Vermont Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

You may devote several hours on-line trying to find the legitimate papers format that meets the state and federal requirements you will need. US Legal Forms gives thousands of legitimate kinds which can be reviewed by professionals. You can easily obtain or print out the Vermont Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds from your support.

If you have a US Legal Forms profile, you are able to log in and click on the Download option. Following that, you are able to comprehensive, change, print out, or signal the Vermont Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Each and every legitimate papers format you purchase is the one you have eternally. To get another copy associated with a purchased develop, go to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms web site the very first time, keep to the straightforward recommendations beneath:

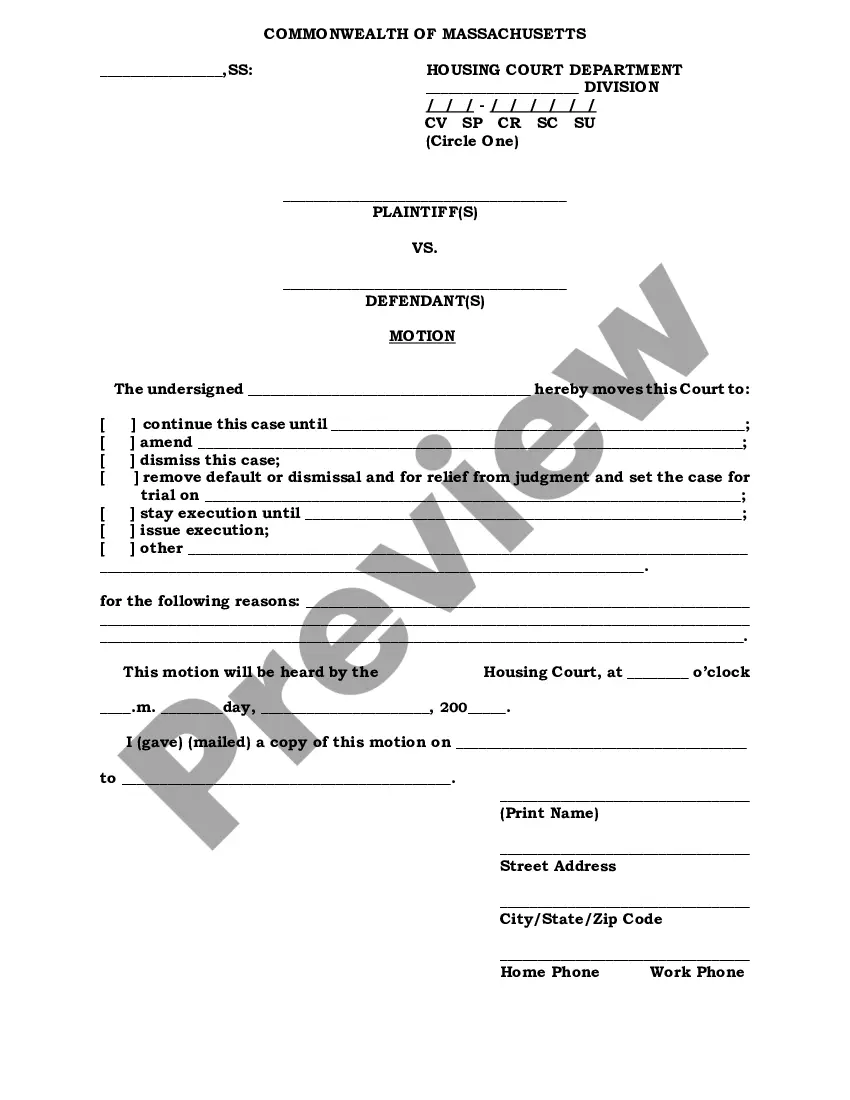

- Very first, make certain you have chosen the right papers format to the county/city of your choosing. Look at the develop information to make sure you have picked out the right develop. If readily available, make use of the Review option to look from the papers format too.

- If you would like discover another variation in the develop, make use of the Search area to get the format that meets your requirements and requirements.

- When you have found the format you would like, click on Purchase now to proceed.

- Find the prices program you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal profile to fund the legitimate develop.

- Find the structure in the papers and obtain it for your device.

- Make changes for your papers if required. You may comprehensive, change and signal and print out Vermont Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Download and print out thousands of papers templates while using US Legal Forms site, which provides the biggest collection of legitimate kinds. Use expert and condition-certain templates to deal with your organization or specific requires.