Vermont Self-Employed Roofing Services Agreement

Description

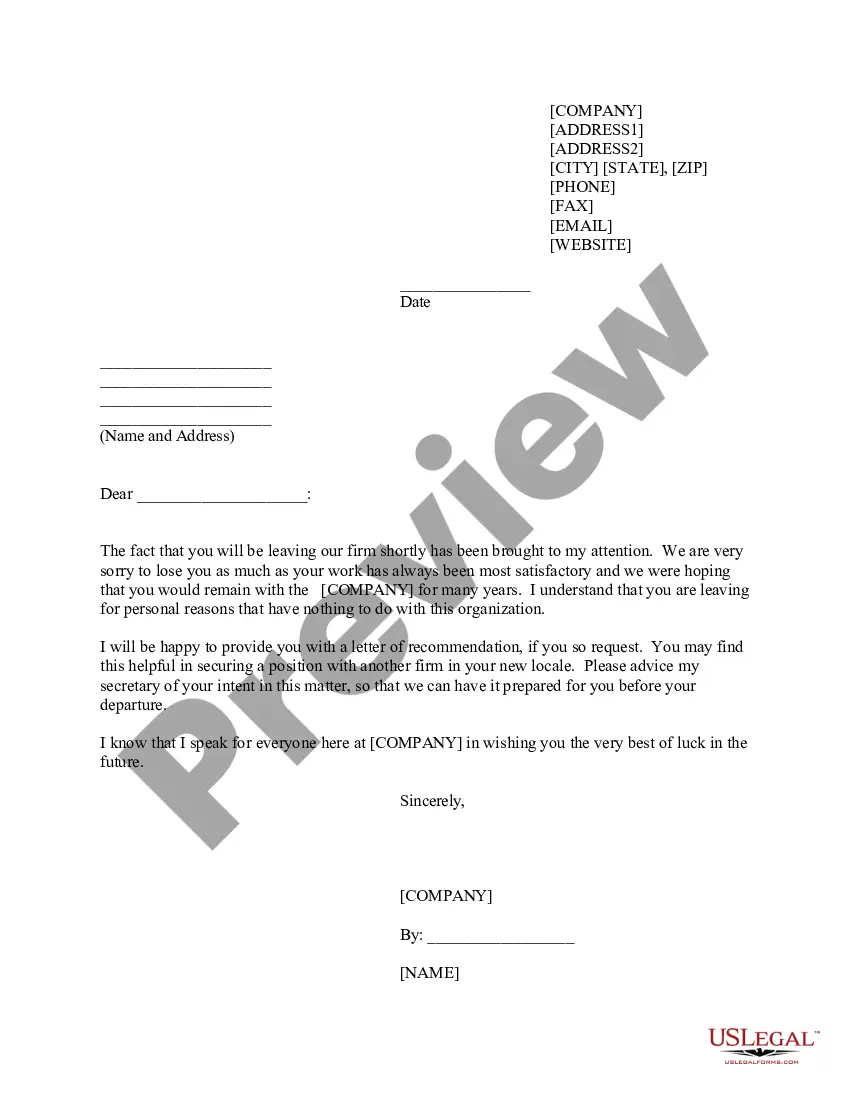

How to fill out Vermont Self-Employed Roofing Services Agreement?

US Legal Forms - one of the most significant libraries of authorized kinds in the United States - gives a wide array of authorized document web templates you are able to down load or produce. Utilizing the internet site, you can find a huge number of kinds for enterprise and individual functions, sorted by classes, says, or key phrases.You will discover the most up-to-date types of kinds such as the Vermont Self-Employed Roofing Services Agreement in seconds.

If you have a registration, log in and down load Vermont Self-Employed Roofing Services Agreement from the US Legal Forms local library. The Down load key can look on every single form you view. You gain access to all formerly acquired kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, allow me to share simple recommendations to help you started:

- Be sure you have picked the proper form to your city/area. Go through the Preview key to examine the form`s content. Read the form information to actually have chosen the appropriate form.

- When the form doesn`t suit your requirements, utilize the Search discipline near the top of the display to discover the one which does.

- Should you be happy with the form, validate your selection by clicking the Purchase now key. Then, choose the pricing plan you want and supply your qualifications to register on an profile.

- Procedure the purchase. Make use of your credit card or PayPal profile to complete the purchase.

- Select the formatting and down load the form on your device.

- Make modifications. Complete, revise and produce and sign the acquired Vermont Self-Employed Roofing Services Agreement.

Every single web template you included with your bank account does not have an expiry date and is also your own property permanently. So, in order to down load or produce an additional duplicate, just visit the My Forms area and click on in the form you will need.

Gain access to the Vermont Self-Employed Roofing Services Agreement with US Legal Forms, probably the most considerable local library of authorized document web templates. Use a huge number of expert and condition-specific web templates that fulfill your company or individual demands and requirements.

Form popularity

FAQ

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The consumer should call the roofing company and ask to speak to the owner or manager and nicely tell them they have changed their minds and would like to cancel the deal without paying a cancellation fee. If the company agrees, put it in writing and the homeowner is out of the deal.

Since Vermont does not require a general contractors license at the state level, you need to understand your local county and city requirements. In many cases, experience and examination will be needed to obtain your license for plumbing, electrical, and specialty trades mentioned above.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Generally, to be legally valid, most contracts must contain two elements:All parties must agree about an offer made by one party and accepted by the other.Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.