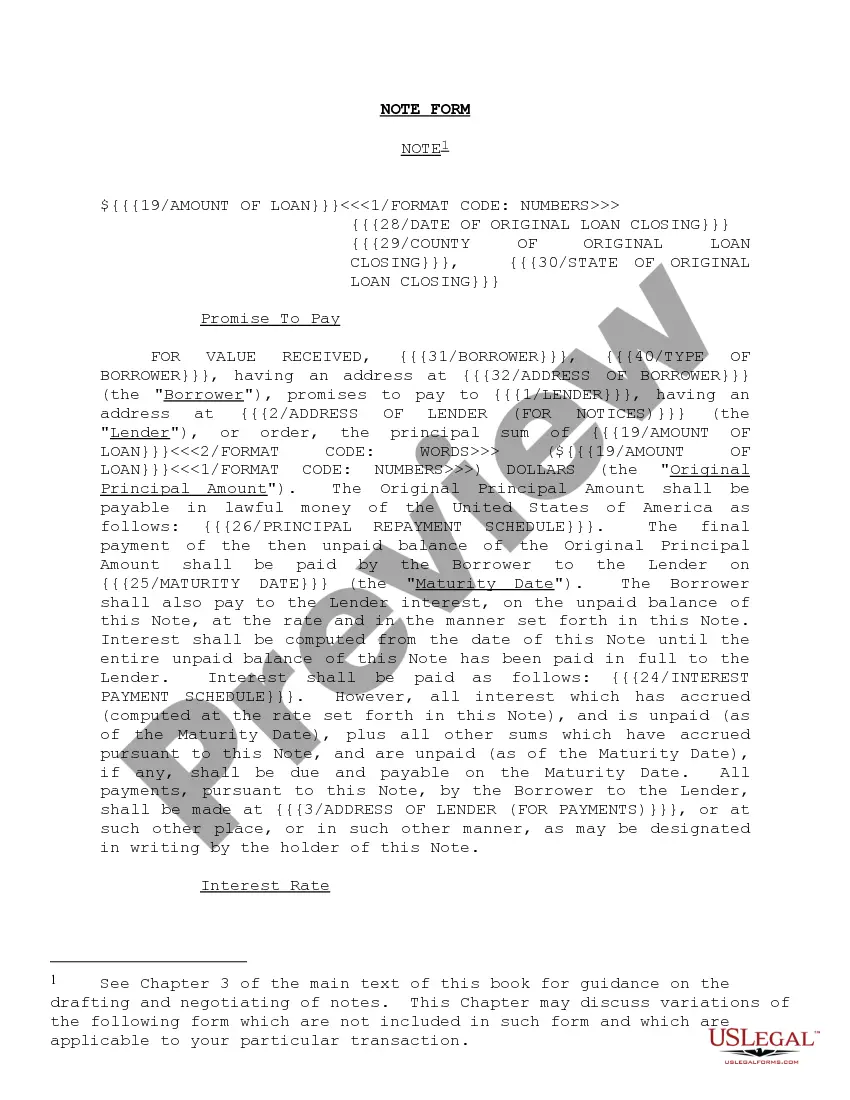

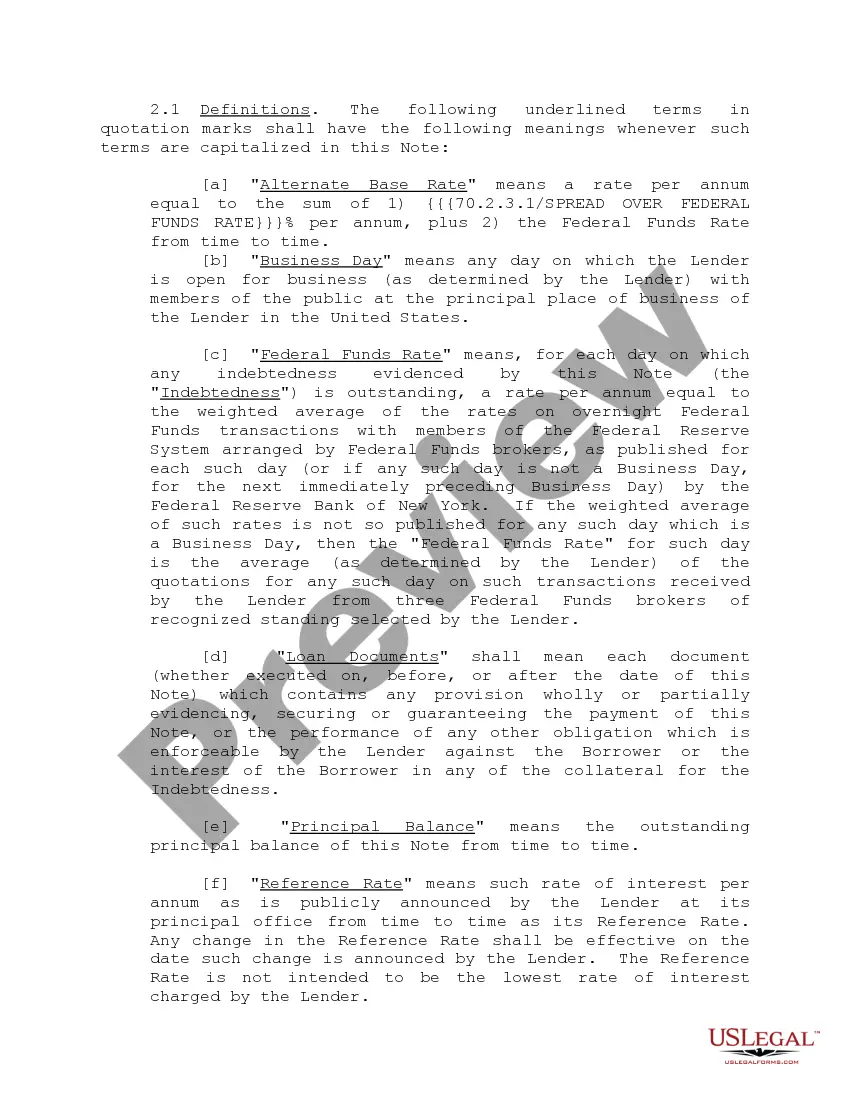

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Vermont Note Form and Variations

Description

How to fill out Note Form And Variations?

If you wish to complete, download, or print out legitimate papers layouts, use US Legal Forms, the greatest variety of legitimate varieties, which can be found on-line. Take advantage of the site`s simple and easy convenient look for to discover the documents you want. Different layouts for company and specific functions are sorted by groups and says, or keywords and phrases. Use US Legal Forms to discover the Vermont Note Form and Variations in just a number of click throughs.

If you are previously a US Legal Forms consumer, log in in your accounts and click on the Obtain option to find the Vermont Note Form and Variations. You may also entry varieties you earlier saved within the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for that correct town/nation.

- Step 2. Take advantage of the Preview method to look through the form`s articles. Never overlook to read through the information.

- Step 3. If you are unhappy with the develop, utilize the Look for field at the top of the display to find other types of your legitimate develop design.

- Step 4. Once you have located the shape you want, click the Acquire now option. Opt for the prices program you choose and include your credentials to register for an accounts.

- Step 5. Method the transaction. You may use your bank card or PayPal accounts to perform the transaction.

- Step 6. Choose the file format of your legitimate develop and download it on your device.

- Step 7. Complete, edit and print out or signal the Vermont Note Form and Variations.

Each legitimate papers design you buy is your own property eternally. You may have acces to every single develop you saved within your acccount. Click the My Forms section and choose a develop to print out or download once again.

Be competitive and download, and print out the Vermont Note Form and Variations with US Legal Forms. There are many skilled and condition-distinct varieties you may use to your company or specific needs.

Form popularity

FAQ

Note form is like bullet points. (This paragraph is an example of continuous writing, although perhaps a tad informal). Differences: continuous is paragraph and full sentences. note form is a list.

The 9 Best Foods to Try in Vermont 01 of 09. Maple Syrup. FrankvandenBergh / Getty Images. ... 02 of 09. Cheddar Cheese. Kim Knox Beckius. ... 03 of 09. Heirloom Apples. Josh Fiedler Photography / Getty Images. ... 05 of 09. Cider Doughnuts. bhofack2 / Getty Images. ... 08 of 09. Wood-Fired Bread. Courtesy of The Wilburton. ... 09 of 09. Lamb.

Hear this out loud Pause? Vermont was first to abolish slavery in its constitution. ? Vermont was the first State to legally recognize gay couples when it created civil unions, and it's the first state to pass marriage equality through the legislature. ? It is the birthplace of two U.S. Presidents - Calvin Coolidge and Chester A. Arthur.

Hear this out loud PauseVermont is known for its scenic rolling mountains, quality skiing, organic locally produced food, and its open-minded culture. Known as the Green Mountain State, (Vermont translates to green mountain ? ver mont- in French) Vermont provides an abundance of outdoor activities winter or summer.

Hear this out loud Pause"Freedom and Unity" is the official motto of the U.S. state of Vermont. The motto was first adopted in 1788 for use on the Great Seal of the Vermont Republic.

Maple Syrup Vermont is famous for its production of maple syrup and supplies the US with over half of its maple syrup. In the early spring months ?sugar shacks? across the state harvest the sap from the maple trees, and boil it down to the maple syrup we all know.