Vermont Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Are you presently within a placement where you will need files for possibly business or personal reasons just about every working day? There are plenty of lawful file web templates accessible on the Internet, but discovering versions you can rely on isn`t easy. US Legal Forms delivers 1000s of develop web templates, such as the Vermont Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, which can be composed to satisfy federal and state demands.

If you are currently knowledgeable about US Legal Forms website and have a free account, basically log in. Following that, you can acquire the Vermont Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on template.

If you do not have an accounts and want to start using US Legal Forms, follow these steps:

- Obtain the develop you need and ensure it is for the appropriate city/state.

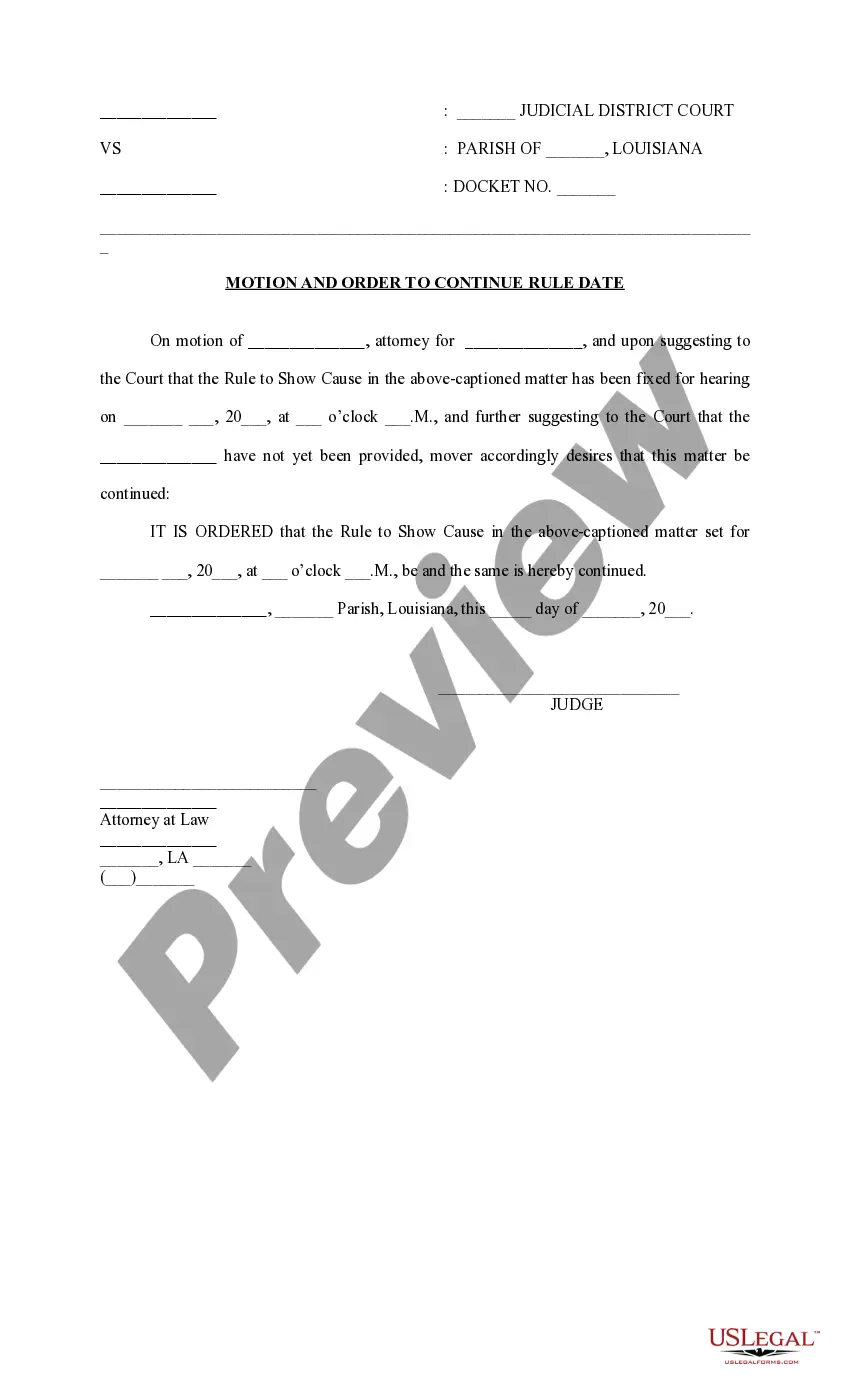

- Utilize the Review option to check the shape.

- Read the description to actually have chosen the correct develop.

- In case the develop isn`t what you are looking for, make use of the Research industry to get the develop that fits your needs and demands.

- Once you obtain the appropriate develop, click on Buy now.

- Choose the prices strategy you desire, submit the necessary information and facts to create your money, and purchase your order using your PayPal or Visa or Mastercard.

- Select a practical paper file format and acquire your copy.

Find all of the file web templates you have purchased in the My Forms food list. You can obtain a additional copy of Vermont Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on at any time, if required. Just click the necessary develop to acquire or produce the file template.

Use US Legal Forms, probably the most considerable selection of lawful types, to save lots of time and steer clear of blunders. The support delivers skillfully manufactured lawful file web templates that can be used for a range of reasons. Make a free account on US Legal Forms and start producing your life a little easier.