The Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., and several banks and financial institutions is a legal document that outlines the terms and conditions of a credit facility provided by the lenders to SBA Communications and its subsidiaries. This credit agreement serves as a contract between the parties involved and defines the borrowing capacity, interest rates, repayment terms, and other key provisions. It provides SBA Communications and SBA Telecommunications with a source of financing for their operations, expansion, and general business needs. Some important elements covered in the Vermont Second Amended and Restated Credit Agreement may include: 1. Borrowing Capacity: The agreement defines the maximum amount of money that SBA Communications and SBA Telecommunications can borrow from the lenders. This limit is based on various factors such as the financial health of the companies, collateral provided, and overall creditworthiness. 2. Interest Rates: The agreement specifies the interest rate at which the borrowed funds will accrue. It may be a fixed rate or variable rate, depending on the terms negotiated between the borrowers and lenders. 3. Repayment Terms: The agreement outlines the repayment schedule, including the frequency of payments, the duration of the loan, and any special payment requirements (e.g., balloon payments or amortization schedules). 4. Security and Collateral: Often, lenders require collateral to secure the loan. The agreement identifies the assets or property being pledged as security and the rights of the lenders in case of default. 5. Financial Covenants: The agreement may impose certain financial covenants that SBA Communications and SBA Telecommunications must meet throughout the duration of the loan. These covenants could include maintaining a minimum level of profitability, liquidity, or leverage ratios, or any other financial benchmarks agreed upon. 6. Events of Default: The agreement details the circumstances that could trigger a default, such as missed payments, violation of covenants, or insolvency. It also outlines the rights and remedies available to the lenders in case of default, such as accelerating the loan or seizing collateral. Note: While different versions or amendments of the Vermont Second Amended and Restated Credit Agreement may exist, the specific names and variations would depend on the individual agreements negotiated between SBA Communications, SBA Telecommunications, and the participating banks and financial institutions.

Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

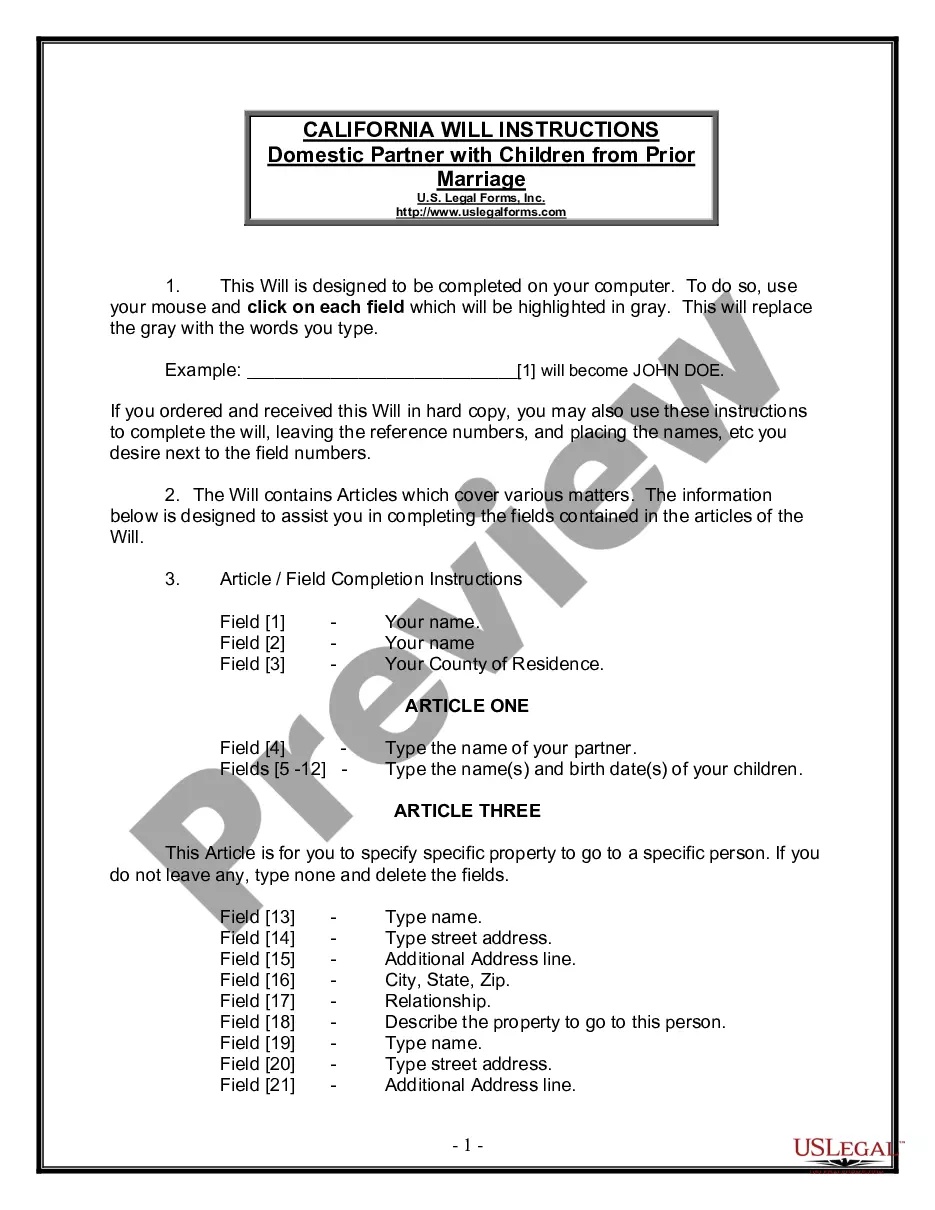

How to fill out Vermont Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

If you have to total, download, or produce lawful file web templates, use US Legal Forms, the largest assortment of lawful kinds, which can be found on the web. Take advantage of the site`s easy and convenient look for to get the files you need. Numerous web templates for enterprise and individual uses are sorted by categories and suggests, or keywords. Use US Legal Forms to get the Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions within a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in in your account and then click the Down load key to have the Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. You can also entry kinds you previously downloaded in the My Forms tab of your account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the form to the appropriate city/nation.

- Step 2. Use the Preview solution to check out the form`s information. Don`t forget to read through the description.

- Step 3. When you are not happy together with the develop, utilize the Lookup industry on top of the display to get other versions from the lawful develop format.

- Step 4. When you have found the form you need, go through the Buy now key. Select the costs program you prefer and include your references to sign up on an account.

- Step 5. Method the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the formatting from the lawful develop and download it on your own gadget.

- Step 7. Full, modify and produce or sign the Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Each and every lawful file format you buy is your own forever. You may have acces to each and every develop you downloaded with your acccount. Click the My Forms portion and decide on a develop to produce or download again.

Compete and download, and produce the Vermont Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions with US Legal Forms. There are many skilled and state-certain kinds you can utilize for your personal enterprise or individual requires.