This provision provides for the assignor to except from this assignment and reserve an overriding royalty interest of all oil, gas, casinghead gas, and other minerals that may be produced from the lands under the terms of the Leases that are the subject of this assignment.

Vermont Reservation of Overriding Royalty Interest

Description

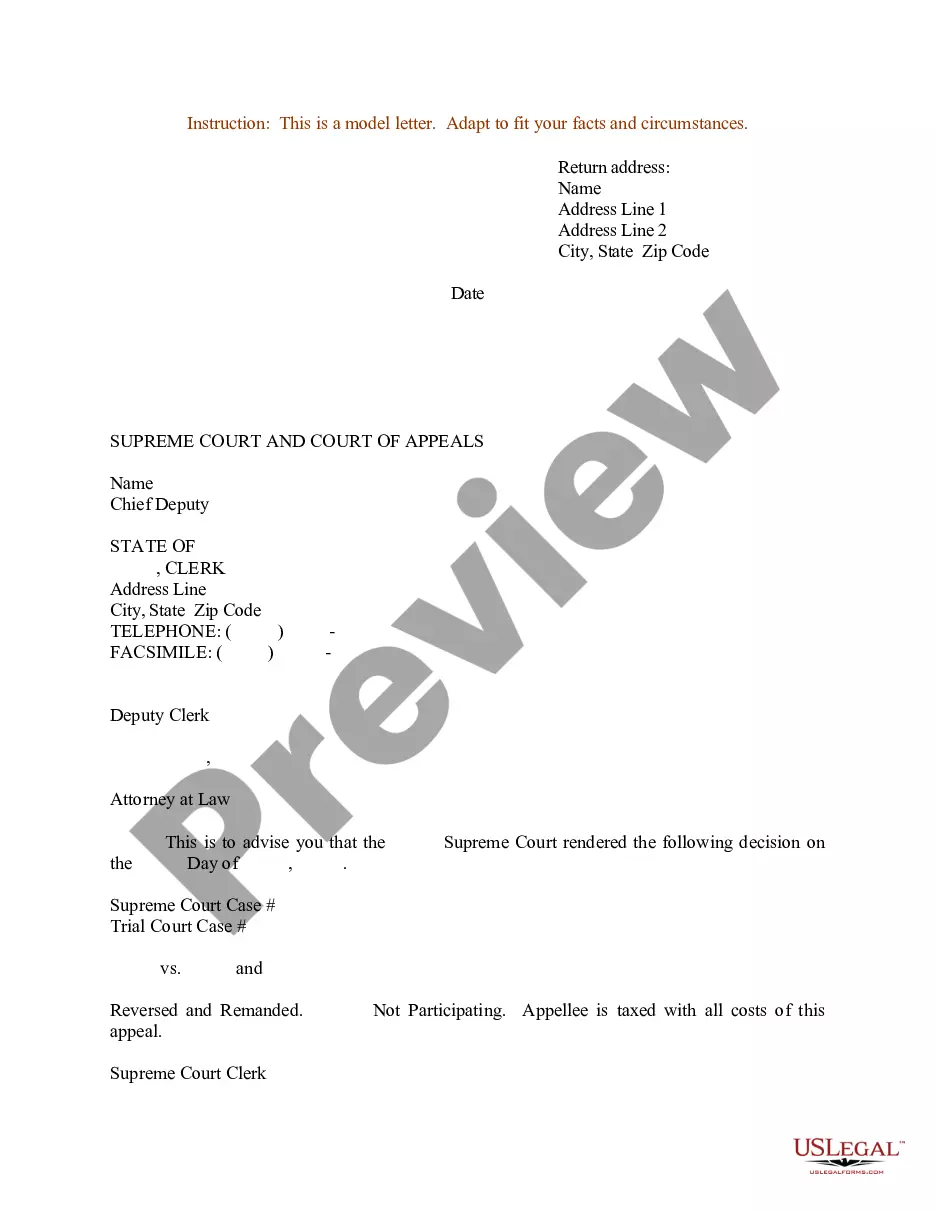

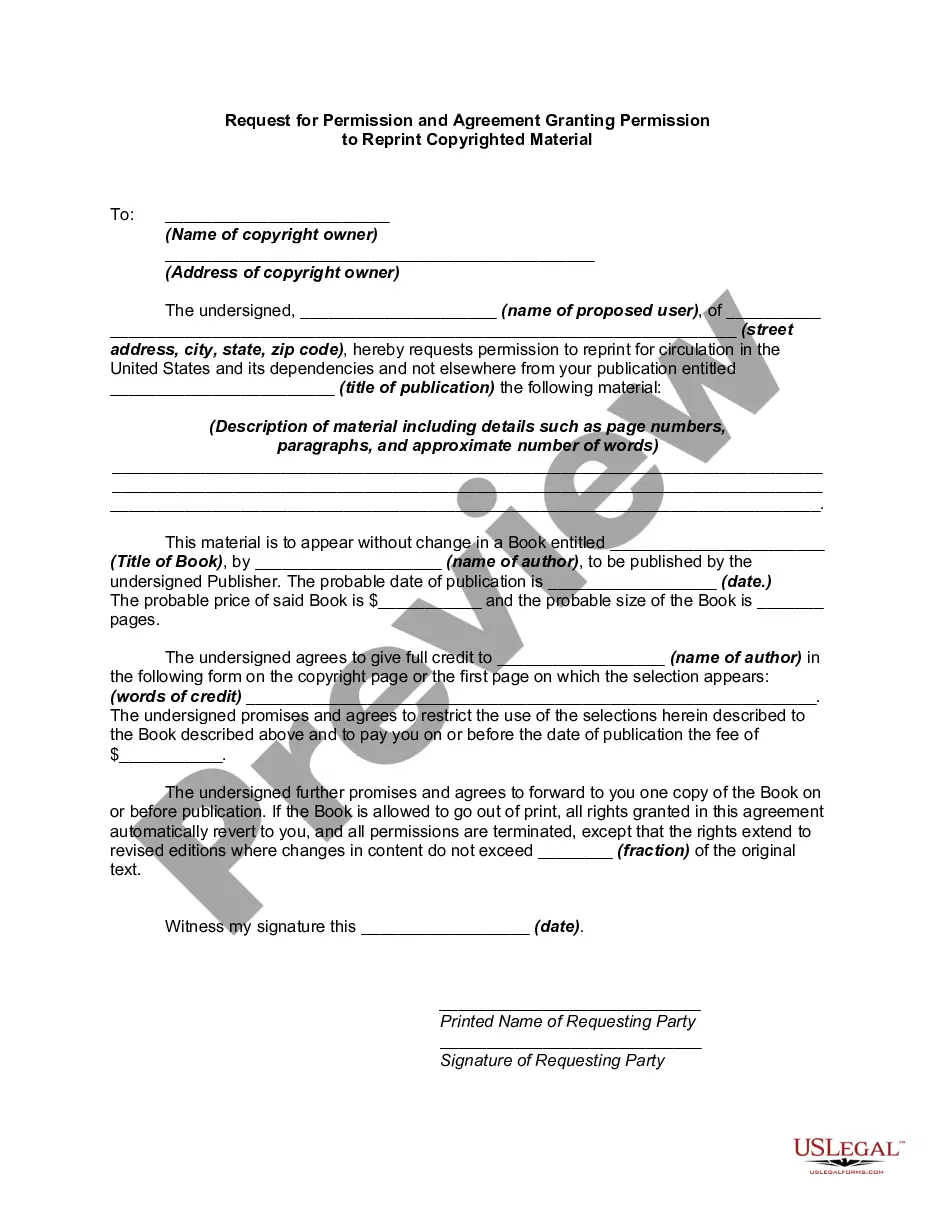

How to fill out Reservation Of Overriding Royalty Interest?

You can commit time on the Internet attempting to find the lawful document design that meets the state and federal specifications you require. US Legal Forms gives a large number of lawful kinds which can be reviewed by specialists. You can actually acquire or printing the Vermont Reservation of Overriding Royalty Interest from the services.

If you have a US Legal Forms bank account, you are able to log in and then click the Download button. After that, you are able to complete, change, printing, or indication the Vermont Reservation of Overriding Royalty Interest. Every single lawful document design you acquire is the one you have forever. To get an additional backup of any bought form, go to the My Forms tab and then click the related button.

Should you use the US Legal Forms site for the first time, keep to the simple guidelines beneath:

- Very first, make sure that you have selected the correct document design for the area/town of your choosing. Read the form information to ensure you have selected the appropriate form. If offered, use the Review button to check with the document design as well.

- If you want to get an additional variation in the form, use the Search discipline to obtain the design that meets your requirements and specifications.

- After you have found the design you need, simply click Purchase now to continue.

- Select the rates strategy you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You may use your charge card or PayPal bank account to fund the lawful form.

- Select the file format in the document and acquire it to the system.

- Make modifications to the document if needed. You can complete, change and indication and printing Vermont Reservation of Overriding Royalty Interest.

Download and printing a large number of document layouts utilizing the US Legal Forms Internet site, which provides the most important variety of lawful kinds. Use skilled and express-distinct layouts to handle your company or specific needs.

Form popularity

FAQ

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

Oil and Gas Interest means any oil or gas royalty or lease, or fractional interest therein, or certificate of interest or participation or investment contract relative to such royalties, leases or fractional interests, or any other interest or right which permits the exploration of, drilling for, or production of oil ...

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

There are 6 types of mineral rights, including mineral interest (MI), royalty interest (RI), overriding royalty interest (ORRI), working Interest (WI), non-operated working interest, and net profits interest.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.