Vermont Acquisition Agreement between Beltrán International Group, Ltd and Internet Protocols Ltd is a legally binding contract that outlines the terms and conditions of a business acquisition between the two companies. Vermont refers to the state in the United States, where the agreement is based. Beltrán International Group, Ltd, a well-established global telecommunications company, and Internet Protocols Ltd, a technology firm specializing in internet network solutions, have entered into this acquisition agreement to facilitate the acquisition of Internet Protocols Ltd by Beltrán International Group, Ltd. The Vermont Acquisition Agreement comprehensively covers various aspects of the acquisition process, ensuring clarity and protection for both parties involved. Below are some key components typically found in such agreements: 1. Parties involved: The agreement identifies Beltrán International Group, Ltd as the acquiring company and Internet Protocols Ltd as the target company being acquired. 2. Purchase price: The agreement specifies the purchase price set by Beltrán International Group, Ltd, which is agreed upon by both parties. The price may include cash, stock, or a combination of both. 3. Assets and liabilities: This section outlines the assets and liabilities that will be transferred from Internet Protocols Ltd to Beltrán International Group, Ltd as part of the acquisition. It includes intellectual property, contracts, equipment, and any debts or liabilities. 4. Closing conditions: The agreement also lists specific conditions that must be met before the acquisition can proceed, such as obtaining necessary regulatory approvals or satisfying due diligence requirements. 5. Representations and warranties: Both companies provide various representations and warranties about their respective businesses, ensuring that the information exchanged is accurate. 6. Indemnification: This section specifies the terms and conditions for indemnification, whereby one party agrees to compensate the other for any losses or damages incurred due to breaches of warranties or representations. 7. Confidentiality: The agreement usually includes a confidentiality clause to protect sensitive information shared during the acquisition process. 8. Governing law and jurisdiction: It states that the agreement is governed by the laws of Vermont and any disputes arising from the agreement will be resolved in the state courts. Different types of Vermont Acquisition Agreements may exist based on the specific nature of the acquisition. For example: — Stock Acquisition AgreementBeltránnan International Group, Ltd acquires Internet Protocols Ltd by purchasing its stock or shares. — Asset Acquisition AgreementBeltránnan International Group, Ltd acquires only specific assets and liabilities from Internet Protocols Ltd without acquiring its stock. — Merger Agreement: If the acquisition involves merging both companies into a single entity, forming a new combined entity. These different types of acquisition agreements have distinct terms and provisions tailored to the specific circumstances of the transaction.

Vermont Acquisition Agreement between Teltran International Group, Ltd and Internet Protocols Ltd

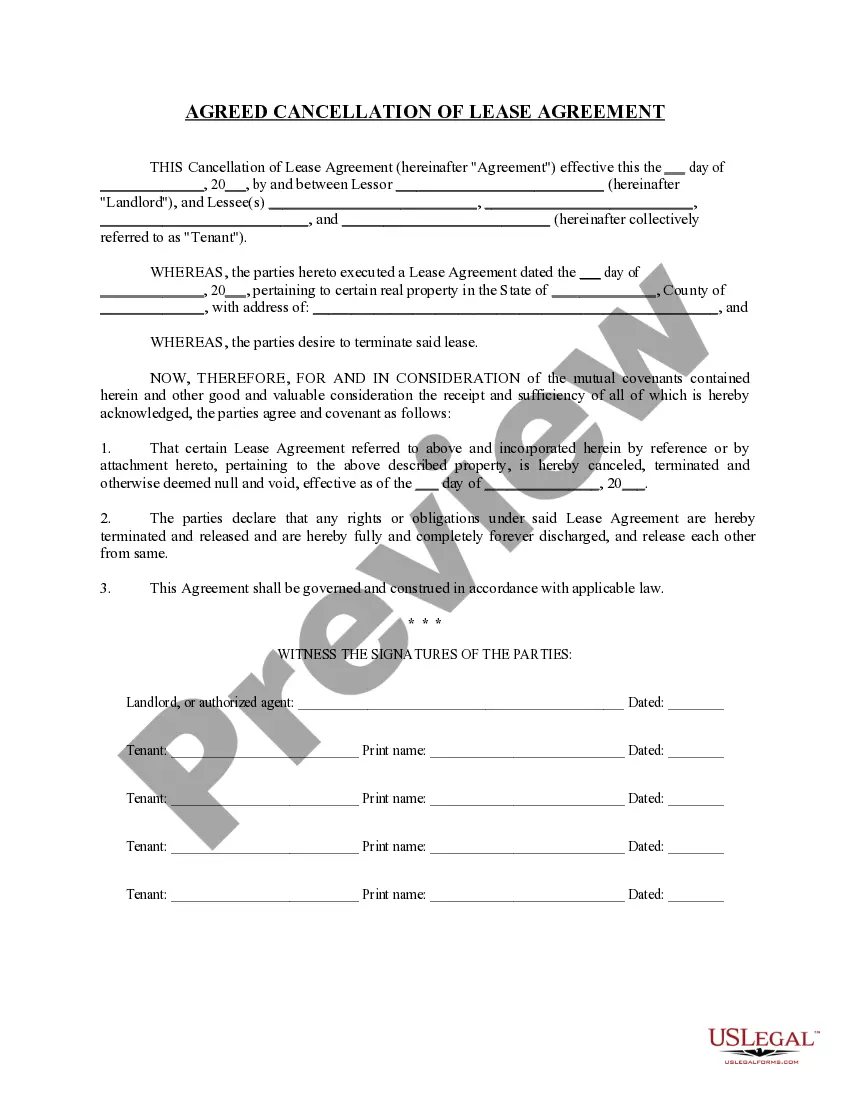

Description

How to fill out Vermont Acquisition Agreement Between Teltran International Group, Ltd And Internet Protocols Ltd?

Are you presently in the placement that you need to have papers for either enterprise or individual uses nearly every day time? There are a lot of legal document layouts available on the Internet, but discovering kinds you can rely on is not easy. US Legal Forms gives a large number of kind layouts, such as the Vermont Acquisition Agreement between Teltran International Group, Ltd and Internet Protocols Ltd, that are created in order to meet federal and state demands.

When you are already acquainted with US Legal Forms web site and get an account, just log in. After that, it is possible to obtain the Vermont Acquisition Agreement between Teltran International Group, Ltd and Internet Protocols Ltd design.

If you do not provide an profile and want to begin using US Legal Forms, follow these steps:

- Get the kind you want and make sure it is for that right area/region.

- Take advantage of the Review key to review the form.

- Read the outline to ensure that you have chosen the appropriate kind.

- In case the kind is not what you`re seeking, use the Look for field to discover the kind that meets your requirements and demands.

- When you get the right kind, simply click Purchase now.

- Select the pricing prepare you need, fill in the required details to produce your bank account, and pay money for the order using your PayPal or charge card.

- Pick a practical file format and obtain your duplicate.

Get each of the document layouts you have bought in the My Forms menus. You can aquire a further duplicate of Vermont Acquisition Agreement between Teltran International Group, Ltd and Internet Protocols Ltd whenever, if required. Just click on the required kind to obtain or print the document design.

Use US Legal Forms, by far the most considerable assortment of legal forms, in order to save time as well as avoid blunders. The support gives expertly created legal document layouts which you can use for a selection of uses. Create an account on US Legal Forms and initiate generating your life easier.