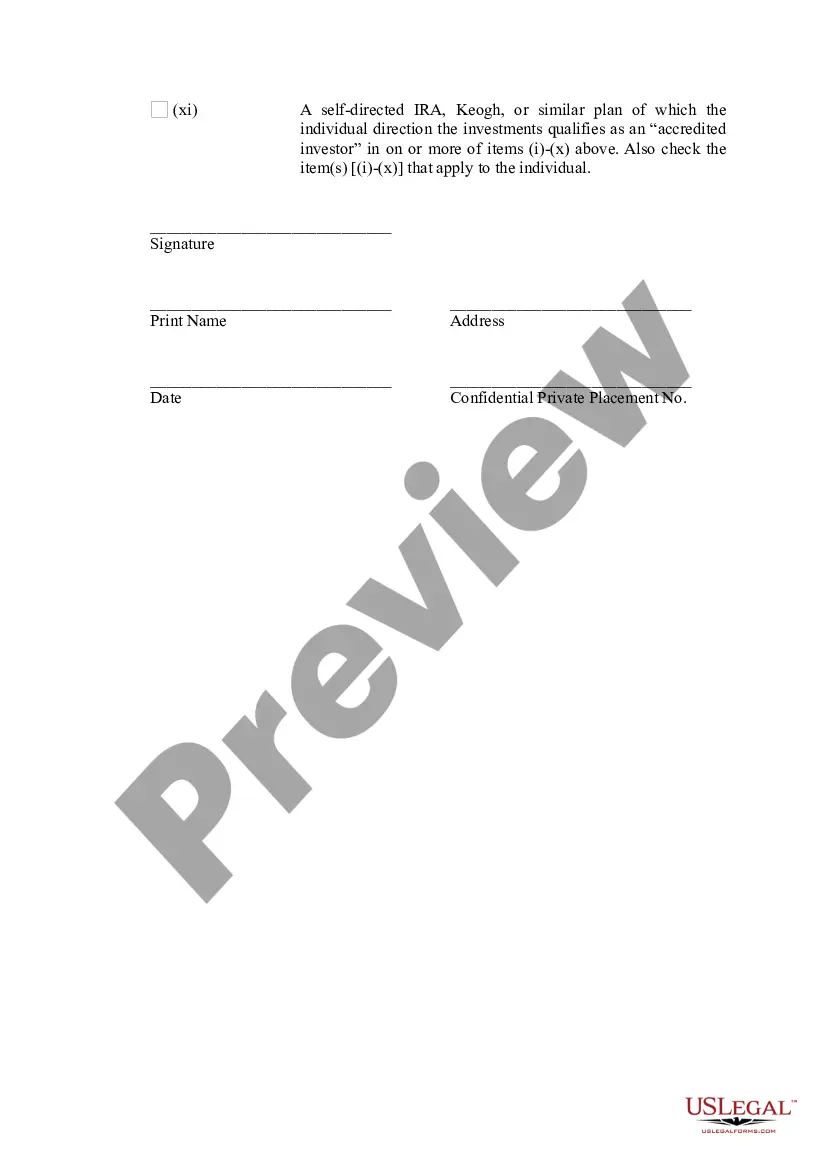

The Vermont Checklist — Certificate of Status as an Accredited Investor serves as a crucial document to verify an individual's accreditation status while making certain investments. The certificate is utilized to prove that the investor meets the requirements set by the Securities and Exchange Commission (SEC) to be classified as an accredited investor. Accredited investors benefit from certain privileges and opportunities that are not available to non-accredited individuals. To acquire this certificate, there are specific criteria that must be met, and a checklist can efficiently guide individuals through the process. The checklist ensures that all necessary information and documents are provided to substantiate an investor's accredited status. The contents of a Vermont Checklist — Certificate of Status as an Accredited Investor typically include: 1. Personal Information: This section necessitates providing personal details, such as legal name, date of birth, social security number, contact information, and the investor's current state of residency. 2. Verification: The checklist outlines the need for appropriate documentation to verify accreditation status. This may include tax returns, financial statements, bank statements, employment history, or any other relevant record that confirms an individual's financial well-being or knowledge and experience in the field of investing. 3. Accreditation Criteria: The checklist outlines the various criteria that can qualify an individual as an accredited investor. These might incorporate net worth, income level, professional qualifications, or affiliation with specific investment institutions. 4. Eligibility Confirmation: In this section, the investor asserts their compliance with the accreditation criteria outlined by the SEC and verifies that they meet all the necessary requirements. Different types of Vermont Checklists — Certificate of Status as an Accredited Investor can be categorized based on purpose or specific investor types. Some of these might include: 1. Individual Accredited Investor Checklist: This type of checklist is intended for an individual investor looking to obtain accreditation status, whether based on net worth or income criteria. 2. Institutional Accredited Investor Checklist: Designed for institutional investors, this checklist focuses on verifying the organization's qualifications as an accredited investor. It usually requires providing appropriate legal and financial documents. 3. Foreign Accredited Investor Checklist: For investors residing outside the United States, this checklist may have additional requirements to validate their accreditation status based on the regulations applicable in their home country. In conclusion, the Vermont Checklist — Certificate of Status as an Accredited Investor is a vital tool to establish an investor's accredited status, opening doors to exclusive investment opportunities. Different variations of this checklist cater to individual, institutional, and foreign investors, ensuring compliance with SEC regulations and providing the necessary documentation to support accreditation.

Vermont Checklist - Certificate of Status as an Accredited Investor

Description

How to fill out Vermont Checklist - Certificate Of Status As An Accredited Investor?

Are you presently within a position where you need to have papers for sometimes organization or specific uses virtually every time? There are a variety of authorized file themes accessible on the Internet, but finding ones you can rely isn`t easy. US Legal Forms provides a huge number of form themes, such as the Vermont Checklist - Certificate of Status as an Accredited Investor, that are written in order to meet federal and state needs.

When you are currently familiar with US Legal Forms site and also have your account, just log in. After that, you can acquire the Vermont Checklist - Certificate of Status as an Accredited Investor web template.

Unless you provide an bank account and want to start using US Legal Forms, abide by these steps:

- Obtain the form you require and ensure it is for your appropriate city/state.

- Take advantage of the Preview option to examine the shape.

- Read the explanation to actually have selected the proper form.

- When the form isn`t what you are seeking, make use of the Lookup industry to obtain the form that suits you and needs.

- If you get the appropriate form, click Get now.

- Pick the prices prepare you would like, fill out the specified information and facts to create your bank account, and pay money for an order using your PayPal or charge card.

- Choose a hassle-free file structure and acquire your backup.

Find each of the file themes you possess bought in the My Forms menu. You can aquire a additional backup of Vermont Checklist - Certificate of Status as an Accredited Investor whenever, if necessary. Just click on the required form to acquire or produce the file web template.

Use US Legal Forms, probably the most considerable assortment of authorized kinds, to save efforts and prevent faults. The service provides appropriately created authorized file themes which can be used for a selection of uses. Make your account on US Legal Forms and commence producing your life easier.