Title: Vermont Plan of Merger Explained: Food Lion, Hanna ford Brothers, and FL Acquisition Sub Intro: In the dynamic grocery industry, mergers and acquisitions play a significant role in shaping the marketplace. One such notable merger occurred between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc., resulting in the creation of the Vermont Plan of Merger. This comprehensive plan marked a significant milestone in the industry. In this article, we will explore the intricacies of the Vermont Plan of Merger, highlighting notable features and different types. 1. Overview of the Vermont Plan of Merger: The Vermont Plan of Merger is a legally binding document that outlines the process and terms for merging Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. It aims to integrate the operations, assets, and resources of the companies involved to create a stronger and more competitive entity. 2. Objectives and Benefits: The plan aims to achieve several key objectives, including: — Synergies: By merging the three companies, the plan seeks to capitalize on their complementary strengths, expertise, and geographical market presence to drive growth and efficiency. — Enhanced Customer Experience: The merger intends to improve the overall customer experience by offering an expanded range of products, services, and convenient store locations. — Market Expansion: The combined entity will have a broader market reach, allowing for increased penetration in existing markets and potential expansion into new regions. — Cost Savings: Through consolidation and optimization of operations, the plan aims to generate cost efficiencies, which can be reinvested in various strategic initiatives. — Brand Integration: The Vermont Plan of Merger orchestrates a seamless blending of various brand identities, ensuring a consistent and compelling brand experience for customers. 3. Types of Vermont Plan of Merger: a) Horizontal Merger: This type of merger involves the combination of two or more companies operating in the same industry and offering similar products or services. The merger of Food Lion and Hanna ford Brothers corresponds to a horizontal merger, creating a larger enterprise in the grocery retail sector. b) Subsidiary Merger: FL Acquisition Sub, Inc. acts as a subsidiary in the merger, acquiring the shares and assets of Food Lion, Inc., and Hanna ford Brothers Company. This subsidiary merger allows the acquiring entity to incorporate the operations, resources, and market presence of the acquired companies seamlessly. c) Financial Merger: The Vermont Plan of Merger may also involve a financial merger, wherein the merger decision is primarily driven by financial considerations, such as cost-effectiveness, profitability, and financial stability. This type of merger ensures a prudent allocation of resources and a maximization of shareholder value. 4. Regulatory Review and Approval: The Vermont Plan of Merger must comply with relevant federal and state regulatory requirements, including antitrust regulations. This comprehensive review process ensures fair competition and protects the interests of consumers. The merger parties need to obtain necessary approvals and adhere to any mandated conditions to complete the merger successfully. Conclusion: The Vermont Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc., represents a strategic move to establish a robust entity with improved market competitiveness. By capitalizing on synergies, enhancing customer experience, and seeking cost efficiencies, this merger aims to redefine the grocery retail landscape. Understanding the different types of mergers and appreciating the regulatory considerations adds clarity to this transformative agreement between these industry leaders.

Vermont Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

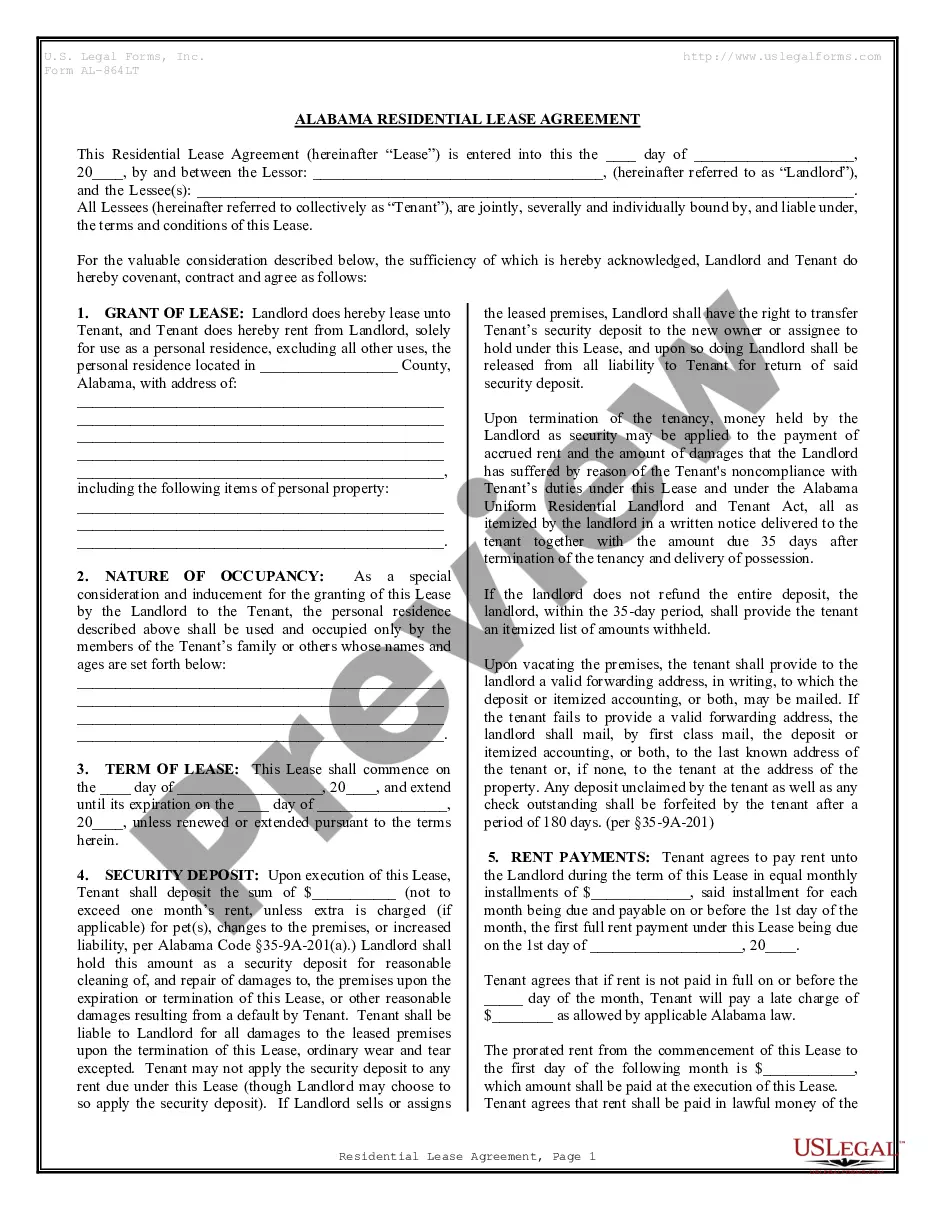

How to fill out Vermont Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

Discovering the right legitimate papers design can be quite a battle. Obviously, there are plenty of templates accessible on the Internet, but how can you discover the legitimate develop you need? Take advantage of the US Legal Forms web site. The service provides 1000s of templates, such as the Vermont Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., which can be used for enterprise and private needs. Every one of the varieties are checked by experts and fulfill state and federal needs.

Should you be already signed up, log in to your account and then click the Download key to obtain the Vermont Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Utilize your account to appear throughout the legitimate varieties you possess acquired previously. Go to the My Forms tab of your respective account and acquire yet another copy of your papers you need.

Should you be a whole new consumer of US Legal Forms, allow me to share simple directions for you to stick to:

- Initial, make sure you have chosen the right develop for your personal city/region. You can check out the shape using the Review key and read the shape explanation to make sure this is basically the right one for you.

- In case the develop fails to fulfill your needs, utilize the Seach area to get the correct develop.

- Once you are sure that the shape is acceptable, click on the Buy now key to obtain the develop.

- Opt for the prices strategy you would like and enter in the required information and facts. Design your account and buy the order utilizing your PayPal account or Visa or Mastercard.

- Choose the document formatting and acquire the legitimate papers design to your device.

- Total, edit and print and indication the acquired Vermont Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

US Legal Forms may be the largest collection of legitimate varieties for which you can discover numerous papers templates. Take advantage of the service to acquire appropriately-produced documents that stick to condition needs.

Form popularity

FAQ

Food Lion's parent company is Ahold Delhaize, the same owners since 1974. Delhaize merged with Ahold in 2015 and holds a wide range of retail stores in 10 different countries. In the United States, they also own the popular online grocery service FreshDirect, as well as my beloved hometown grocery store Giant.

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

The Food Town chain was acquired by the Belgium-based Delhaize Group grocery company in 1974. The Food Lion name was adopted in 1983; as Food Town expanded into Virginia, the chain encountered several stores called Foodtown in the Richmond area.

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed. Hannaford Brothers Company - Wikipedia wikipedia.org ? wiki ? Hannaford_Brothers_C... wikipedia.org ? wiki ? Hannaford_Brothers_C...