Vermont Due Diligence Review Summary is a comprehensive examination of the legal, financial, and operational aspects of a particular project, investment, or business transaction conducted in the state of Vermont. It aims to provide a clear understanding of any potential risks, liabilities, and opportunities involved in the venture. The Vermont Due Diligence Review Summary encompasses various types of assessments, each focusing on a specific aspect of the undertaking. Some key types include: 1. Legal Due Diligence: This examination focuses on reviewing contracts, agreements, permits, licenses, and any legal documents related to the project. It aims to identify any potential legal issues, such as compliance with state and federal regulations, pending litigation, or any contractual obligations. 2. Financial Due Diligence: This analysis involves a thorough review of financial statements, tax records, budgets, and projections to assess the financial health and stability of the investment. It aims to determine the accuracy of financial information provided, identify any potential financial risks, and evaluate the viability of the project. 3. Environmental Due Diligence: Vermont has strict environmental regulations, making this type of due diligence crucial. It assesses the potential environmental impact of the project, including any past or present pollution, compliance with environmental laws, and the presence of hazardous substances. The goal is to reveal any environmental liabilities that may pose legal, financial, or reputational risks. 4. Market Due Diligence: This analysis focuses on evaluating the target market and competitive landscape in Vermont. It involves assessing market trends, customer behavior, demand and supply dynamics, and the competitive positioning of the project. The aim is to evaluate the market potential and determine the feasibility of the venture. 5. Operational Due Diligence: This review examines the operational aspects of the project to identify any potential operational inefficiencies, gaps in processes, or risks associated with the day-to-day management. It also involves evaluating the capabilities of the management team and their experience in similar projects. 6. Compliance Due Diligence: Given Vermont's diverse regulatory landscape, this type of due diligence ensures that the project adheres to all relevant laws, regulations, and industry standards. It covers areas such as data privacy, employment regulations, safety standards, and licensing requirements. Overall, the Vermont Due Diligence Review Summary provides a comprehensive assessment of the project's legal, financial, operational, environmental, market, and compliance aspects. Conducting this thorough review helps in making well-informed decisions, mitigating risks, and maximizing the chances of a successful venture in the state of Vermont.

Vermont Due Diligence Review Summary

Description

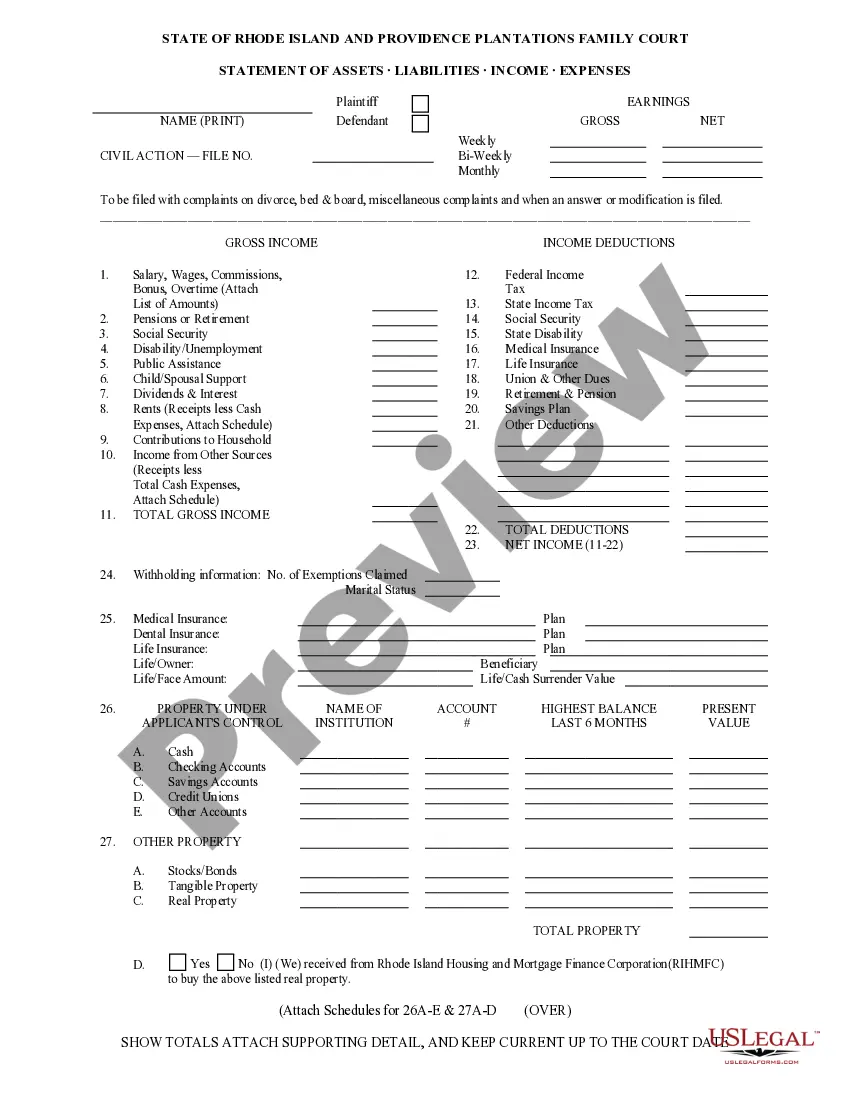

How to fill out Vermont Due Diligence Review Summary?

Choosing the best authorized file format could be a have difficulties. Of course, there are a lot of templates available on the Internet, but how will you get the authorized kind you need? Take advantage of the US Legal Forms web site. The service delivers a large number of templates, for example the Vermont Due Diligence Review Summary, which can be used for business and private demands. Every one of the varieties are checked out by experts and meet state and federal needs.

When you are currently authorized, log in in your account and click on the Down load button to obtain the Vermont Due Diligence Review Summary. Use your account to check with the authorized varieties you may have purchased previously. Go to the My Forms tab of your account and have one more duplicate of the file you need.

When you are a new user of US Legal Forms, here are straightforward instructions that you should comply with:

- Very first, make certain you have selected the appropriate kind for the area/area. You are able to look through the form while using Review button and look at the form outline to make sure this is the best for you.

- When the kind will not meet your expectations, make use of the Seach discipline to obtain the proper kind.

- When you are sure that the form would work, go through the Get now button to obtain the kind.

- Select the pricing strategy you need and enter in the needed information. Create your account and pay for your order with your PayPal account or charge card.

- Choose the submit format and down load the authorized file format in your device.

- Comprehensive, modify and print out and indication the acquired Vermont Due Diligence Review Summary.

US Legal Forms is definitely the most significant catalogue of authorized varieties for which you will find different file templates. Take advantage of the company to down load skillfully-manufactured paperwork that comply with condition needs.

Form popularity

FAQ

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

This includes any existing debt, liability or financial responsibilities. Provide statistics: Data can provide a brief snapshot of the due diligence process. Include any surveys, analyses, market research or key data points you uncovered during your investigation that might help your CEO make an informed decision.

An example of the due diligence process in real estate would be a survey of a property for a sale by a professional and registered agent. The findings from the survey would then be given to the buyer so that they can make a fully informed decision as to whether to pursue purchasing the property.

Below, we take a closer look at the three elements that comprise human rights due diligence ? identify and assess, prevent and mitigate and account ?, quoting from the Guiding Principles.

A due diligence checklist is a way to analyze a company that you are acquiring through a sale or merger. In the context of an M&A transaction, ?due diligence? describes a thorough and methodical investigation and assessment.

The phrase ?Due diligence? sounds complicated but in reality, it is simply the process of doing your homework before you make a major commitment, either on a business or personal level.

Due diligence falls into three main categories: legal due diligence. financial due diligence. commercial due diligence.

The quality of working carefully and with a lot of effort: She hoped that her diligence would be noticed at work. The exhibition has been researched with extraordinary diligence.