Vermont Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

Choosing the right legitimate record format can be quite a battle. Needless to say, there are plenty of themes available on the net, but how will you find the legitimate type you want? Utilize the US Legal Forms site. The services provides 1000s of themes, for example the Vermont Accounting Agreement - Self-Employed Independent Contractor, that you can use for business and personal requirements. Each of the kinds are inspected by specialists and meet up with federal and state requirements.

In case you are previously authorized, log in to the bank account and then click the Down load key to get the Vermont Accounting Agreement - Self-Employed Independent Contractor. Make use of your bank account to appear throughout the legitimate kinds you may have ordered in the past. Visit the My Forms tab of your respective bank account and acquire one more backup of the record you want.

In case you are a fresh consumer of US Legal Forms, listed below are basic directions that you should stick to:

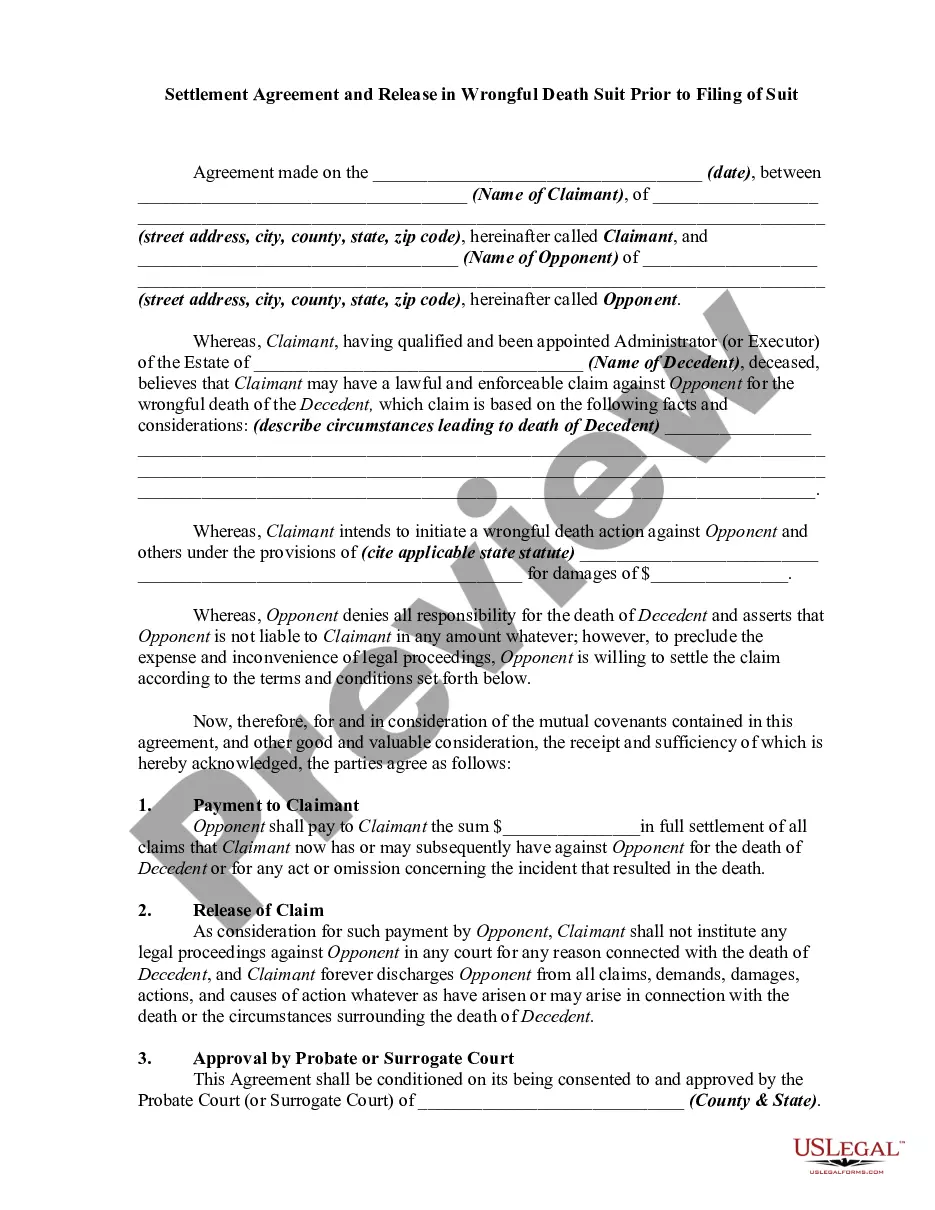

- Initial, make sure you have selected the right type for your personal town/area. It is possible to look over the form while using Review key and read the form outline to guarantee it will be the best for you.

- When the type will not meet up with your preferences, utilize the Seach discipline to discover the correct type.

- When you are certain that the form is acceptable, select the Buy now key to get the type.

- Select the prices plan you desire and enter the necessary information and facts. Design your bank account and buy the order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the submit format and acquire the legitimate record format to the device.

- Full, modify and print and sign the obtained Vermont Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the biggest catalogue of legitimate kinds for which you can find various record themes. Utilize the company to acquire professionally-produced documents that stick to express requirements.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

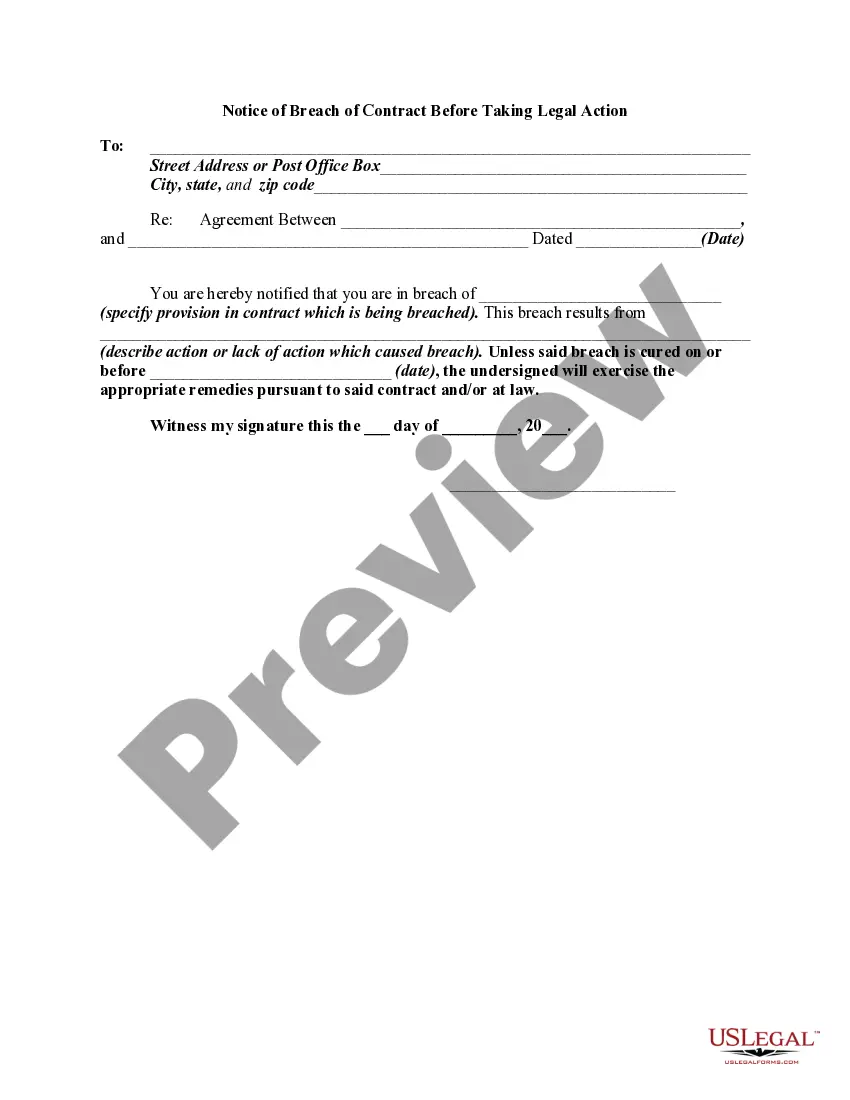

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.