Vermont Compensation Agreement

Description

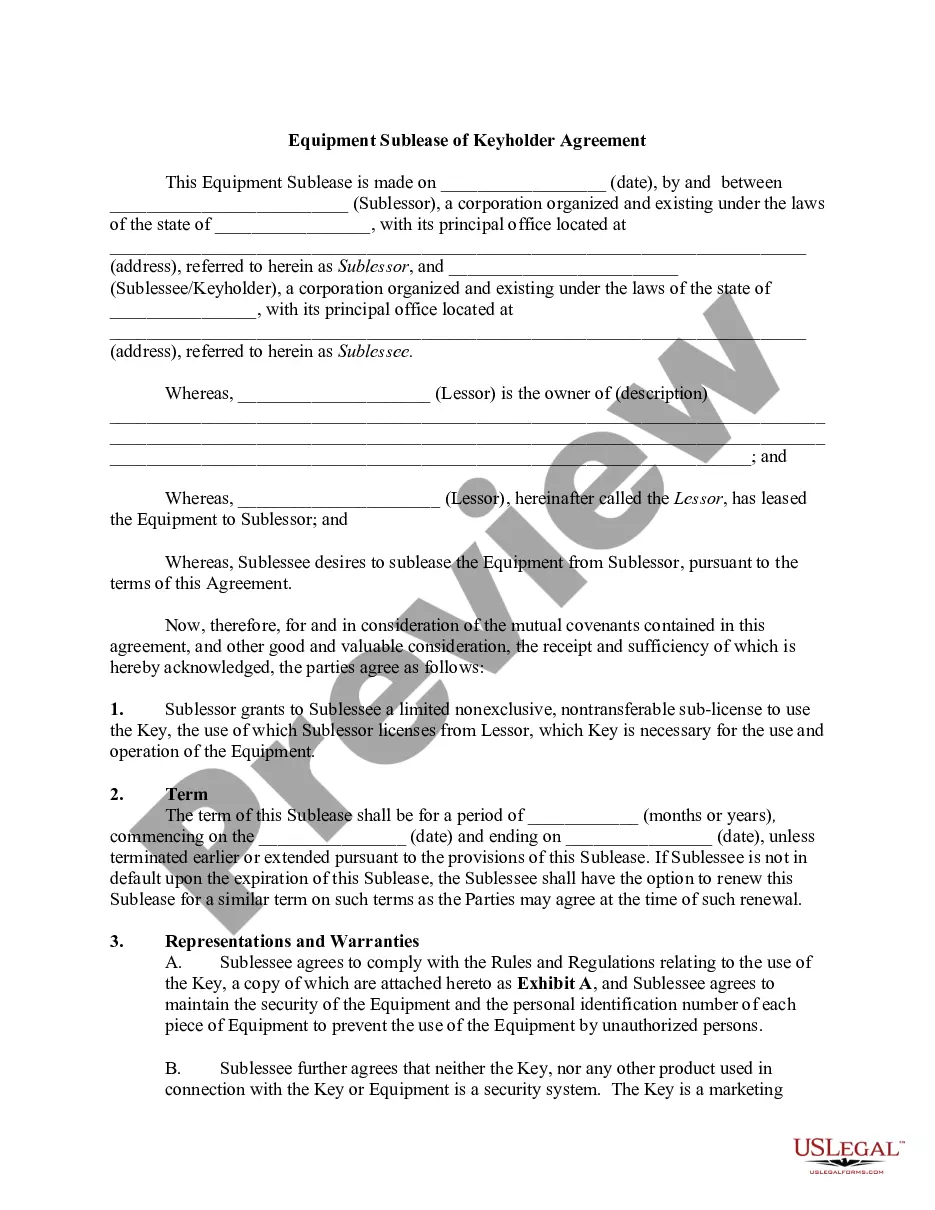

How to fill out Compensation Agreement?

If you wish to total, download, or produce lawful document web templates, use US Legal Forms, the largest collection of lawful types, that can be found on the Internet. Use the site`s basic and hassle-free look for to discover the files you want. Various web templates for enterprise and individual uses are categorized by types and says, or keywords and phrases. Use US Legal Forms to discover the Vermont Compensation Agreement in a couple of clicks.

Should you be previously a US Legal Forms consumer, log in to the account and then click the Acquire option to find the Vermont Compensation Agreement. You can also entry types you previously acquired in the My Forms tab of your own account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for that appropriate area/region.

- Step 2. Use the Preview option to look through the form`s content. Don`t forget to learn the explanation.

- Step 3. Should you be unsatisfied together with the form, make use of the Search area near the top of the display screen to get other versions of your lawful form template.

- Step 4. When you have discovered the form you want, select the Purchase now option. Select the rates program you prefer and put your references to register for an account.

- Step 5. Process the deal. You can use your charge card or PayPal account to perform the deal.

- Step 6. Pick the format of your lawful form and download it in your device.

- Step 7. Complete, change and produce or signal the Vermont Compensation Agreement.

Each and every lawful document template you buy is your own property forever. You might have acces to each and every form you acquired inside your acccount. Select the My Forms area and pick a form to produce or download once again.

Remain competitive and download, and produce the Vermont Compensation Agreement with US Legal Forms. There are many professional and condition-particular types you may use for the enterprise or individual requires.

Form popularity

FAQ

Vermont workers' compensation insurance can help: Pay for medical care if an employee gets hurt or sick from their job. Replace most of their lost wages if they miss work due to an injury or illness from their job. Pay for funeral costs if they lose their life due to a work accident or work-related illness.

The average cost of workers' compensation in Vermont is $47 per month. Your workers' comp premium is calculated based on a few factors, including: Payroll. Location.

Workers' compensation disability payments are approximately two-thirds of your average weekly wage and are non-taxable.

Workers' compensation provides coverage for all reasonable and necessary medical treatment that is related to your work injury/illness. WCP will pay for this treatment once your claim is approved. You must also complete and return your Medical Authorization (VDOL Form 7) in order for your medical bills to be paid.

Vermont Workers' Comp Verification The state of Vermont provides a free online tool for verifying workers' compensation insurance coverage. Anyone can search by business name or FEIN. The results will only show the business name and policy number for employers who have coverage in the state being searched.

The compensation policy outlines the guidelines and procedures for compensating employees at your organization. It is designed to ensure that employees are fairly and competitively compensated for their work, while also aligning with the organization's financial goals and objectives.

21 Days calculating in case of FORM 5 If an Employee's Notice of Injury and Claim for Compensation (Form 5) is filed by an injured worker, the employer/carrier shall investigate the claim immediately to determine whether any compensation is due within 21 days.