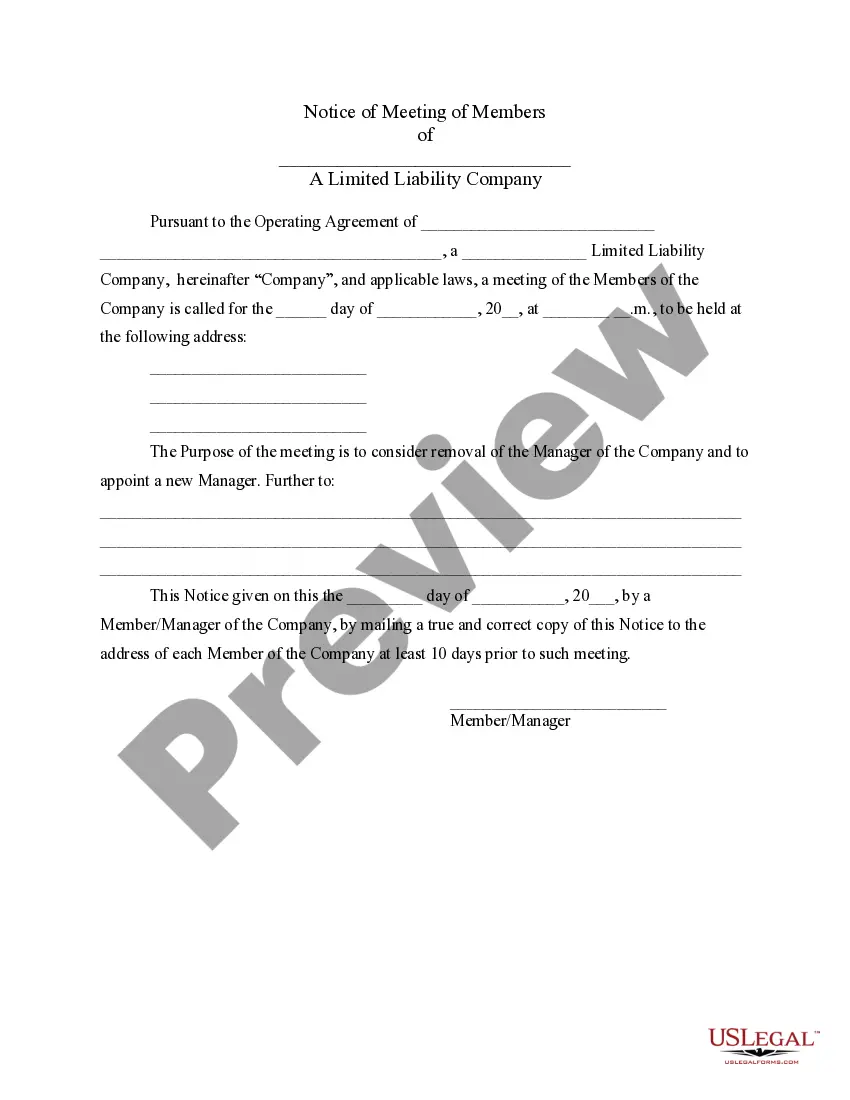

Vermont Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager

Description

How to fill out Vermont Notice Of Meeting Of Members Of LLC Limited Liability Company To Consider Removal Of Manager And Appoint New Manager?

Are you within a position that you require papers for sometimes organization or specific purposes nearly every working day? There are a variety of legitimate file layouts available on the net, but discovering kinds you can depend on isn`t easy. US Legal Forms gives thousands of kind layouts, like the Vermont Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager, that are written to meet state and federal requirements.

If you are presently acquainted with US Legal Forms web site and also have your account, merely log in. Next, you may obtain the Vermont Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager template.

If you do not provide an account and would like to begin to use US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is to the proper area/state.

- Utilize the Preview switch to examine the shape.

- Look at the description to actually have selected the right kind.

- In case the kind isn`t what you`re seeking, use the Lookup area to get the kind that suits you and requirements.

- When you obtain the proper kind, click on Buy now.

- Select the rates strategy you want, fill out the specified information to produce your bank account, and pay money for your order using your PayPal or charge card.

- Decide on a convenient file formatting and obtain your duplicate.

Get all the file layouts you may have purchased in the My Forms food list. You can get a more duplicate of Vermont Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager at any time, if necessary. Just go through the needed kind to obtain or print out the file template.

Use US Legal Forms, by far the most extensive selection of legitimate varieties, to save lots of time as well as steer clear of errors. The support gives professionally produced legitimate file layouts which you can use for a range of purposes. Create your account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

A limited liability company, or LLC, is a type of business entity that is separate from its owners. It is not required to pay its own taxes, unlike a corporation, as it's a pass-through tax entity. All profits and losses from the business are passed through to the owners, who then report them on their own tax returns.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

A member of a member-managed LLC or a manager of a manager-managed LLC is liable to the LLC for any damages the LLC incurs because of such conduct. this duty is a limited duty of care because it does not include ordinary negligence.

A manager may be removed at any time by the consent of a majority of the members without cause, subject to the rights, if any, of the manager under any service contract with the limited liability company.

Under all LLC statutes, the general rule is that the members of the LLC are not personally liable for obligations of the LLC, subject to such exceptions as personal guarantees or piercing of the organizational veil.

This is one of the benefits of having an LLC because it allows a Manager to run the business without fear of personal liability. But, a Manager may be held personally liable for criminal action and intentional actions that are outside the scope of its authority.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

The owners of an LLC are called Members. An LLC can be managed by a Manager or its Members. A key aspect of an LLC lies within the name itself: limited liability. In essence, the Members of an LLC are not liable for the debts, obligations, and actions of the company itself.