Vermont Special Delivery — Special Offer Agreement is a contractual agreement between the sender and Vermont Special Delivery, a prominent delivery service provider operating in the state of Vermont. This agreement allows customers to take advantage of special promotional offers provided by the company. Under the Vermont Special Delivery — Special Offer Agreement, customers can avail exclusive discounts, preferential rates, or additional benefits when utilizing the services of Vermont Special Delivery. These specialized offers are tailored to cater to a range of customer requirements, ensuring a cost-effective and efficient delivery solution. This agreement enables customers to choose from various types of special offers, each designed to suit different delivery needs. Some common types of Vermont Special Delivery — Special Offer Agreements include: 1. Volume-Based Offers: Vermont Special Delivery provides discounted rates for customers who frequently send a large volume of packages. This type of agreement is ideal for businesses or individuals with regular shipping requirements, offering substantial cost savings. 2. Seasonal or Holiday Offers: This category of special offer agreement is specific to certain times of the year, such as during festive seasons or holidays. Vermont Special Delivery may introduce promotional deals during these periods to encourage customers to choose their services. 3. Contractual Offers: For customers who require ongoing delivery services, Vermont Special Delivery offers contractual agreements. These agreements often feature special rates, customized plans, and dedicated customer support. 4. First-Time User Offers: This type of agreement targets new customers who haven't previously utilized Vermont Special Delivery's services. It may provide a one-time discounted rate or additional benefits to encourage first-time users to experience the company's reliable delivery services. 5. Referral Offers: Vermont Special Delivery rewards customers who refer their friends, family, or business associates to use their services. This type of agreement offers incentives, such as discounts or credits, to both the referrer and the referred customers. The Vermont Special Delivery — Special Offer Agreement is designed to benefit customers by providing them with exceptional delivery solutions at competitive rates. It allows customers to choose from a range of promotional offers based on their specific needs, ensuring a seamless and cost-effective shipping experience.

Vermont Special Delivery - Special Offer Agreement

Description

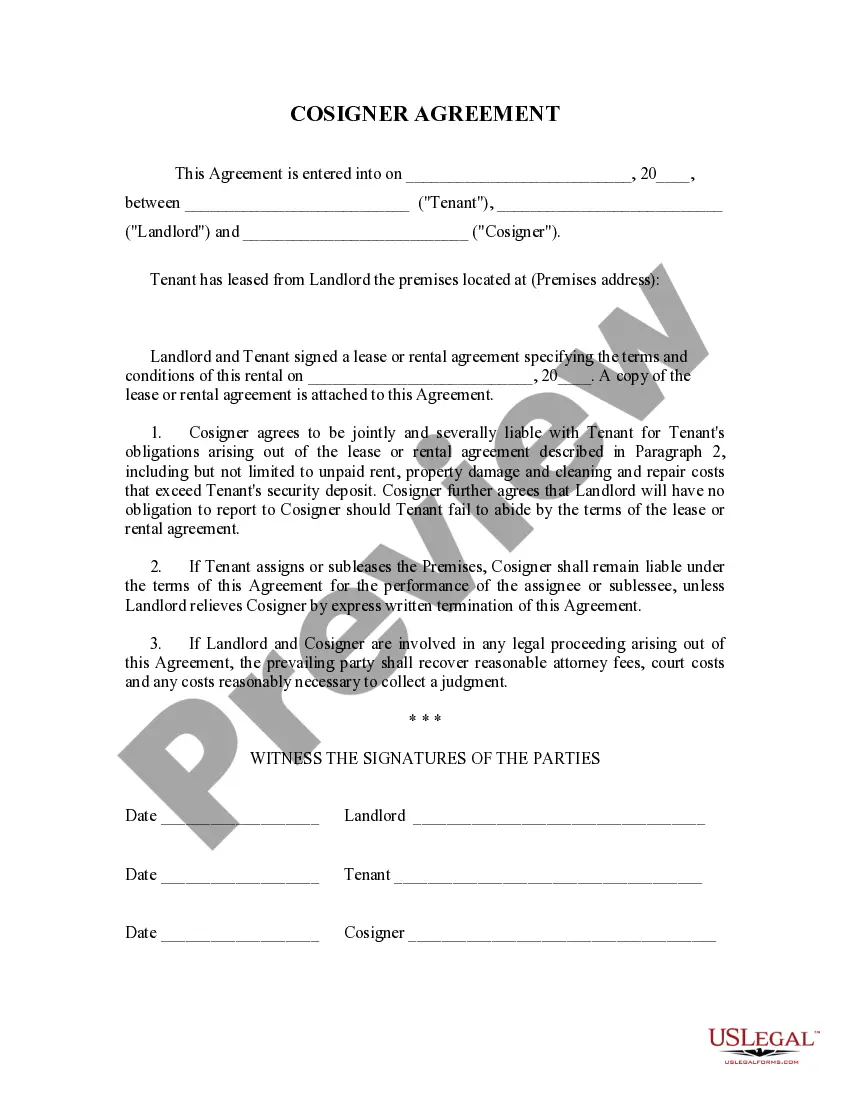

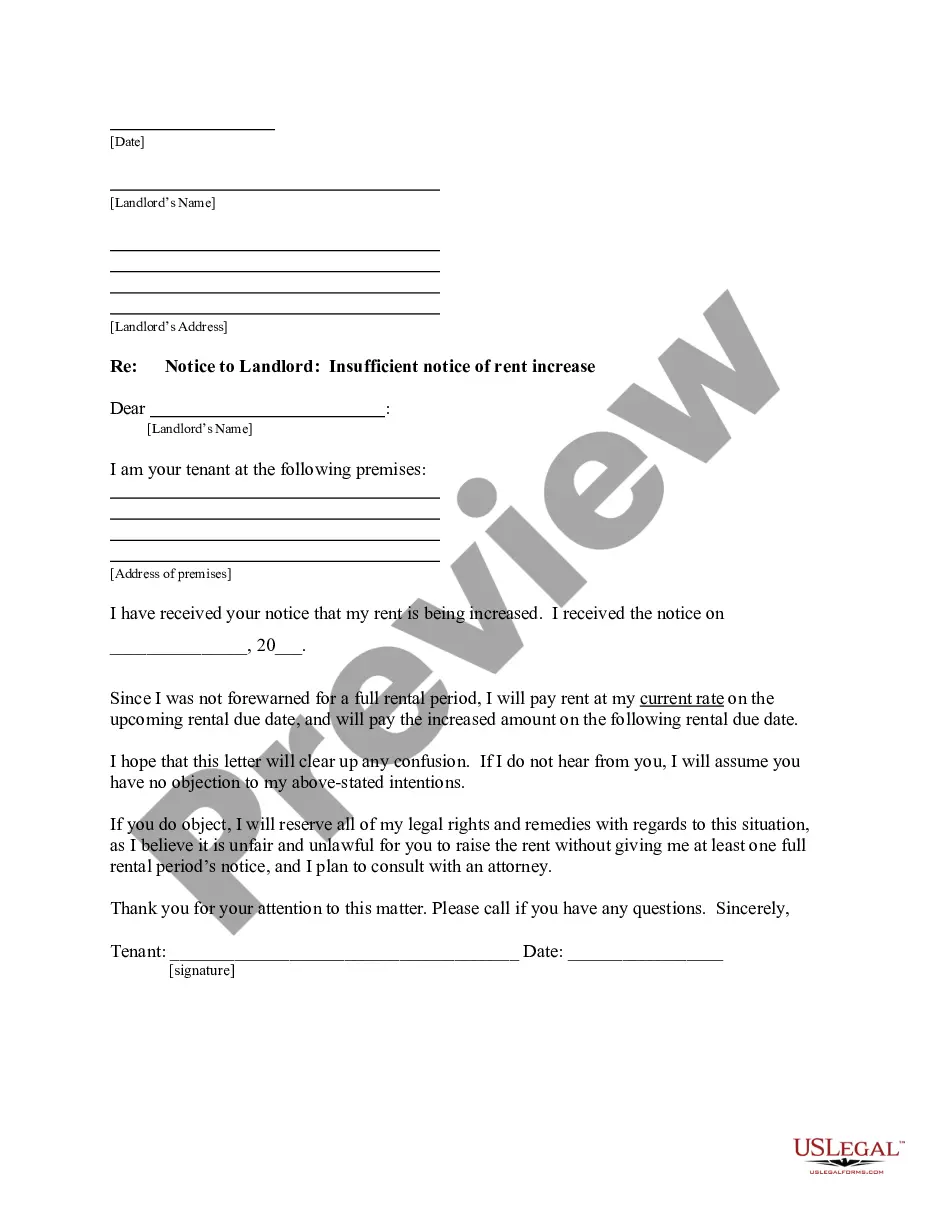

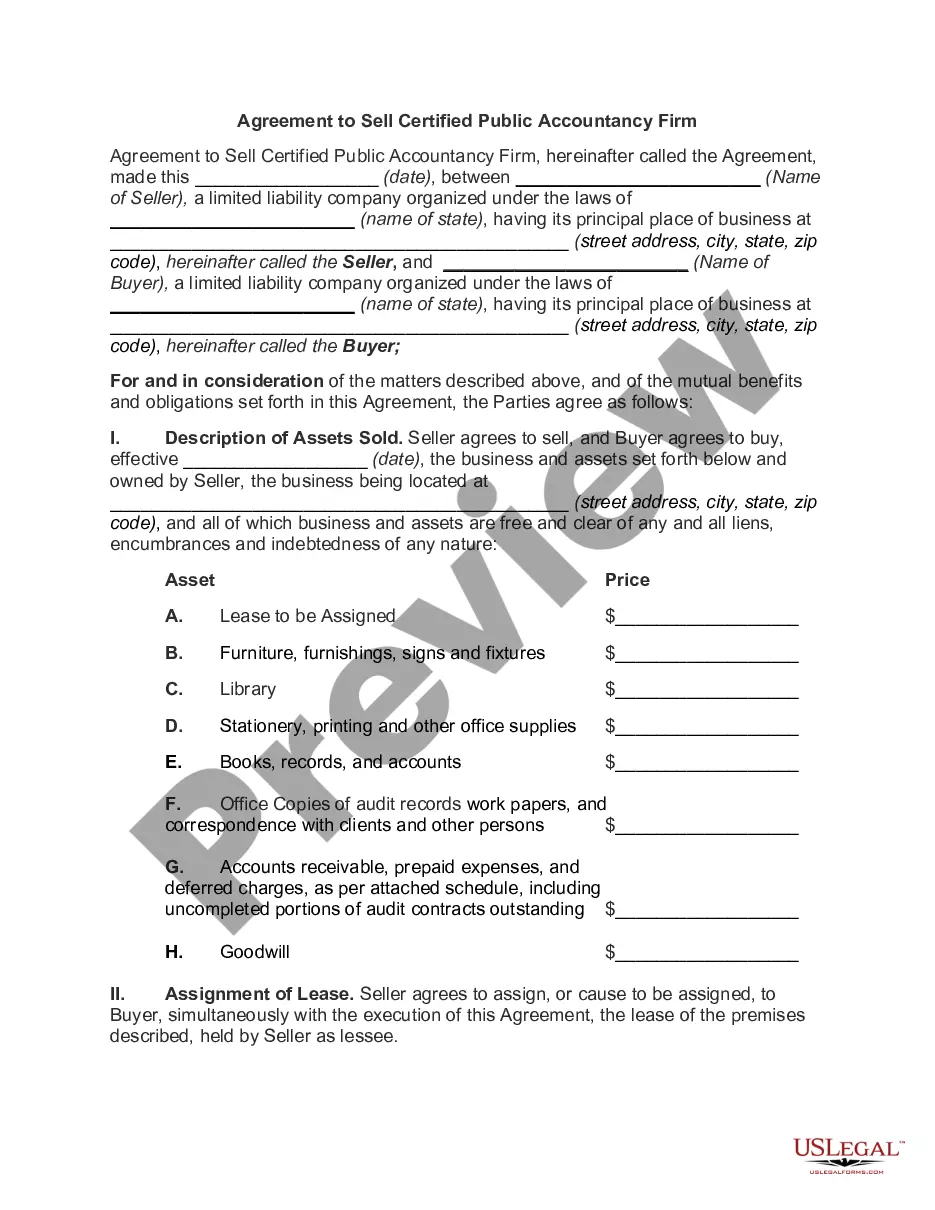

How to fill out Vermont Special Delivery - Special Offer Agreement?

Are you presently in the position where you need paperwork for either company or specific uses virtually every time? There are plenty of legal file web templates accessible on the Internet, but getting versions you can rely isn`t simple. US Legal Forms offers a large number of form web templates, just like the Vermont Special Delivery - Special Offer Agreement, that are published to satisfy state and federal demands.

In case you are already knowledgeable about US Legal Forms internet site and have a merchant account, simply log in. Next, you may acquire the Vermont Special Delivery - Special Offer Agreement web template.

Unless you provide an profile and would like to begin to use US Legal Forms, follow these steps:

- Find the form you need and ensure it is for that right city/state.

- Take advantage of the Preview key to analyze the form.

- Look at the outline to actually have selected the correct form.

- In case the form isn`t what you`re searching for, use the Research field to obtain the form that fits your needs and demands.

- Once you obtain the right form, click on Buy now.

- Opt for the prices plan you would like, complete the specified information to produce your bank account, and purchase the transaction utilizing your PayPal or bank card.

- Pick a convenient document format and acquire your duplicate.

Get each of the file web templates you may have purchased in the My Forms menus. You may get a additional duplicate of Vermont Special Delivery - Special Offer Agreement at any time, if required. Just click on the essential form to acquire or produce the file web template.

Use US Legal Forms, by far the most comprehensive assortment of legal types, to save lots of efforts and stay away from blunders. The service offers expertly created legal file web templates which can be used for a variety of uses. Create a merchant account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Vermont Sales and Use Tax is ?destination-based.? One of the following must happen for the purchased item to be subject to sales and use tax: The buyer takes possession of the item in Vermont. The buyer has the item delivered or shipped to Vermont.

Being tax-exempt means that some or all of a transaction, entity or person's income or business is free from federal, state or local tax. Tax-exempt organizations are typically charities or religious organizations recognized by the IRS. Internal Revenue Service. What Does It Mean to Be Tax Exempt? Definition & How Tax ... nerdwallet.com ? article ? taxes ? what-are-t... nerdwallet.com ? article ? taxes ? what-are-t...

Vermont sales tax on clothing Most clothing and footwear sales are exempt from Vermont sales and use tax. However, sales and use tax applies to clothing accessories and equipment. What states require you to collect sales tax on clothing? - Avalara avalara.com ? blog ? north-america ? 2020/02 avalara.com ? blog ? north-america ? 2020/02

Services are generally tax-exempt in Vermont, though there are exceptions: Services to tangible personal property. If labor is expended in producing a new or different item, a tax applies to the labor charge. Does Vermont Charge Sales Tax on Services? - TaxJar taxjar.com ? blog ? 2023-02-does-vermont-... taxjar.com ? blog ? 2023-02-does-vermont-...

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services. What Is a California Sales Tax Exemption? [Definition Examples] sambrotman.com ? california-sales-tax-exem... sambrotman.com ? california-sales-tax-exem...

Vermont sales tax details The Vermont (VT) state sales tax rate is currently 6%.

Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

Is sales tax due on delivery and freight charges when I purchase an item and have it delivered? If the item is taxable, then tax is also due on delivery and freight charges for delivery of the item. Conversely, if the item is tax-exempt, delivery charges are also exempt.