A Vermont Sale and Servicing Agreement is a legal contract that outlines the terms and conditions between a seller and a service provider. This agreement is relevant in various industries, such as real estate, automobile sales, or even software licensing. It establishes the rights and responsibilities of both parties involved in the sale and servicing process. In Vermont, there are different types of Sale and Servicing Agreements that cater to specific industries or business needs. These include: 1. Vermont Real Estate Sale and Servicing Agreement: This type of agreement is commonly used in the real estate industry, where it governs the sale of properties and the subsequent services provided by real estate agents or agencies. It outlines the obligations of the seller, such as disclosing property defects or providing accurate information, and the responsibilities of the agent, such as marketing the property or negotiating on the seller's behalf. 2. Vermont Automobile Sale and Servicing Agreement: This type of agreement is applicable when purchasing or selling automobiles in Vermont. It covers the terms of sale, pricing, warranty, and post-sale services such as repairs, maintenance, or warranty claims. It ensures that both parties are aware of their rights, obligations, and any potential liabilities associated with the sale or servicing of the vehicle. 3. Vermont Software Sale and Servicing Agreement: In the digital space, this type of agreement is crucial for software companies offering products or services within Vermont. It encompasses the sale of software licenses, subscriptions, or any related services. The agreement may include provisions on intellectual property rights, payment terms, the scope of services, and customer support. Regardless of the specific industry, a Vermont Sale and Servicing Agreement typically includes essential components such as: a. Parties Involved: Identifies the seller and the service provider, and their legal names or company names. b. Sale Terms: Outlines the specifics of the sale, including the price, payment terms, delivery methods, and any applicable taxes or fees. c. Servicing Terms: Details the services to be provided after the sale, such as maintenance, repairs, customer support, or any other agreed-upon post-sale services. d. Duration and Termination: Specifies the duration of the agreement and the conditions under which either party can terminate it, including any penalties or notice requirements. e. Confidentiality and Non-Disclosure: Protects sensitive information shared during the sale and servicing process and ensures that both parties maintain confidentiality. f. Dispute Resolution: Establishes mechanisms for resolving disputes, whether through mediation, arbitration, or litigation, and identifies the jurisdiction where disputes will be addressed. In summary, a Vermont Sale and Servicing Agreement is a legally binding contract that governs the relationship between a seller and a service provider. It varies depending on the industry, such as real estate, automobile sales, or software licensing, and outlines the rights and obligations of both parties involved in the sale and servicing process. It is important to seek legal counsel or professional advice when drafting or entering into such agreements to ensure compliance with Vermont laws and regulations.

Vermont Sale and Servicing Agreement

Description

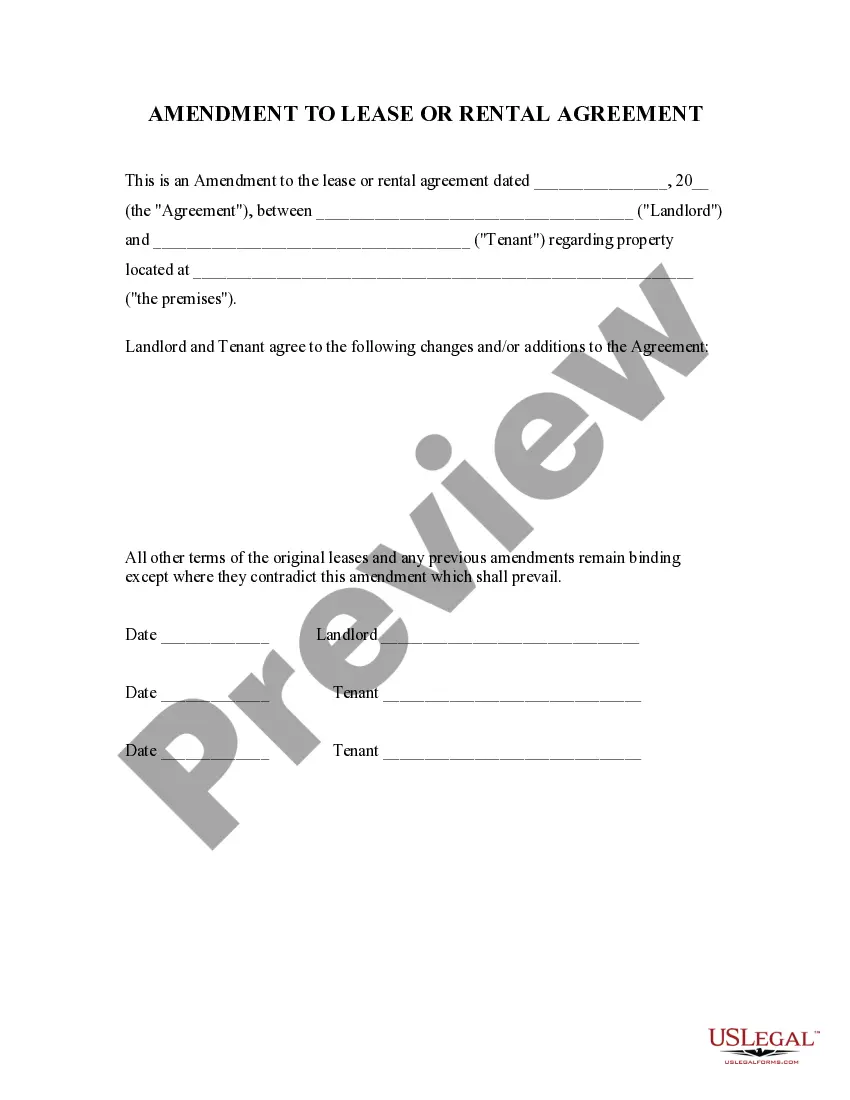

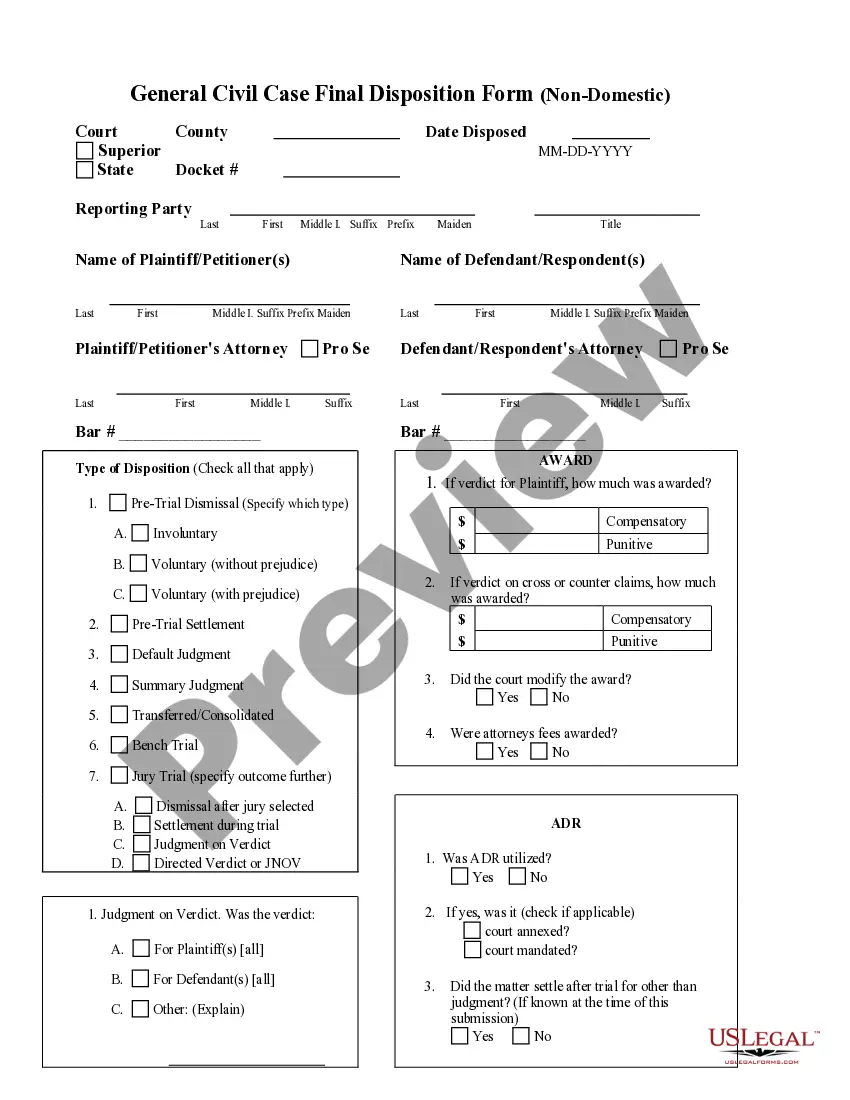

How to fill out Sale And Servicing Agreement?

Choosing the right authorized record format might be a struggle. Of course, there are a lot of themes available on the net, but how do you discover the authorized kind you want? Make use of the US Legal Forms site. The services offers thousands of themes, for example the Vermont Sale and Servicing Agreement, which can be used for business and personal demands. Each of the kinds are checked out by professionals and fulfill state and federal specifications.

If you are already registered, log in to your account and click on the Download switch to obtain the Vermont Sale and Servicing Agreement. Use your account to check from the authorized kinds you have purchased earlier. Proceed to the My Forms tab of the account and obtain another copy of your record you want.

If you are a whole new user of US Legal Forms, listed below are straightforward directions so that you can stick to:

- First, ensure you have selected the correct kind to your town/region. It is possible to examine the shape utilizing the Review switch and look at the shape outline to ensure this is the best for you.

- In the event the kind does not fulfill your requirements, use the Seach field to find the correct kind.

- Once you are certain the shape is suitable, click on the Buy now switch to obtain the kind.

- Select the costs plan you would like and type in the essential details. Design your account and purchase the order with your PayPal account or Visa or Mastercard.

- Select the document structure and down load the authorized record format to your device.

- Full, revise and printing and sign the attained Vermont Sale and Servicing Agreement.

US Legal Forms is definitely the biggest local library of authorized kinds for which you can see a variety of record themes. Make use of the company to down load skillfully-made documents that stick to condition specifications.

Form popularity

FAQ

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.

In MA, sellers take on the burden of real estate transfer taxes. The sum of MA real estate transfer taxes is calculated by the market value of the home and the tax rate of $4.56 per thousand. It is included as part of closing costs for sellers and is commonly required before the deed files.

When a transfer is made by deed, the buyer or transferee is liable for the transfer tax.

There are two types of property taxes in Vermont: local property taxes and the state education tax rate. Local property tax rates are determined by municipalities and are applied to a home's assessed value. The assessed value is determined by local assessors, who are called listers in Vermont.

Services are generally tax-exempt in Vermont, though there are exceptions: Services to tangible personal property. If labor is expended in producing a new or different item, a tax applies to the labor charge.

The seller must obtain an exemption certificate from the buyer either prior to or at the time of the sale. If the certificate is not available at the time of sale, the seller has 90 days after the sale to obtain a fully executed certificate, accepted in good faith.

(l) ?Exclusive Right to Market Agreement? means a seller service agreement which grants to the brokerage firm the exclusive right to market the property, and which recognizes a liability on the part of the owner for a commission or fee to the brokerage firm, even if the property is sold by the owner.

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed.