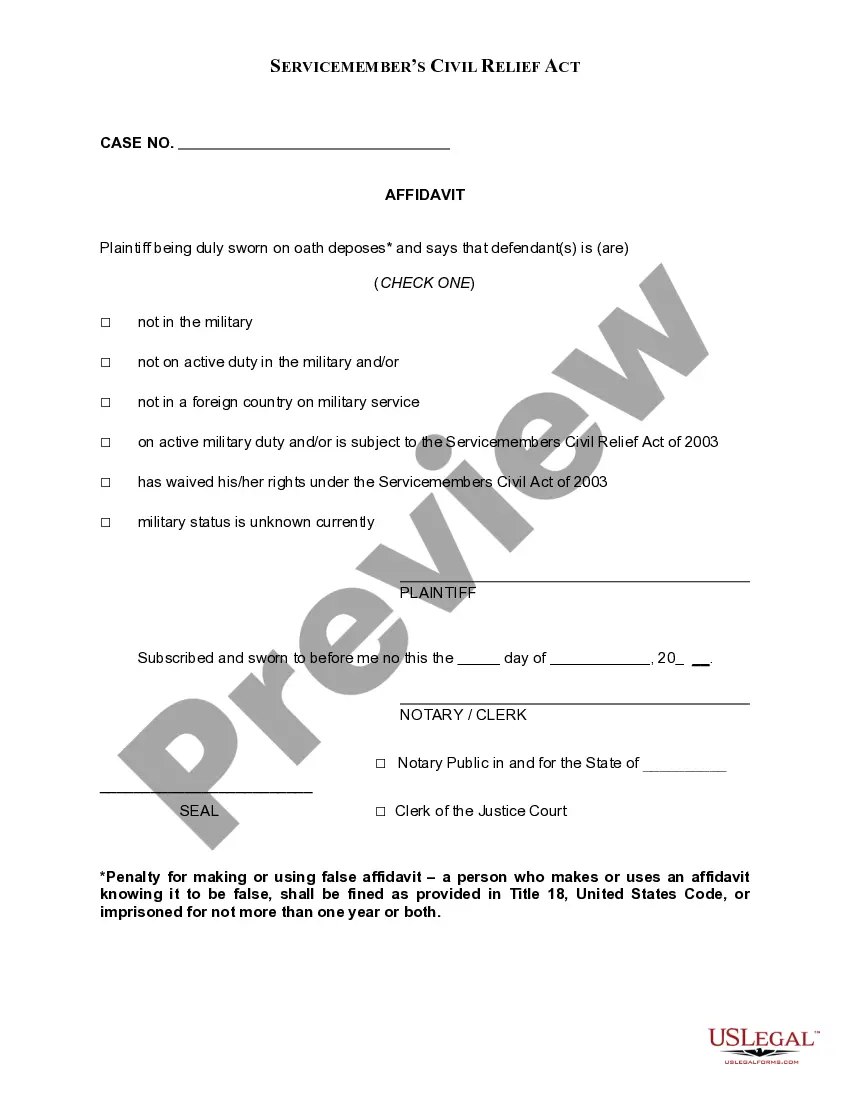

How to fill out Vermont Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

US Legal Forms - one of several biggest libraries of authorized types in the USA - gives an array of authorized papers web templates you are able to acquire or print out. While using web site, you can get thousands of types for enterprise and individual functions, sorted by types, suggests, or search phrases.You can get the most recent types of types just like the Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas in seconds.

If you have a registration, log in and acquire Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas through the US Legal Forms collection. The Down load switch can look on each kind you perspective. You gain access to all formerly saved types inside the My Forms tab of the profile.

In order to use US Legal Forms initially, listed below are simple instructions to help you get started:

- Ensure you have chosen the correct kind for your personal metropolis/county. Select the Preview switch to examine the form`s information. Browse the kind explanation to actually have chosen the correct kind.

- When the kind doesn`t suit your demands, use the Search discipline near the top of the display to get the one which does.

- Should you be pleased with the shape, validate your selection by clicking on the Get now switch. Then, opt for the costs program you favor and provide your accreditations to register to have an profile.

- Method the purchase. Make use of Visa or Mastercard or PayPal profile to perform the purchase.

- Choose the format and acquire the shape in your device.

- Make modifications. Fill out, modify and print out and indicator the saved Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas.

Every single design you added to your account does not have an expiry particular date and it is your own permanently. So, if you wish to acquire or print out another backup, just check out the My Forms area and then click in the kind you will need.

Gain access to the Vermont Credit Agreement between Southwest Royalties, Inc. and Bank One Texas with US Legal Forms, one of the most comprehensive collection of authorized papers web templates. Use thousands of specialist and state-distinct web templates that meet up with your business or individual requires and demands.