The Vermont Investors Rights Agreement is a legal contract that outlines the rights and protections of investors in the state of Vermont. It establishes a set of rules and regulations that govern the relationship between investors and the companies they invest in. This agreement ensures that investors have certain privileges and safeguards to protect their interests and promote transparency and accountability. One key aspect of the Vermont Investors Rights Agreement is the provision for information rights. It grants investors access to accurate and timely financial information, business updates, and reports from the company they have invested in. This helps investors make informed decisions about their investments and stay updated on the company's progress. Another important clause in the Vermont Investors Rights Agreement pertains to voting rights. This section outlines the investors' ability to vote on important matters, such as electing board members or approving major business decisions. These voting rights ensure that investors have a say in the company's operations and strategic direction. Additionally, the agreement may include anti-dilution provisions. These provisions protect investors from experiencing a decrease in their ownership percentage due to subsequent financing rounds or issuing new shares. By safeguarding the investors' ownership stake, these provisions ensure that the value of their investment remains intact. There may be different types of Vermont Investors Rights Agreements, depending on the stage of investment or type of investor involved. For instance, early-stage investors may have a separate agreement that offers additional rights and protections, such as preemptive rights. Preemptive rights enable investors to maintain their ownership percentage by allowing them to participate in future fundraising rounds before other investors. Furthermore, different types of investors, such as venture capitalists or angel investors, may have specific provisions tailored to their requirements and preferences. For example, venture capitalists may negotiate specific exit rights or liquidation preferences to protect their financial interests when the company is sold or undergoes an initial public offering (IPO). In conclusion, the Vermont Investors Rights Agreement is a comprehensive legal document that outlines the rights and protections of investors in Vermont. It ensures transparency, provides access to relevant information, grants voting rights, and safeguards investors against dilution. Depending on the stage of investment and types of investors involved, there may be variations or additional provisions to address specific needs.

Vermont Investors Rights Agreement

Description

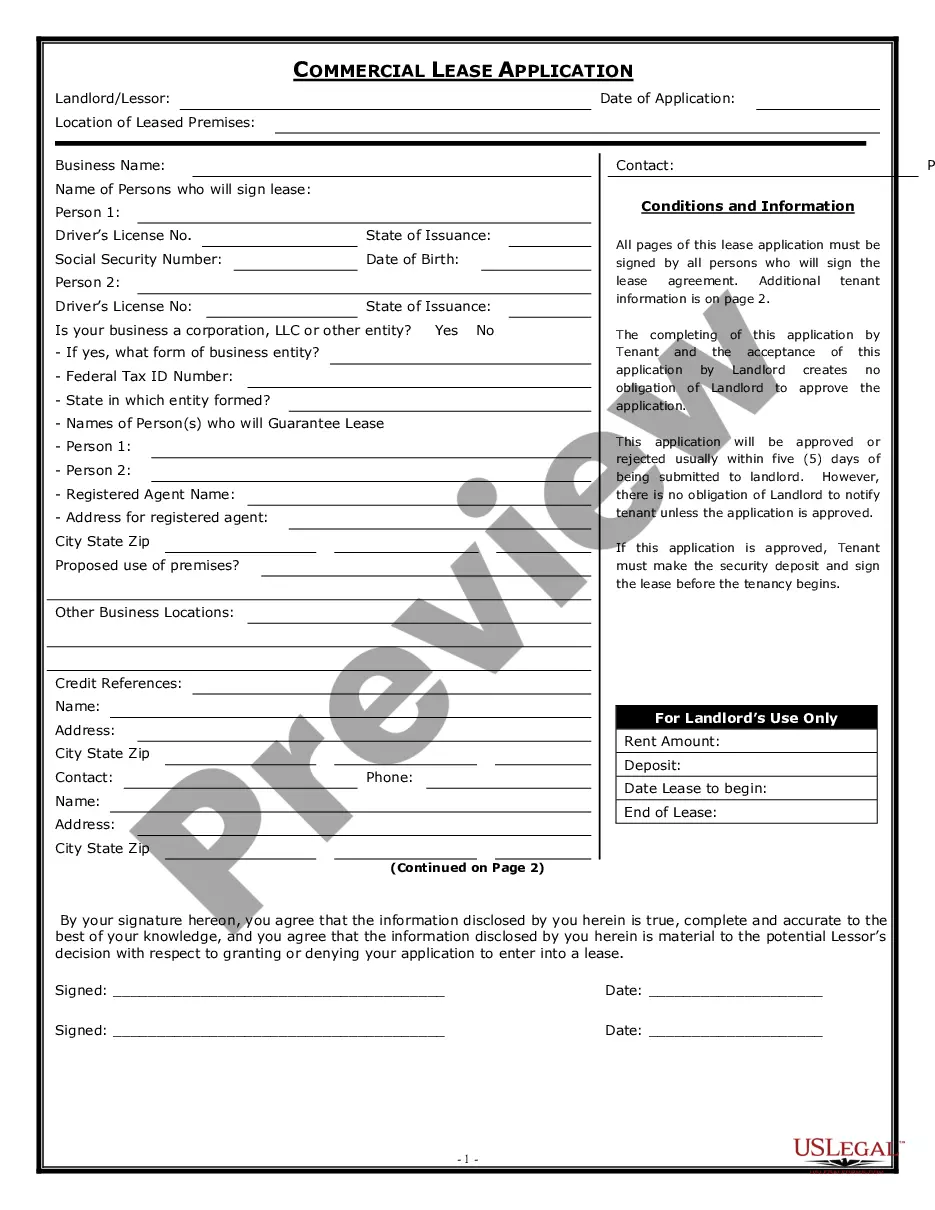

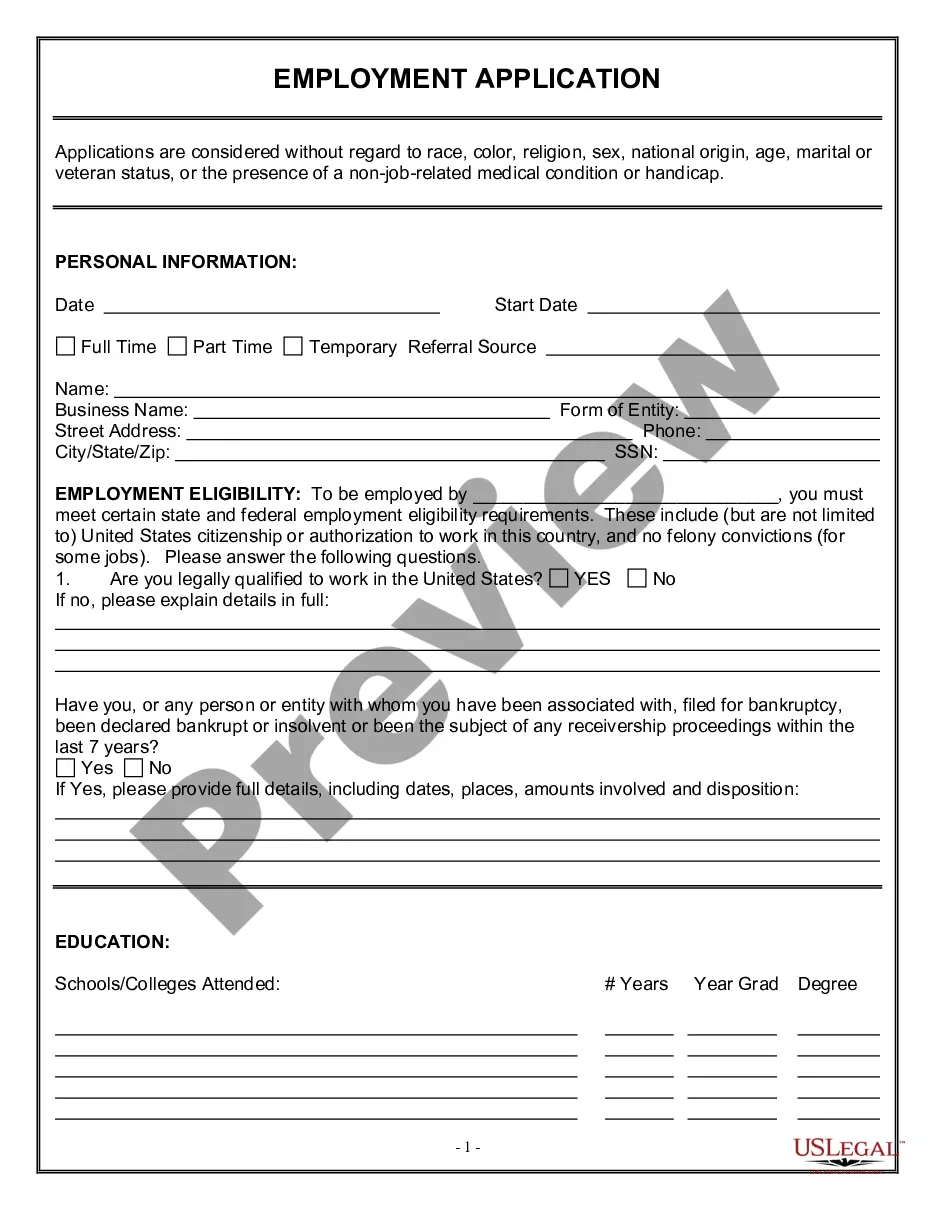

How to fill out Vermont Investors Rights Agreement?

You can devote hrs online trying to find the legitimate file format that meets the state and federal needs you will need. US Legal Forms offers a large number of legitimate types which are evaluated by pros. You can actually obtain or printing the Vermont Investors Rights Agreement from our services.

If you already have a US Legal Forms profile, you can log in and click on the Download key. Following that, you can total, change, printing, or indicator the Vermont Investors Rights Agreement. Each legitimate file format you get is your own permanently. To have yet another version of any purchased type, visit the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms web site the first time, keep to the straightforward instructions beneath:

- First, make sure that you have selected the correct file format for the area/metropolis of your choice. Browse the type information to ensure you have picked out the appropriate type. If readily available, use the Review key to appear through the file format as well.

- If you would like discover yet another model of the type, use the Search field to obtain the format that meets your requirements and needs.

- After you have found the format you want, click on Buy now to continue.

- Find the prices program you want, type your references, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your credit card or PayPal profile to pay for the legitimate type.

- Find the format of the file and obtain it to your device.

- Make changes to your file if possible. You can total, change and indicator and printing Vermont Investors Rights Agreement.

Download and printing a large number of file layouts using the US Legal Forms site, which provides the biggest collection of legitimate types. Use expert and state-certain layouts to tackle your organization or specific requires.

Form popularity

FAQ

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

Keep your VC pitch short, easy to scan and packed with valuable information A clear explanation of the problem your product or service is solving. The size of your market and potential competitors. Growth models. Evidence that your team can pull it off.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds. ... Pre-money valuation. ... Non-participating liquidation preference. ... conversion to common. ... Anti-dilution provisions. ... The pay-to-play provision. ... Boardroom makeup. ... Dividends.

[?DPA Triggering Rights? means (i) ?control? (as defined in the DPA); (ii) access to any ?material non-public technical information? (as defined in the DPA) in the possession of the Company; (iii) membership or observer rights on the Board of Directors or equivalent governing body of the Company or the right to ...

No-Shop/Confidentiality Provision = Binding Everything in a term sheet can be broken down into two parts in terms of what's binding: a ?No-Shop?/confidentiality provision, and everything else. Most term sheets have a No-Shop/confidentiality provision.