Title: Vermont Documentation Required to Confirm Accredited Investor Status Introduction: Understanding the requirements and documentation needed to confirm accredited investor status in Vermont is crucial for individuals or entities seeking investment opportunities within the state. This article will provide a detailed description of the various types of documentation necessary to establish accredited investor status, highlighting relevant keywords. 1. Accredited Investor Defined: In Vermont, an accredited investor is an individual or entity meeting specific financial criteria, entitling them to participate in certain investment opportunities that are restricted to non-accredited investors. 2. Personal Financial Statements: One of the primary documents required to confirm accredited investor status in Vermont is a personal financial statement. This statement provides a comprehensive snapshot of an individual's or entity's financial standing. It typically includes information on assets, liabilities, net worth, income, and expenses. The financial statement serves as evidence of the financial capacity necessary to meet the accredited investor criteria. 3. Income Verification: Proof of income is crucial to confirming accredited investor status. Relevant keywords associated with income verification documentation include tax returns, W-2 forms, 1099 forms, and pay stubs. These documents substantiate an investor's income level and its consistency, establishing eligibility for accredited investor status. 4. Net Worth Documentation: Net worth is another critical criterion in determining accredited investor status. To assess net worth, various documents are required, including bank statements, brokerage account statements, pension or retirement account statements, and property valuation reports. Keywords associated with net worth verification include balance sheet, statement of assets and liabilities, property appraisals, and investment valuations. 5. Professional Certifications and Designations: Certain professional certifications and designations may allow individuals to automatically qualify as accredited investors in Vermont. Examples include individuals holding a Series 7 or Series 65 license issued by the Financial Industry Regulatory Authority (FINRA). Keywords associated with professional certifications and designations include FINRA, Series 7 license, and Series 65 license. 6. Verification by Registered Broker-Dealer or Investment Adviser: An alternative method of establishing accredited investor status involves verification by a registered broker-dealer or investment adviser who reasonably verifies an individual's accredited investor status using specified methods. This option may involve providing additional documentation and participating in an accredited investor examination. Conclusion: Vermont requires various types of documentation to confirm accredited investor status. This includes personal financial statements, income verification documents, net worth documentation, professional certifications, and, in some cases, verification by a registered broker-dealer or investment adviser. Complying with these requirements allows individuals and entities to access restricted investment opportunities within the state of Vermont. Always consult with legal and financial advisers to ensure compliance with state regulations and rules.

Vermont Documentation Required to Confirm Accredited Investor Status

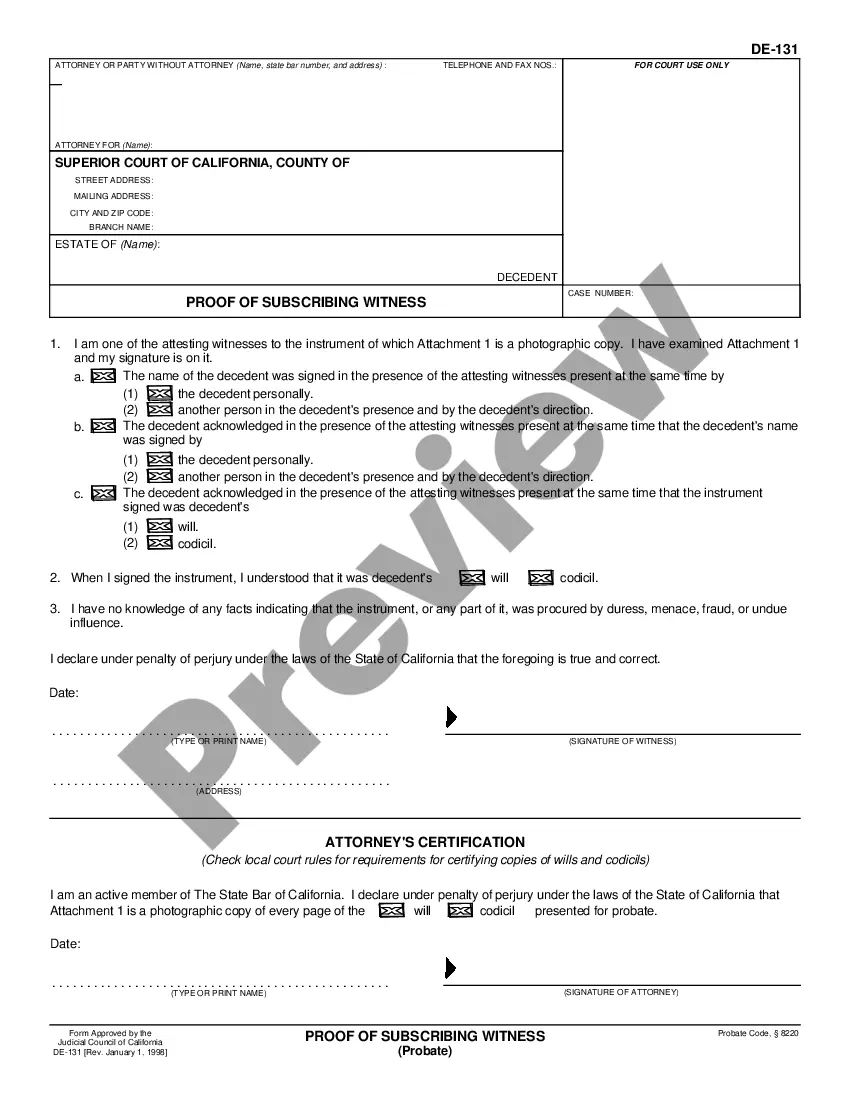

Description

How to fill out Vermont Documentation Required To Confirm Accredited Investor Status?

Are you in the situation where you need files for both organization or individual functions almost every day? There are tons of authorized document themes available on the Internet, but finding ones you can rely on isn`t easy. US Legal Forms provides thousands of develop themes, such as the Vermont Documentation Required to Confirm Accredited Investor Status, which are created to meet federal and state demands.

If you are currently informed about US Legal Forms website and have a free account, simply log in. Following that, you can acquire the Vermont Documentation Required to Confirm Accredited Investor Status design.

If you do not have an profile and want to begin using US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for the correct city/county.

- Use the Preview option to analyze the shape.

- Read the information to actually have selected the proper develop.

- When the develop isn`t what you are searching for, use the Look for area to obtain the develop that meets your needs and demands.

- Whenever you get the correct develop, click Acquire now.

- Pick the rates plan you want, fill in the desired details to produce your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a handy file structure and acquire your duplicate.

Discover all the document themes you might have purchased in the My Forms food list. You may get a extra duplicate of Vermont Documentation Required to Confirm Accredited Investor Status any time, if necessary. Just click on the essential develop to acquire or print out the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save lots of some time and stay away from errors. The support provides professionally made authorized document themes which you can use for an array of functions. Generate a free account on US Legal Forms and commence generating your lifestyle easier.