A Vermont Director Option Agreement is a legal contract that grants a director of a company the option to purchase shares of stock in the company at a predetermined price. This agreement is often used as an incentive or reward for directors by allowing them to acquire ownership in the company. It gives directors the opportunity to benefit from the company's success and align their interests with those of the shareholders. The Vermont Director Option Agreement outlines the terms and conditions of the option, including the exercise price, the number of shares the director can purchase, the vesting period, and the expiration date of the option. The exercise price is usually set at fair market value or a discounted price to encourage directors to exercise their options. There are different types of Vermont Director Option Agreements based on the structure of the options. The most common types include non-qualified stock options (NO) and incentive stock options (ISO). Nests are more flexible and can be granted to directors without meeting specific IRS requirements. They are subject to ordinary income tax upon exercise. On the other hand, SOS have more favorable tax treatment but require compliance with certain IRS rules, such as being granted at fair market value and having a maximum exercise price. The vesting period of the Vermont Director Option Agreement is an important aspect as it determines when the director can exercise the options and acquire ownership in the company. It is often structured over a specific period, with a portion of the options becoming exercisable each year. This vesting period incentivizes directors to remain with the company for a certain period, aligning their interests with long-term success. It is important for both the company and the director to carefully negotiate and define the terms of the Vermont Director Option Agreement to ensure fairness and alignment of interests. Consulting with legal and financial professionals is crucial to understanding the legal and tax implications associated with the agreement. In conclusion, the Vermont Director Option Agreement is a contractual arrangement between a company and its director that provides an opportunity for the director to purchase company shares at a predetermined price. Different types of agreements, such as Nests and SOS, offer varying tax treatment and requirements. These agreements serve as a valuable tool for attracting and retaining skilled directors who can play a vital role in the success of the company.

Vermont Director Option Agreement

Description

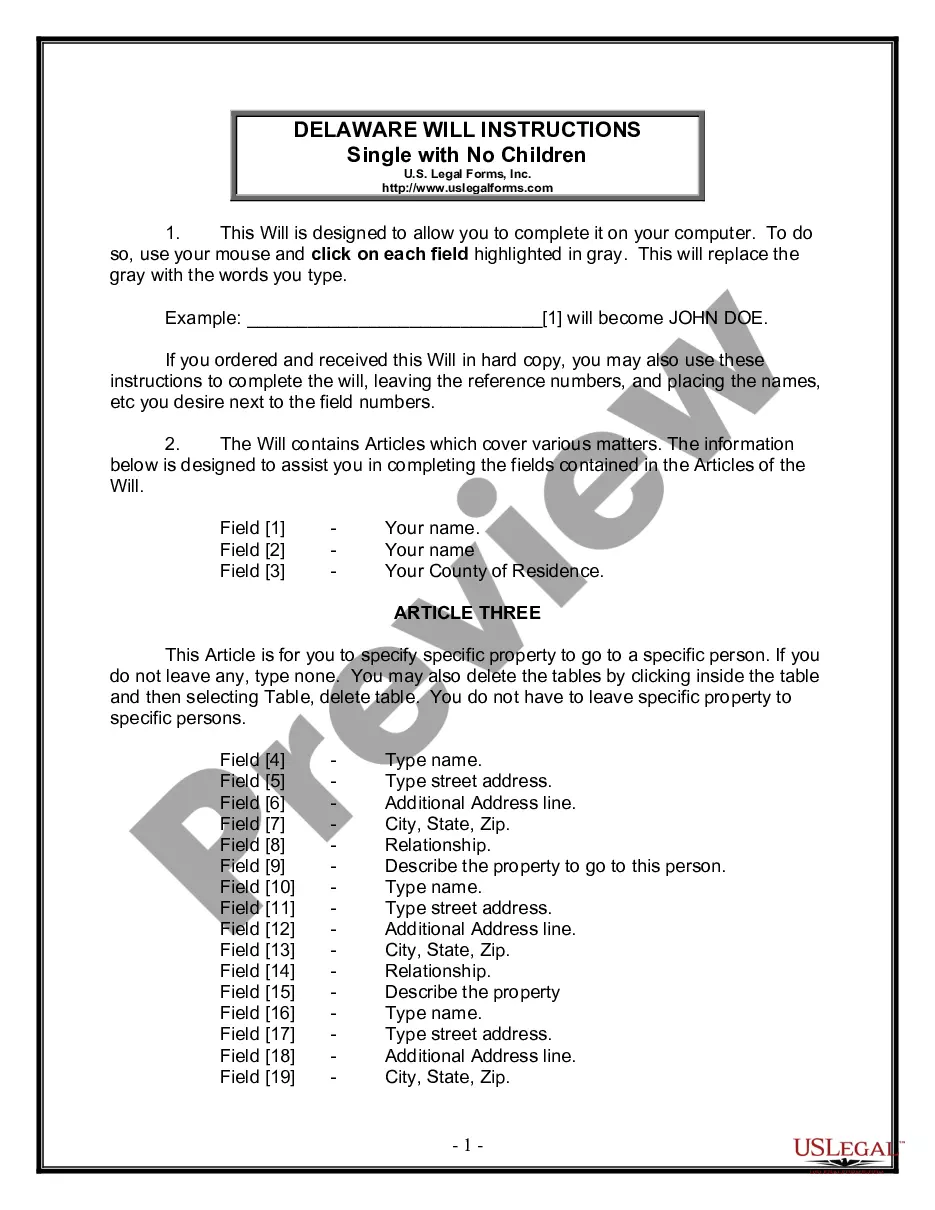

How to fill out Vermont Director Option Agreement?

Have you been in a place where you will need paperwork for both business or person functions just about every time? There are plenty of legal file themes accessible on the Internet, but discovering versions you can depend on isn`t straightforward. US Legal Forms gives 1000s of type themes, like the Vermont Director Option Agreement, that are created to satisfy federal and state demands.

If you are presently informed about US Legal Forms site and possess a free account, just log in. After that, you are able to download the Vermont Director Option Agreement format.

Unless you provide an account and need to begin to use US Legal Forms, adopt these measures:

- Get the type you require and make sure it is for your correct city/region.

- Take advantage of the Preview key to examine the shape.

- Read the information to ensure that you have selected the correct type.

- In the event the type isn`t what you are trying to find, utilize the Look for industry to discover the type that suits you and demands.

- If you discover the correct type, just click Get now.

- Opt for the prices program you need, submit the required details to produce your account, and pay for the transaction utilizing your PayPal or credit card.

- Pick a hassle-free file format and download your copy.

Discover each of the file themes you possess bought in the My Forms food list. You can get a additional copy of Vermont Director Option Agreement anytime, if required. Just click on the essential type to download or printing the file format.

Use US Legal Forms, one of the most extensive collection of legal kinds, in order to save efforts and steer clear of mistakes. The service gives appropriately created legal file themes that you can use for a variety of functions. Generate a free account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

The personal income tax rate in Vermont is 3.35%?8.75%. Vermont does not have reciprocity with other states.

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateState6.60%3.57%Local0.00%0.00%Total Income Taxes23.64%Income After Taxes4 more rows ?

Vermont has four income tax brackets, and the state still taxes Social Security benefits for some filers. Property taxes are high when compared to most other states, and Vermont also has an estate tax. However, the sales tax rate in Vermont is about average, and many types of essential items are tax-exempt.

Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks. Soft drinks are subject to Vermont tax under 32 V.S.A. § 9701(31) and (54).

In the State of Vermont, you have the legal right to refuse access to your property for an inspection by the assessor's office. The assessor is then required to follow State statute and value your property to the best of his/her ability without seeing the grade, condition, updating and other possible improvements.

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota ? which both received a B ? also have no state income tax.