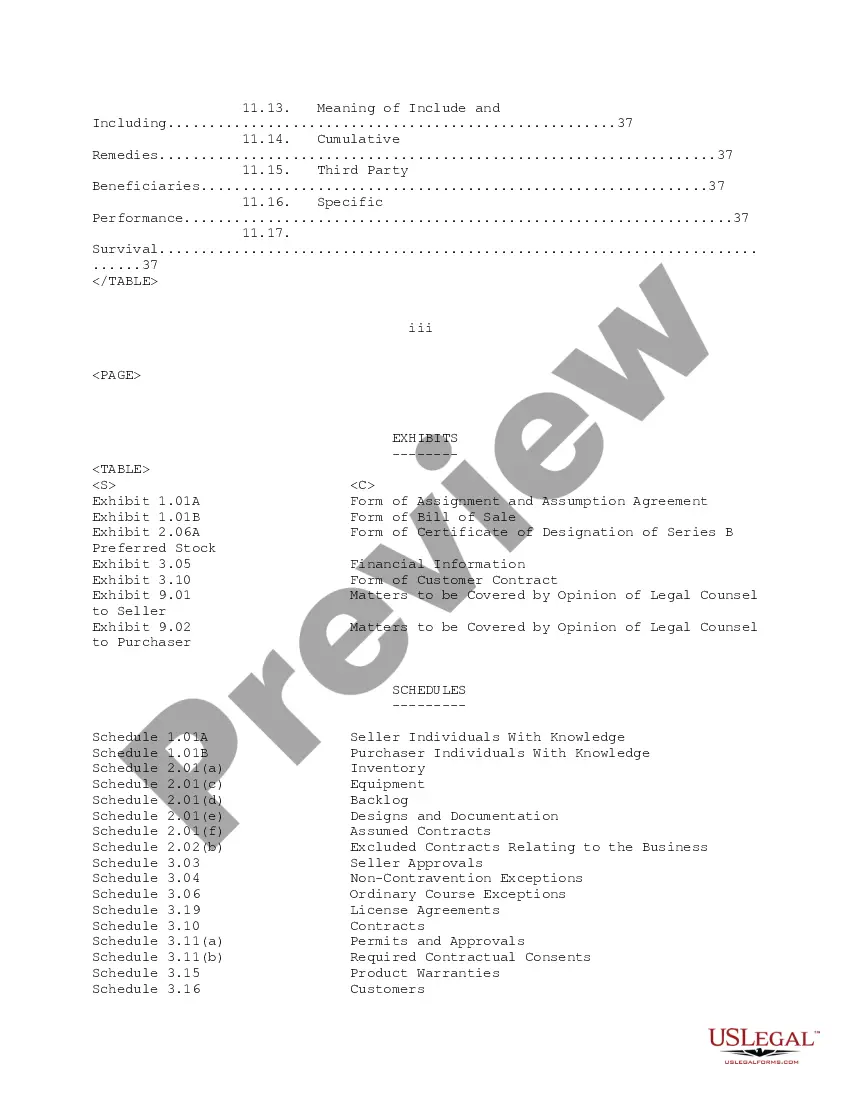

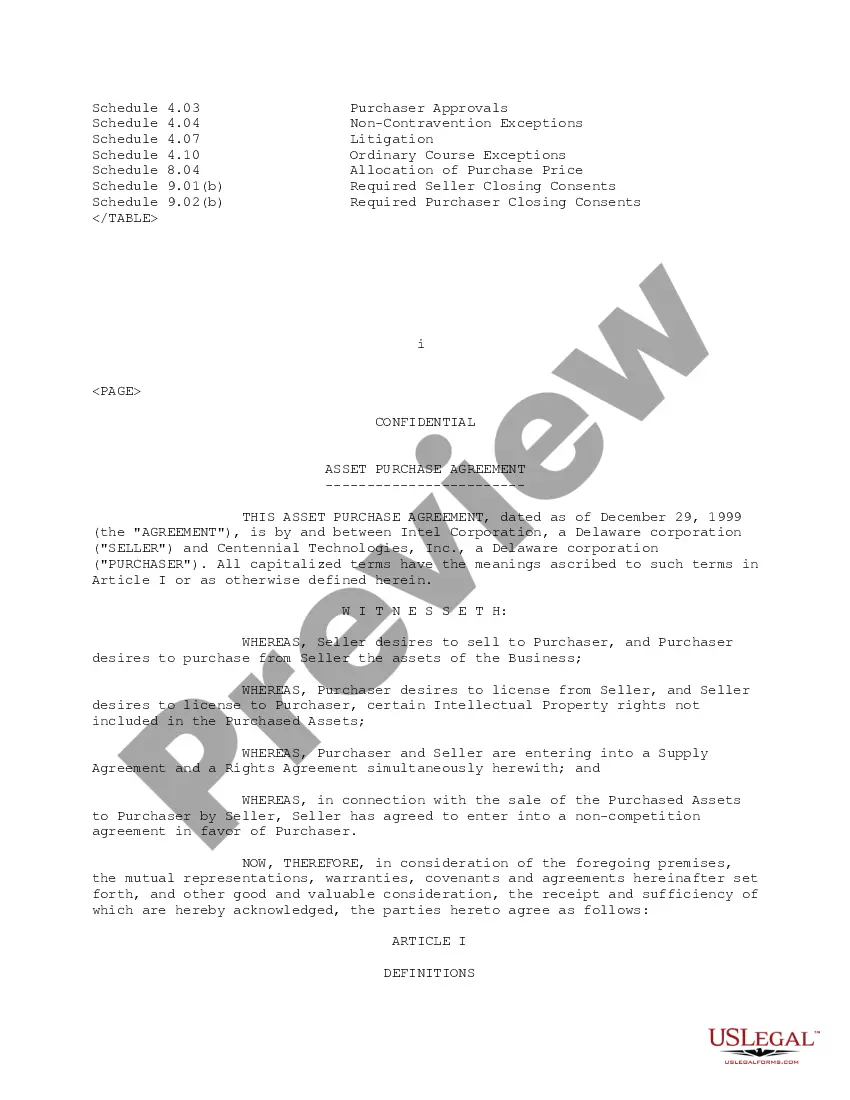

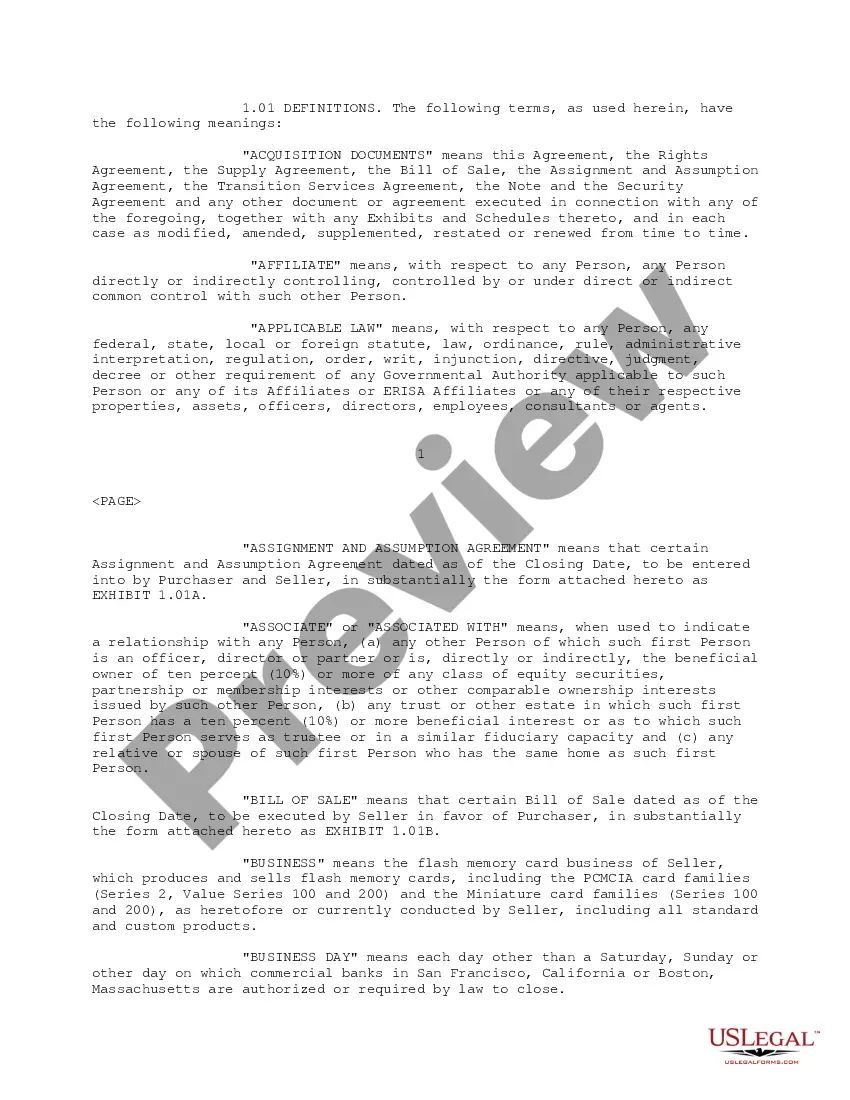

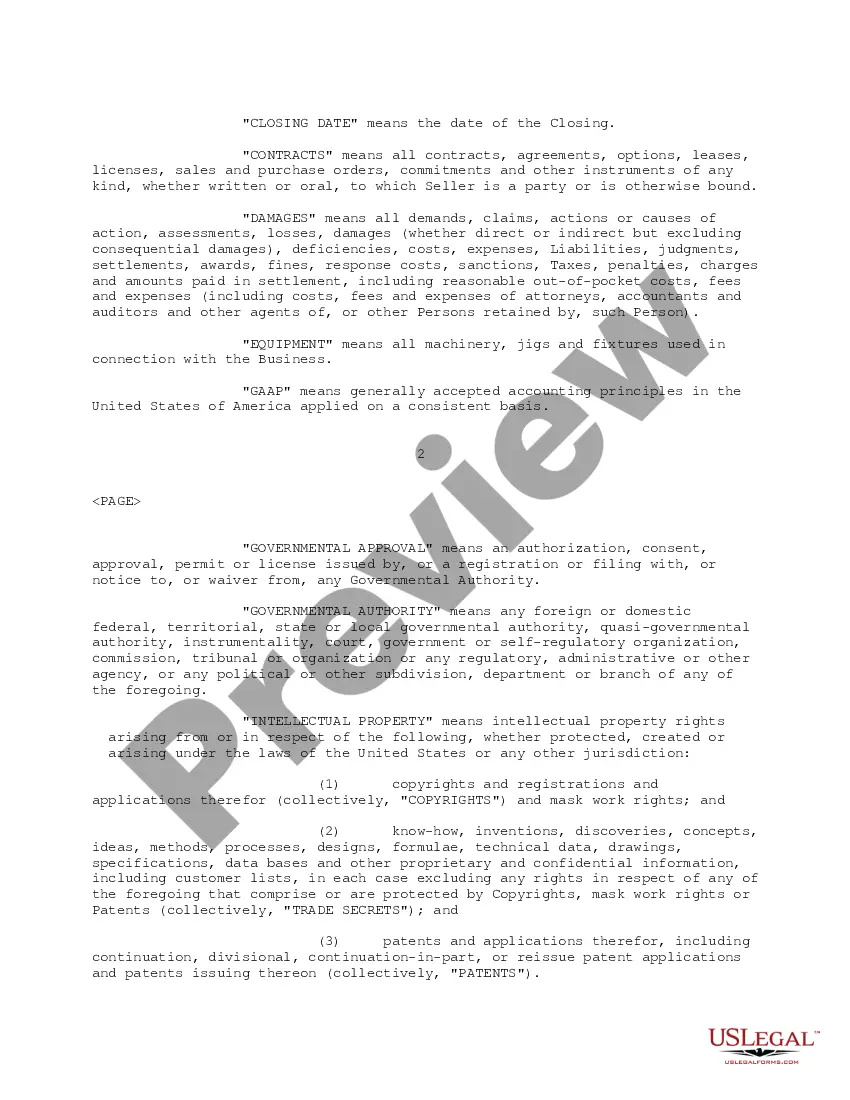

A Vermont Sample Asset Purchase Agreement is a legally binding document that outlines the terms and conditions under which Centennial Technologies, Inc. will sell certain assets to Intel Corporation. This agreement is crucial in facilitating the transfer of assets from one company to another and ensures that both parties are protected. The asset purchase agreement will typically include the following sections: 1. Introduction: This section contains the date of the agreement and identifies the parties involved, which in this case are Centennial Technologies, Inc. and Intel Corporation. It also provides background information about the intent of the agreement. 2. Definitions: Here, the document defines specific terms used throughout the agreement, ensuring clarity and consistency in language. 3. Asset Sale: This section outlines the assets being sold by Centennial Technologies, Inc. to Intel Corporation. It will include a detailed description of each asset, such as intellectual property rights, patents, trademarks, equipment, inventory, contracts, and any other tangible or intangible assets involved in the purchase. 4. Purchase Price and Payment Terms: This section specifies the purchase price Intel Corporation will pay to acquire the assets. It also outlines the payment terms and any additional provisions for deferred payments, contingency payments, or adjustments based on performance. 5. Representations and Warranties: Both parties will make representations and warranties concerning their authority, the assets being sold, and any liabilities or encumbrances associated with those assets. This section provides assurances to Intel Corporation that Centennial Technologies, Inc. has the legal right and authority to sell the assets. 6. Covenants: This section sets forth the obligations and undertakings of each party during and after the asset sale, defining the rights and responsibilities of both Centennial Technologies, Inc. and Intel Corporation. 7. Conditions Precedent: These are the conditions that must be fulfilled before the agreement becomes effective. It may include obtaining necessary approvals, consents, or waivers from third parties or regulatory authorities. 8. Indemnification: This section details the indemnification obligations of each party in case of any claims, losses, damages, or liabilities arising out of the sale of assets. 9. Governing Law and Dispute Resolution: The agreement will specify the governing law, which in this case would likely be Vermont law. It will also outline the dispute resolution mechanism, such as mediation, arbitration, or litigation, should any conflicts arise. Different variations of the Vermont Sample Asset Purchase Agreement may exist, tailored to specific industries or asset types. For example, there could be a version specific to technology companies, manufacturing companies, or real estate transactions. The core structure and provisions will likely remain the same, with adjustments made to address industry-specific nuances and considerations.

Vermont Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Vermont Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

US Legal Forms - one of the most significant libraries of lawful forms in America - gives a wide array of lawful record web templates you are able to acquire or print. While using site, you will get thousands of forms for organization and personal purposes, sorted by groups, states, or keywords and phrases.You can find the latest types of forms like the Vermont Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample in seconds.

If you already have a monthly subscription, log in and acquire Vermont Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample from the US Legal Forms collection. The Down load switch can look on every kind you look at. You get access to all in the past downloaded forms in the My Forms tab of your own accounts.

If you would like use US Legal Forms for the first time, here are easy directions to help you get started out:

- Make sure you have selected the right kind to your town/state. Click on the Preview switch to examine the form`s information. See the kind information to ensure that you have chosen the appropriate kind.

- If the kind doesn`t suit your specifications, use the Lookup field on top of the screen to find the one who does.

- If you are content with the form, verify your decision by clicking on the Acquire now switch. Then, pick the pricing plan you like and give your accreditations to sign up for an accounts.

- Process the deal. Use your Visa or Mastercard or PayPal accounts to perform the deal.

- Pick the file format and acquire the form on the device.

- Make changes. Fill up, edit and print and indication the downloaded Vermont Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

Each and every template you put into your bank account does not have an expiry day and is also yours for a long time. So, if you want to acquire or print another copy, just proceed to the My Forms segment and then click on the kind you will need.

Obtain access to the Vermont Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample with US Legal Forms, probably the most comprehensive collection of lawful record web templates. Use thousands of skilled and condition-specific web templates that fulfill your organization or personal needs and specifications.