Vermont Accredited Investor Status Certificate

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate?

You can spend hrs online searching for the legitimate papers web template which fits the state and federal specifications you will need. US Legal Forms provides a huge number of legitimate kinds that happen to be reviewed by professionals. It is simple to acquire or produce the Vermont Accredited Investor Status Certificate from your services.

If you already have a US Legal Forms accounts, you can log in and click on the Download key. Afterward, you can full, edit, produce, or indicator the Vermont Accredited Investor Status Certificate. Each legitimate papers web template you buy is yours for a long time. To obtain an additional backup associated with a bought kind, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms site initially, keep to the simple instructions listed below:

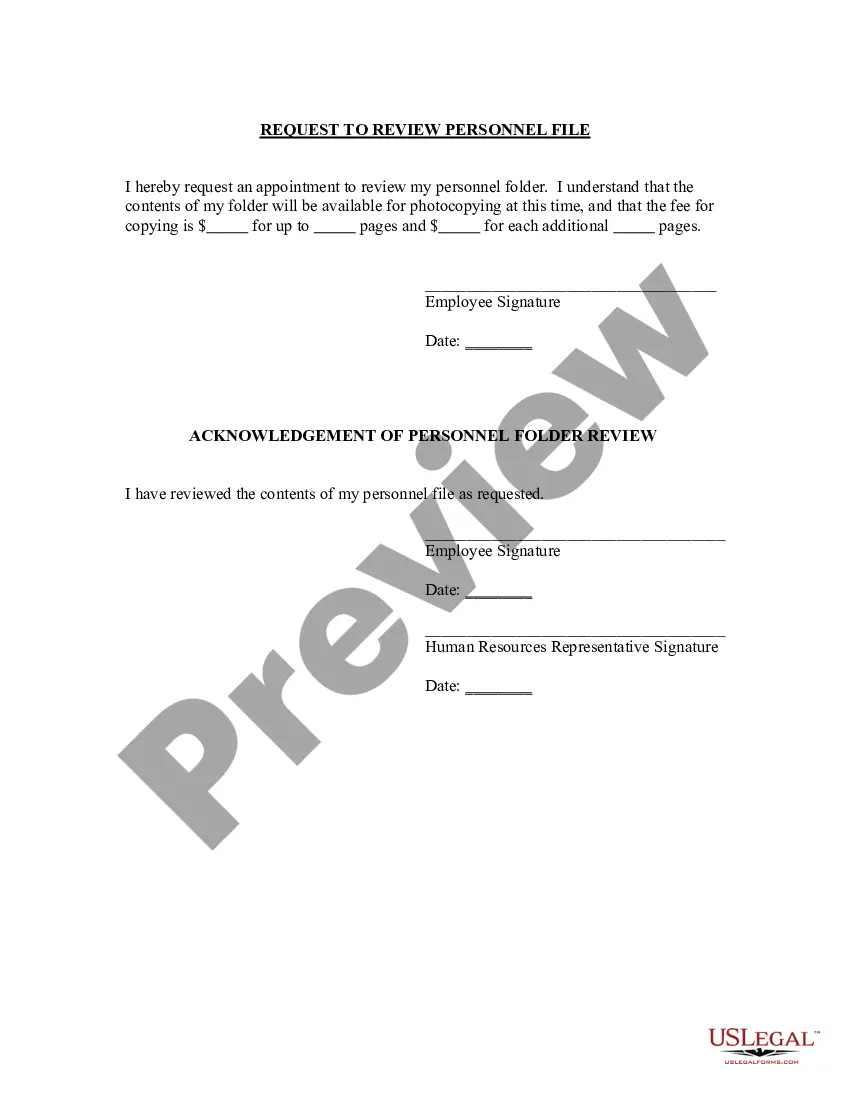

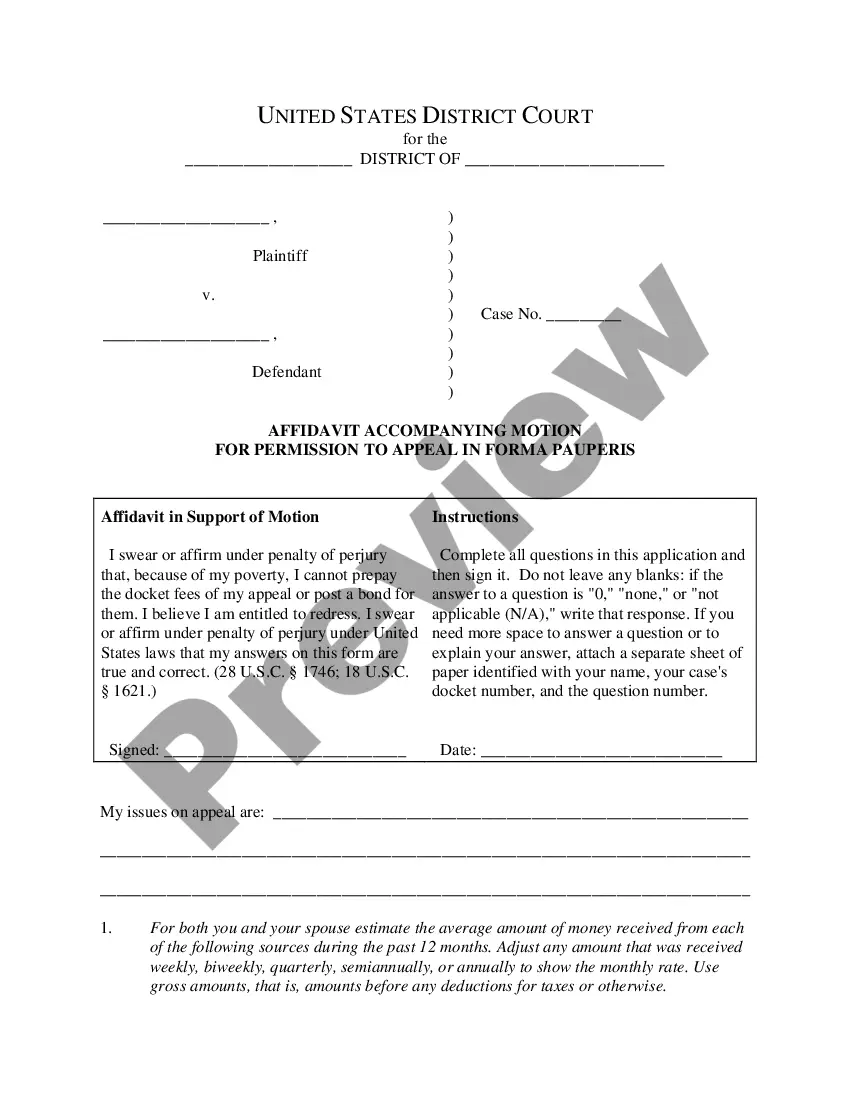

- First, make certain you have selected the best papers web template for that state/town of your liking. Browse the kind outline to ensure you have chosen the right kind. If accessible, utilize the Review key to appear from the papers web template as well.

- If you would like discover an additional variation of the kind, utilize the Lookup industry to discover the web template that suits you and specifications.

- When you have located the web template you need, click Acquire now to continue.

- Pick the pricing prepare you need, key in your references, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal accounts to fund the legitimate kind.

- Pick the formatting of the papers and acquire it to the device.

- Make changes to the papers if required. You can full, edit and indicator and produce Vermont Accredited Investor Status Certificate.

Download and produce a huge number of papers web templates making use of the US Legal Forms web site, which provides the most important variety of legitimate kinds. Use professional and express-particular web templates to handle your organization or individual demands.

Form popularity

FAQ

You can provide a letter from your own licensed CPA, licensed attorney, or registered wealth advisor attesting to your status as an accredited investor. The uploaded letter must: Be signed and dated by a qualified third-party; AND.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant. Other paths require cumbersome documentation that can deter would-be investors from profitable investments, such as InvestinKona.com.

dealer registered with the Securities and Exchange Commission. An investment advisor registered with the Securities and Exchange Commission. A licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law.

A statement of net worth will include balance sheets, income statements and cash flow statements. Balance sheets : Balance sheets provide detailed accounting of a company or individual's assets, liabilities and shareholders' equity.

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.