Vermont Self-Employed Independent Contractor Payment Schedule

Description

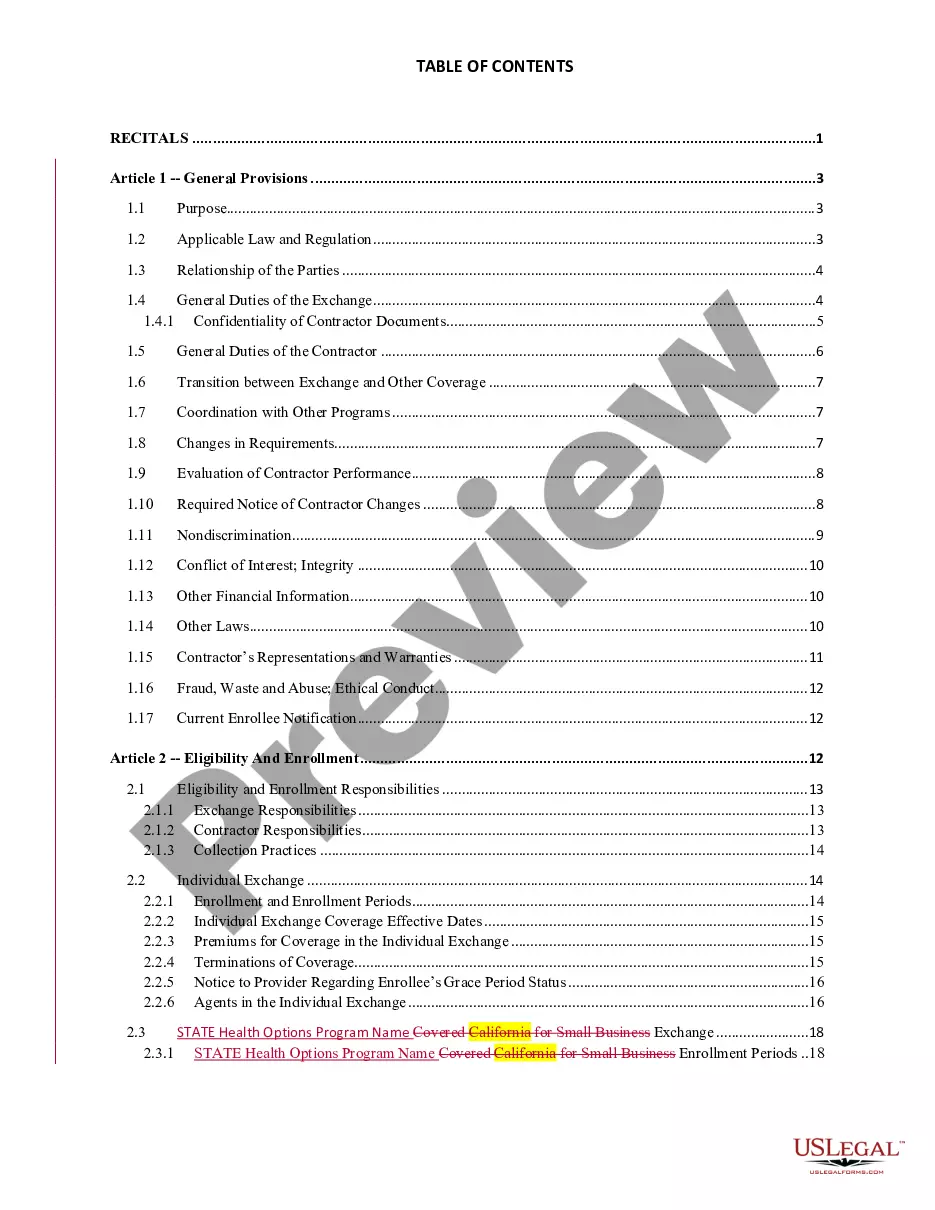

How to fill out Vermont Self-Employed Independent Contractor Payment Schedule?

If you wish to comprehensive, obtain, or print out authorized document web templates, use US Legal Forms, the biggest variety of authorized forms, that can be found on-line. Utilize the site`s simple and easy convenient lookup to find the paperwork you need. Various web templates for organization and individual reasons are sorted by types and says, or search phrases. Use US Legal Forms to find the Vermont Self-Employed Independent Contractor Payment Schedule in just a few click throughs.

When you are currently a US Legal Forms buyer, log in in your bank account and click the Download button to obtain the Vermont Self-Employed Independent Contractor Payment Schedule. You may also access forms you in the past saved from the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape to the correct area/region.

- Step 2. Take advantage of the Preview option to look over the form`s information. Do not overlook to learn the explanation.

- Step 3. When you are not happy using the kind, take advantage of the Look for discipline at the top of the monitor to locate other types in the authorized kind design.

- Step 4. Upon having located the shape you need, select the Acquire now button. Choose the prices strategy you like and add your accreditations to register to have an bank account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Select the format in the authorized kind and obtain it on your own gadget.

- Step 7. Total, modify and print out or sign the Vermont Self-Employed Independent Contractor Payment Schedule.

Each authorized document design you purchase is yours eternally. You have acces to each kind you saved inside your acccount. Click the My Forms portion and decide on a kind to print out or obtain once again.

Compete and obtain, and print out the Vermont Self-Employed Independent Contractor Payment Schedule with US Legal Forms. There are millions of expert and status-specific forms you can utilize for the organization or individual requirements.

Form popularity

FAQ

You can receive unemployment insurance benefits for 26 weeks and extended benefits for 13 weeks.

200bIf you currently have an open UI claim, there is nothing for you to do other than continue filing your weekly claim. You cannot apply for any UI programs in advance, so you must wait for the week after your benefits are exhausted to move into the PEUC program.

200bEB provides an additional 13 weeks benefits to claimants after their 26 weeks of regular benefits and 13 weeks of PEUC benefits have been exhausted. it is important to note that the EB program is dependent on Vermont's unemployment rate and is subject to change.

Your initial claim is still processing. It can take up to 72 business hours from the time you submit your initial claim for it to be uploaded into the system. You are attempting to file a claim too early or too late. The weekly claim filing window begins each Sunday until Friday at p.m.

If you file your weekly claim on Sunday: your payment will be processed on Monday. If you file your weekly claim Monday or anytime by the close of business on Wednesday: your payment will be processed on Thursday.

If you become unemployed and have worked in Vermont anytime in the past 18 months, you may be eligible to receive unemployment insurance. Once you become totally or partially unemployed, the time to establish a new claim is during the first week you work less than 35 hours.

Federal Self-Employment Tax The current self-employment tax rate is 15.3 percent. You'll be able to deduct some of your business expenses from your income when calculating how much self-employment tax you owe.

Pandemic Unemployment Assistance (PUA): This will allow for unemployment insurance benefits to individuals not eligible for regular Unemployment Insurance, such as the self-employed.

Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program, although nine states provide fewer weeks, and two provide more. Extended Benefits (EB) are not triggered on in any state.

Vermont Business Magazine The Vermont Department of Labor has been informed that it will not be allowed to administer a supplemental unemployment insurance benefit that was passed during the 2021 legislative session.