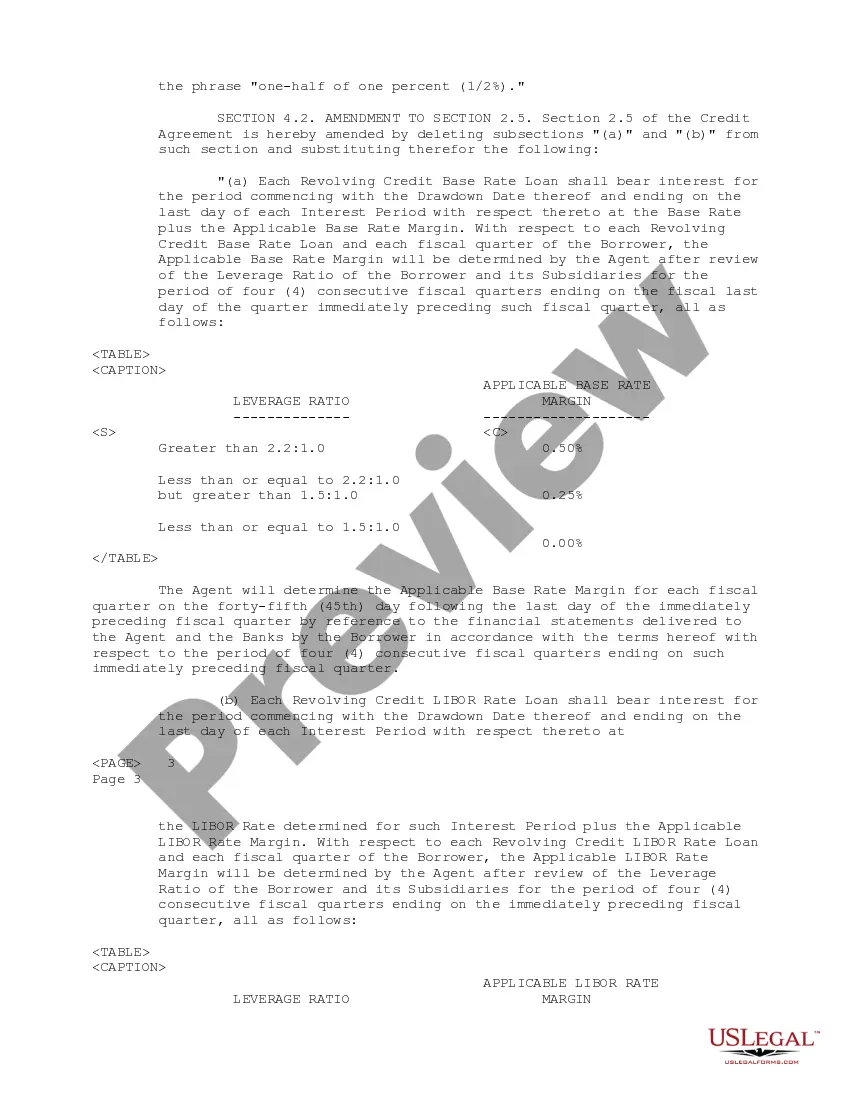

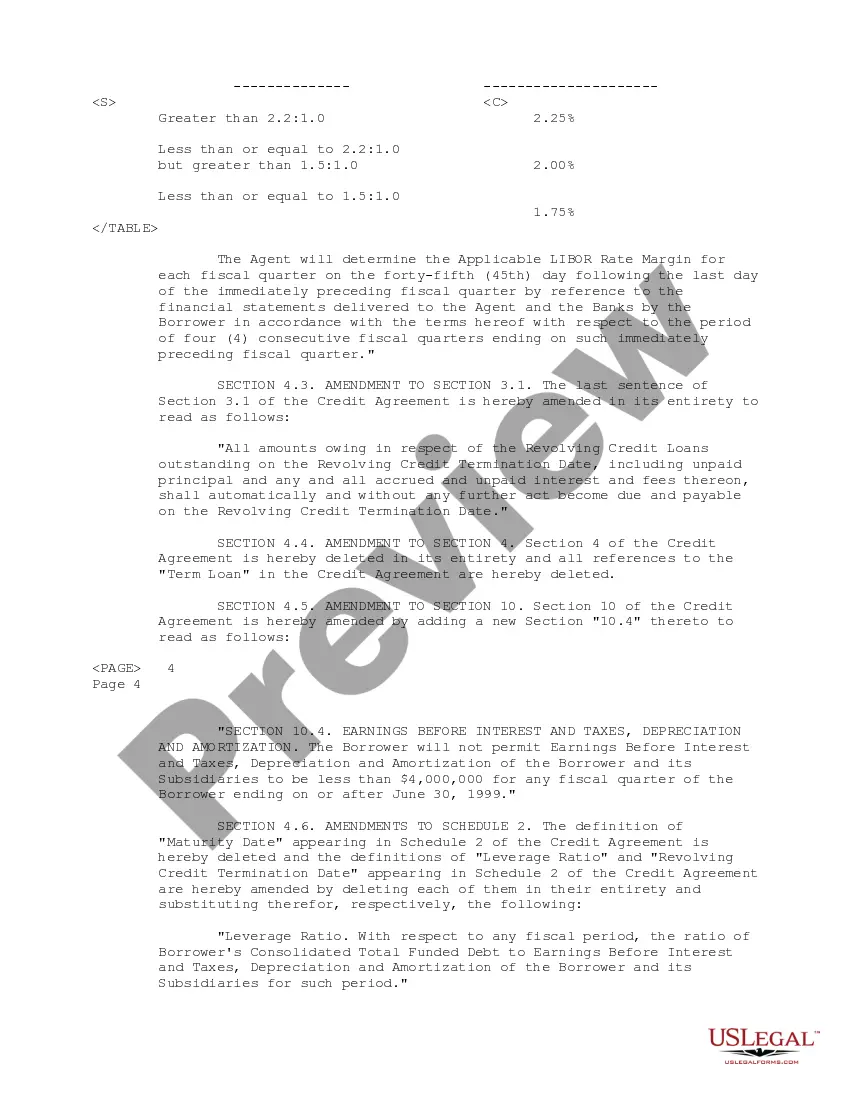

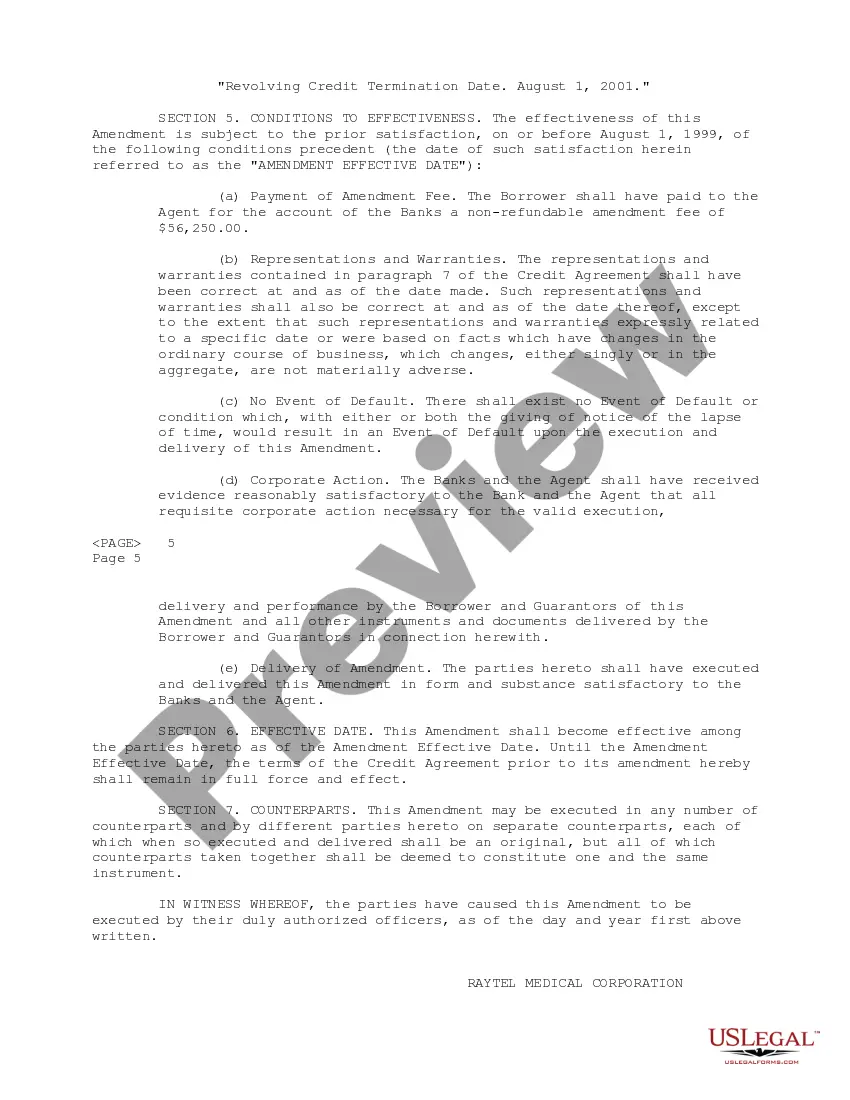

The Vermont Fourth Amendment to Amended Restated Credit Agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus is a legally binding document that outlines the modifications made to the original credit agreement between the parties involved. This amendment is specific to the state of Vermont and highlights the changes that have been agreed upon by all parties. Keywords: Vermont Fourth Amendment, Amended Restated Credit Agreement, Ray tel Medical Corp, Bank Boston, N.A., Banquet Paribus. 1. Purpose: The purpose of the Vermont Fourth Amendment to Amended Restated Credit Agreement is to detail the revisions and updates made to the existing credit agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. The amendment aims to ensure that all parties involved are aware of the changes and new terms. 2. Key Changes: This fourth amendment introduces several modifications to the existing credit agreement. Specific changes may include adjustments to interest rates, extending or reducing the term of the credit, modifying repayment terms, revising collateral requirements, or altering financial covenants. The amendment outlines the precise adjustments made in each area, granting clarity and transparency to all involved parties. 3. Legal Implications: The Vermont Fourth Amendment to Amended Restated Credit Agreement has various legal implications. It serves as a contractual agreement, legally binding all parties involved to adhere to the amended terms. This amendment provides legal protection for both the borrowing entity (Ray tel Medical Corp) and the lending institutions (Bank Boston, N.A., and Banquet Paribus) by establishing the new terms that regulate their financial relationship. 4. Borrower's Perspective: Ray tel Medical Corp, as the borrowing entity, gains several benefits from this fourth amendment. It may include obtaining more favorable financial terms, such as lower interest rates, extended payment deadlines, or modified ratios regarding financial covenants. In some cases, the amendment might provide additional flexibility to the borrower, allowing it to revise repayment schedules or other terms based on its changing financial situation. 5. Lender's Perspective: Bank Boston, N.A., and Banquet Paribus, as the lending institutions, have their interests protected through this amendment. It ensures they have legal documentation evidencing the revised terms, protecting them from any potential disputes in the future. The lenders may have adjusted the financial terms to reflect changing market conditions, creditworthiness, or other factors affecting the borrowing entity. The amendment also allows the lenders to set clear boundaries and requirements for the borrower, minimizing potential risks. 6. Compliance with Vermont Regulations: The Vermont Fourth Amendment to Amended Restated Credit Agreement is specifically designed to comply with the regulations set by the state of Vermont. By tailoring the agreement to meet the state's legislations and guidelines, all parties involved ensure that the contract is legally enforceable within Vermont's jurisdiction. Different types or variations of the Vermont Fourth Amendment to Amended Restated Credit Agreement might exist, depending on the specific needs and circumstances of the involved parties. However, without specific information regarding the variations, it is difficult to provide details on each specific type.

Vermont Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Vermont Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

If you wish to complete, acquire, or produce legal record themes, use US Legal Forms, the largest variety of legal forms, that can be found on the web. Use the site`s basic and convenient look for to discover the files you will need. Numerous themes for business and personal reasons are categorized by categories and suggests, or search phrases. Use US Legal Forms to discover the Vermont Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas in just a few mouse clicks.

If you are presently a US Legal Forms buyer, log in in your account and click on the Download button to have the Vermont Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas. You may also access forms you in the past downloaded from the My Forms tab of your respective account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct area/nation.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Don`t neglect to read through the information.

- Step 3. If you are unsatisfied with all the type, utilize the Research discipline at the top of the monitor to discover other versions of the legal type template.

- Step 4. Upon having discovered the form you will need, click the Get now button. Choose the pricing program you like and put your accreditations to sign up for an account.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Pick the format of the legal type and acquire it on the product.

- Step 7. Complete, revise and produce or indication the Vermont Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas.

Each legal record template you get is your own forever. You may have acces to each and every type you downloaded within your acccount. Go through the My Forms portion and pick a type to produce or acquire once more.

Be competitive and acquire, and produce the Vermont Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas with US Legal Forms. There are many skilled and state-distinct forms you can utilize for your personal business or personal needs.