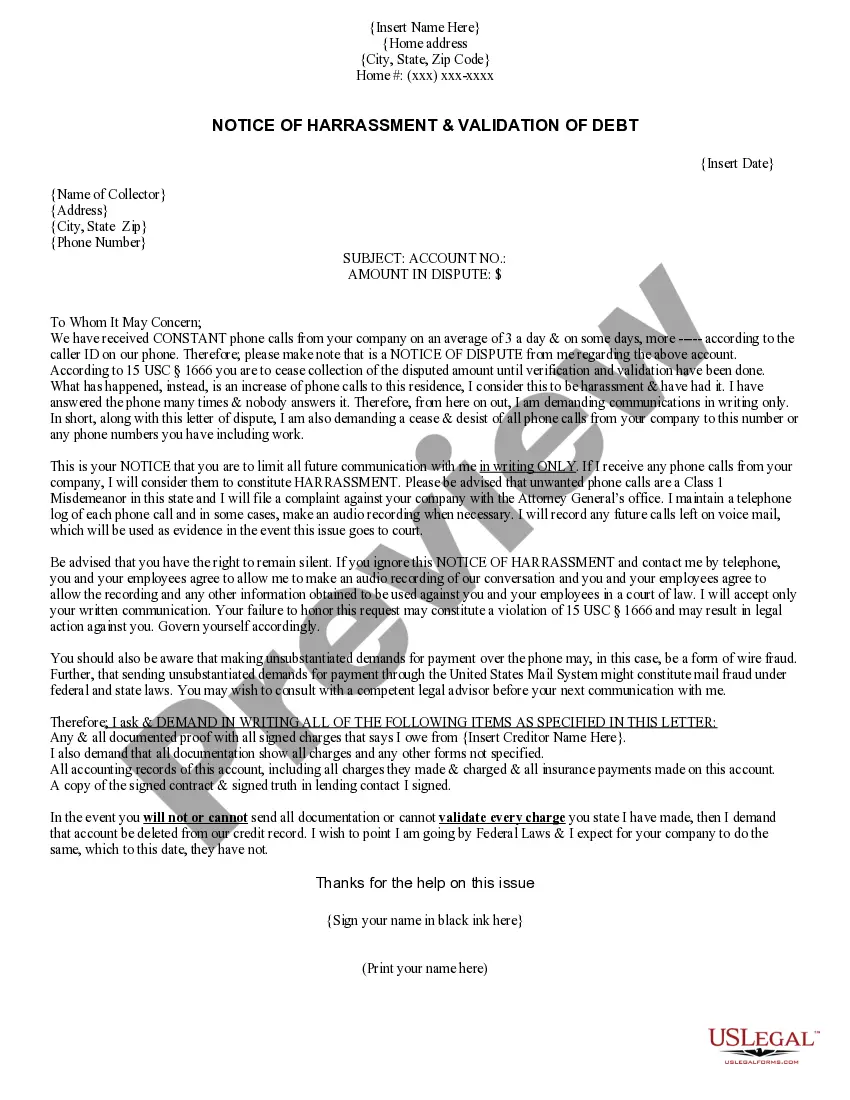

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Vermont Notice of Harassment and Validation of Debt

Description

How to fill out Vermont Notice Of Harassment And Validation Of Debt?

US Legal Forms - one of several biggest libraries of legitimate varieties in the States - delivers a wide array of legitimate document web templates you can down load or produce. Utilizing the site, you will get 1000s of varieties for organization and specific purposes, sorted by groups, suggests, or keywords and phrases.You will discover the newest variations of varieties much like the Vermont Notice of Harassment and Validation of Debt in seconds.

If you currently have a membership, log in and down load Vermont Notice of Harassment and Validation of Debt from the US Legal Forms catalogue. The Down load button can look on every single form you view. You gain access to all in the past delivered electronically varieties in the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, here are simple directions to obtain began:

- Ensure you have selected the best form to your metropolis/area. Click the Preview button to examine the form`s articles. Browse the form information to actually have chosen the right form.

- When the form does not fit your requirements, use the Research industry towards the top of the screen to obtain the one that does.

- When you are satisfied with the shape, confirm your choice by clicking on the Purchase now button. Then, pick the rates plan you like and give your qualifications to sign up for the accounts.

- Method the transaction. Make use of your bank card or PayPal accounts to complete the transaction.

- Select the formatting and down load the shape in your product.

- Make adjustments. Fill up, revise and produce and indication the delivered electronically Vermont Notice of Harassment and Validation of Debt.

Each template you added to your bank account lacks an expiry particular date and is also the one you have forever. So, in order to down load or produce one more copy, just visit the My Forms segment and click on about the form you will need.

Gain access to the Vermont Notice of Harassment and Validation of Debt with US Legal Forms, the most extensive catalogue of legitimate document web templates. Use 1000s of specialist and condition-certain web templates that fulfill your business or specific requires and requirements.

Form popularity

FAQ

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

If a debt collector fails to validate the debt in question and continues trying to collect, you have a right under the FDCPA to countersue for up to $1,000 for each violation, plus attorney fees and court costs, as mentioned previously.

A debt verification letter doesn't have to say anything fancy. Just state that you're responding to a collection effort, you don't recognize the debt, you are demanding they prove you owe it and, if they can't, to stop contacting you. That's it.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

Collectors are required by Fair Debt Collection Practices Act to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

The CFPB explicitly states that the final rule does not require a debt collector to use the model validation notice and that use of the model notice is one way to comply to comply with the content and format requirements in Regulation F. It states further that debt collectors who choose not to use the model